What Is Input Tax Credit Explain Its Significance The Importance of Input Tax Credit Input Tax Credit ITC is a critical feature in modern tax systems offering a mechanism for businesses to deduct the taxes they ve incurred

Input credit means that the taxpayer can reduce the output tax liability by the amount of tax already paid on inputs So every registered person while paying the tax on Ans Input tax credit means claiming the credit of the GST paid on the purchase of products and services used for the furtherance of business The

What Is Input Tax Credit Explain Its Significance

What Is Input Tax Credit Explain Its Significance

https://i.ytimg.com/vi/-VC-RRmkMVw/maxresdefault.jpg

Input Tax Credit A New Era A Nightmare

https://taxguru.in/wp-content/uploads/2022/10/Input-Tax-Credit-–-A-New-era-A-Nightmare.jpg

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GST-India/Images/Apportionment of Input Tax Credit in case of Goods and Services Used-Section 17-1.gif

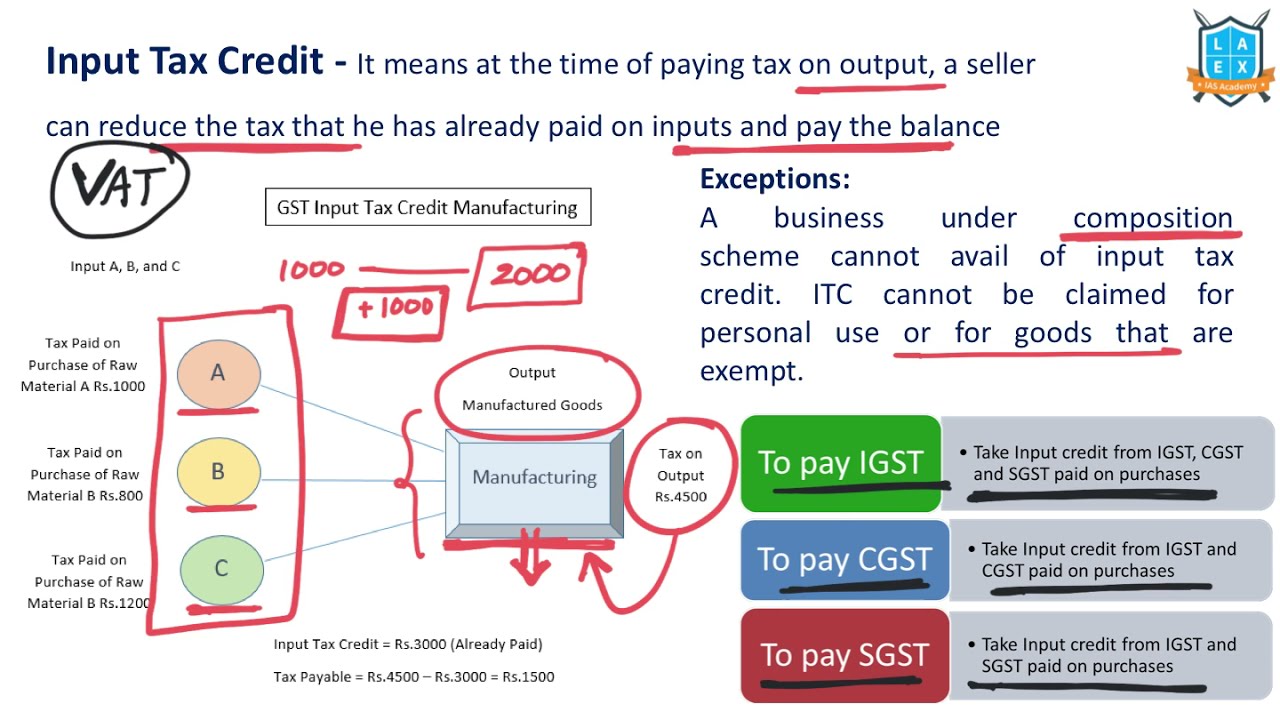

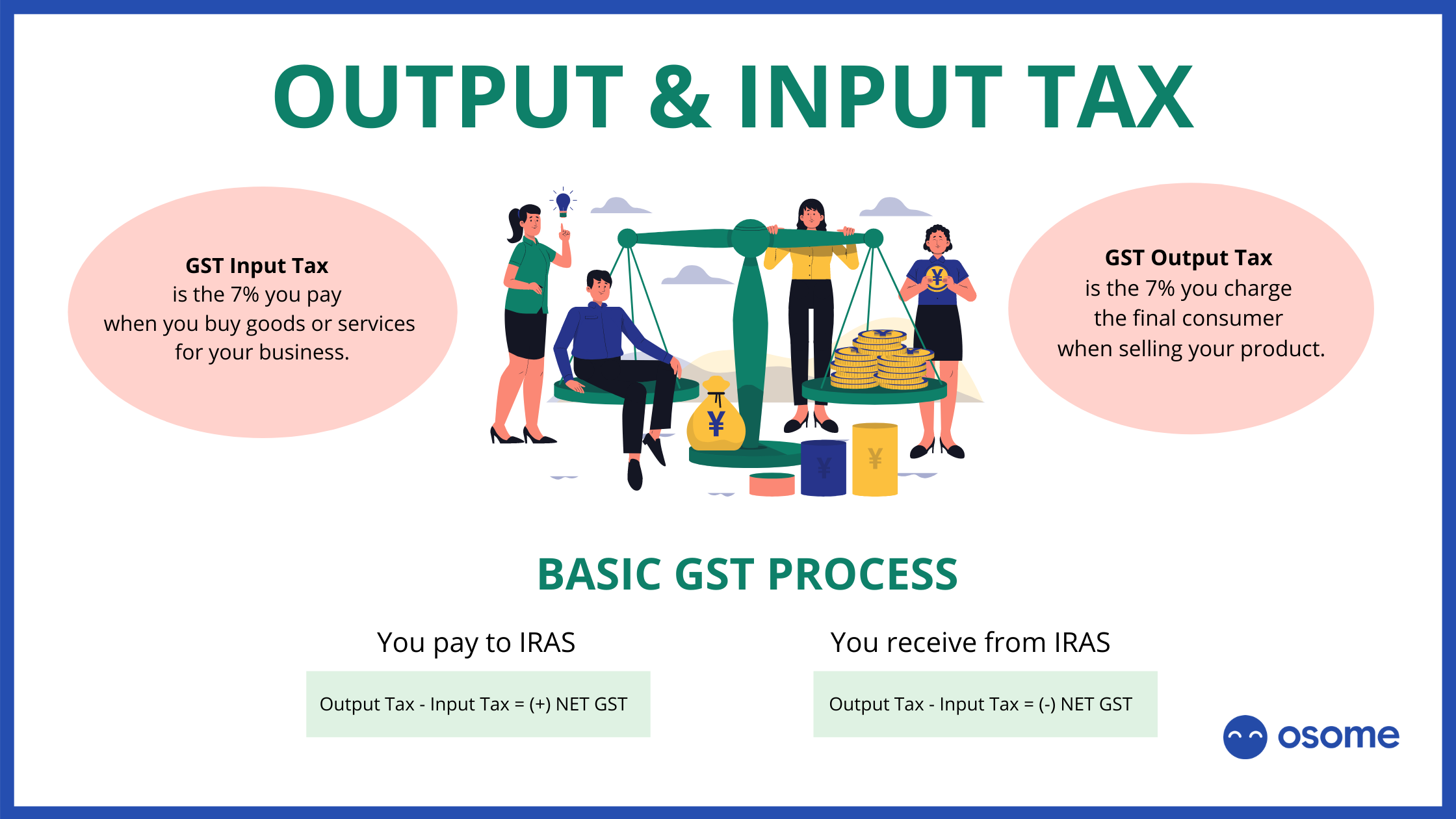

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input In simple terms input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance

How do you explain input tax credit Input Tax Credit ITC is a mechanism that enables firms to claim credit for the GST they paid on purchasing goods What is Input Tax Credit ITC Input Tax Credit refers to the tax already paid by a person at time of purhase of goods ro services and which is available as deduction from tax payable For eg A

Download What Is Input Tax Credit Explain Its Significance

More picture related to What Is Input Tax Credit Explain Its Significance

What Is Input Tax Credit Input Tax Credit La

https://i.ytimg.com/vi/kM_OYQg22CY/maxresdefault.jpg

![]()

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_930/https://www.saralgst.com/wp-content/uploads/2018/06/Input-Tax-credit.jpg

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

https://www.taxmann.com/post/wp-content/uploads/2021/10/BlogBanner_Pushpinder1.jpg

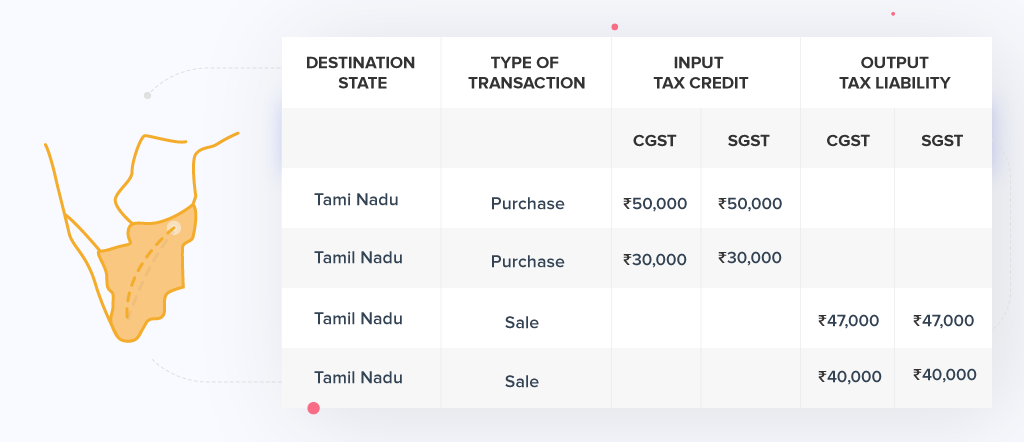

2023 12 21 GST HST Find out about input tax credits if you are eligible to claim ITCs how to calculate ITCs how to claim ITCs determine the time limit to claim Input Tax Credit under GST means the credit of input tax paid on purchases which the taxpayer can use it towards payment of output tax charged on sales ITC comprises of credit in form of IGST

Therefore input tax credit means that you can lessen the tax you already paid on the input when you pay output tax Hence you pay only the balance Input Tax Credit ITC is a kind of tax that businesses pay on a purchase ITC can be used to reduce tax liability when businesses make a sale It means that businesses can

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

What Is Input Tax Credit And How To Claim It

https://vakilsearch.com/advice/wp-content/uploads/2018/12/What-is-input-credit_-and-how-to-claim-it_-1024x683.jpg

https://taxleopard.com.au/input-tax-credit

The Importance of Input Tax Credit Input Tax Credit ITC is a critical feature in modern tax systems offering a mechanism for businesses to deduct the taxes they ve incurred

https://support.taxaj.com/portal/en/kb/articles/what-is-input-tax-credit

Input credit means that the taxpayer can reduce the output tax liability by the amount of tax already paid on inputs So every registered person while paying the tax on

What Is Input Tax Credit And How To Claim It YouTube

What Is Input Credit ITC Under GST

A Complete Guide On Input Tax Credit ITC Under GST

What Is Input Tax Credit ITC INSIGHTSIAS

What Is Input Tax Credit ITC Under GST How To Claim ITC In GST

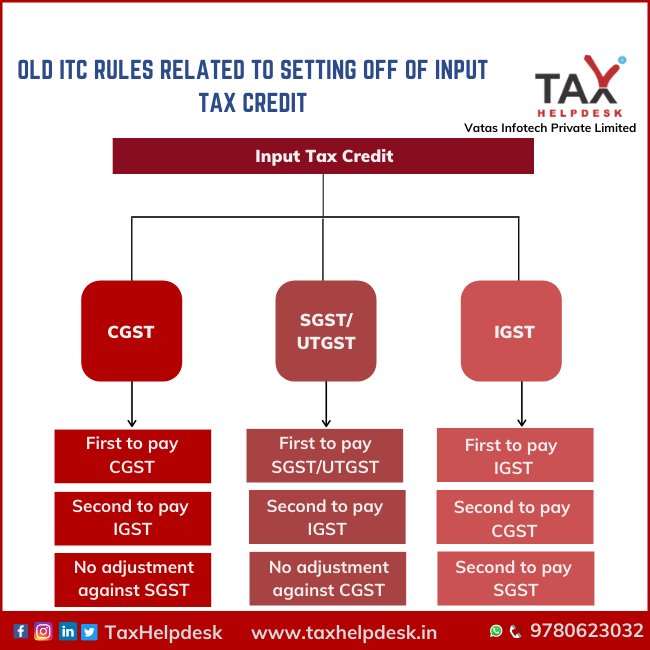

Input Tax Credit Utilisation Changes Through GST Amendment 2019

Input Tax Credit Utilisation Changes Through GST Amendment 2019

Output Tax

Rules Related To Setting Off Of Input Tax Credit

An In depth Look At Input Tax Credit Under GST Razorpay Business

What Is Input Tax Credit Explain Its Significance - In simple terms input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance