What Is The Annual Pension Allowance For 2023 24 Your annual allowance which is 60 000 in 2023 24 is the total amount you can save each year into a pension Which explains how the annual allowance works

Find out rates and allowances for pension schemes for the 2024 to 2025 tax year The Annual Allowance AA restricts the amount a person can pay into a pension during a particular year The Lifetime Allowance LTA seeks to cap the size of the fund that accrues during your lifetime

What Is The Annual Pension Allowance For 2023 24

What Is The Annual Pension Allowance For 2023 24

https://s3-eu-west-1.amazonaws.com/fta-ez-prod/ez/images/6/8/9/6/3676986-8-eng-GB/hourglass-on-calendar-2021-08-26-22-29-57-utc.jpg

Pension Re enrolment Is Here EPayMe

https://www.epayme.co.uk/wp-content/uploads/2016/10/Pensions.jpg

Workers Pension Fund Not For Borrowing NLC Warn Governors

https://lawcarenigeria.com/wp-content/uploads/2020/12/pension-e1562619027391.jpg

The pension annual allowance is set at 60 000 and this is the total value that can be paid into all your pensions each tax year before triggering a tax charge Lower limits may apply if The standard annual allowance is 60 000 for tax year 2024 25 For tax years 2016 17 to 2022 23 it was 40 000 It s possible to save more than the standard annual allowance

In their March 2023 Economic and Fiscal Outlook EFO the OBR estimated that changes to the lifetime allowance and the annual allowance on pension An annual allowance limits the amount someone can pay into pension schemes each year before they must pay tax It is 60 000 in 2024 25 A person cannot

Download What Is The Annual Pension Allowance For 2023 24

More picture related to What Is The Annual Pension Allowance For 2023 24

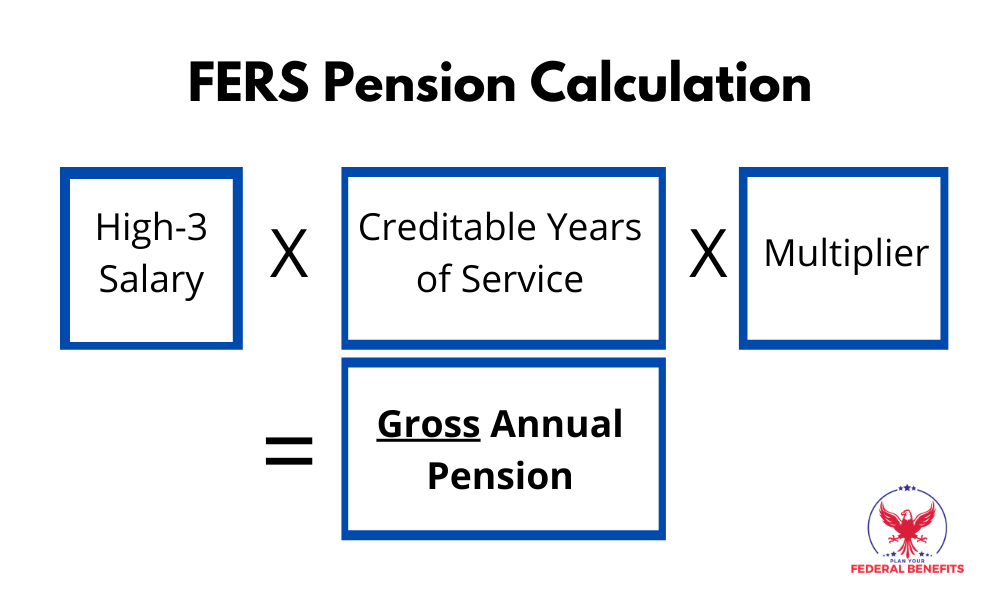

FERS Retirement Pension Calculator

https://hawsfederaladvisors.com/wp-content/uploads/2020/11/FERS-Pension-Calculation.png

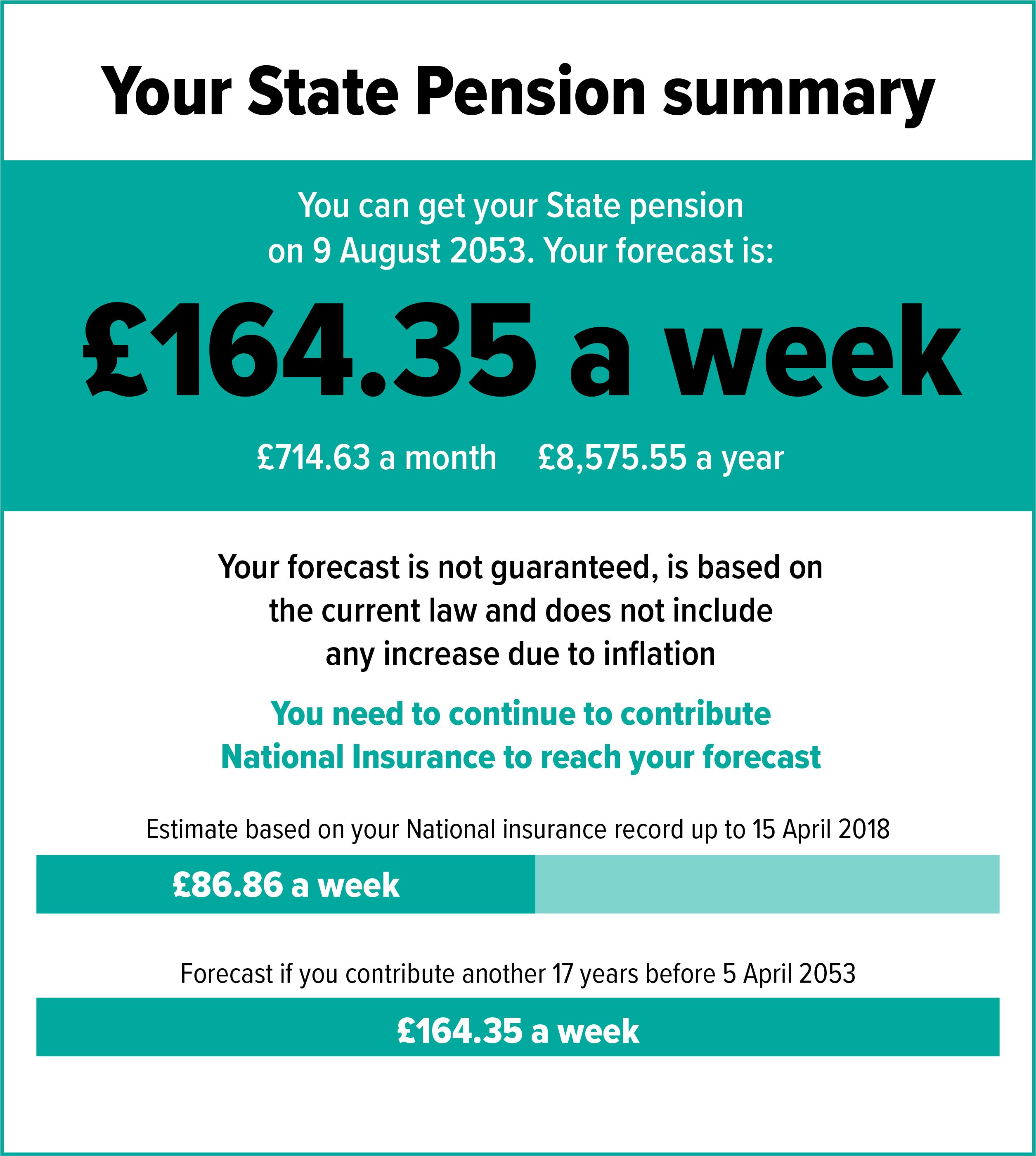

Your State Pension Forecast Explained Which

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

Higher Earner Act Now Before Annual Pension Allowance Cut Your Money

https://www.yourmoney.com/wp-content/uploads/sites/3/oldimg/2269454-money-and-locks.jpg

Currently the most you can normally save into private pension pots in one tax year before you start paying tax is 40 000 This is known as the pensions annual The annual allowance is a limit set by HM Revenue Customs HMRC on the total amount of pension savings you can make in each tax year and still benefit from

Find out how the change to the annual pension allowance in 2023 24 tax year will affect you Annual Allowance Annual Allowance for the 2023 24 tax year is 60 000 Excess contributions Total contributions in excess of the annual allowance If your

Using Your Pension Annual Allowance Albert Goodman

https://albertgoodman.co.uk/wp-content/uploads/bigstock-Pension-Fund-And-Retirement-Bu-292084363.jpg

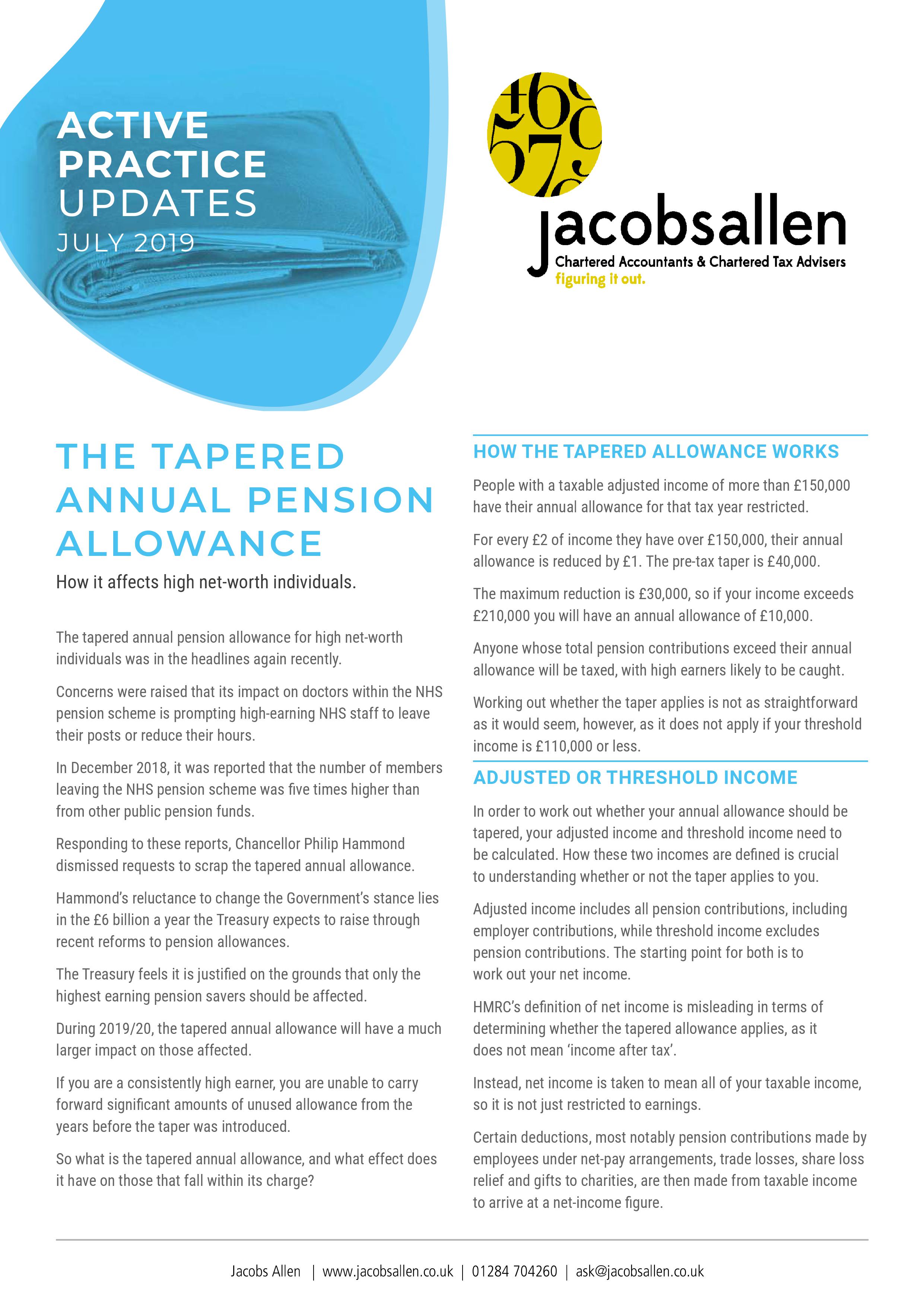

The Tapered Annual Pension Allowance Jacobs Allen

https://www.jacobsallen.co.uk/wp-content/uploads/2019/07/0001.jpg

https://www.which.co.uk/money/pensions-…

Your annual allowance which is 60 000 in 2023 24 is the total amount you can save each year into a pension Which explains how the annual allowance works

https://www.gov.uk/government/publications/rates...

Find out rates and allowances for pension schemes for the 2024 to 2025 tax year

Feb Exceeding The Annual Pension Allowance Viewpoint Accountants

Using Your Pension Annual Allowance Albert Goodman

How Much The State Pension Pays In 2024

Pension Allowances Part 2 Lifetime Allowance Boosst Financial

How To Reduce The Pension Annual Allowance Tax Charge

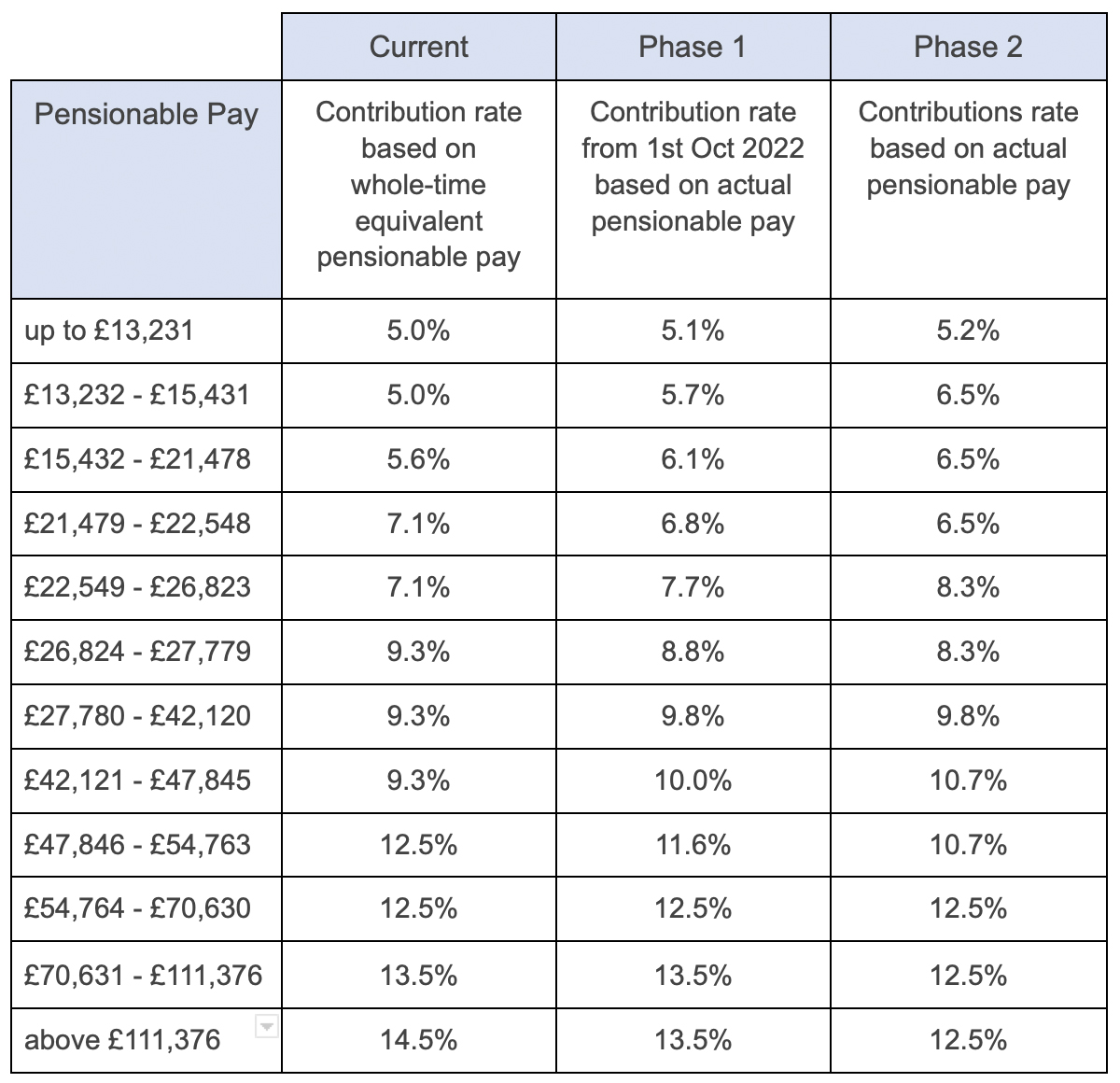

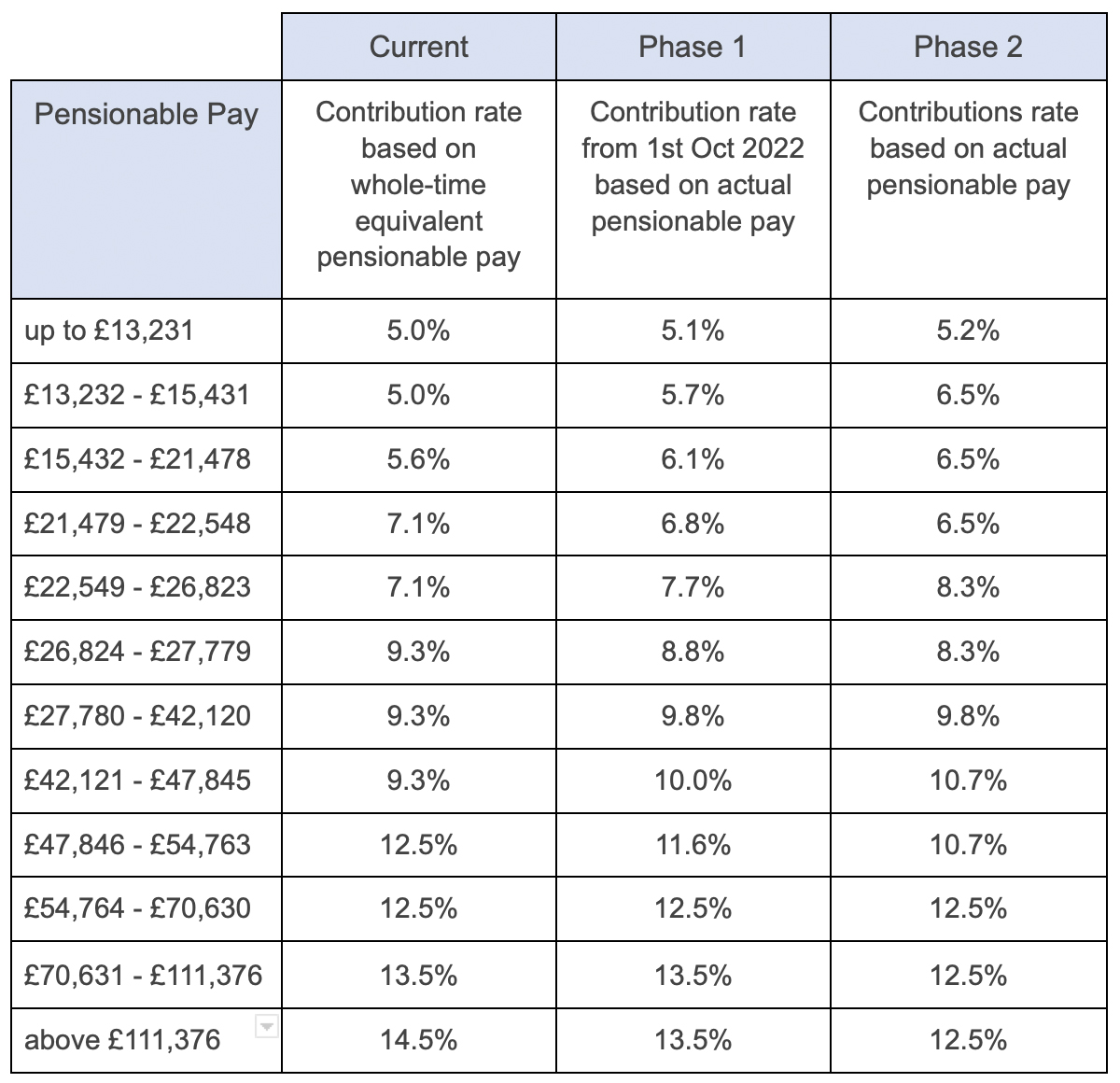

Changes In NHS Pension Contributions Are You A Winner Or Loser

Changes In NHS Pension Contributions Are You A Winner Or Loser

Exceeding The Annual Pension Allowance Progress Accountants

Best Fixed Rate Bond 2023 Up To 60 Per Annum PPP Investment Trade Wise

Help

What Is The Annual Pension Allowance For 2023 24 - An annual allowance limits the amount someone can pay into pension schemes each year before they must pay tax It is 60 000 in 2024 25 A person cannot