What Is The Carbon Tax On Gas A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions high prices for carbon emitting goods reduce demand for them The carbon tax is generally

Carbon taxes levied on coal oil products and natural gas in proportion to their carbon content can be collected from fuel suppliers They in turn will pass on the tax in the form of higher prices for electricity gasoline A carbon tax is a tax levied on the carbon emissions from producing goods and services Carbon taxes are intended to make visible the hidden social costs of carbon emissions They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels This both decreases demand for goods and services that produce high emissions and incentivizes making the

What Is The Carbon Tax On Gas

What Is The Carbon Tax On Gas

https://www.pennlive.com/resizer/pWIs_Tu_EqTIEGJNCPrkl_0j7m4=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/opinion/photo/shutterstock-73723585jpg-d16c80d4865485e6.jpg

Carbon Tax Pricing In Singapore The Straits Journal

https://bostonglobe-prod.cdn.arcpublishing.com/resizer/QfLyGgntvkaiv4Z7j7FfnRMmmWM=/1440x0/arc-anglerfish-arc2-prod-bostonglobe.s3.amazonaws.com/public/GFQJZSDLQAI6TK32JDLGCL665I.jpg

EU Considers Carbon Tax On Australian Exports 2SER

https://assets.2ser.com/wp-content/uploads/2021/04/02214038/shutterstock_1387517006-scaled.jpg

Carbon tax this is a levy that is applied to the production of greenhouse gas emissions directly or fuels that emit these gases when they re burned This means goods and services which emit more With the federal government under pressure to freeze its planned increase to the carbon tax here s a look at how the policy is supposed to work and to what extent it is effective

A carbon tax is a policy that would set a fixed price per ton of carbon or carbon dioxide emitted with a goal of incentivizing lower carbon emissions Because CO emissions from the combustion of The rates in Tables 1 and 2 reflect a pricing trajectory for each fuel type and combustible waste from April 1 2023 to April 1 2030 The rates also reflect a carbon

Download What Is The Carbon Tax On Gas

More picture related to What Is The Carbon Tax On Gas

Carbon Tax Emissions Reduction And Employment Some Evidence From

https://oecdecoscope.blog/wp-content/uploads/2020/01/image-2.png

Carbon Dioxide Toxicity Symptoms

https://blog.sscor.com/hubfs/Carbon Dioxide Toxicity Symptoms.jpg

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/BEOP5IB5MBHSLMN7HE7HVVLGDY.jpg)

Government mandated Carbon Tax Stickers Planned For Ontario Gas Pumps

https://www.theglobeandmail.com/resizer/LO9Yznxr3yf6ABRBu4QB1cxS5Wo=/1200x799/filters:quality(80)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/BEOP5IB5MBHSLMN7HE7HVVLGDY.jpg

The Canada Carbon Rebate In provinces where the federal fuel charge applies a family of four will receive up to 1 800 under the base Canada Carbon Rebate in 2024 25 In Starting April 1 the carbon tax will tack an extra 2 2 cents onto the cost of a litre of gas With that change the carbon tax will account for 11 cents of the litre Rebates meant to offset

As of April 1 2021 the carbon tax on gasoline is 8 8 cents per litre based on the application of the 40 per tonne carbon tax and is estimated to reach 39 6 cents At 50 per tonne of emissions the year s increase to the carbon tax amounts to a spike of 2 21 cents per litre of gasoline and 2 68 cents per litre of diesel

The Carbon Tax Demystified Grist

https://grist.org/wp-content/uploads/2012/08/carbon_tax.jpg?w=600&h=386&crop=1

Carbon Tax Canada 2019

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/federal-government-s-carbon-tax-and-rebate-plan.png

https://www.weforum.org/agenda/2022/0…

A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions high prices for carbon emitting goods reduce demand for them The carbon tax is generally

https://www.imf.org/.../what-is-carbon-t…

Carbon taxes levied on coal oil products and natural gas in proportion to their carbon content can be collected from fuel suppliers They in turn will pass on the tax in the form of higher prices for electricity gasoline

And 3 Illustrate How The Effective Carbon Tax Rates For The States With

The Carbon Tax Demystified Grist

What Is A Carbon Credit

Will The EU s Carbon Import Tax Hurt Poor Nations Context

February 2013 Link To The World

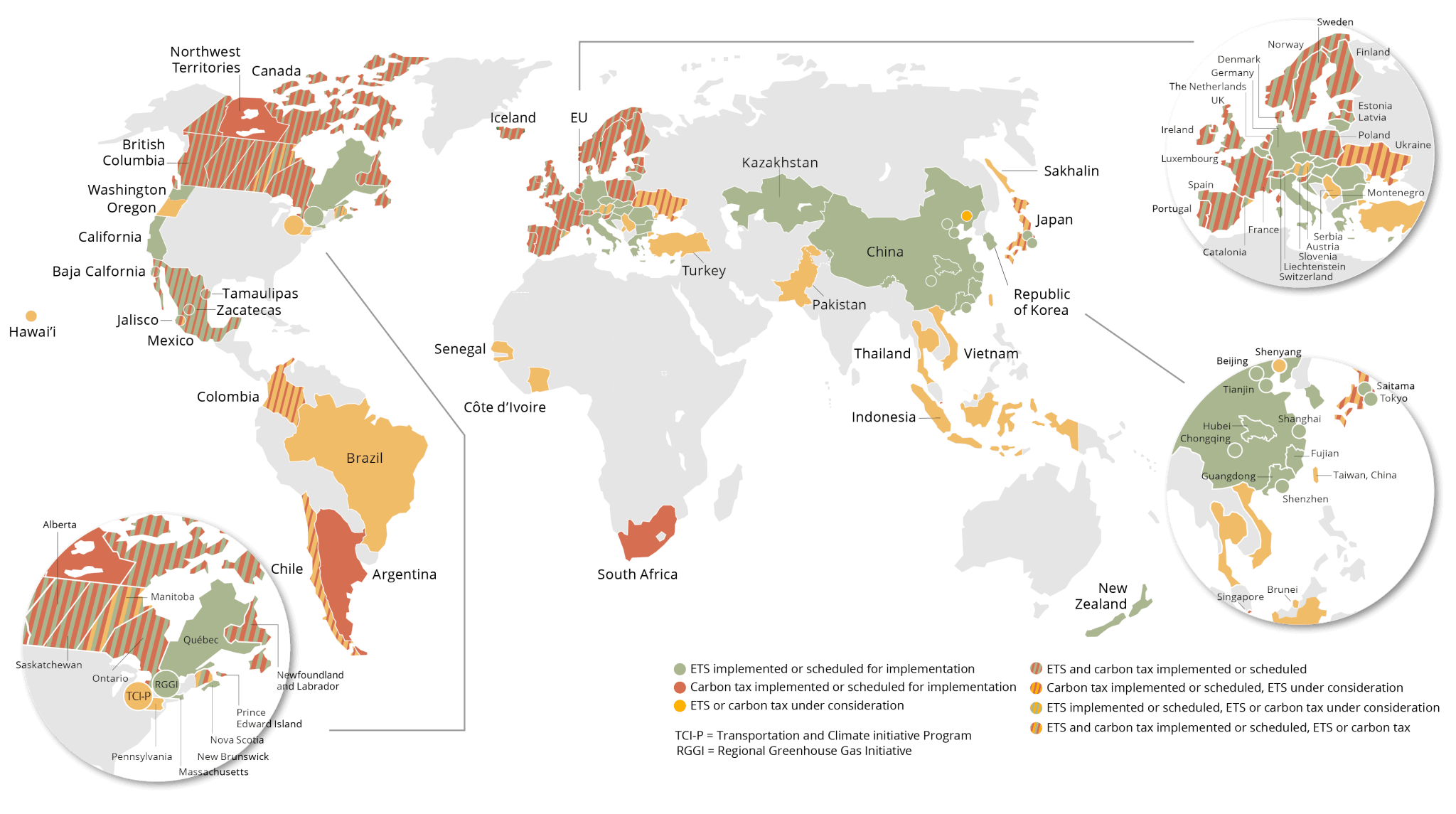

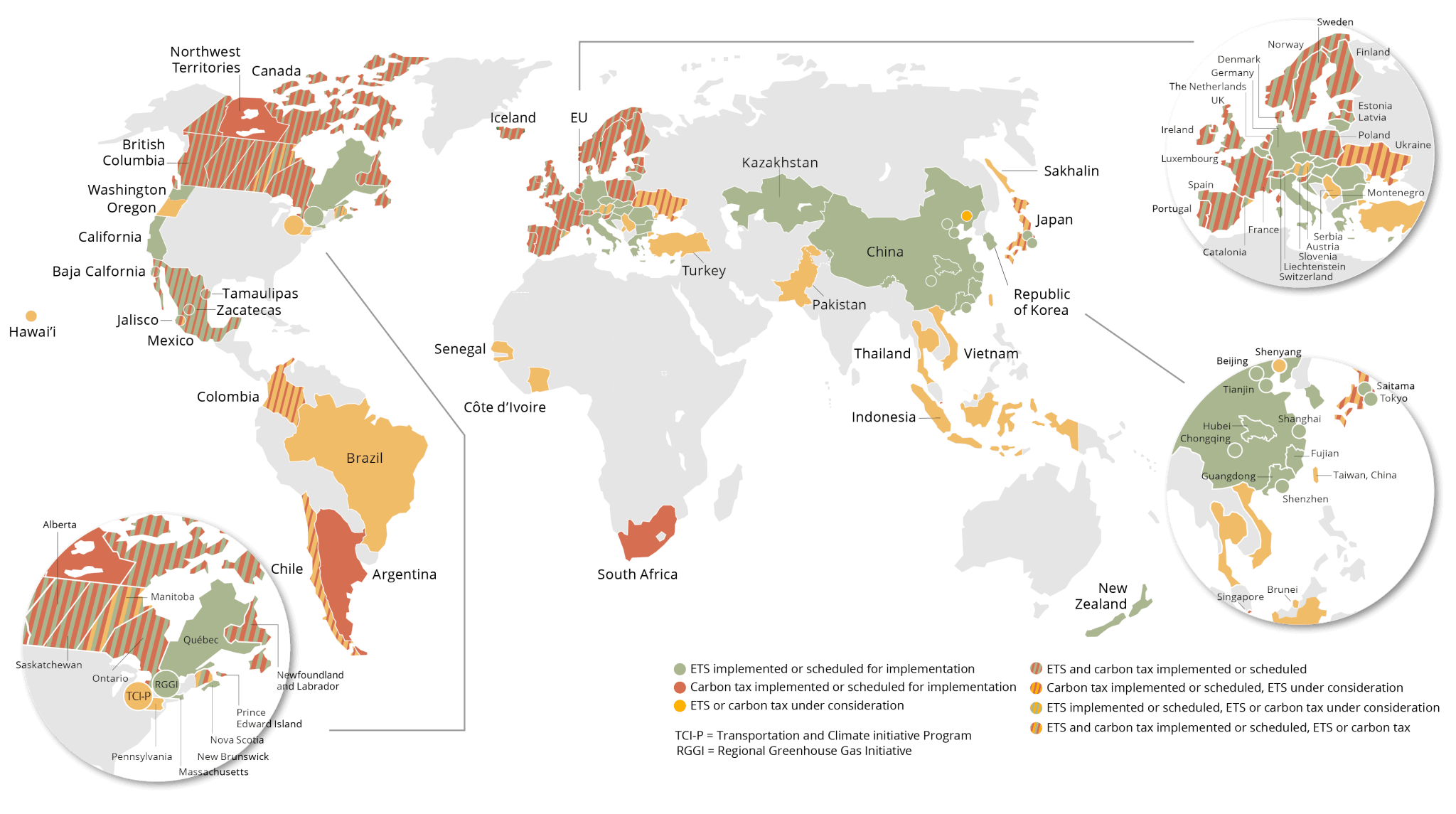

Tipik Bizon Kano World Bank Carbon Pricing Suswm

Tipik Bizon Kano World Bank Carbon Pricing Suswm

/cdn.vox-cdn.com/uploads/chorus_image/image/60431081/shutterstock_586114652.0.jpg)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

No To Carbon Tax People Before Profit

Chart How Would A Carbon Tax Impact Energy Bills Statista

What Is The Carbon Tax On Gas - Carbon tax this is a levy that is applied to the production of greenhouse gas emissions directly or fuels that emit these gases when they re burned This means goods and services which emit more