What Is Non Refundable Tax Credit A nonrefundable tax credit is a type of state or federal credit that offsets your tax bill dollar for dollar It s called nonrefundable because once your tax bill

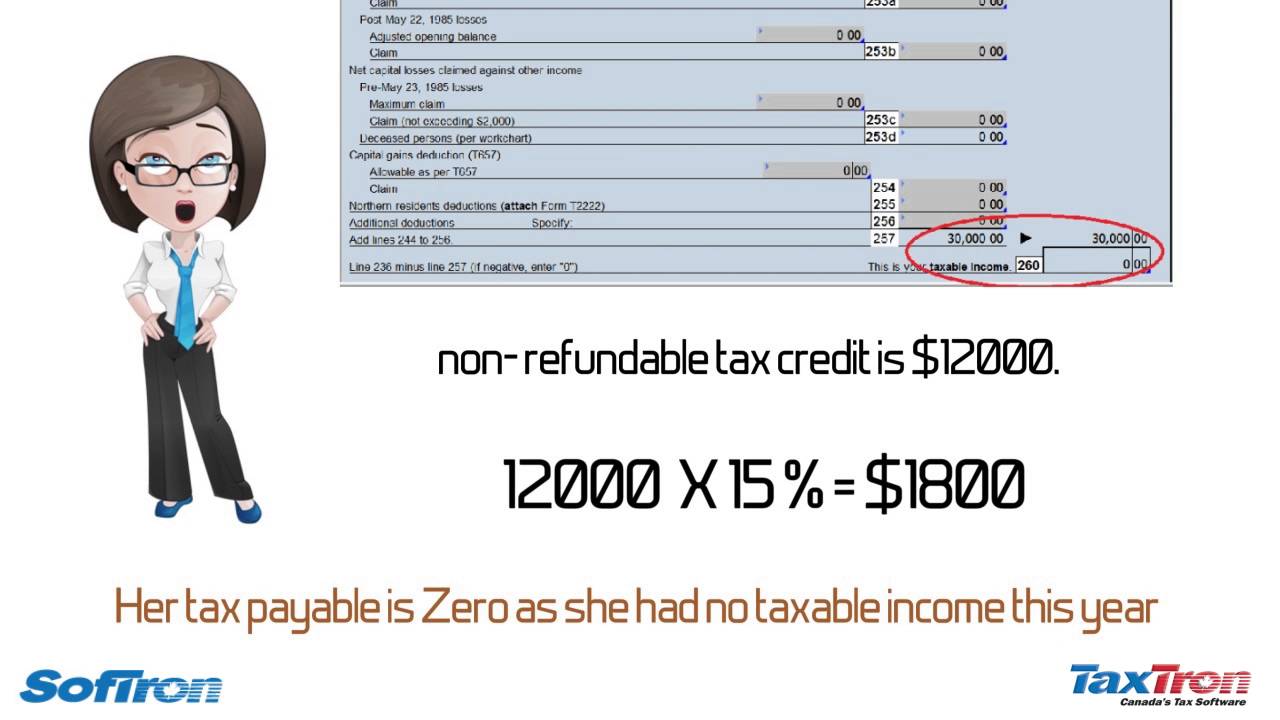

A nonrefundable credit is subtracted from your income tax liability up to the total amount you owe But unlike a refundable tax credit a nonrefundable credit cannot reduce your tax balance beyond zero Any unused portion of a nonrefundable tax credit will expire in the year the credit is claimed and cannot be carried over A nonrefundable tax credit is a tax benefit that reduces the amount of tax you owe to the government Unlike a refundable tax credit which can result in a tax refund even if the credit exceeds your tax liability a nonrefundable tax credit can only be used to reduce your tax liability to zero

What Is Non Refundable Tax Credit

What Is Non Refundable Tax Credit

https://www.universalcpareview.com/wp-content/uploads/2021/01/Personal-tax-credits.png

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits.jpg

What Are Non Refundable Tax Credits YouTube

https://i.ytimg.com/vi/uMhxbPTRo8I/maxresdefault.jpg

What are non refundable tax credits Want to pay less tax One totally legit way to do it is by using non refundable tax credits These credits reduce the amount of tax you have to pay though unlike refundable tax credits they can t bring that amount below zero where you get paid the difference What Is a Non Refundable Tax Credit Non refundable tax credits are a type of credit that gets applied to certain tax deductions The credit can only reduce a taxpayer s total liability to zero Basically a non refundable tax credit cannot get refunded to the taxpayer or create an overpayment

Key Takeaways Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

Download What Is Non Refundable Tax Credit

More picture related to What Is Non Refundable Tax Credit

Refundable V Non refundable Tax Credits What s The Difference YouTube

https://i.ytimg.com/vi/38DAHVg252Q/maxresdefault.jpg

Refundable Vs Non Refundable Tax Credits Wessel Company

https://www.wesselcpa.com/wp-content/uploads/2019/04/543881659.jpg

Refundable Non Refundable Tax Credits YouTube

https://i.ytimg.com/vi/_58zVuDiEtg/maxresdefault.jpg

The amount of a refundable tax credit that exceeds income tax liability is refunded to taxpayers Most tax credits are nonrefundable Notable exceptions include the fully refundable earned income tax credit EITC the premium tax credit for health insurance PTC the refundable portion of the child tax credit CTC known as the additional A nonrefundable tax credit eliminates your 1 200 tax liability and stops there A refundable tax credit on the other hand wipes out your liability and pays you the remaining 800 in a tax refund Some tax credits are partially refundable

[desc-10] [desc-11]

What Is A Non Refundable Tax Credit Taxpy

https://taxpy.net/wp-content/uploads/2023/12/What-Is-A-Non-Refundable-Tax-Credit.jpg

What Are Refundable Tax Credits YouTube

https://i.ytimg.com/vi/Ya86EU_smGE/maxresdefault.jpg

https://www.forbes.com/advisor/taxes/nonrefundable-tax-credit

A nonrefundable tax credit is a type of state or federal credit that offsets your tax bill dollar for dollar It s called nonrefundable because once your tax bill

https://www.irs.com/en/refundable-vs-non-refundable-tax-credits

A nonrefundable credit is subtracted from your income tax liability up to the total amount you owe But unlike a refundable tax credit a nonrefundable credit cannot reduce your tax balance beyond zero Any unused portion of a nonrefundable tax credit will expire in the year the credit is claimed and cannot be carried over

Non refundable Tax Credits CKH Group

What Is A Non Refundable Tax Credit Taxpy

Nonrefundable Tax Credit Requirements Examples How To Claim

What Is The Difference Between A Refundable And Non Refundable Tax

Maximize Tax Savings A Guide To Refundable Vs Non Refundable Tax Credits

Maximize Tax Savings A Guide To Refundable Vs Non Refundable Tax Credits

Maximize Tax Savings A Guide To Refundable Vs Non Refundable Tax Credits

Refundable Vs Non refundable Tax Credits Caras Shulman

Investopedia On Twitter A Non refundable Tax Credit Explained Https

Explanation Of The Non refundable Part Of Employee Retention Credit

What Is Non Refundable Tax Credit - Key Takeaways Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe