What Is The Homeowners Exemption In Illinois To get the exemption you must own and live in your home on January 1 of each year If you buy a home after January 1 of the year you return you can get the returning veterans exemption the next tax year

The amount of the exemption benefit is determined each year based on 1 the property s current EAV minus the frozen base year value the property s prior year s EAV for which the applicant first qualifies for the exemption and 2 the applicant s total household maximum income limitation You can receive the Homeowner Exemption if you own or have a lease or contact which makes you responsible for the real estate taxes of the residential property It must also be used as your principal place of residence for the year in question

What Is The Homeowners Exemption In Illinois

What Is The Homeowners Exemption In Illinois

https://www.lavislaw.com/wp-content/uploads/2020/11/Homeowners-Insurance-1024x683.jpg

Texas Sales And Use Tax Resale Certificate Example 01 315 Form Fill

https://i0.wp.com/startingyourbusiness.com/wp-content/uploads/2019/09/Fillable-Ohio-Sales-Tax-Exemption-Certificate.png

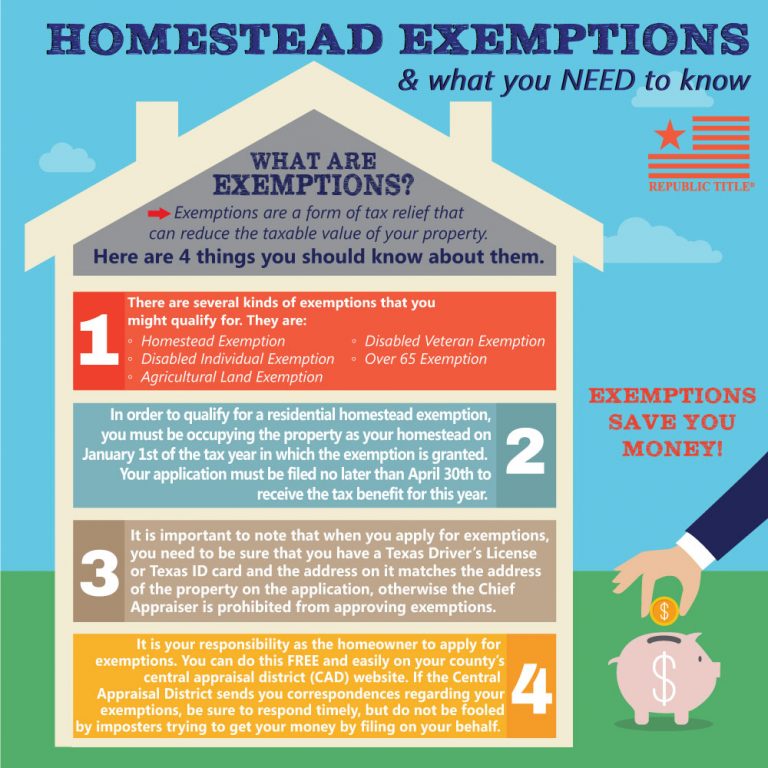

Homestead Exemption Mojgan JJ Panah

http://www.jjpanah.com/files/2018/12/Homestead-Exemption-Infographic-768x768.jpg

Property tax exemptions are savings that contribute to lowering a homeowner s property tax bill The most common is the Homeowner Exemption which saves a Cook County property owner an average of approximately 950 dollars Property tax exemptions are provided for owners with the following situations Homeowner Exemption Senior Citizen Exemption Senior Freeze Exemption Longtime Homeowner Exemption Home Improvement Exemption Returning Veterans Exemption Disabled Veterans Exemption Disabled Persons Exemption

Homeowner Exemption Cook County homeowners may reduce their tax bills by hundreds or even thousands of dollars a year by taking advantage of the Homeowner Exemption Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill A Homeowner Exemption provides property tax savings by reducing the equalized assessed value Automatic Renewal Yes this exemption automatically renews each year How can a homeowner see which exemptions were applied to their home last year Check the Cook County Portal website then review the Exemption History and Status section

Download What Is The Homeowners Exemption In Illinois

More picture related to What Is The Homeowners Exemption In Illinois

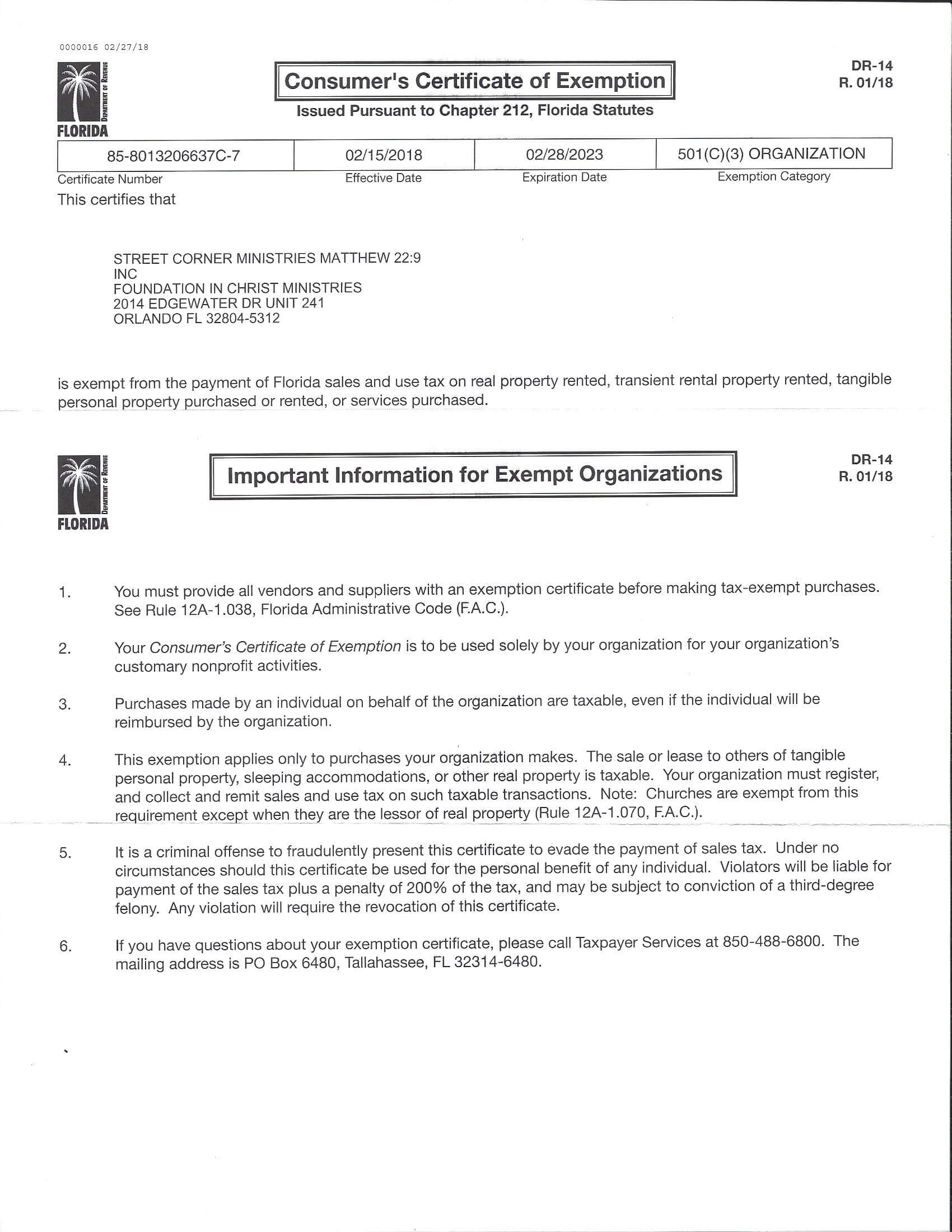

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

What Is Coverage D On A Homeowners Policy

https://i.pinimg.com/originals/eb/c9/7b/ebc97b9b3aa8178b9003af6c19cb5397.jpg

Tax Exempt Forms San Patricio Electric Cooperative

https://www.sanpatricioelectric.org/sites/default/files/inline-images/SPEC SALES TAX FORM Example.jpg

The exemptions listed in this brochure reduce the equalized assessed value EAV or taxed value of a home Exemption applications are due in spring of 2022 for the 2021 Tax Year These savings will be reflected on the second installment property tax bills mailed in the summer of 2022 Generally you may be eligible for an Illinois property tax exemption if you own occupy and pay taxes on your primary residence and meet at least one of the state s other qualifications Exemptions are aimed at helping certain groups of Illinois homeowners who

Under the Illinois homestead exemption a homeowner can exempt up to 15 000 of equity in their property provided that it is suitably covered by the exemption For married couples filing bankruptcy jointly it is possible to double the exemption amount and protect up to 30 000 of equity in a home This filing allows you to apply for the following Exemptions Homeowner Exemption Senior Exemption Low Income Senior Citizens Assessment Freeze Exemption Persons with Disabilities Exemption Returning Veterans Exemption Veterans with

Homestead Exemptions

https://www.pbcgov.org/papa/_images/Five_Ways_to_Lose_Homestead.png

Buying Homeowners Insurance In California Progress Preferred

https://www.progresspreferred.com/wp-content/uploads/2021/02/iStock-905902144.jpg

https://www.illinoislegalaid.org/legal-information/...

To get the exemption you must own and live in your home on January 1 of each year If you buy a home after January 1 of the year you return you can get the returning veterans exemption the next tax year

https://tax.illinois.gov/localgovernments/property/taxrelief

The amount of the exemption benefit is determined each year based on 1 the property s current EAV minus the frozen base year value the property s prior year s EAV for which the applicant first qualifies for the exemption and 2 the applicant s total household maximum income limitation

Homestead Exemption MySouthlakeNews

Homestead Exemptions

Chicago Illinois Sample Letter Concerning Free Port Tax Exemption US

Homeowner s Association Certification 2012 Fill And Sign Printable

What Is A Sales Tax Exemption Certificate In Florida Printable Form

Il Senior Citizen Exemption Application Fill Online Printable

Il Senior Citizen Exemption Application Fill Online Printable

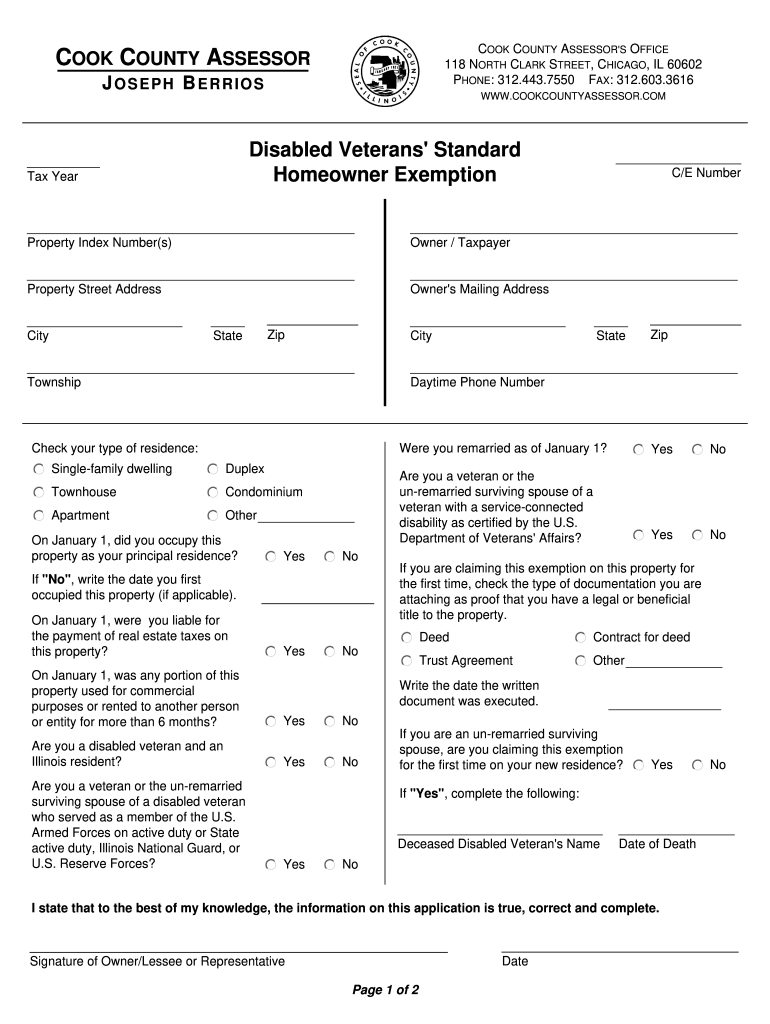

Illinois Disabled Veterans Exemption Form Fill Out And Sign Printable

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

What Is A Homestead Exemption And How Does It Work LendingTree

What Is The Homeowners Exemption In Illinois - Property tax exemptions are savings that contribute to lowering a homeowner s property tax bill The most common is the Homeowner Exemption which saves a Cook County property owner an average of approximately 950 dollars