What Is The Additional Tax Deduction For Over 65 For single filers and heads of households age 65 and over the additional standard deduction increases slightly from 1 950 in 2024 returns you ll file soon in early 2025 to 2 000 in 2025

For seniors over 65 an extra standard deduction is available This amount increases the base standard deduction offering significant savings This additional deduction acknowledges the common income and health The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors the taxable amount of Social Security

What Is The Additional Tax Deduction For Over 65

What Is The Additional Tax Deduction For Over 65

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

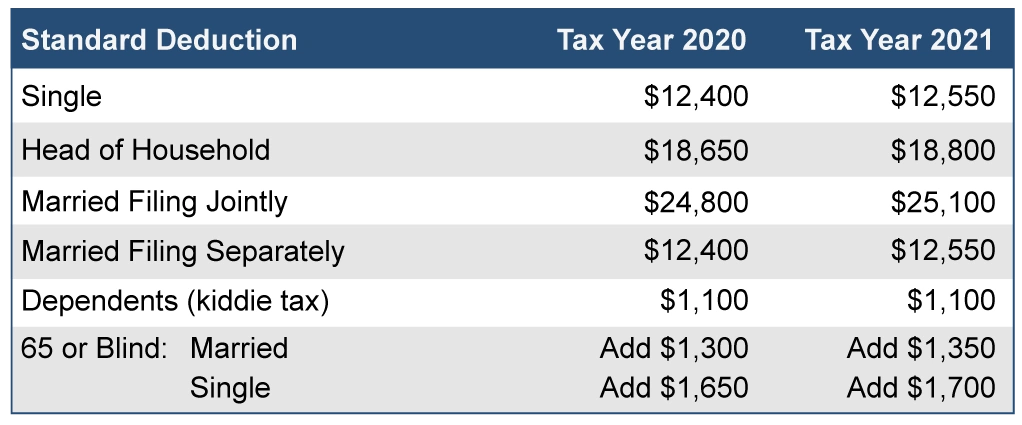

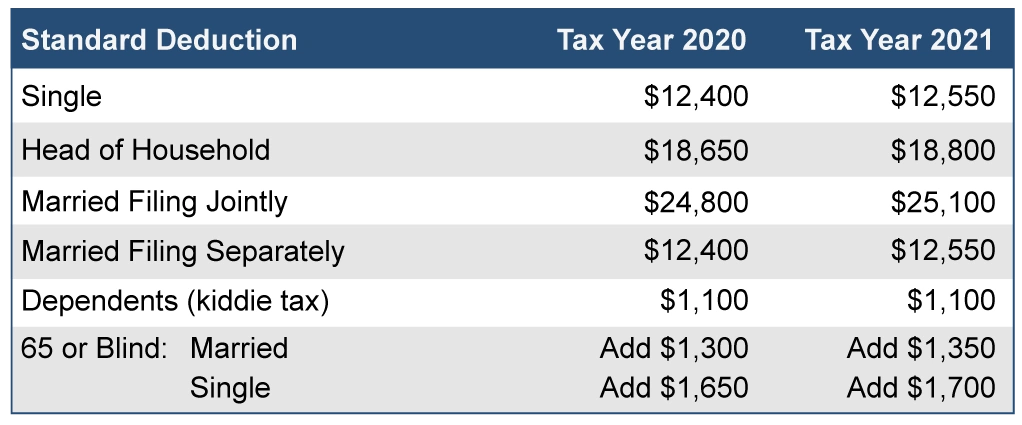

However if you are 65 or older on the last day of the year and don t itemize deductions or are blind you can claim an additional standard deduction The IRS considers an individual to be 65 If you file as single or head of household and you re either 65 or older or blind you can claim an additional standard deduction of 1 950 for the 2024 tax year

Seniors over 65 automatically qualify for the extra deduction when they file their tax returns It s important to ensure that personal information like birthdate accurately reflects Seniors struggling to make ends meet may save some money when they do their 2023 taxes by claiming the extra tax deduction Here s how it works

Download What Is The Additional Tax Deduction For Over 65

More picture related to What Is The Additional Tax Deduction For Over 65

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

2021 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-2-1024x1024.png

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

Additional Deduction for 65 Taxpayers aged 65 and older qualify for an additional deduction on top of the standard deduction This extra deduction which increases slightly each year is designed to alleviate tax pressure on For tax year 2023 the additional standard deduction amounts for taxpayers who are 65 and older OR blind are 1 850 for single or head of household 1 500 for married

Americans ages 65 years and older can claim the extra standard deduction this year and some ages 60 to 63 can set themselves up now for even more savings in 2026 Individuals who are 65 years old or blind can claim an additional 1 300 1 700 standard deduction The Internal Revenue Service IRS gives seniors a more significant

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

2020 Tax Deduction Amounts And More Heather

https://specials-images.forbesimg.com/imageserve/5dc2fc6eca425400073c2a95/960x0.jpg?fit=scale

https://www.kiplinger.com › taxes

For single filers and heads of households age 65 and over the additional standard deduction increases slightly from 1 950 in 2024 returns you ll file soon in early 2025 to 2 000 in 2025

https://nationaltaxreports.com

For seniors over 65 an extra standard deduction is available This amount increases the base standard deduction offering significant savings This additional deduction acknowledges the common income and health

Tax Rates Absolute Accounting Services

Printable Itemized Deductions Worksheet

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

2023 IRS Standard Deduction

2021 Taxes For Retirees Explained Cardinal Guide

What Is The Standard Deduction For 2021

What Is The Standard Deduction For 2021

Should You Take The Standard Deduction On Your 2021 2022 Taxes

2020 Standard Deduction Over 65 Standard Deduction 2021

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

What Is The Additional Tax Deduction For Over 65 - However if you are 65 or older on the last day of the year and don t itemize deductions or are blind you can claim an additional standard deduction The IRS considers an individual to be 65