What Is Normal Tax Deduction A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill The standard deduction is a fixed number that is based on your filing status It can vary each tax year It allows you to subtract a specific amount from your adjusted

What Is Normal Tax Deduction

What Is Normal Tax Deduction

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Deposit Deduction Form PDF Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/63/206/63206740/large.png

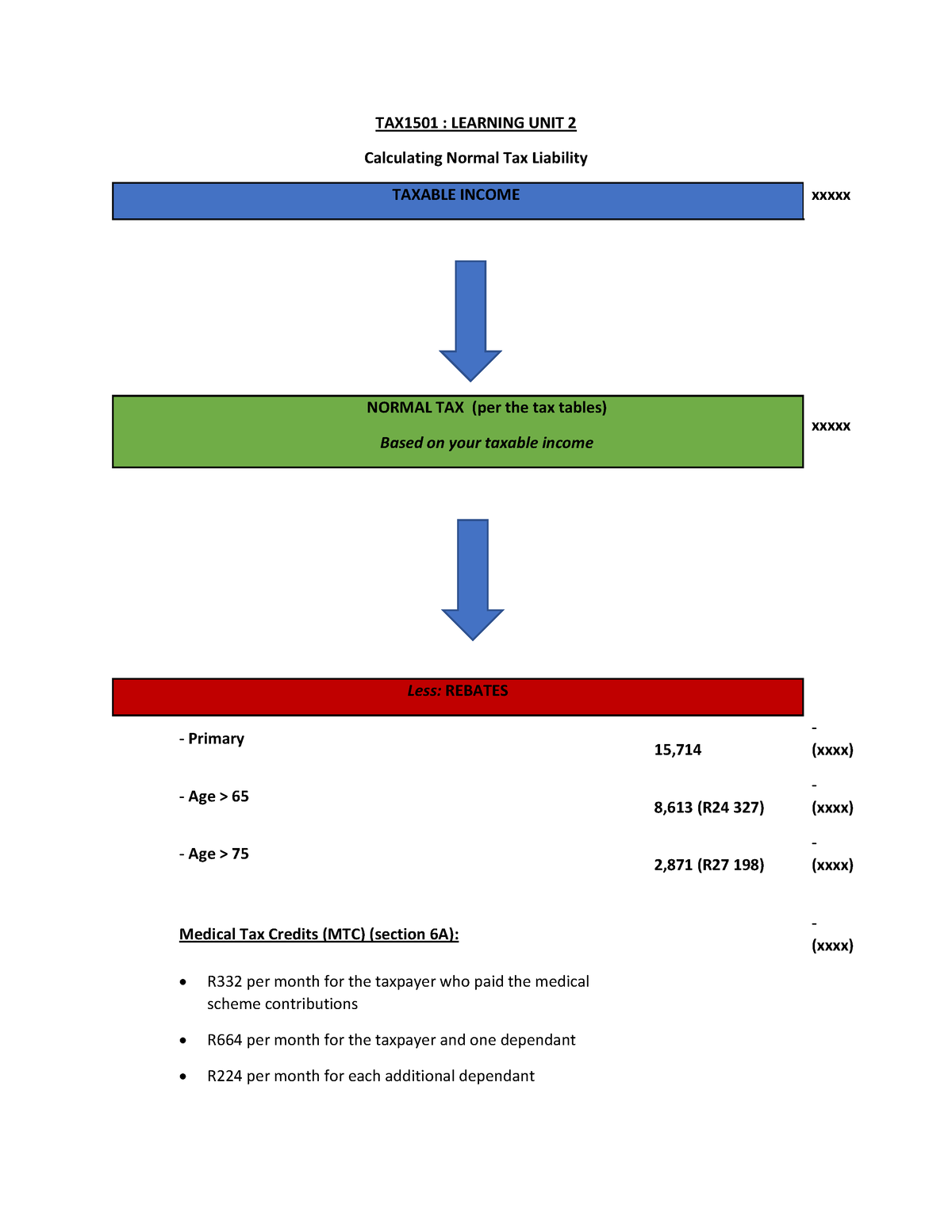

TAX1501 LU2 Calculating Normal Tax Liability TAX1501 LEARNING UNIT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fd7a547eb2914c7f2e1d6d4f44259d59/thumb_1200_1553.png

The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe Browse Investopedia s expert written library to

A deduction is an amount you subtract from your income when you file so you don t pay tax on it By lowering your income deductions lower your tax You need The standard tax deduction is a fixed amount that the tax system lets you deduct from your income no questions asked

Download What Is Normal Tax Deduction

More picture related to What Is Normal Tax Deduction

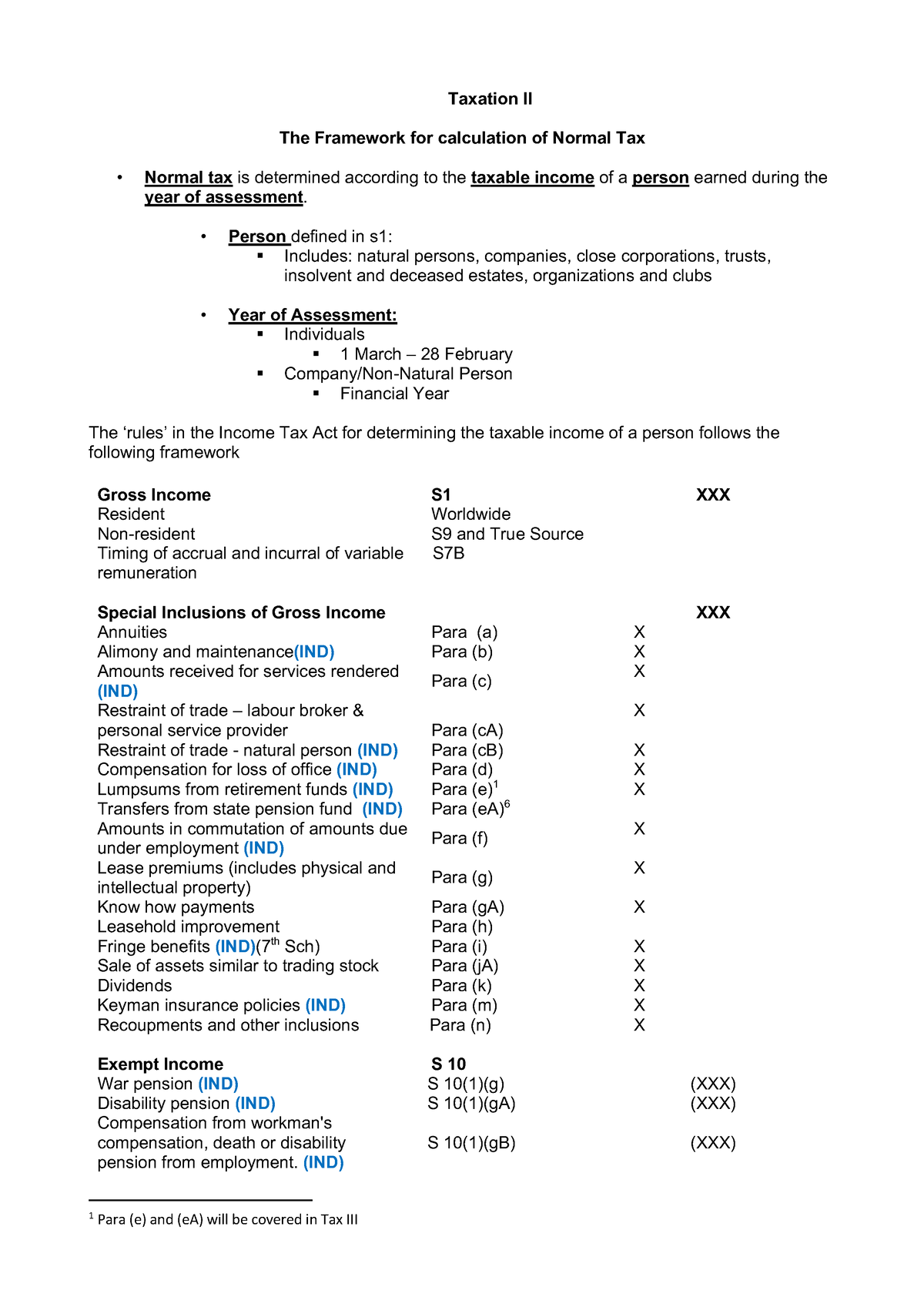

The Framework For Calculation Of Normal Tax Taxation II The Framework

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/e18a91ff2942387e745d607801629182/thumb_1200_1697.png

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_570xN.3985544266_82sm.jpg

A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for heads of household

The standard deduction for tax year 2024 is 14 600 for singles 29 200 for joint filers and 21 900 for heads of household Learn more Deductions from your pay Your employer is not allowed to make deductions unless it s required or allowed by law for example National Insurance income tax or student loan

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

https://www.investopedia.com/terms/t/tax-deduction.asp

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

The Deductions You Can Claim Hra Tax Vrogue

What Is Tax Deduction Definition Types And Benefits

Solved Please Note That This Is Based On Philippine Tax System Please

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

What Is A Tax Deduction

Section 179 Tax Savings Explained For 2022

2020 Tax Deduction Amounts And More Heather

What Is Normal Tax Deduction - The standard tax deduction is a fixed amount that the tax system lets you deduct from your income no questions asked