What Is Property Tax Refund Your tax refunds are only applied on an unpaid amount of real estate tax if the tax has fallen due before the end date of your tax assessment process How do I know when my tax assessment is completed

To make the payment you need the amount and due date of real estate tax the Tax Administration s bank account number and your personal reference number Direct payment is also available for individual taxpayers If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

What Is Property Tax Refund

What Is Property Tax Refund

https://i.ytimg.com/vi/LRDVwVguDYw/maxresdefault.jpg

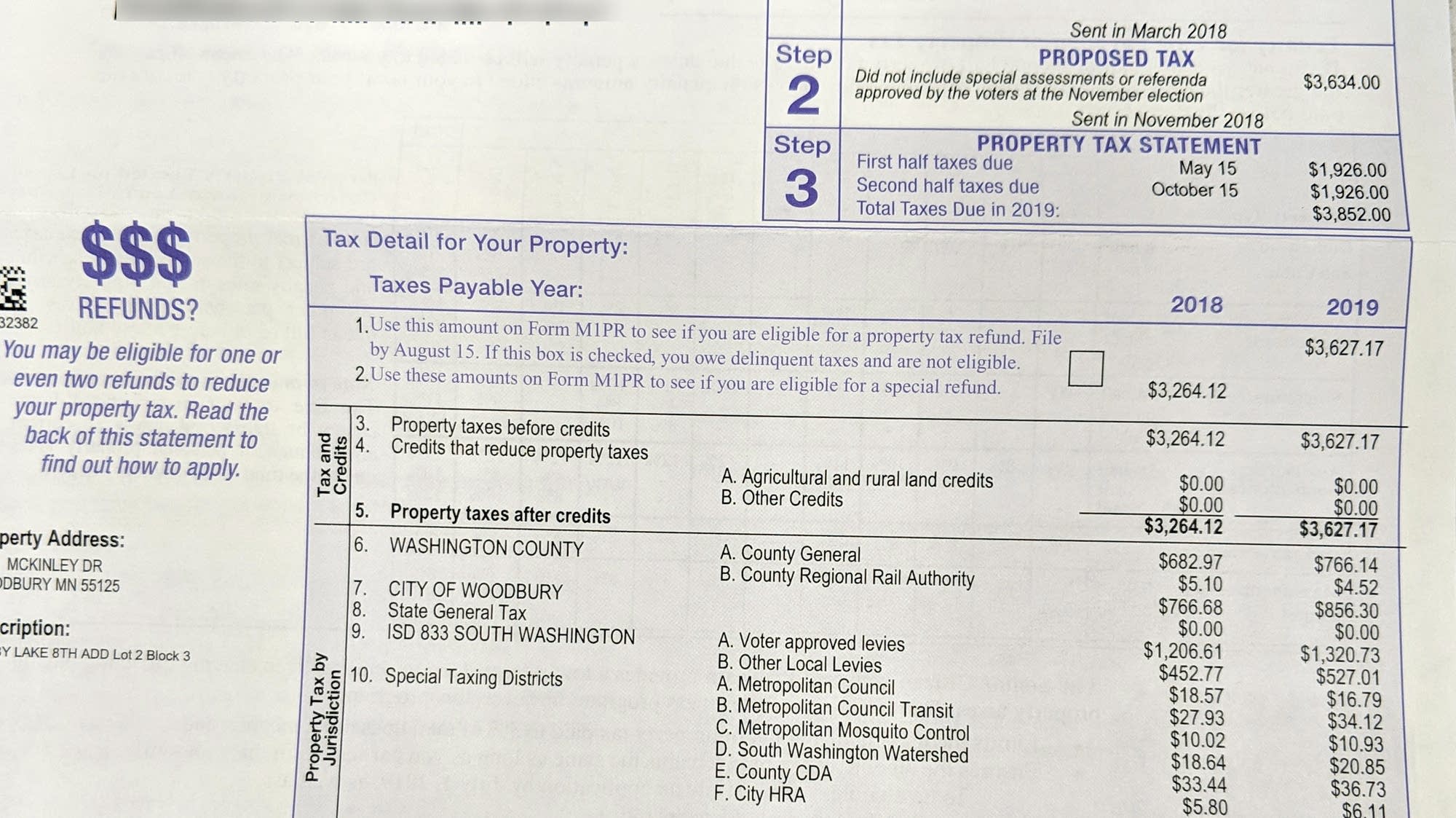

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

https://theshoppersweekly.com/wp-content/uploads/2018/04/tax-1.jpg

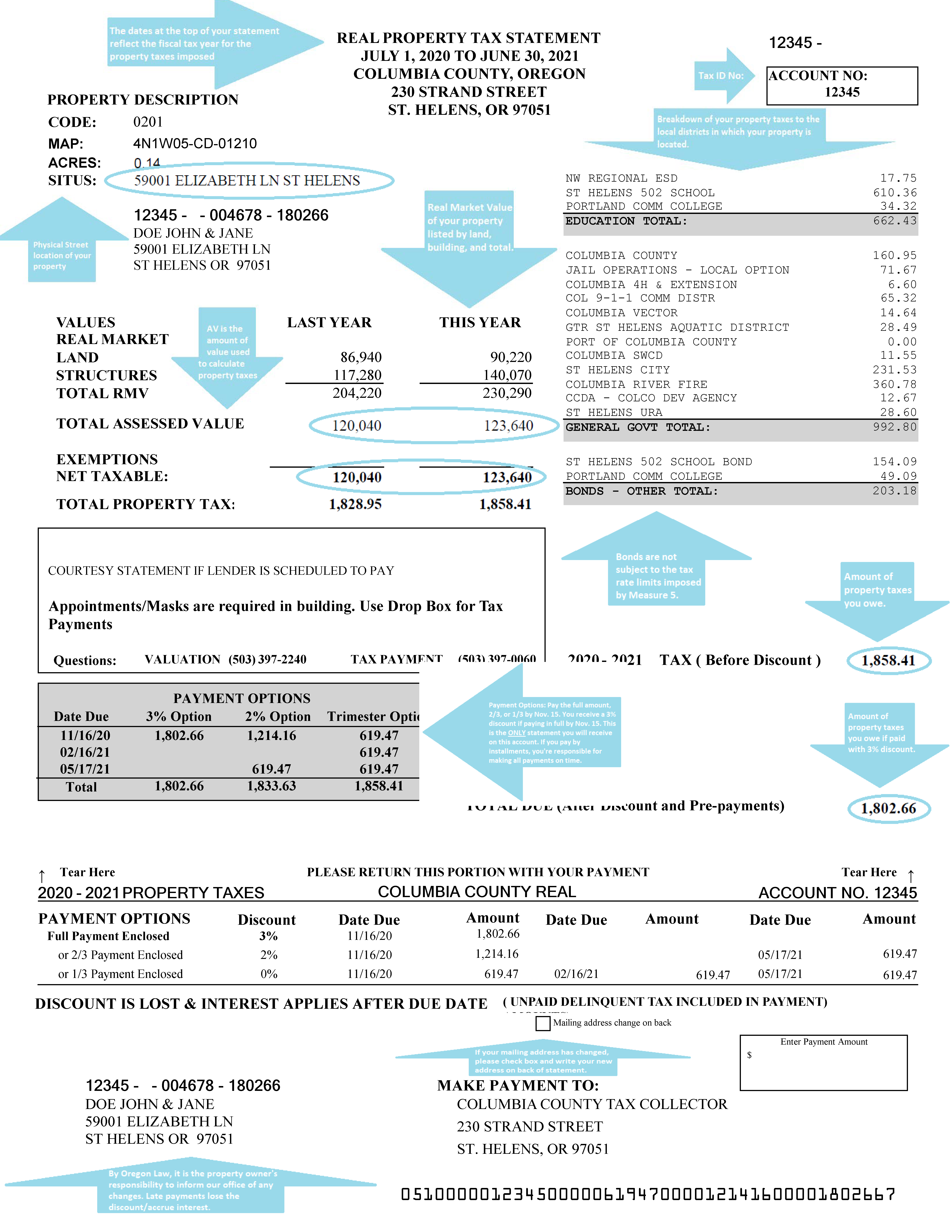

Columbia County Oregon Official Website Understanding Your Property

https://www.columbiacountyor.gov/media/Tax_Collector/PHOTOS/2020 Tax Statement Sample.png

The refund is 60 of the amount of tax paid that exceeds the 12 increase up to 1 000 You may qualify for this special refund even if you do not qualify for the 2023 Homestead Credit Refund If you are filing only for the special property tax refund complete only lines 1 15 19 20 23 25 and Schedule 1 ST PAUL Minn The Minnesota Department of Revenue reminds homeowners and renters to file for their 2020 Property Tax Refund before the deadline of August 15 2022 Additionally claims for 2021 refunds can be filed from now until August 15 2023

If you qualified for a property tax refund on your 2023 tax filings the Minnesota Department of Revenue s website has all of the information you ll need to track it down if the refund hasn t yet 2024 property taxes must be paid in full prior to refund issuance Tax bills will be available on the Pinellas County Tax Collectors website on November 1 2024 Supporting documentation must be provided showing the real property could not be inhabited following the date of the catastrophic event includes utility bills insurance claims

Download What Is Property Tax Refund

More picture related to What Is Property Tax Refund

How To Calculate Property Taxes

https://www.stlouis-mo.gov/government/departments/assessor/media/images/How-To-Calculate-Property-Taxes-2019.png

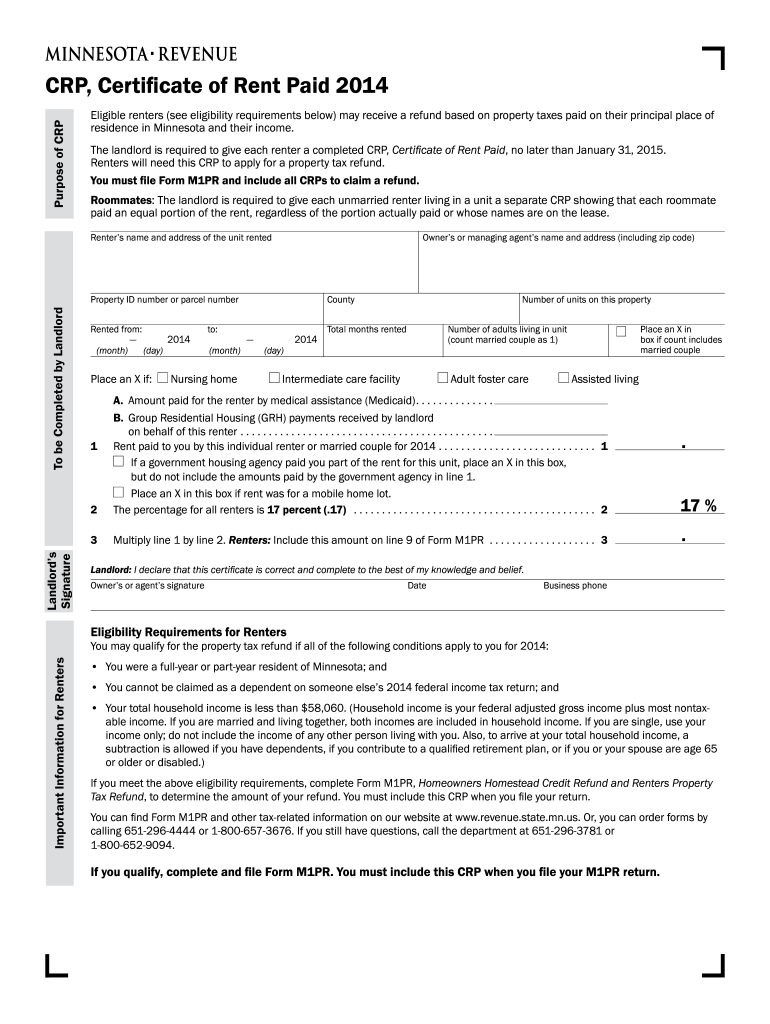

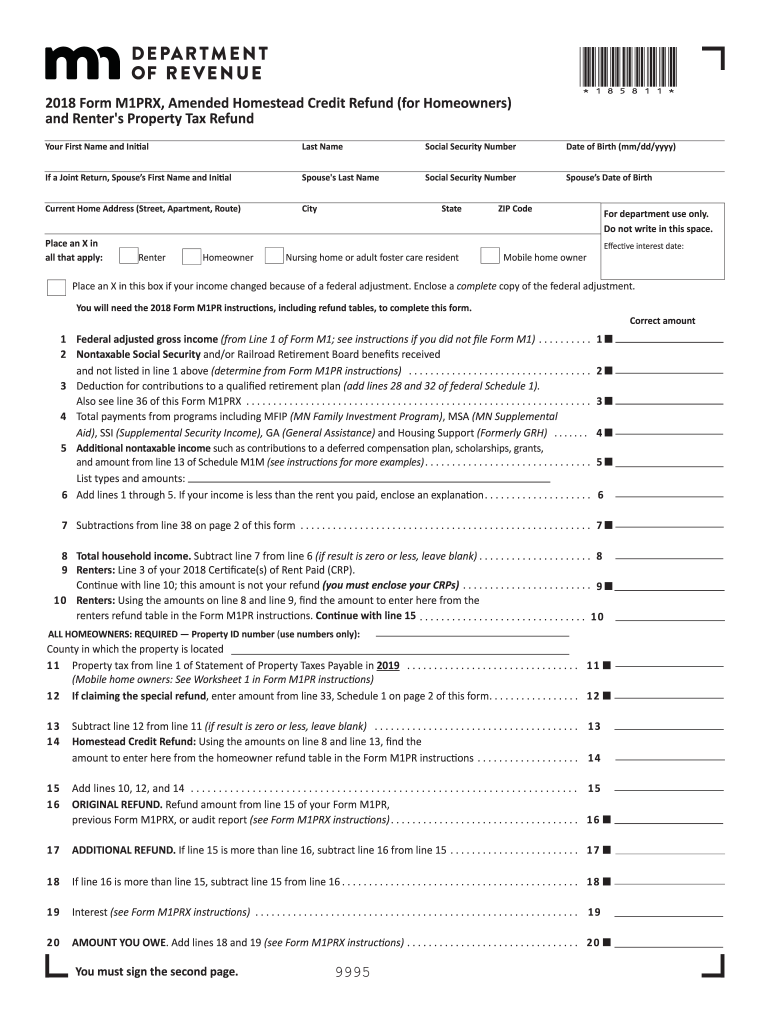

Fillable Form M1pr Homestead Credit Refund For Homeowners And

https://data.formsbank.com/pdf_docs_html/361/3610/361049/page_1_thumb_big.png

Renter s Property Tax Refund Minnesota Department Of Revenue Fill Out

https://www.signnow.com/preview/100/442/100442201/large.png

The refund is 75 of the 2023 general property tax paid or to be paid as shown on the 2023 real estate tax statement for the residence in which the claimant lived in 2023 The 2023 property tax consists of the 1st half which is due December 20 2023 and the 2nd half which is Property Tax Refunds If you re a homeowner or renter in Ramsey County you may qualify for one or more property tax refunds from the State of Minnesota Visit the Department of Revenue property tax refund page for details and a full list of refund programs

The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older This program is supported by funds from the Pennsylvania Lottery and gaming Ways to Apply Forms and Information What is the Illinois Property Tax Credit The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside

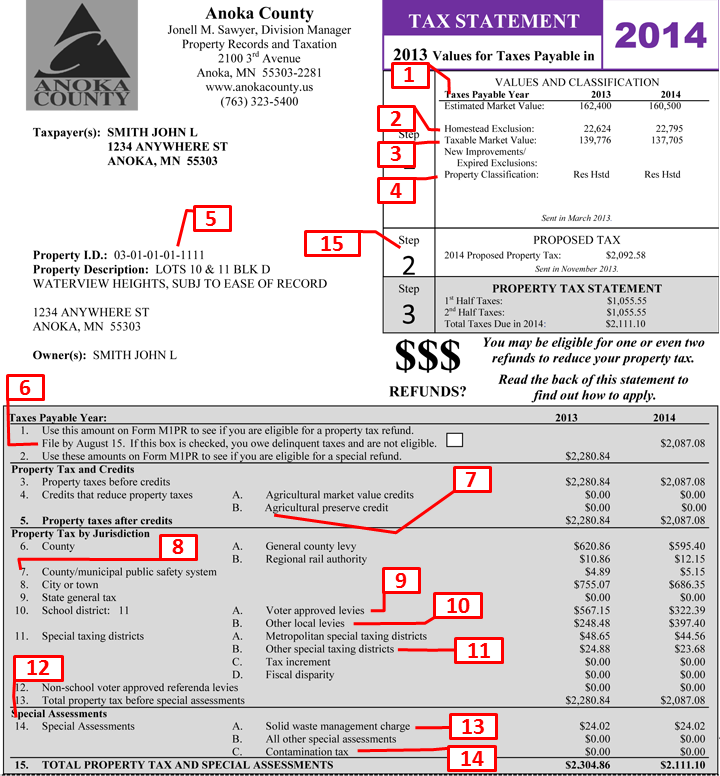

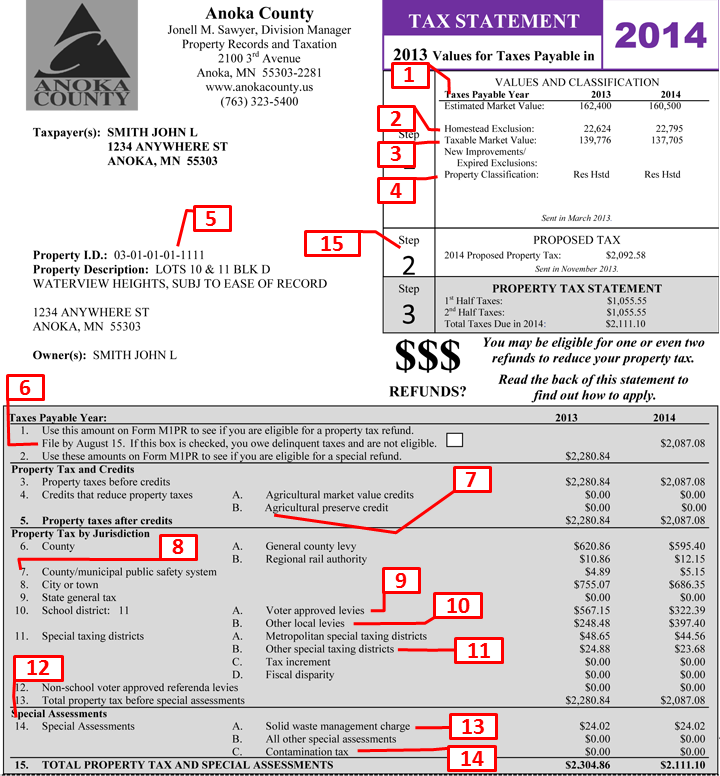

About Your Property Tax Statement Property Records Taxation Anoka

http://www.anokacounty.org/v1_departments/div-property-rec-tax/statements/images2014/property-tax-statement-2014.png

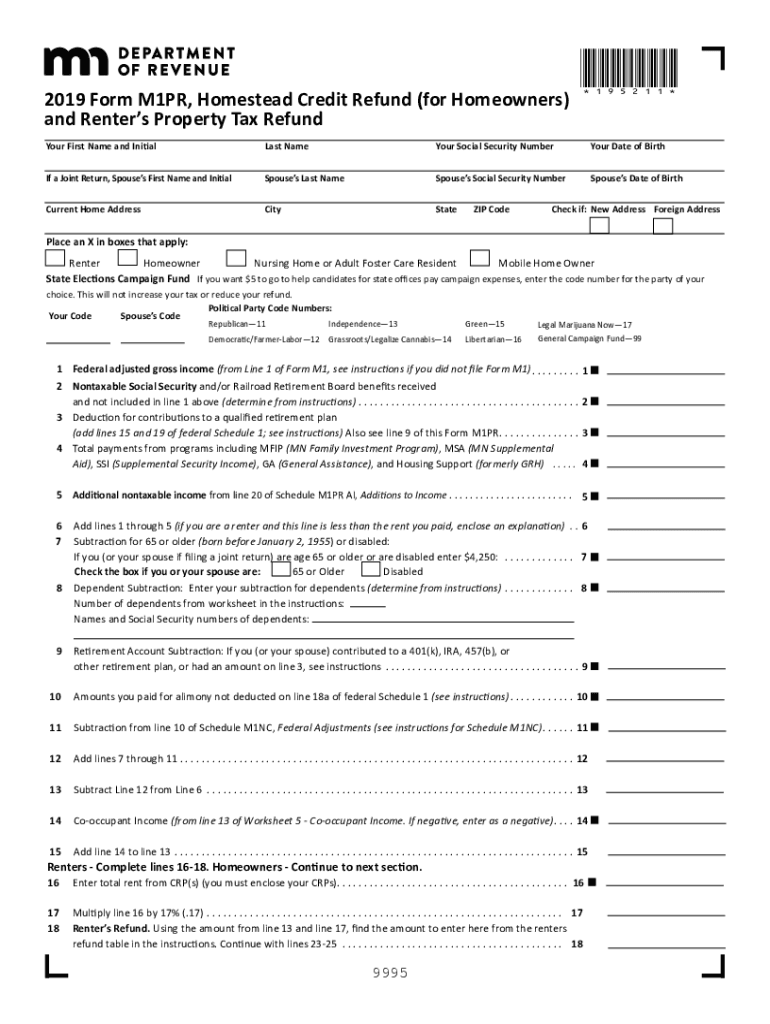

Mn Property Tax Refund Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/513/825/513825734/large.png

https://www.vero.fi/en/individuals/property/real...

Your tax refunds are only applied on an unpaid amount of real estate tax if the tax has fallen due before the end date of your tax assessment process How do I know when my tax assessment is completed

https://www.vero.fi/en/individuals/property/real...

To make the payment you need the amount and due date of real estate tax the Tax Administration s bank account number and your personal reference number Direct payment is also available for individual taxpayers

Show Us Your Property Tax Statement MPR News

About Your Property Tax Statement Property Records Taxation Anoka

About Your Property Tax Statement Anoka County MN Official Website

Supplemental Secured Property Tax Bill Placer County CA

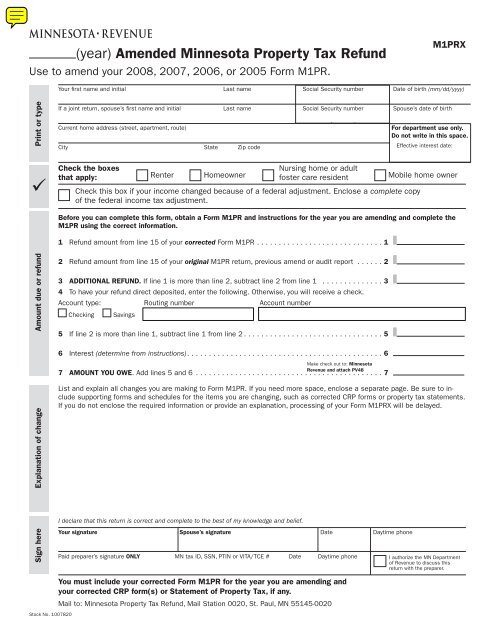

M1PRX Amended Property Tax Refund Return Minnesota

Property Taxes Due This Week

Property Taxes Due This Week

5 Common Real Estate Tax Mistakes Property Tax Consultant Tips

How High Are Property Taxes In Your State Tax Foundation

Minnesota Property Tax Form M1prx Fill Out And Sign Printable PDF

What Is Property Tax Refund - If you qualified for a property tax refund on your 2023 tax filings the Minnesota Department of Revenue s website has all of the information you ll need to track it down if the refund hasn t yet