What Is The Enhanced Star Program In New York State Enhanced STAR Income Verification Program IVP Note If you re a new homeowner or first time STAR applicant you need to register for the STAR credit with

Normally to be eligible for Enhanced STAR all of the property owners must be at least 65 years of age However when property is jointly owned by a married Enhanced STAR provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes 98 700 or less for the 2024

What Is The Enhanced Star Program In New York State

What Is The Enhanced Star Program In New York State

https://www.signnow.com/preview/624/625/624625208/large.png

The Enhanced STAR Program 2021 2022 YouTube

https://i.ytimg.com/vi/oRmLx4AtGWM/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgUig3MA8=&rs=AOn4CLCUZMXpY_pEILLzjiWoJo-C1DmnIg

Stimulus Check Update Homeowners In This State Can Apply For Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1lufhI.img?w=2500&h=1667&m=4&q=89

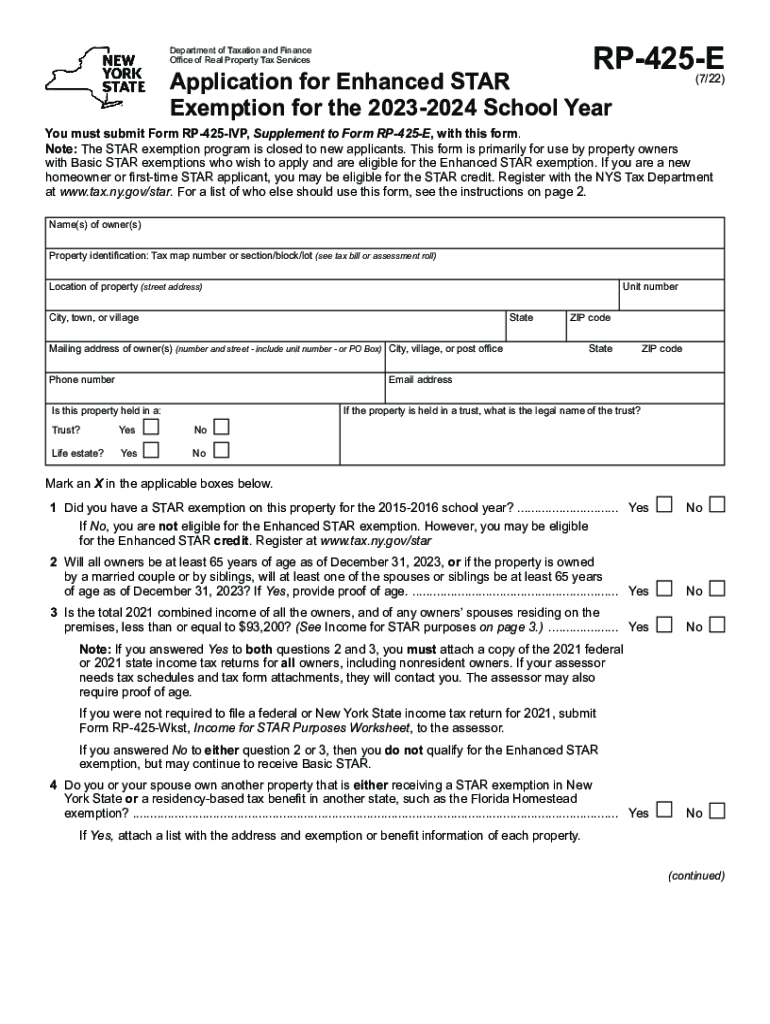

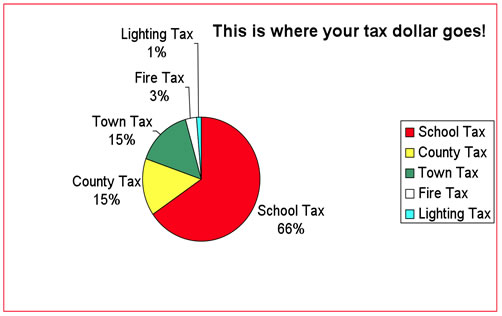

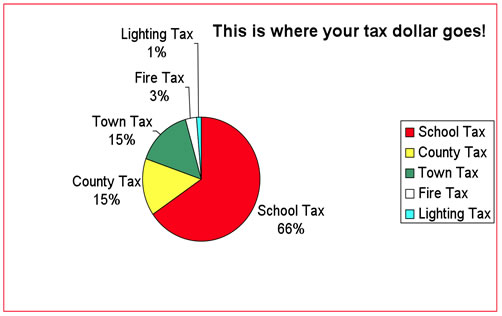

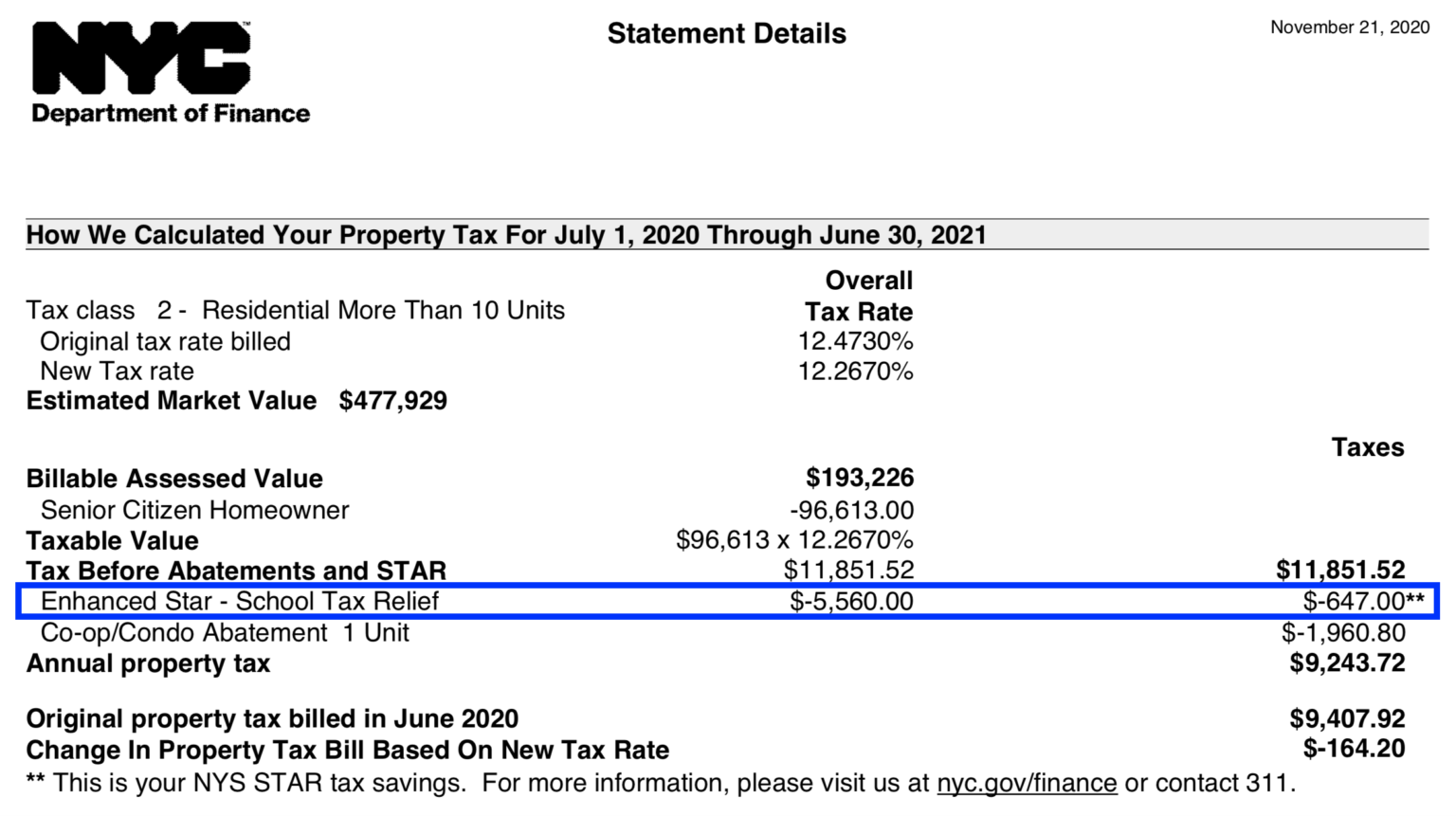

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in The total amount of school taxes owed prior to the reduction for the STAR exemption Follow these steps to calculate the STAR savings amount Find your

A The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you re eligible and enrolled in the STAR program you ll receive The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes If you are a STAR recipient you

Download What Is The Enhanced Star Program In New York State

More picture related to What Is The Enhanced Star Program In New York State

Enhanced STAR May Change For Seniors

https://www.poughkeepsiejournal.com/gcdn/-mm-/356cf371d712b9bedce825dd7143ba976da91f9b/c=0-180-4012-2447/local/-/media/2017/01/18/Westchester/Westchester/636203474143968580-New-York-State-Capitol-2017.jpg?width=3200&height=1809&fit=crop&format=pjpg&auto=webp

Starting Next Week Ohioans Can Renew Their Driver s License Online

https://www.cleveland.com/resizer/ImwKvnHWCR44mk-obIw9cFrcoiA=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OJABCHFRCFGJVO2TDBOYPI5XBI.jpg

TAX WATCH STAR Changes A Money Maker For Co ops

https://www.lohud.com/gcdn/-mm-/1fecae5856e58374cc9e1c0fd6dcc3c6aae79d4e/c=0-293-5760-3547/local/-/media/2016/07/27/Westchester/Westchester/636052350165592208-ts072716eastchestercoop01.JPG?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Enhanced STAR is for homeowners 65 and older whose total household income for all owners and residents spouses is 93 200 or less The benefit is The Enhanced STAR for eligible senior citizens at or above age 65 exempts an annually variable amount 65 300 for the 2015 2016 school year from the true value of their

Enhanced STAR is a school property tax benefit that saves most senior homeowners in New York State hundreds of dollars each year Who is eligible for What is STAR STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner occupied primary residences

Assessor s Office Town Of Warrensburg New York

https://warrensburgny.us/assets/images/piechartassessor.jpg

What Is New York State Star Program The Right Answer 2022 TraveliZta

https://www.travelizta.com/wp-content/uploads/2022/09/what-is-new-york-state-star-program-780x470.jpg

https://www.tax.ny.gov/pit/property/star/ivp.htm

Enhanced STAR Income Verification Program IVP Note If you re a new homeowner or first time STAR applicant you need to register for the STAR credit with

https://www.tax.ny.gov/pit/property/star/eligibility.htm

Normally to be eligible for Enhanced STAR all of the property owners must be at least 65 years of age However when property is jointly owned by a married

New York To Add Nonbinary Gender Option X For Driver s Licenses

Assessor s Office Town Of Warrensburg New York

12 27 2022 Assessment Community Weekly

EmpireStateDev On Twitter Did You See First Ever Digital Game

Enhanced STAR Program Is Working For NY Taxpayers Opinion

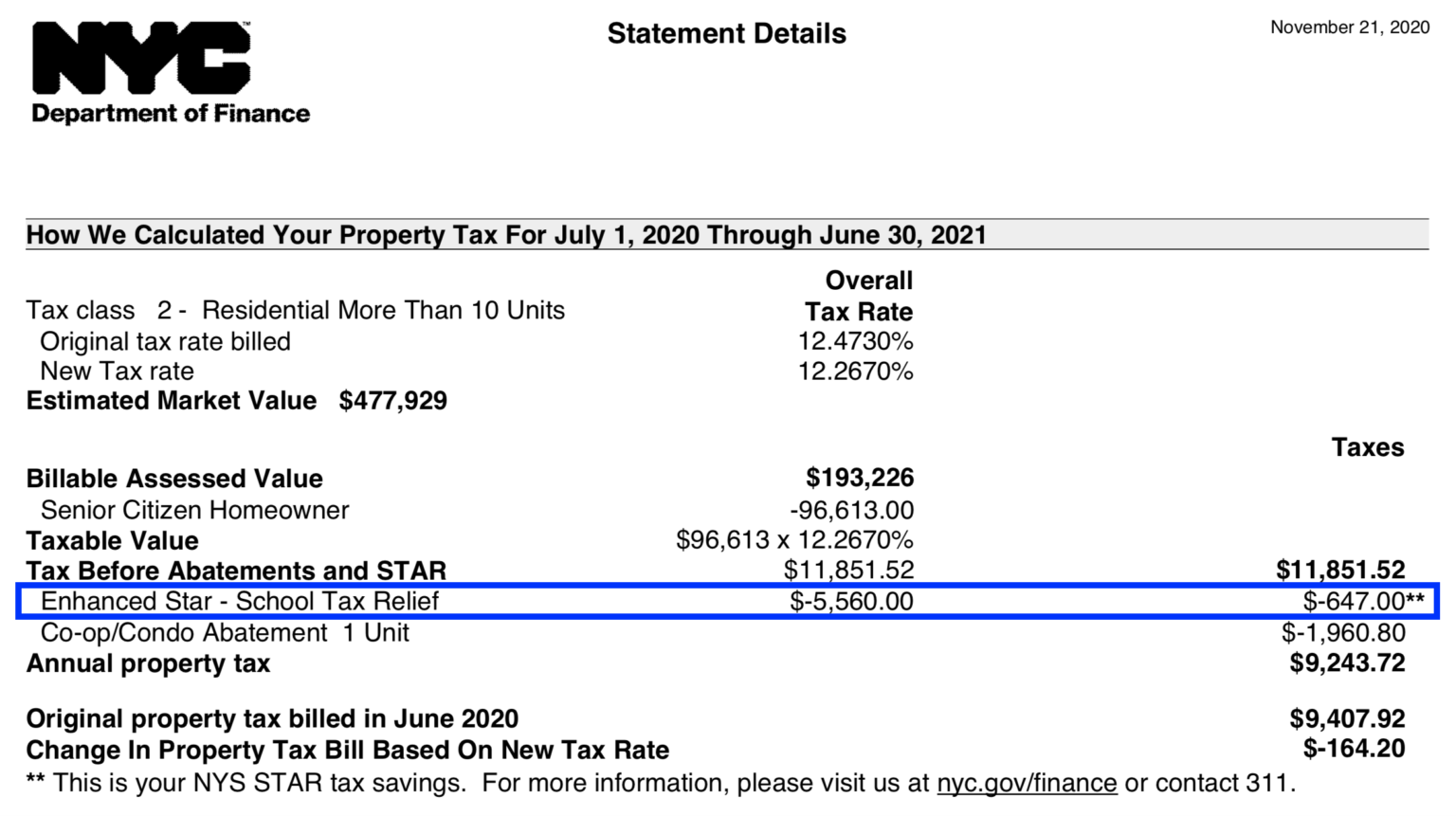

What Is The Enhanced STAR Property Tax Exemption In NYC Hauseit

What Is The Enhanced STAR Property Tax Exemption In NYC Hauseit

Http www tax ny gov star Screech Owl Journal Gallery Of Photos

Don t Miss Deadline To Save Thousands Of Dollars Through Enhanced Star

OP ED Kolb Says There s Easier Way To Avoid STAR Debacle In NYS

What Is The Enhanced Star Program In New York State - The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in