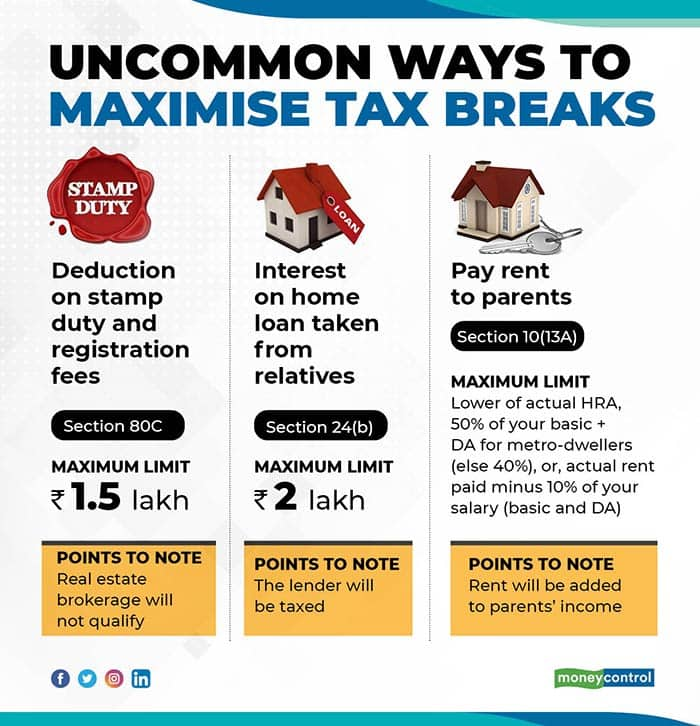

What Is The Exemption Limit For Housing Loan Principal Verkko 18 jouluk 2023 nbsp 0183 32 For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on

Verkko 25 maalisk 2016 nbsp 0183 32 2 according to 80C the total limit is 1 5L the principal repayment limit is 1 5L my doubt is that the Principal Verkko 14 jouluk 2022 nbsp 0183 32 FAQs Home loan principal amount is the amount banks lend to their customers The amount you request the bank to sanction so that you can purchase

What Is The Exemption Limit For Housing Loan Principal

What Is The Exemption Limit For Housing Loan Principal

https://www.signnow.com/preview/497/332/497332572/large.png

Request Letter For Increase In Credit Card Limit SemiOffice Com

https://semioffice.com/wp-content/uploads/2021/09/Request-Increase-in-Credit-Card-Limit.png

E595e Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/239/145/239145965/large.png

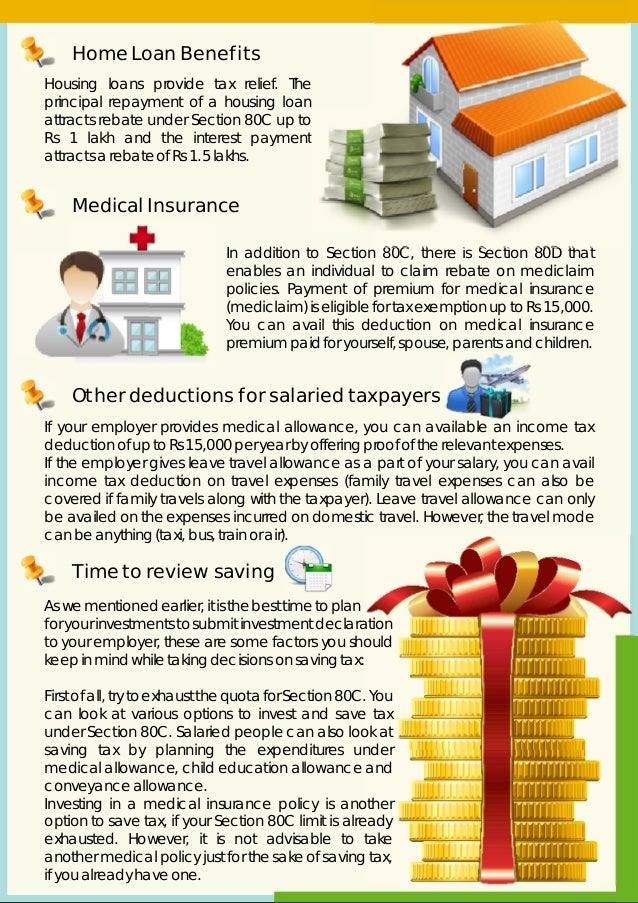

Verkko 22 maalisk 2023 nbsp 0183 32 Is home loan interest part of section 80C of the Income tax Act No section 80C of the Income tax Act does not apply to interest paid on a mortgage Verkko 9 helmik 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax

Verkko 11 tammik 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Verkko Section 24b of income tax act allows deduction of interest on home loan from the taxable income Such loan should be taken for purchase or construction or repair or

Download What Is The Exemption Limit For Housing Loan Principal

More picture related to What Is The Exemption Limit For Housing Loan Principal

Agent Resources HOMESTEAD EXEMPTION LETTER 2 doc NextHome Excellence

https://i0.wp.com/nexthomeexcellence.com/wp-content/uploads/2020/01/HOMESTEAD-EXEMPTION-LETTER-2-scaled.jpg?fit=1978%2C2560&ssl=1

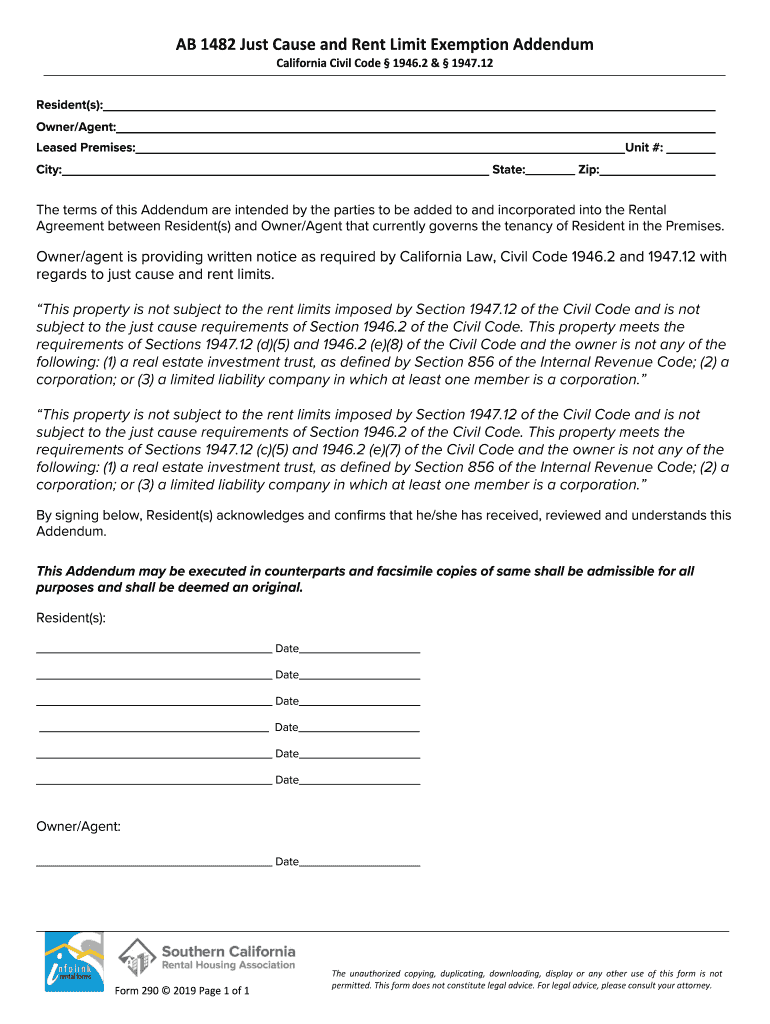

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021-1404x2048.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Verkko Yes the home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of Verkko 20 lokak 2023 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals

Verkko 28 jouluk 2023 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing Verkko 16 kes 228 k 2020 nbsp 0183 32 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the

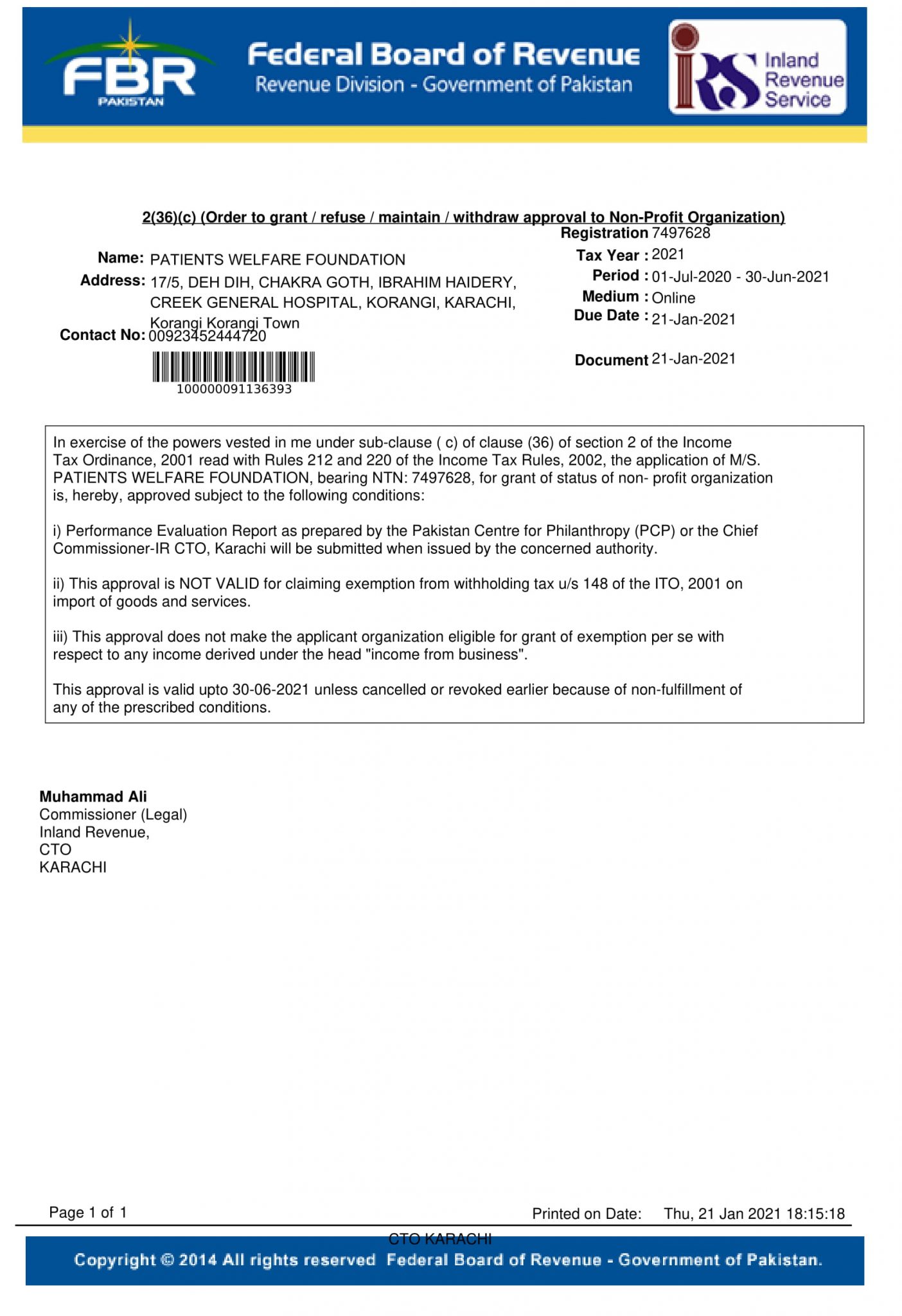

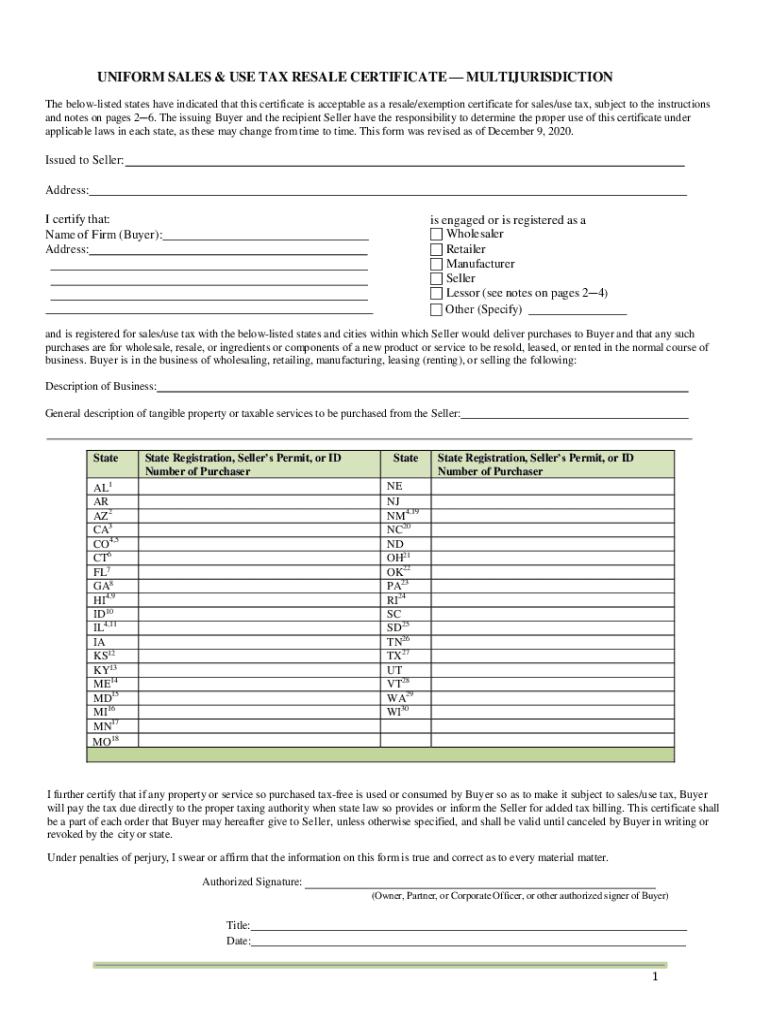

Sales Tax Exemption Certificate Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/541/304/541304812/large.png

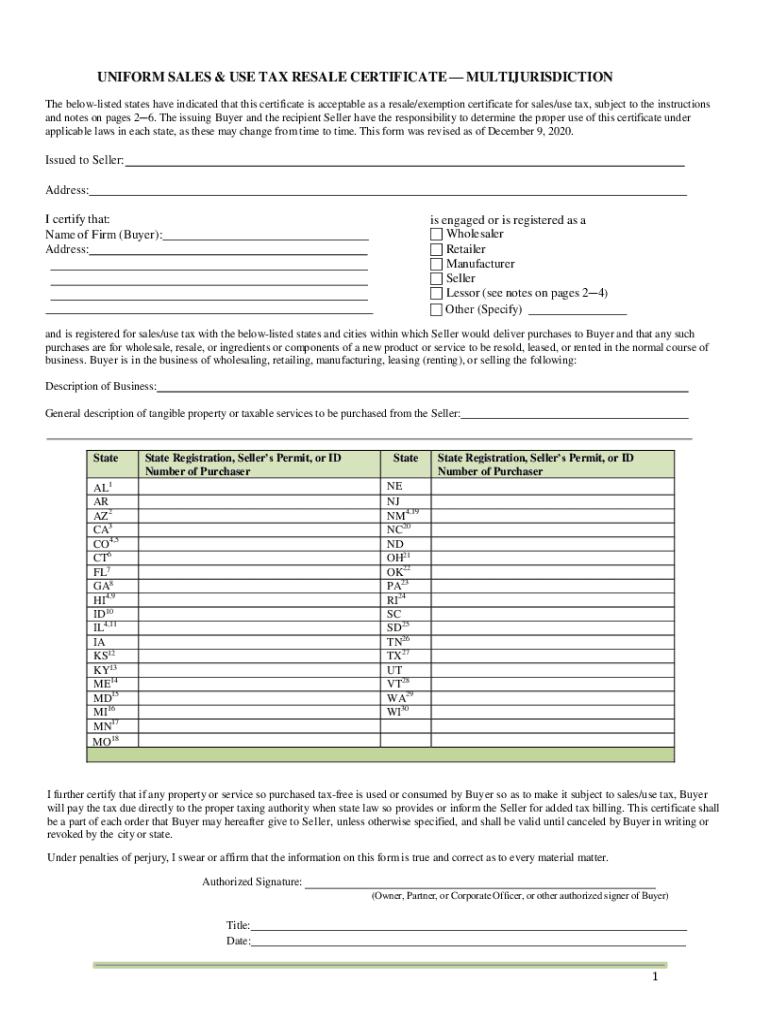

AB 1482 Exemption Addendum Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/490/33/490033181/large.png

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on

https://blog.saginfotech.com/tax-benefit-on-h…

Verkko 25 maalisk 2016 nbsp 0183 32 2 according to 80C the total limit is 1 5L the principal repayment limit is 1 5L my doubt is that the Principal

What Is The Exemption Limit For GST

Sales Tax Exemption Certificate Fill Out Sign Online DocHub

Sample Home Loan Declaration Indemnity Bond PDF

Housing Loans Tax Exemption For Housing Loan Principal

Paying A Home Loan EMI Or Staying On Rent Know The Tax Benefits

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

2017 PAFPI Certificate of TAX Exemption Certificate Of

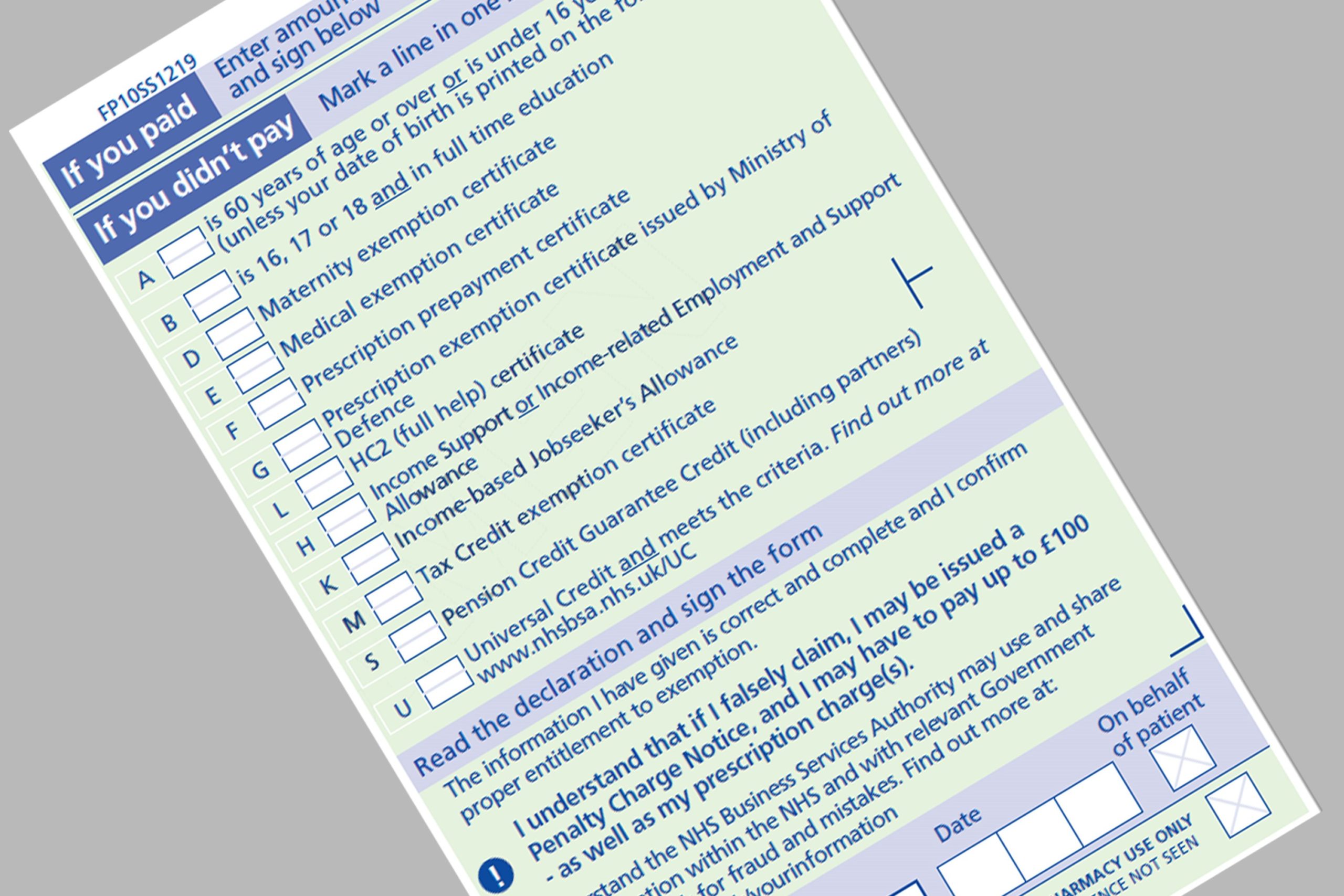

Revised Prescription Forms With Universal Credit Tick Box To Be

What Is The Exemption Limit For Housing Loan Principal - Verkko 10 toukok 2021 nbsp 0183 32 An individual is eligible to get deduction under section 80EE with maximum limit of rupees of 50 000 Conditions 1 Value of house should be less then