What Is School Tax Credit The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023 You can claim these education

This interview will help you determine if your education expenses qualify for a tax benefit Information you ll need Filing status Student s enrollment status Your adjusted gross The Lifetime Learning Credit or LLC allows a maximum credit of up to 2 000 for qualifying educational expenses paid during the tax year for an eligible student enrolled at an eligible educational institution The LLC is

What Is School Tax Credit

What Is School Tax Credit

https://i.ytimg.com/vi/Yf63zSEkXXA/maxresdefault.jpg

Back To School Initiative Tax Credit Awareness Wynantskill Union

https://www.wynantskillufsd.org/wp-content/uploads/2023/08/back-to-school-tax-credit-2048x1325.jpg

From Vouchers To Tax Credits What Is School Choice And How Does It

https://i.ytimg.com/vi/-aVO7H_Xc2I/maxresdefault.jpg

The American Opportunity Tax Credit AOTC is a tax credit for qualified education expenses associated with the first four years of a student s postsecondary education The maximum annual Differences in the learning results of different schools are small and nearly all students complete comprehensive school within target time Preschool education comprehensive education and upper

The Lifetime Learning Credit is available for qualifying tuition and fee payments you made to a post secondary school after high school during the tax year The maximum credit you can claim is 20 Read instructions for arriving in Finland to work here you need a tax card and or an individual tax number Work in Finland

Download What Is School Tax Credit

More picture related to What Is School Tax Credit

New Pa Budget Injects 125M Into Private School Tax Credit Program

https://www.spotlightpa.org/imgproxy/insecure/rt:fill/w:1200/h:900/g:sm/el:1/q:75/ZXh0ZXJuYWwvc3k5ZDNhanpucGhiazhld2RmczB5OTR5bTQuanBlZw==.jpeg

Fillable Online 2016 Arizona School Tax Credit Form Fax Email Print

https://www.pdffiller.com/preview/459/274/459274027/large.png

Enrollment Verification Problems Delay Start Of Private School Tax

https://www.wdnonline.com/sites/wdnonline.etypegoogle7.com/files/03caf954e6_Ar00301005.jpg

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in Free interpretation Are you a full year or part year New York City resident New York offers several New York City income tax credits that can reduce the amount of New York City

The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which March 6 2023 The American Opportunity Tax Credit AOTC allows eligible parents to claim an annual tax credit of up to 2 500 per student to help cover college costs The

How Do School Tax Rates Work YouTube

https://i.ytimg.com/vi/5Fg1c3_Lcyw/maxresdefault.jpg

Court Says Tax Credit Program Can t Exclude Religious Schools

https://www.ncronline.org/files/20200630T1143-254-CNS-SCOTUS-TAX-CREDIT.jpg

https://www.nerdwallet.com/.../education-t…

The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023 You can claim these education

https://www.irs.gov/help/ita/am-i-eligible-to-claim-an-education-credit

This interview will help you determine if your education expenses qualify for a tax benefit Information you ll need Filing status Student s enrollment status Your adjusted gross

Oklahoma Launches Private School Tax Credit Program Following Delay

How Do School Tax Rates Work YouTube

School Should Be Teaching Us Taxes Mf s When School Actually Teaches

Somers Offers Multiple Ways To Pay School Tax Bill Yorktown NY Patch

2022 Tax Credit Resource Book By Aztaxcreditfunds Issuu

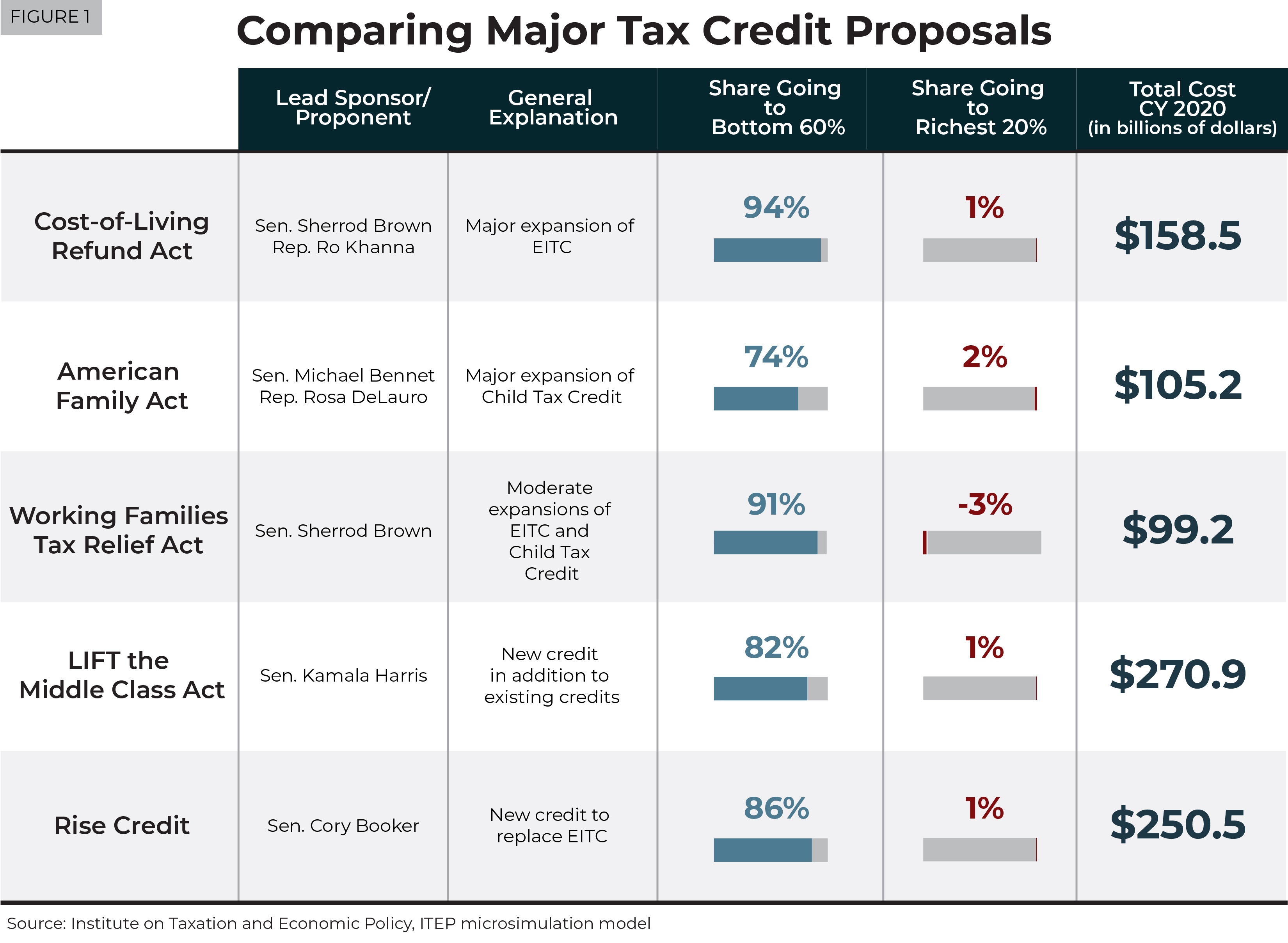

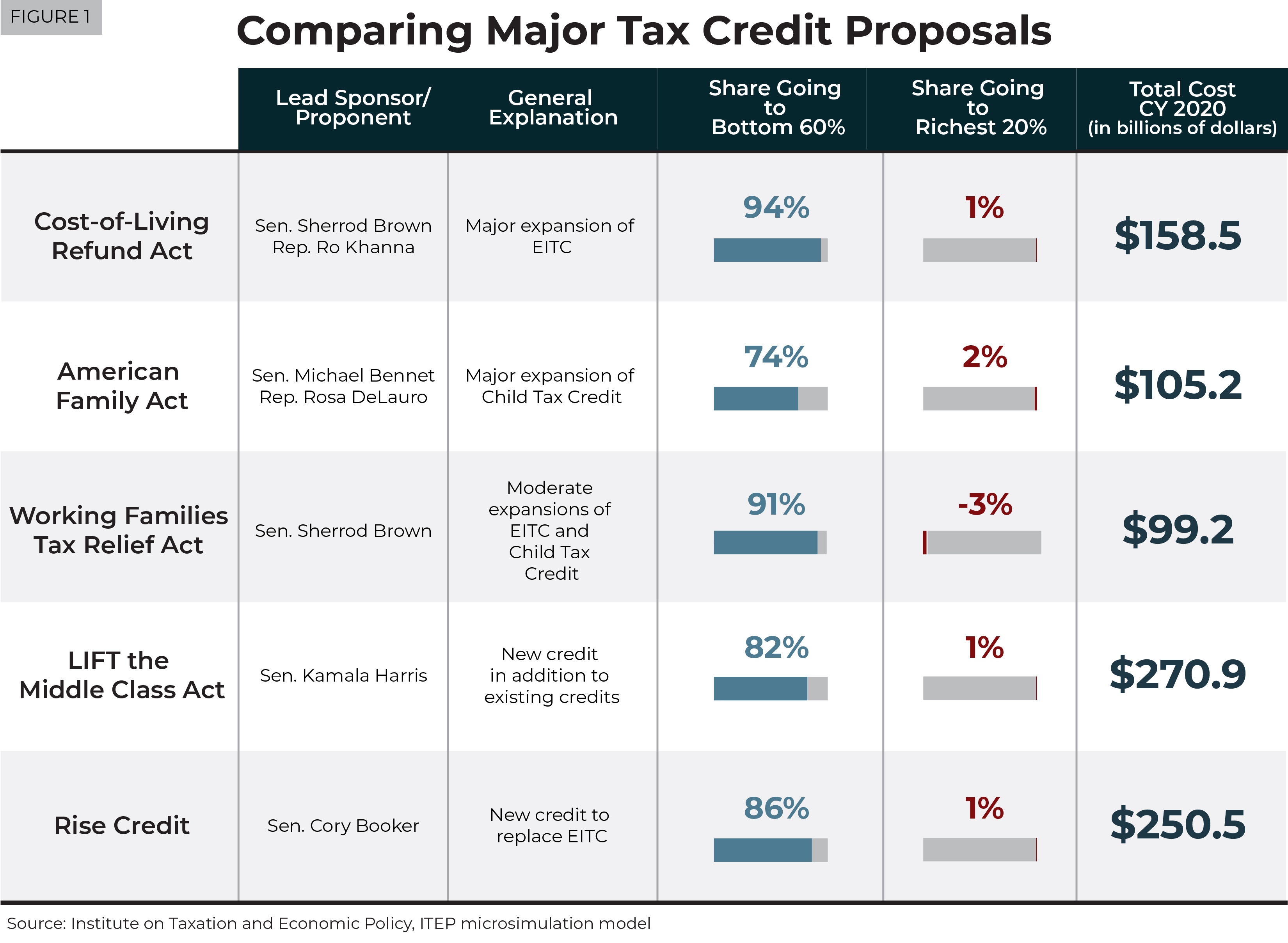

Understanding Five Major Federal Tax Credit Proposals Common Dreams

Understanding Five Major Federal Tax Credit Proposals Common Dreams

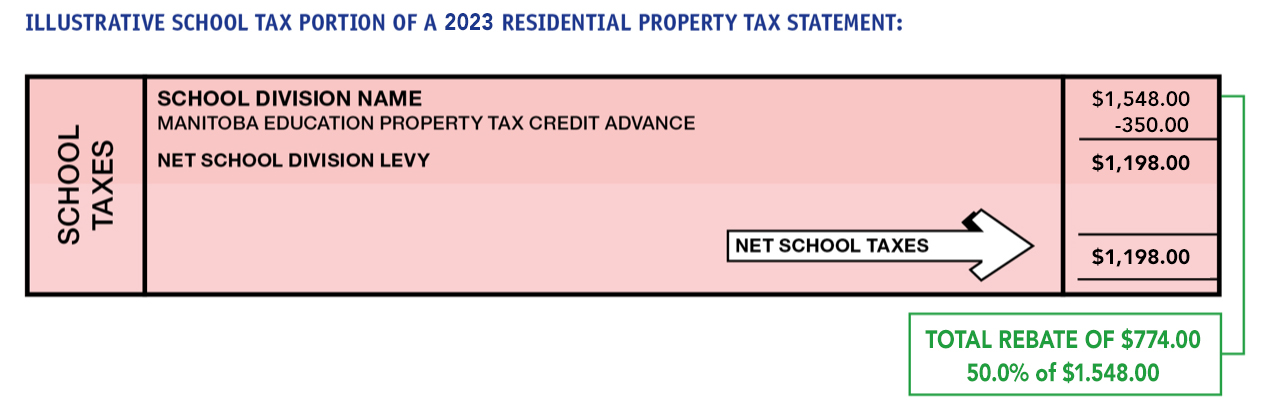

Province Of Manitoba School Tax Rebate

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

What Is School Tax

What Is School Tax Credit - The Lifetime Learning Credit is available for qualifying tuition and fee payments you made to a post secondary school after high school during the tax year The maximum credit you can claim is 20