What Is Security Tax How Much Is Social Security Tax The Social Security tax is part of the FICA taxes withheld from your paychecks For 2022 the total Social Security tax rate is 12 4 on a worker s

Calculating Social Security Taxes Let s say you earn 165 240 per year or 13 770 per month The maximum in wages that can be taxed for Social Security is 168 600 in 2024 or 14 050 per The Social Security tax is the money that gets withheld from your earned income to fund Social Security benefits You pay a portion of your salary currently 6 2 and your employer pays a portion currently an equal amount

What Is Security Tax

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

What Is Security Tax

https://www.investopedia.com/thmb/9mmAdVRVBVIyS-vjuCbvZwYEvRo=/2121x1414/filters:fill(auto,1)/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg

Employee Social Security Tax Deferral Repayment Process

https://www.patriotsoftware.com/wp-content/uploads/2020/09/social-security-tax-deferral-illustration-1.jpg

How To Deduct Social Security Tax And Medicare Tax

https://www.patriotsoftware.com/wp-content/uploads/2019/12/fica-tax-2020-visual.jpeg

All wages and self employment income up to the Social Security wage base are subject to the 12 4 Social Security tax The wage base is adjusted periodically to keep pace with inflation It was increased from 132 900 to 137 700 in Tax revenues finance government activities including public works and services such as roads and schools or programs such as Social Security and Medicare In economics taxes fall on whoever

The Social Security tax is one of two taxes all employers are required to withhold under the Federal Insurance Contributions Act FICA The other is the Medicare Tax FICA also mandates an Additional Medicare tax though only for employees earning more than a Social Security is a payroll tax that is used to fund Social Security benefits For most people the tax is withheld from your paycheck with an equal amount paid by your employer Others such as self employed individuals typically pay their own Social Security tax as both the employee and the employer

Download What Is Security Tax

More picture related to What Is Security Tax

NCSC 10 Steps MTI

https://fr.mti.com/wp-content/uploads/2018/02/NCSC-10-Steps.png

What Is The Social Security Tax Rate The Motley Fool

https://g.foolcdn.com/editorial/images/209288/social-security-tax.jpg

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

https://www.investopedia.com/thmb/5gy0lgsoZKBuV5kVXHzbm22WH4M=/2121x1414/filters:fill(auto,1)/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg

Up to 85 of your Social Security benefits may be subject to taxes at your ordinary income tax rate but 44 of people won t owe any income taxes on their Social Security benefits Those En espa ol Published October 10 2018 Updated March 18 2024 If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed

Social Security 7 Things to Know About Social Security and Taxes Your overall income primarily determines whether you owe taxes on your benefits and how much By Andy Markowitz AARP En espa ol Published January 18 2023 Updated January 30 2024 SSI is a monthly Social Security benefit for people with limited resources low incomes and who are blind disabled or 65 or older Determine how your Social Security is taxed Federal

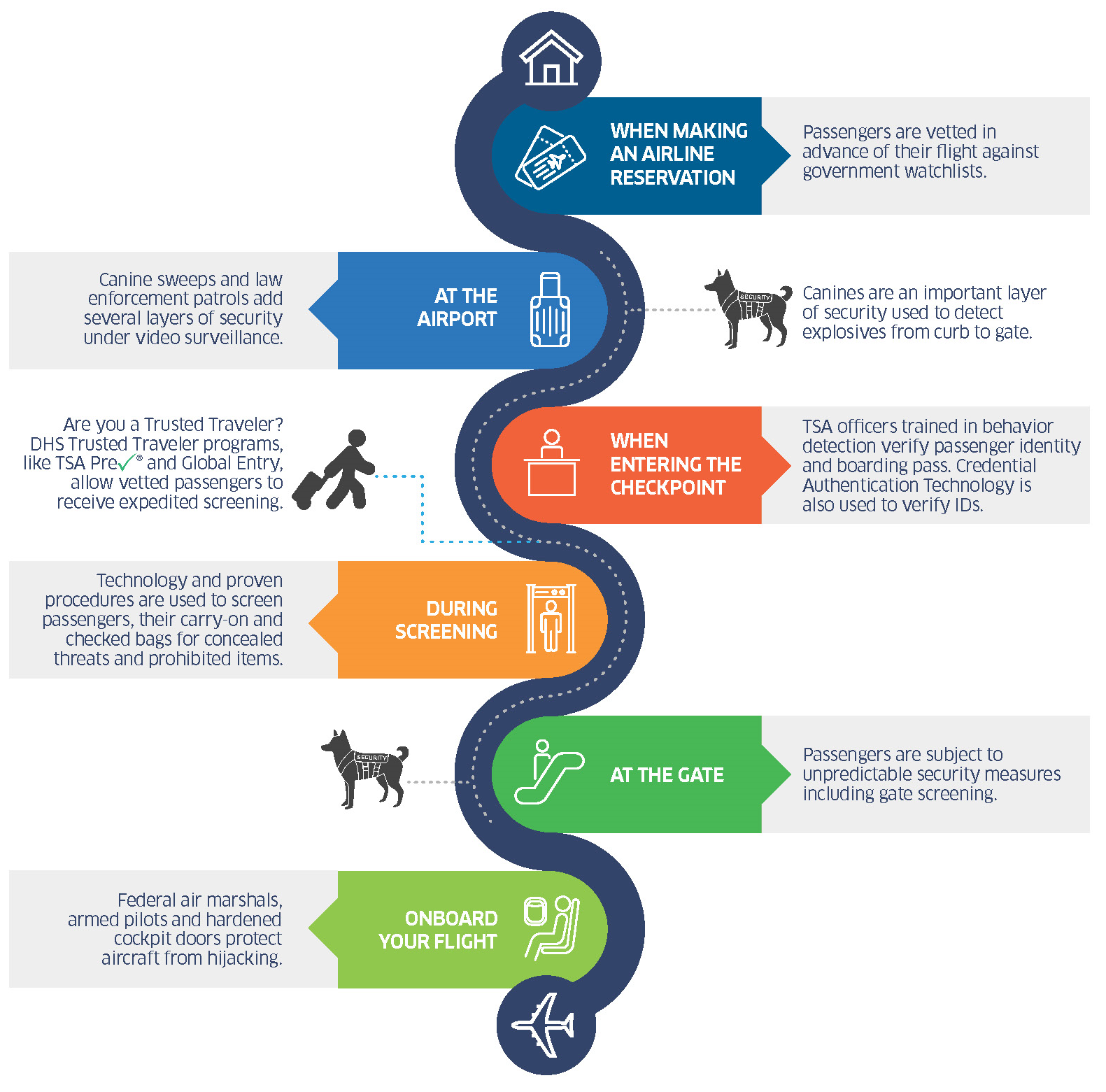

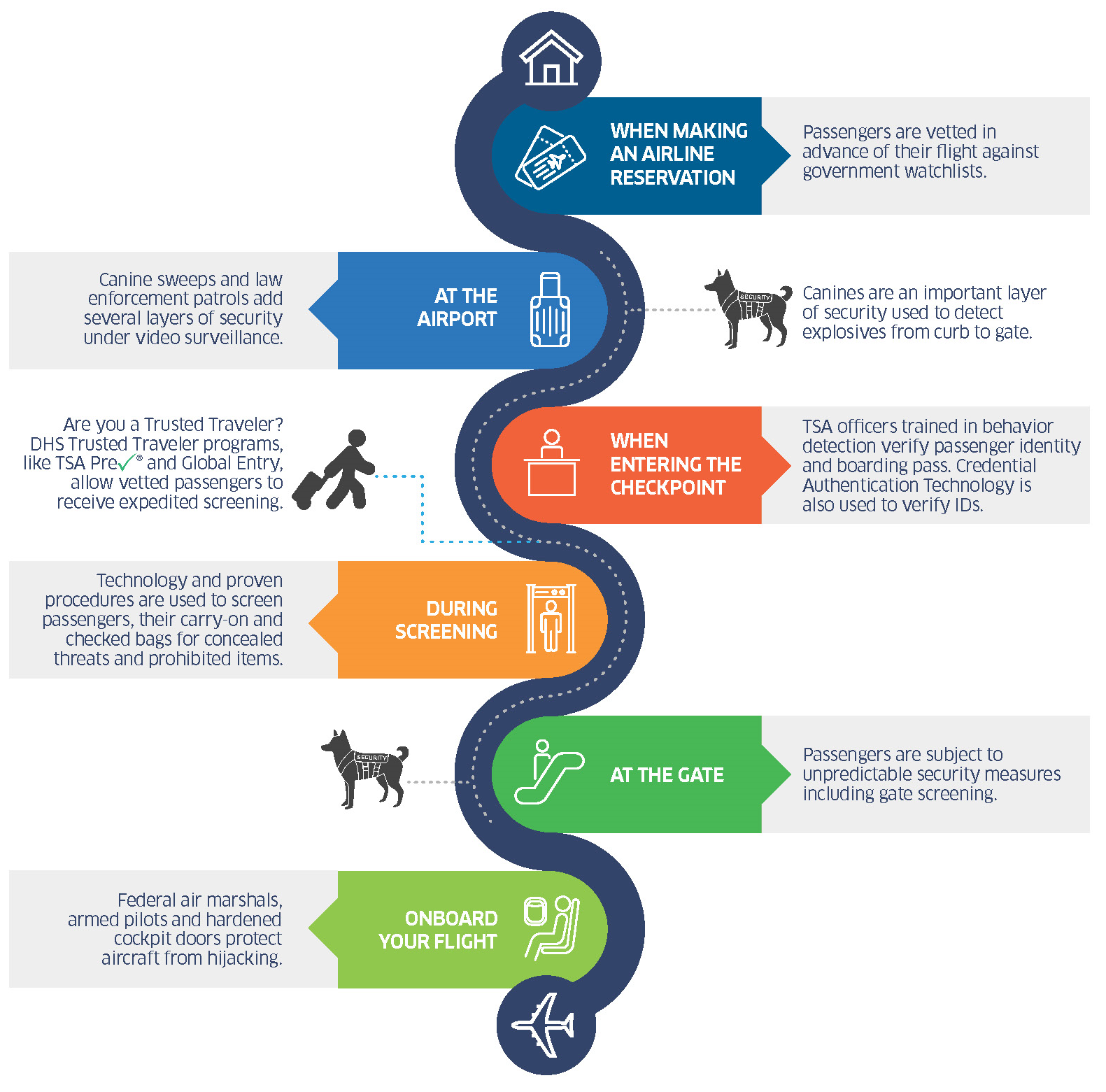

Layers Of Security Transportation Security Administration

https://www.tsa.gov/sites/default/files/layers_of_security.png

What Is Security Virtualization Definition SDxCentral

https://www.sdxcentral.com/wp-content/uploads/2020/12/What-Is-Security-Virtualization-Definition.jpg

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg?w=186)

https://www. forbes.com /advisor/taxes/social-security-tax

How Much Is Social Security Tax The Social Security tax is part of the FICA taxes withheld from your paychecks For 2022 the total Social Security tax rate is 12 4 on a worker s

https://www. investopedia.com /ask/answers/081915/...

Calculating Social Security Taxes Let s say you earn 165 240 per year or 13 770 per month The maximum in wages that can be taxed for Social Security is 168 600 in 2024 or 14 050 per

The Senior Citizens League National Survey Says 56 Of Social

Layers Of Security Transportation Security Administration

Information Security Audit And Self Assessment Frameworks For

The Sony Pictures Hack And Learning Information Security Lessons The

JCPS Security Levels A Quick Update Dear JCPS

What Are Administrative Security Controls

What Are Administrative Security Controls

What Makes A Great Security Officer Inter Con Security

Seguridad Imagenes Hot Sex Picture

Social Security Tax Deferment ArmyReenlistment

What Is Security Tax - Image credit Getty Images By Kelley R Taylor last updated 22 March 2024 It may come as a surprise but Social Security benefits are not entirely tax free Depending on your income up to