What Is Property Tax Exemption If you have a property tax exemption you don t have to pay that particular tax when you re filing your taxes An exemption can help you avoid a property tax bill completely while a deduction can help you lower your tax liabilities at tax time

A property tax exemption reduces the taxable value of your property which can significantly decrease your tax bill All property owners homeowners veterans charitable organizations and senior citizens can qualify for tax exemptions if they meet certain criteria Gains from the sale of property are included in the income from capital category and taxed at progressive rates from 30 to 34 Gains not exceeding 1 000 are exempt from capital gains tax Taxable capital gains are computed in two ways

What Is Property Tax Exemption

What Is Property Tax Exemption

https://www.exemptform.com/wp-content/uploads/2022/08/texas-sales-and-use-tax-exemption-certificate.png

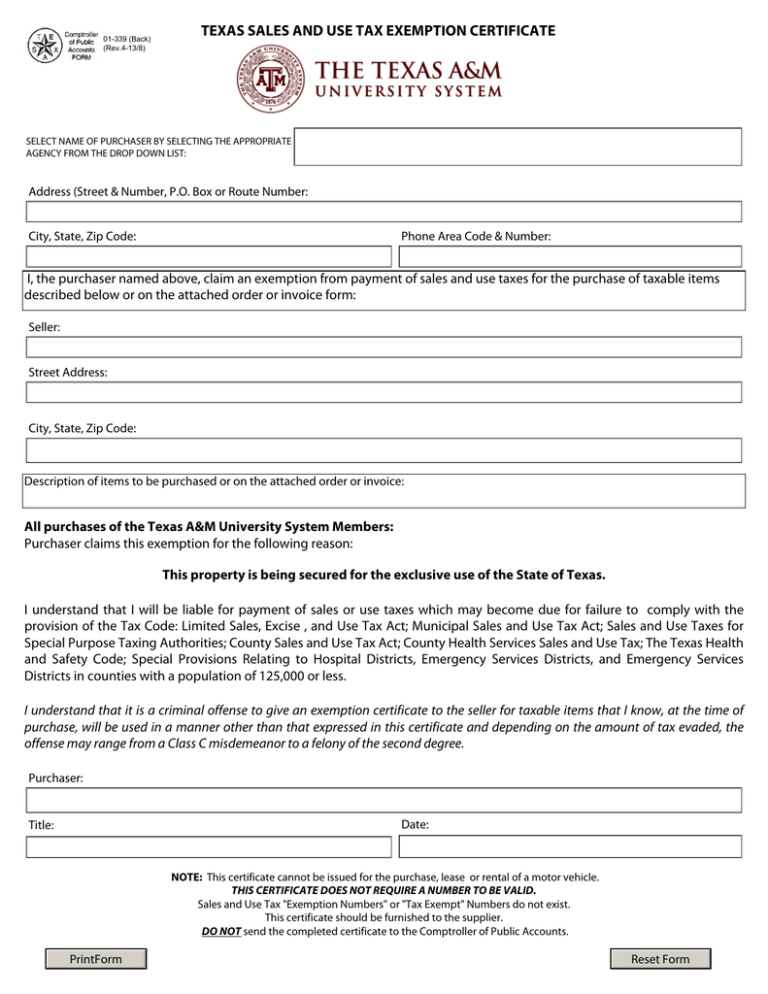

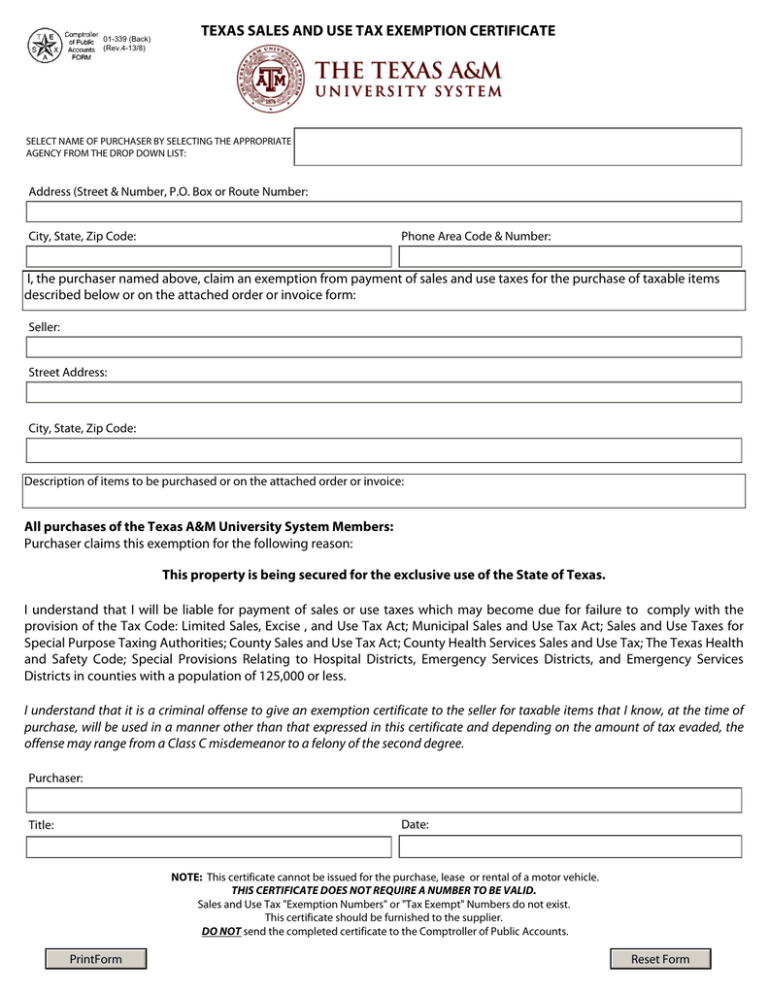

Tax Exempt Form 2020 2021 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/11/44/11044386/large.png

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

https://www.propertytax.lacounty.gov/images/Tax-Bills/annualbill2016.gif

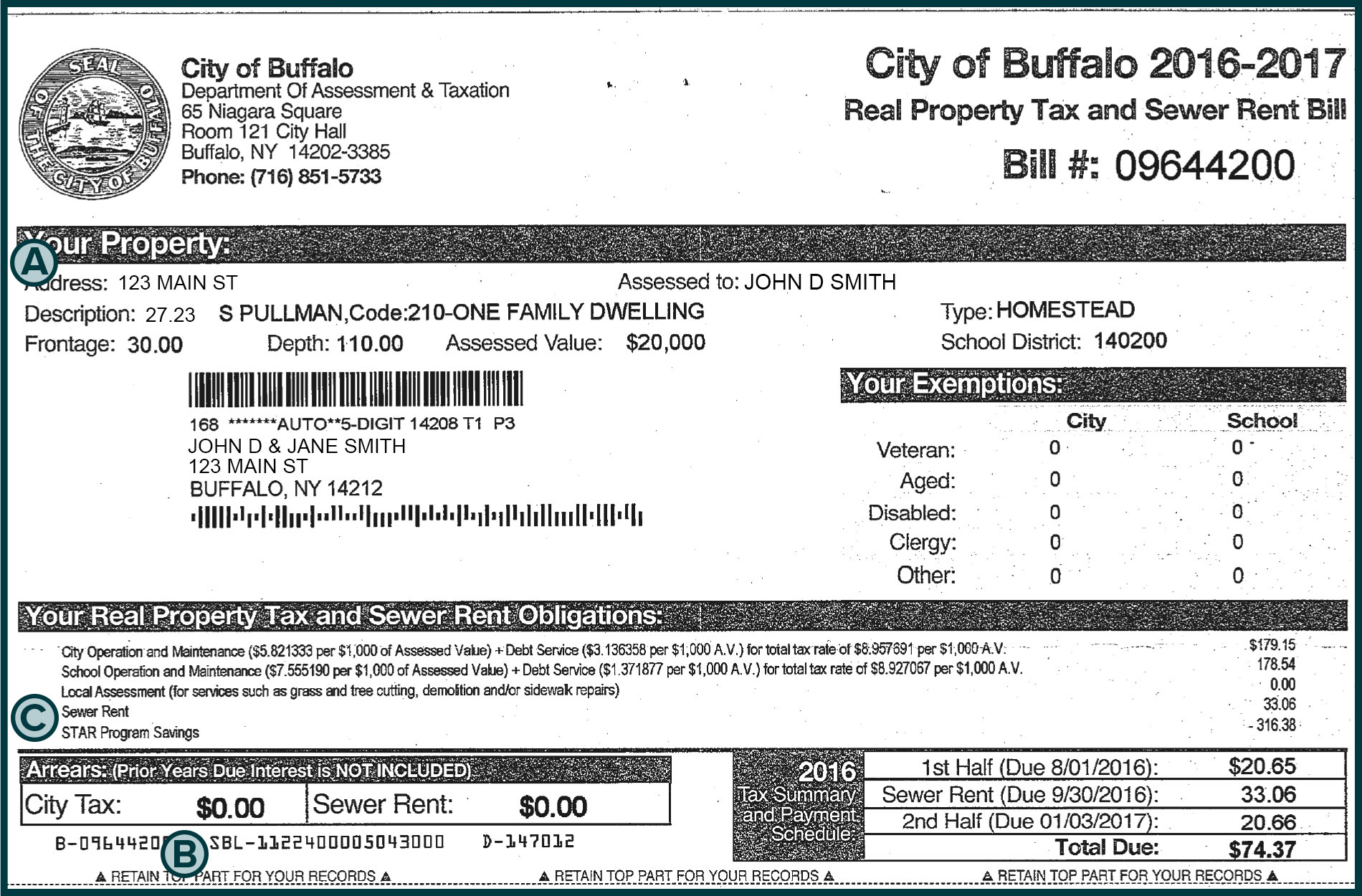

The homeowners property tax exemption is a tax relief program that alleviates the property tax burden for individuals who own a property and use it as their primary residence It works by lowering the assessed value of the property by up to 7 000 thereby reducing the property tax bill Capital Gains on Property Tax Exemption In 2024 the capital income tax rate is 30 for income up to 30 000 and 34 for capital income exceeding that amount

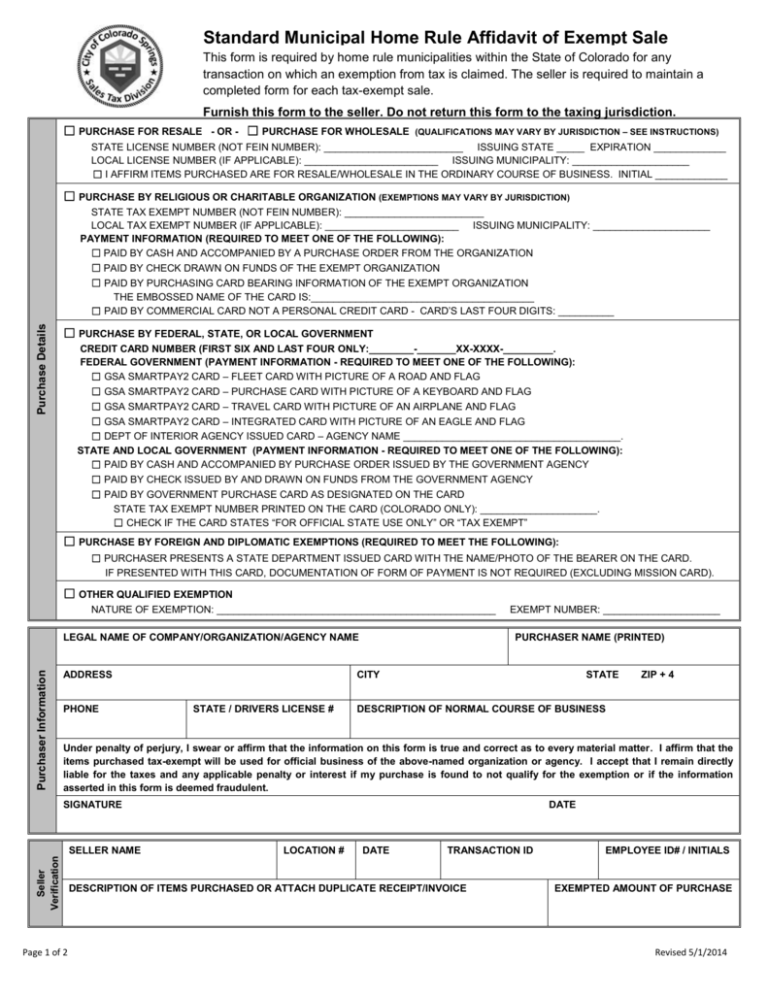

A property tax exemption allows a taxpayer to waive payment of some or all of their property taxes Individuals may be granted these exemptions based on certain qualifications Property Tax Exemptions vs Deductions Property tax exemptions can be a useful way of decreasing what you owe if you qualify Here we ll explore some of the most common property tax exemptions and who qualifies for them

Download What Is Property Tax Exemption

More picture related to What Is Property Tax Exemption

Roxy Dew

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2020/05/federal-estate-tax-rates.png

How To Fill Out Tax Declaration Form Louis Fitting s Templates

https://i.pinimg.com/originals/c2/23/27/c22327c3ebe7e718809bb897b8d177a5.png

What Is A Homestead Exemption For Property Ta Bios Pics

https://www.pdffiller.com/preview/100/121/100121915/large.png

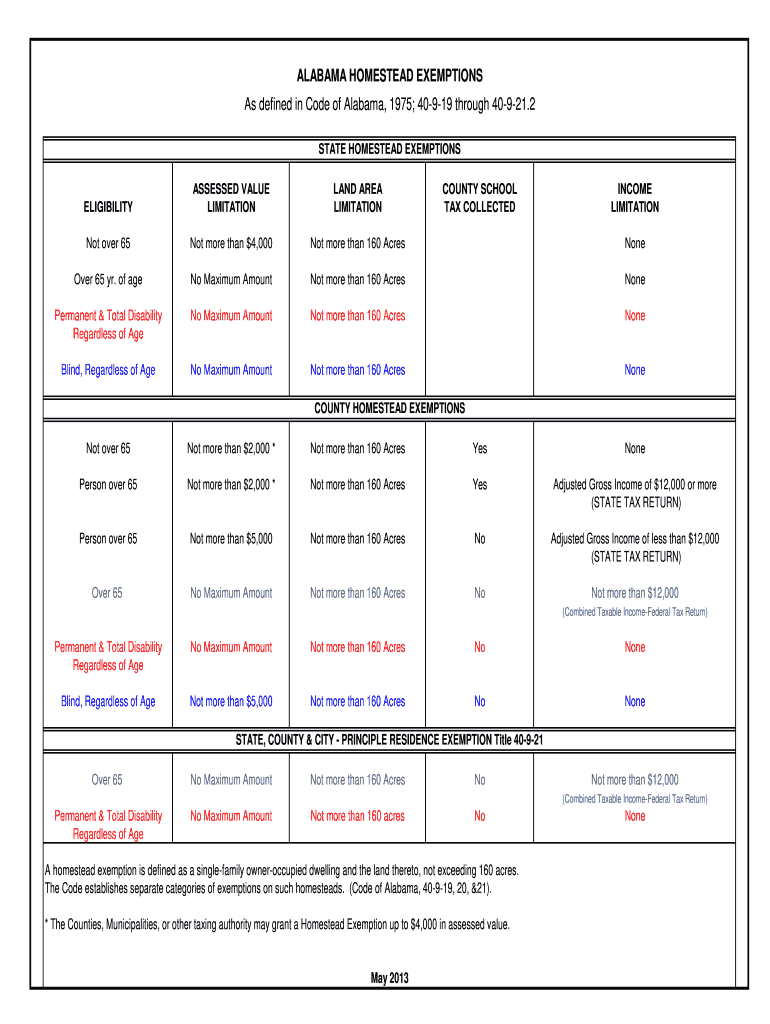

Tax on property You have to pay tax to the Finnish Tax Administration on inheritance valuable gifts rent income sales profits investment income and real estate for instance Rent income investment income sales profits and timber selling expenses will be taxed as capital income A homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner s spouse or the declaration of bankruptcy and minimizes property taxes for

A homestead tax exemption shelters either a dollar amount or percentage of the home value in the calculation of the homeowner s property tax bill Homeowners Exemption The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on the lien date January 1st

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

https://www.signnow.com/preview/479/105/479105302/large.png

Tax Exempt Form TAX

https://images.sampletemplates.com/wp-content/uploads/2016/12/19155608/Property-Tax-Exemption-Form.jpg

https://www.rocketmortgage.com › learn › property-tax-exemptions

If you have a property tax exemption you don t have to pay that particular tax when you re filing your taxes An exemption can help you avoid a property tax bill completely while a deduction can help you lower your tax liabilities at tax time

https://www.taxfyle.com › blog › property-tax-exemptions

A property tax exemption reduces the taxable value of your property which can significantly decrease your tax bill All property owners homeowners veterans charitable organizations and senior citizens can qualify for tax exemptions if they meet certain criteria

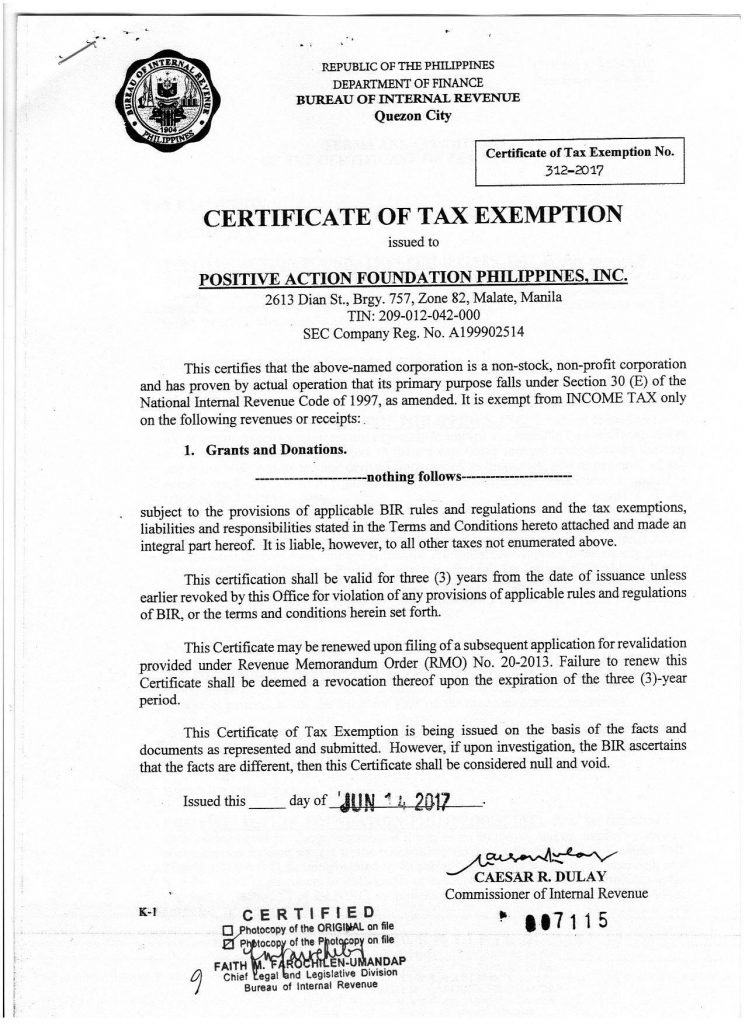

Certificate Of TAX Exemption PAFPI

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

Homestead Related Tax Exemptions Fill Out Sign Online DocHub

New Tax Exempt Form

Property Tax Bill Examples

Tax Exempt Form Ny Fill Out Sign Online DocHub

Tax Exempt Form Ny Fill Out Sign Online DocHub

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Homestead Exemption Form Fill Out Sign Online DocHub

What Is Property Tax Exemption - A property tax exemption allows a taxpayer to waive payment of some or all of their property taxes Individuals may be granted these exemptions based on certain qualifications Property Tax Exemptions vs Deductions