What Is Nsc In 80c Under NSC the principal sum invested qualifies for tax deductions u s 80C The interest earned on the investment is also tax deductible under the Rs 1 5 Lakh ceiling for the

What is 80C in Income Tax and its Sub sections Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are spread diversely National Savings Certificate NSC is a savings scheme that primarily encourages small to mid income investors to invest along with availing tax benefits under Section 80C of the Income Tax Act This scheme has a lock

What Is Nsc In 80c

What Is Nsc In 80c

https://2.bp.blogspot.com/_tNVazWmUufs/TBj25h_9RkI/AAAAAAAAA9M/jPTsC0XVyOY/s1600/NSC+MN+logo+4CLR+RGB.jpg

NSC V s ELSS Which Is Better Option For 80C Deduction YouTube

https://i.ytimg.com/vi/glIIXdUfV6A/maxresdefault.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

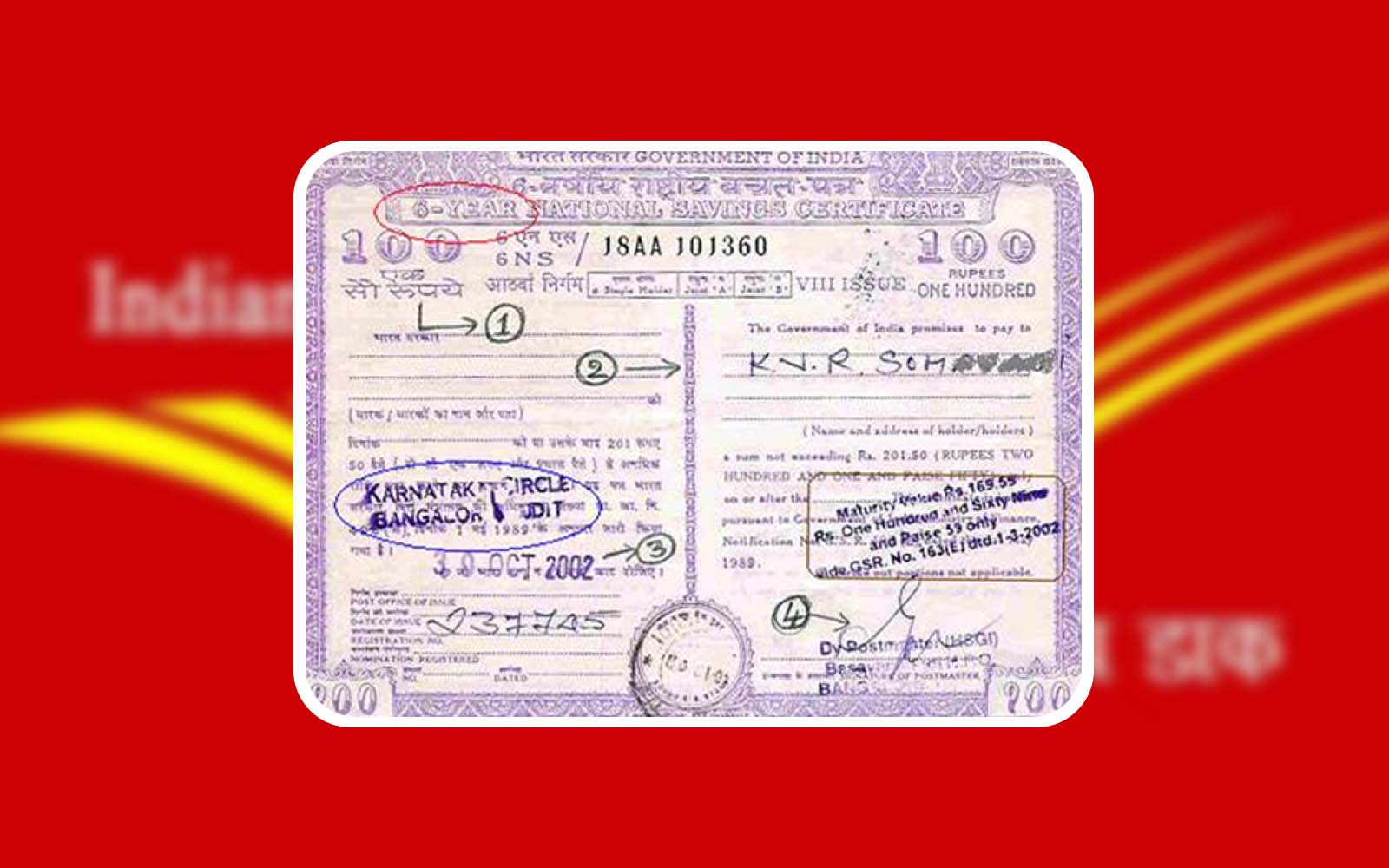

Deposits up to Rs 1 50 lakh in NSC qualify for Deduction Section 80C of the Income Tax Act Accrued interest on NSC also qualifies for deduction u s 80C NSC interest is Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

The National Savings Certificate NSC offers tax benefits to investors under Section 80C of the Indian Income Tax Act Here are NSC s key tax benefits Tax Deduction The amount invested in NSC is eligible for a tax National Savings Certificate is a savings bond scheme that encourages subscribers primarily small to mid income investors to invest while saving on income tax under Section 80C

Download What Is Nsc In 80c

More picture related to What Is Nsc In 80c

National Savings Certificate NSC Benefits Type Invest

https://paytmblogcdn.paytm.com/wp-content/uploads/2023/08/Blog_Paytm_What-is-NSC-National-Savings-Certificate.jpg

What Is National Saving Certificate Best One Time Deposit Scheme

https://bestinvestindia.com/wp-content/uploads/2020/07/Screenshot_2020_0728_132810.png

NSC 2 Kampioen De Veense Courant Online

https://www.nijkerkerveen.org/wp-content/uploads/2022/06/NSC-2-1.jpg

A tax payer can claim deduction in respect of investments made by him in NSC in the year of investments under Section 80 C within the overall limit of 1 50 lakh The interest accrued on NSC National Savings Certificate NSC Public Provident Fund PPF and Kisan Vikas Patra KVP are the most popular fixed income earning instruments which can be opened with a Post Office

Section 80C of the Income Tax Act exempts NSC investments up to Rs 1 5 lakhs from tax They have a five year lock in term Fixed interest is earned on NSC certificates NSC investments are eligible for tax deductions under Section 80C of the Income Tax Act allowing deductions of up to 1 5 lakh per year

NSC CSP Athlete Factory

https://www.cspathletefactory.com.au/wp-content/uploads/2021/09/NSC.png

NSC Verliest Wederom De Veense Courant Online

https://www.nijkerkerveen.org/wp-content/uploads/2022/10/NSC-16.jpg

https://fi.money › guides › investments › nsc-national...

Under NSC the principal sum invested qualifies for tax deductions u s 80C The interest earned on the investment is also tax deductible under the Rs 1 5 Lakh ceiling for the

https://groww.in › tax

What is 80C in Income Tax and its Sub sections Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are spread diversely

All Deductions In Section 80C Chapter VI A FinCalC Blog

NSC CSP Athlete Factory

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

What Is 80c All You Need To Know About Section 80C Tata Capital Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Deductions Under Section 80C Its Allied Sections

Deductions Under Section 80C Its Allied Sections

How Section 80C Of IT Act Has Fallen Out Of Sync With

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deduction Under Section 80C In India Paisabazaar

What Is Nsc In 80c - Upto Rs 1 50 lakh under Section 80C NSC caters to the needs of anyone looking for a safe investment opportunity to earn steady interest while saving on taxes The government has