What Is Input Tax Credit For Car Insurance What should you put at the Input Tax Credit question when making an insurance claim What Percentage of Input Tax Credits ITCs Are Strata Companies Entitled To As

So you would put down 100 of the ITC to be claimed 2 Assets which are 100 private or where you are unable to claim any GST credits back An example of Input Tax Credit ITC is a critical feature in modern tax systems offering a mechanism for businesses to deduct the taxes they ve incurred on inputs from the taxes they collect on

What Is Input Tax Credit For Car Insurance

What Is Input Tax Credit For Car Insurance

https://solution-is-here.com/wp-content/uploads/2022/09/ITC-1.png

Pin On Legal Services

https://i.pinimg.com/originals/4f/87/9e/4f879e7fccf462897fd26085cd6508bd.png

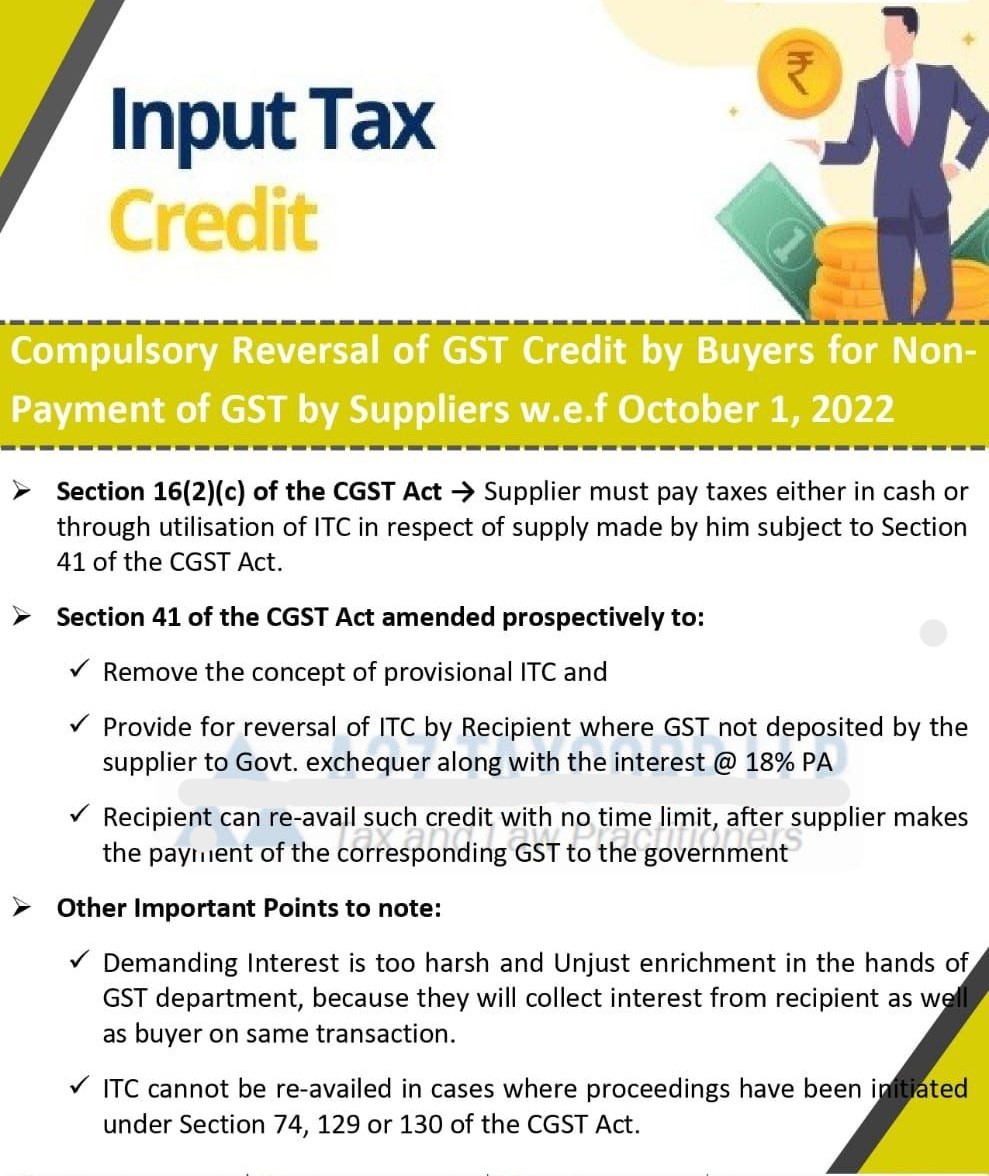

Input Tax Credit A New Era A Nightmare

https://taxguru.in/wp-content/uploads/2022/10/Input-Tax-Credit-–-A-New-era-A-Nightmare.jpg

The insurer pays out 20 000 That is the full face value of the policy less the input tax credit entitlement of the insured if it spent 22 000 on a new vehicle On Examples of operating expenses for which you may be eligible to claim an ITC are home office expenses restrictions apply see Line 9945 Business use of home expenses

Taxes GST HST for businesses Complete and file a GST HST return Calculate the net tax Complete and file a GST HST return Input tax credits Calculate What is an ITCE and why is it deducted You must tell us about the Input Tax Credits ITC you re entitled to for your premium and claim every time you make a claim If

Download What Is Input Tax Credit For Car Insurance

More picture related to What Is Input Tax Credit For Car Insurance

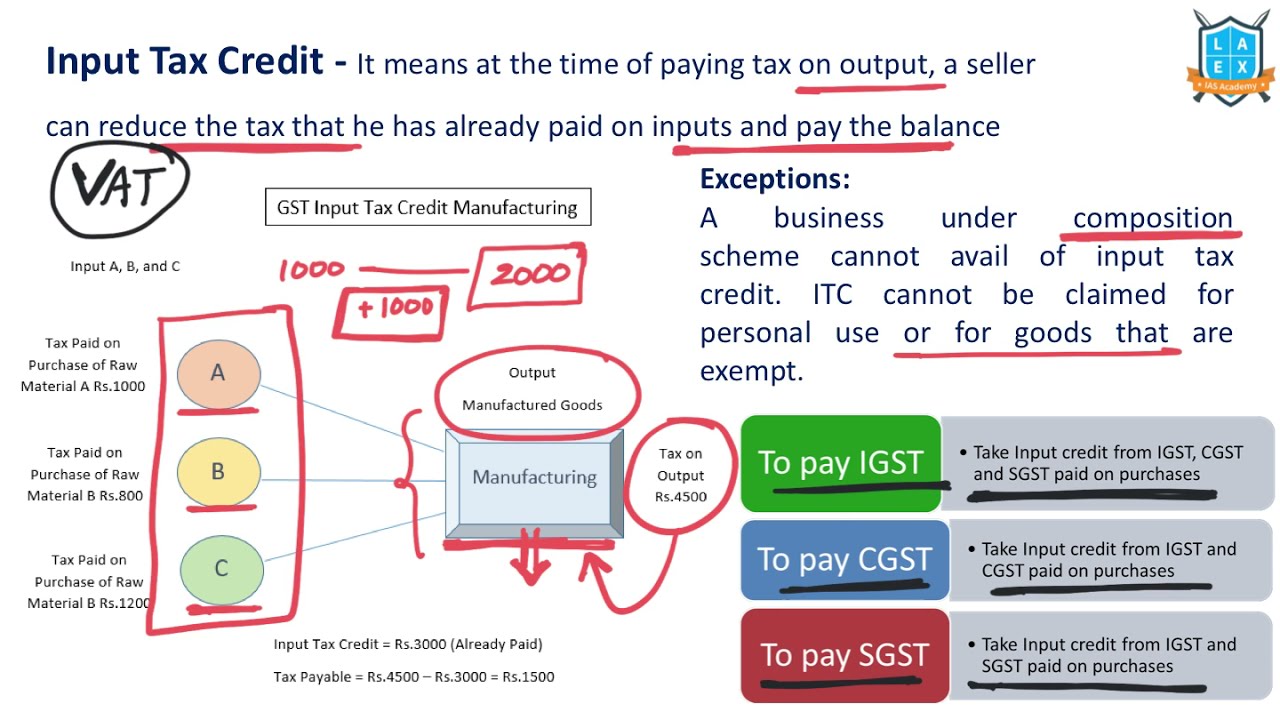

What Is Input Tax Credit Input Tax Credit La

https://i.ytimg.com/vi/kM_OYQg22CY/maxresdefault.jpg

![]()

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_930/https://www.saralgst.com/wp-content/uploads/2018/06/Input-Tax-credit.jpg

What Is Input Tax Credit And How To Claim It YouTube

https://i.ytimg.com/vi/pDMQR1e2g4w/maxresdefault.jpg

Yes under the GST Act you must tell us what your entitlement to ITC was for your insurance premium If you need more information please contact the ATO on 13 28 66 What is an Input Tax Credit estimator An ITC estimator is our general term for any methodology used to estimate GST credits for unprocessed tax invoices

Life insurance these are input taxed health insurance policies these are GST free You can t claim a GST credit for any part of your insurance that relates to What does Input Tax Credit ITC Entitlement mean Since 2003 customers that use their vehicle as part of a GST registered business have been able to claim back the GST

What Is Input Tax Credit And How To Claim It

https://vakilsearch.com/advice/wp-content/uploads/2018/12/What-is-input-credit_-and-how-to-claim-it_-1024x683.jpg

Input Tax Credit

https://bristax.com.au/wp-content/uploads/2023/07/gst-input-tax-credit-bristax-tax-accountants-1.webp

https://www.ascendstrata.com.au/blog/the-input-tax...

What should you put at the Input Tax Credit question when making an insurance claim What Percentage of Input Tax Credits ITCs Are Strata Companies Entitled To As

https://www.linkedin.com/pulse/what-my-input-tax...

So you would put down 100 of the ITC to be claimed 2 Assets which are 100 private or where you are unable to claim any GST credits back An example of

The Electric Car Tax Credit What You Need To Know OsVehicle

What Is Input Tax Credit And How To Claim It

Conditions Made To Claim Input Tax Credit Authoritative Blog

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

What Is Input Credit ITC Under GST

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

Input Tax Credit Under Goods And Services Tax Act RJA

What Is Input Tax Credit ITC INSIGHTSIAS

Input Tax Credit Reversal On Sale Of Shares Mutual Funds Chandan

What Is Input Tax Credit For Car Insurance - What is an ITCE and why is it deducted You must tell us about the Input Tax Credits ITC you re entitled to for your premium and claim every time you make a claim If