What Is The Credit Score For First Time Home Buyers Verkko 24 huhtik 2023 nbsp 0183 32 Generally speaking you ll need a minimum credit score between 500 and 620 Check your mortgage eligibility Start here But even though some lenders and loan programs allow lower scores

Verkko 29 toukok 2023 nbsp 0183 32 FHA lenders have a more generous minimum credit score requirement You only need a 580 credit score and a 3 5 percent down payment to get approved If your credit score is between 500 and 579 you may still qualify for a loan but you ll have to make a 10 percent down payment Verkko 19 syysk 2017 nbsp 0183 32 What credit score is needed to buy a house For most loan types the credit score needed to buy a house is at least 620 However a higher score significantly improves your chances of

What Is The Credit Score For First Time Home Buyers

What Is The Credit Score For First Time Home Buyers

https://i.pinimg.com/originals/3c/0e/00/3c0e00199f35c60bb8711c13cc17fc1b.jpg

Tips For First Time Homebuyers INFOGRAPHIC

https://homeingreenecounty.com/wp-content/uploads/2022/10/20221014-MEM.png

What Credit Score Do I Need To Buy A House First Time Home Buyer

https://i.ytimg.com/vi/P_9cCfw82KI/maxresdefault.jpg

Verkko Via HomeReady buyers must only show a 620 credit score in order to be approved Military borrowers with lower credit scores meanwhile can use their VA benefits from the Department of Verkko 13 maalisk 2022 nbsp 0183 32 In a recent Fannie Mae report it found that first time home buyers had an average credit score of 746 And that s pretty much in line with the average credit score across all

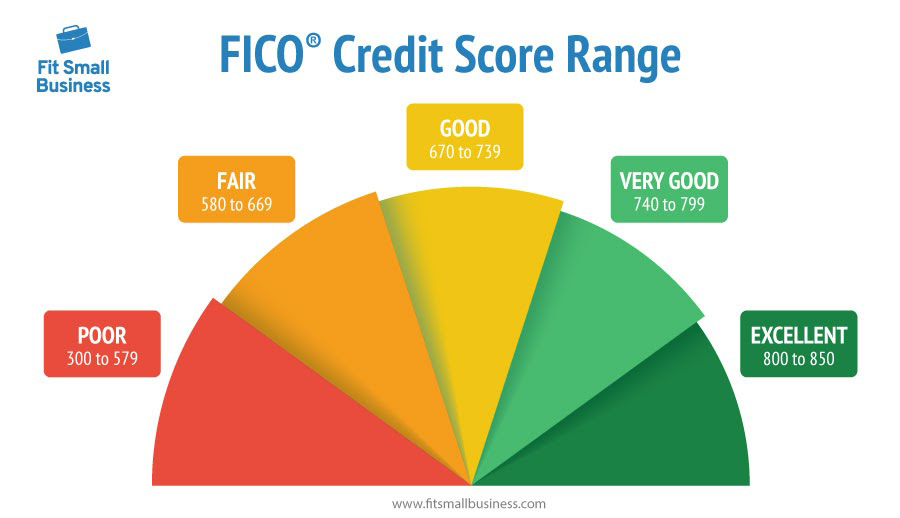

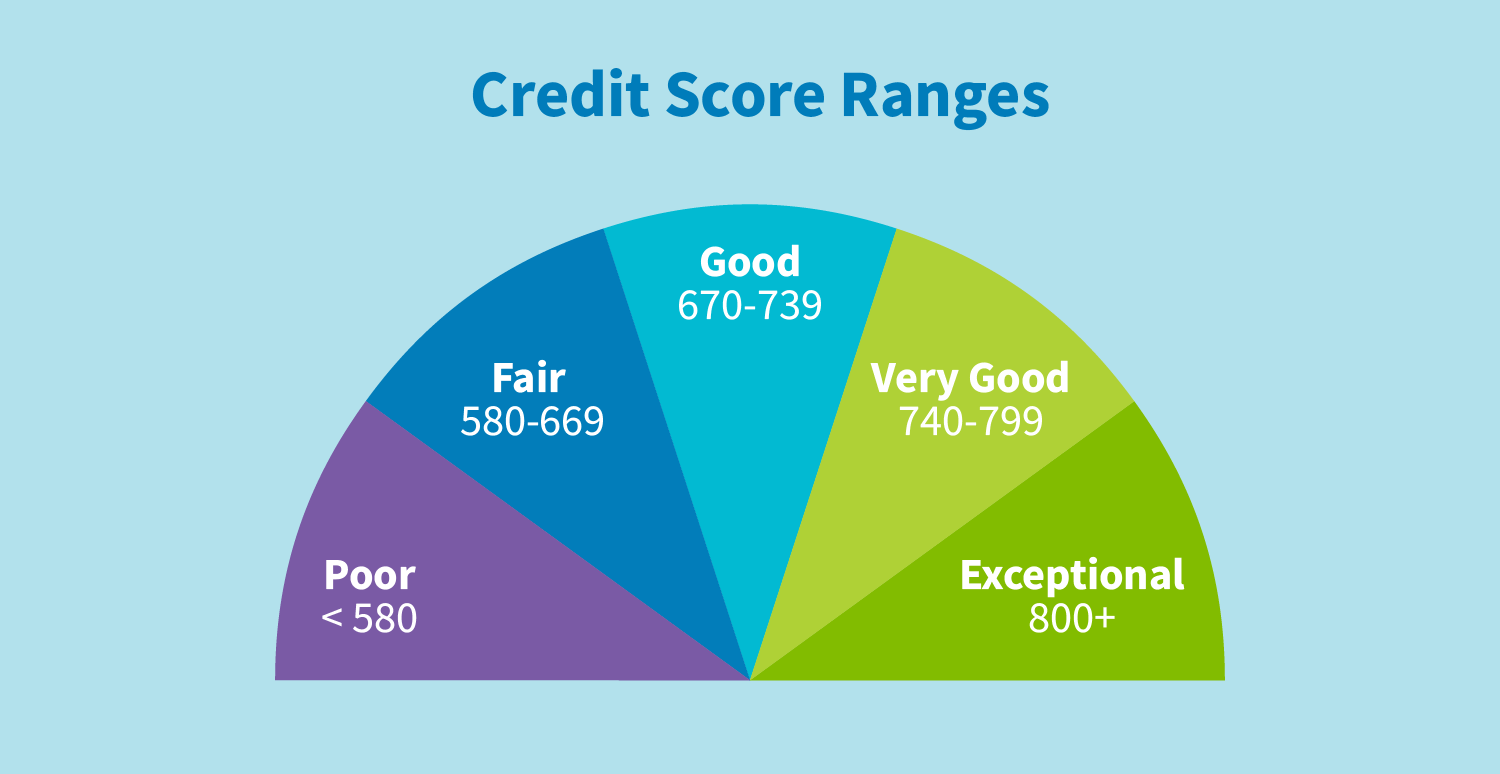

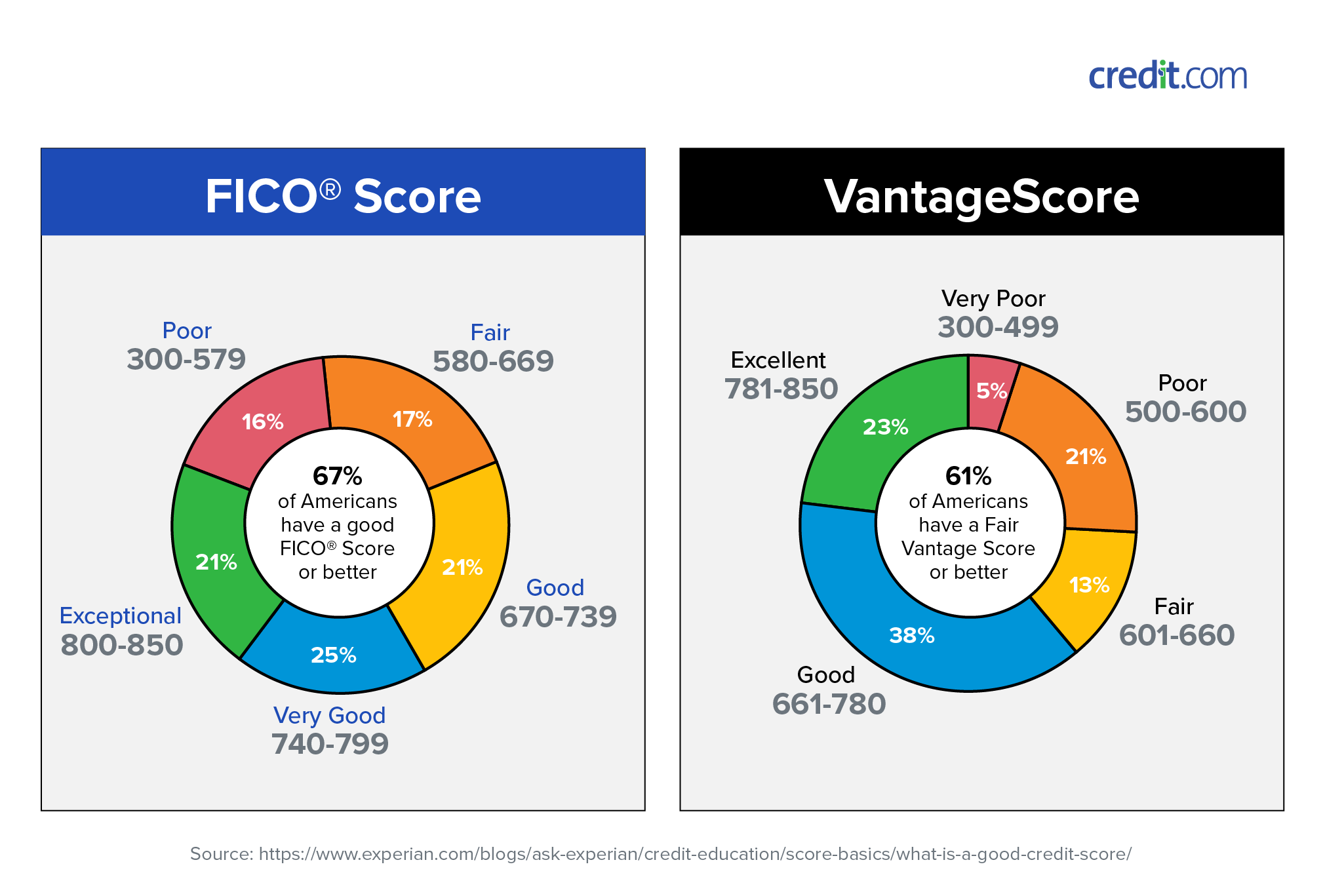

Verkko Credit scores provide a lender with a quick determination of your likelihood of repaying a loan A credit score can range from 300 to 850 where 300 implies an extremely low probability of repaying a loan while a score of 850 Verkko 23 jouluk 2022 nbsp 0183 32 Let s say you have credit scores from the three credit bureaus of 720 740 and 760 and your co borrower has credit scores of 640 660 and 680 The lowest scores come from your co borrow and their middle score is 660 Lenders will use a decision score of 660 to decide whether to offer you both a loan and determine the

Download What Is The Credit Score For First Time Home Buyers

More picture related to What Is The Credit Score For First Time Home Buyers

Checklist For First Time Home Buyers Patrons Blog

https://www.patrons.com/blog/wp-content/uploads/2021/04/Screen-Shot-2021-04-13-at-3.11.36-PM.png

What Is A Bad Credit Score

https://fitsmallbusiness.com/wp-content/uploads/2020/03/What-Is-a-Bad-Credit-Score_-img01.png

Average Credit Score By Age 2023 Where Do You Stand

https://tokenist.com/wp-content/uploads/2021/02/Average-credit-score-by-generation.png

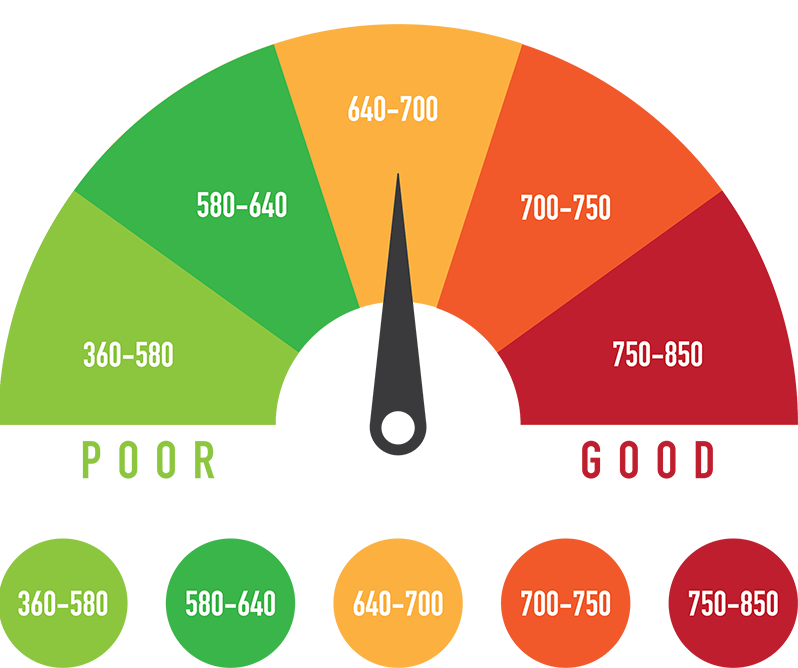

Verkko If you have bad credit but are a first time home buyer start maximizing your score before you begin house hunting Check your credit score so you know where you stand review your credit history to make sure it s accurate and remember to consistently pay your bills on time Verkko 17 toukok 2022 nbsp 0183 32 In most cases mortgage lenders consider a score above 650 to be good while borrowers with a score below 620 are considered as being higher risk As a first time home buyer a good credit score to secure your mortgage would be anything in the 650 to 850 range

Verkko 17 lokak 2022 nbsp 0183 32 And for some first time home buyers with a low credit score it can feel especially daunting So you want to make sure you can get the best possible mortgage with the lowest interest rates Loqbox is here to help Read on to find out what credit score first time home buyers need and how to start building your credit Verkko 15 jouluk 2023 nbsp 0183 32 Credit score First time home buyers must have a minimum credit score of 580 for an FHA loan or 620 for a conventional loan Debt to income ratio DTI Your debt to income ratio DTI considers what percentage of your monthly income goes toward debt payments Most lenders look for a DTI ratio below 50 depending on

Credit Score Ranges How Do You Compare NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2019/04/credit-score-range.png

What Is A Good Credit Score To Buy A House In 2019 Homes For Heroes

https://www.homesforheroes.com/wp-content/uploads/2019/02/general-credit-score-impact-on-mortgage-loan-interest-rates-Homes-for-Heroes-Infographic.jpg

https://themortgagereports.com/101145/whats-a-good-first-time-home...

Verkko 24 huhtik 2023 nbsp 0183 32 Generally speaking you ll need a minimum credit score between 500 and 620 Check your mortgage eligibility Start here But even though some lenders and loan programs allow lower scores

https://www.banks.com/articles/credit/credit-score/first-time-home-buyer

Verkko 29 toukok 2023 nbsp 0183 32 FHA lenders have a more generous minimum credit score requirement You only need a 580 credit score and a 3 5 percent down payment to get approved If your credit score is between 500 and 579 you may still qualify for a loan but you ll have to make a 10 percent down payment

Credit Score Credit Reports Free In Canada Borrowell

Credit Score Ranges How Do You Compare NerdWallet

What Is A Good Credit Score Credit Repair

The Ultimate Guide To Understanding Your Credit Score And How To

Credit Score To Buy A House Infographic HouseHunt Real Estate Blog

4 Steps For Black Entrepreneurs To Build Their First Business Credit Report

4 Steps For Black Entrepreneurs To Build Their First Business Credit Report

What Is A Good Credit Score Credit

First time Homebuyer Credit Could Bring 9 3M Renters Into The Market

Factors Lowering Your Credit Score Jcount

What Is The Credit Score For First Time Home Buyers - Verkko 6 lokak 2023 nbsp 0183 32 Typical first time home buyer qualifications include Credit score of at least 620 Down payment of at least 3 Debt to income ratio below 43 Steady income Two year job history Clean