What Is The Gst Rebate For Seniors Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2023 base year You can also use the child and family benefits calculator to get an estimate of your GST HST credit

A single senior with 20 000 in net income will be receiving 233 50 for the July through December 2022 period and another 233 50 for the January through June 2023 period under the current GST Credit This includes a one time special payment through the Goods and Services Tax GST credit in April which provided an average of 375 to single seniors and 510 to senior couples helping over 4 million low and modest income seniors

What Is The Gst Rebate For Seniors

What Is The Gst Rebate For Seniors

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

AY 2022 2023 GST Vouchers Everything You Need To Know

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

New GST Number Online Registration Documents Required

https://vakilsearch.com/blog/wp-content/uploads/2022/03/gst-certificate-download-by-gst-number-without-login.jpg

Eligible seniors aged 65 and above in 2022 will receive GSTV MediSave of 150 450 in August 2022 This will be credited to your CPF MediSave Account which can be used to pay for your hospitalisation expenses and approved outpatient treatments listed on This one time payment will essentially double the GST credit amount for the 11 million eligible Canadians for a six month period

GST HST credit payments Eligible Canadians could get up to 519 over the course of the four payments While those who are married or have a common law partner could get up to 680 Those eligible for the GST rebate as of January 2023 will be eligible for the one time top up no application is required The payment amounts are based on net income for the 2021 tax year

Download What Is The Gst Rebate For Seniors

More picture related to What Is The Gst Rebate For Seniors

Older Disabled Residents Can File For Property Tax Rent Rebate Program Lower Bucks Times

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-1024x683.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

What Is The GST Rebate On Homes And How Does It Work TroiWest Builders

https://troiwestbuilders.com/wp-content/uploads/2021/10/04-DSC_0776.jpg

How much is the rebate for The grocery rebate will be equivalent to double the GST HST credit amount received in January and depends on your family situation If you are single you will receive Share Financial Support Seniors Assurance Package AP Seniors Bonus 600 to 900 cash payouts over 3 years from 2023 to 2025 for eligible Singapore Citizens aged 55 and above SCHEME HIGHLIGHTS 600 to 900 cash payouts to

Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it works who is eligible and how much you could be entitled to What is the GST HST credit The GST HST credit is a quarterly payment for individuals and families with low to modest incomes meant to help offset the goods and services tax harmonized sales

400 Safety Security Rebate For WA Seniors Prestige Lock Service

https://www.prestigelock.com.au/wp-content/uploads/2021/08/400-rebate.png

What Has Been The Impact Of GST On Real Estate World Read Here app app

https://okcredit-blog-images-prod.storage.googleapis.com/2020/10/gstnew3.jpg

https://www.canada.ca/en/revenue-agency/services/...

Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2023 base year You can also use the child and family benefits calculator to get an estimate of your GST HST credit

https://www.canada.ca/en/department-finance/news/...

A single senior with 20 000 in net income will be receiving 233 50 for the July through December 2022 period and another 233 50 for the January through June 2023 period under the current GST Credit

What Is GST

400 Safety Security Rebate For WA Seniors Prestige Lock Service

Gst191 Fillable Form Printable Forms Free Online

Summary Of Changes 37th GST Council Meet SBSandco

GST Rate Hikes List Of Goods And Services Which Are Expensive Now India Today

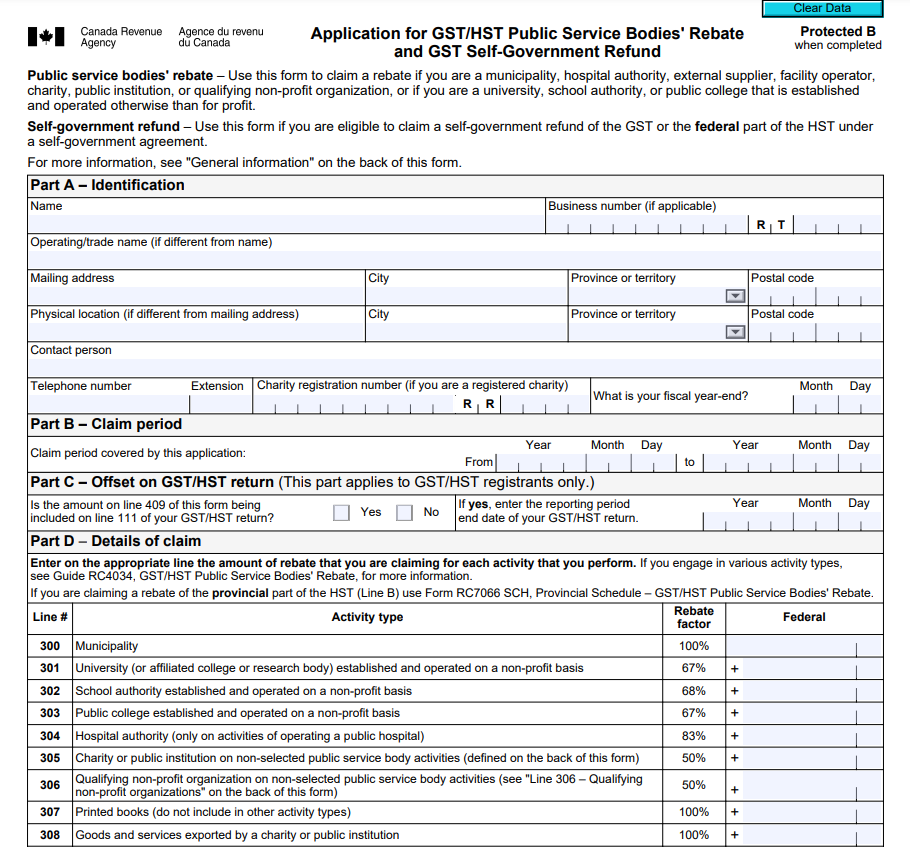

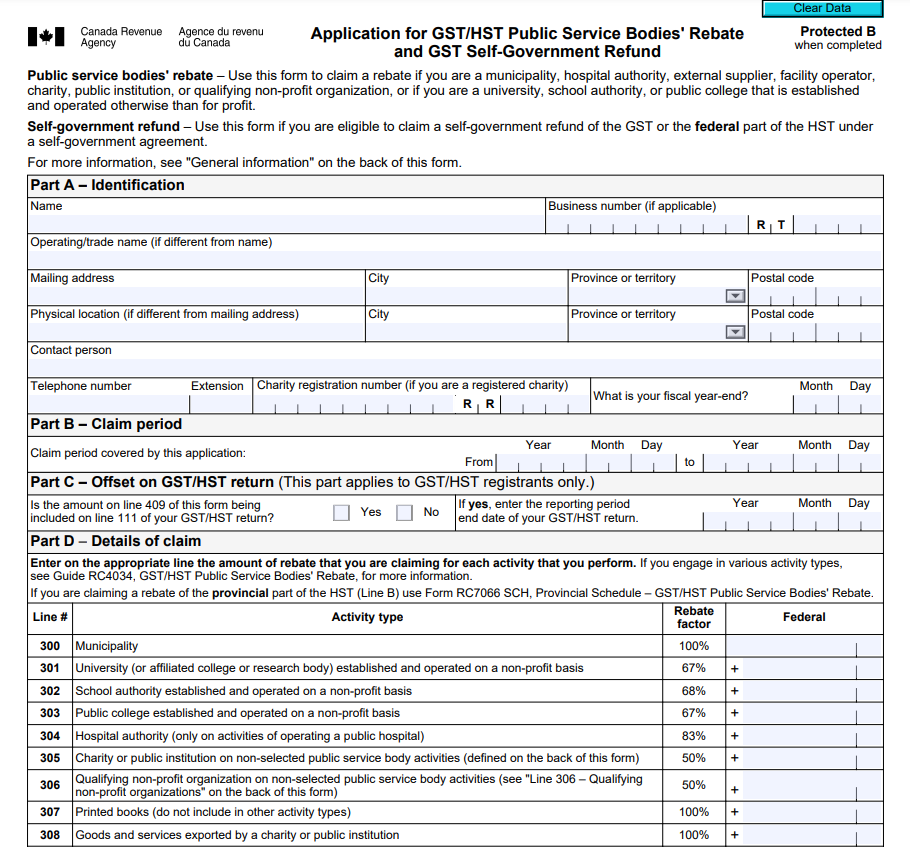

GST Rebate Form For Charities PrintableRebateForm

GST Rebate Form For Charities PrintableRebateForm

Printable Rebate Form For Old Style Beer Printable Forms Free Online

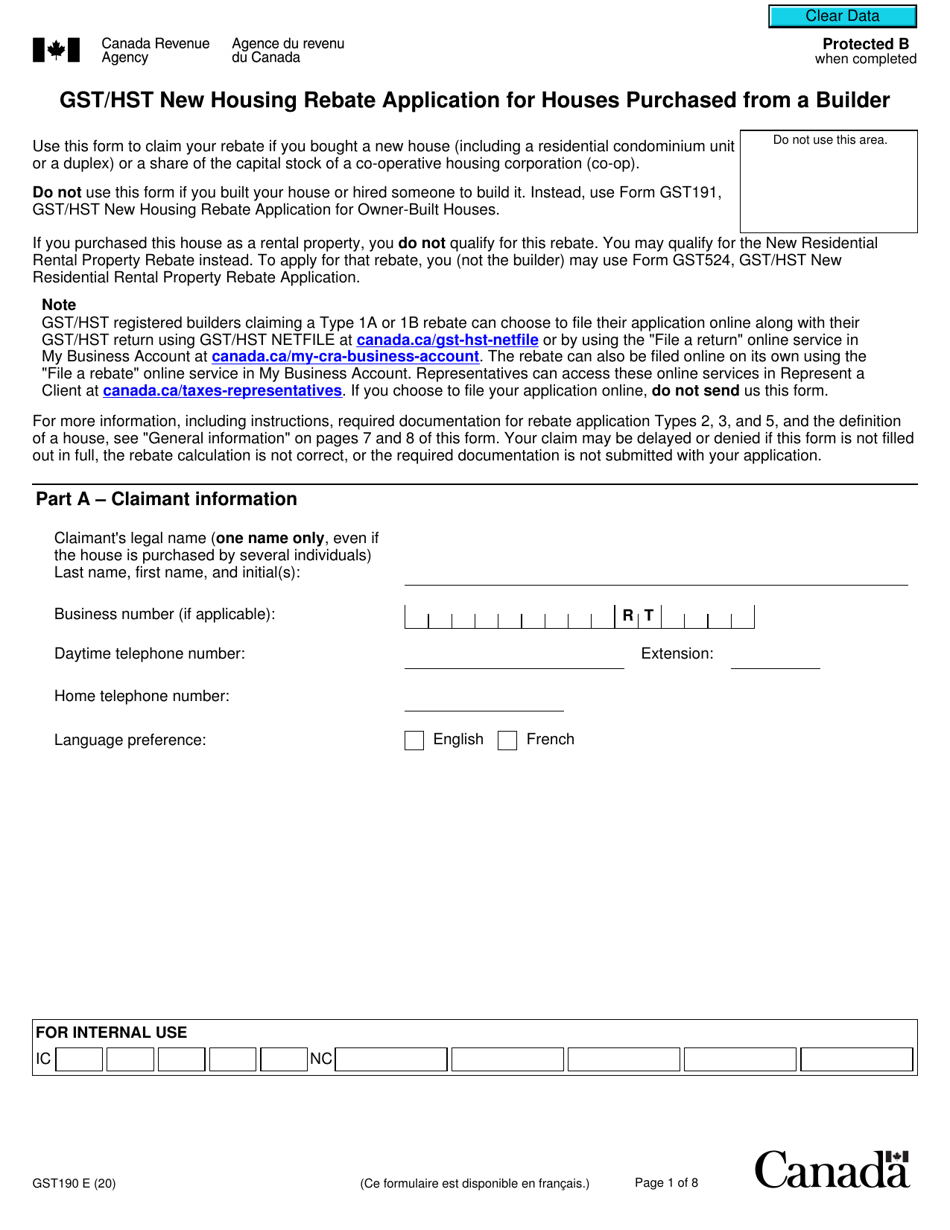

Gst190 Fillable Form Printable Forms Free Online

Gst Return Working Form Fill Out And Sign Printable PDF Template AirSlate SignNow

What Is The Gst Rebate For Seniors - GST HST credit payments Eligible Canadians could get up to 519 over the course of the four payments While those who are married or have a common law partner could get up to 680