What Is The Homestead Exemption In Montana 2023 Montana Homestead Exception amount 250 000 Status and notes Mont Code Ann 70 32 104 Real property or mobile home you occupy to 250 000 sale condemnation or insurance proceeds exempt for 18 months Must record homestead declaration before filing for bankruptcy Nebraska Homestead Exception amount 60 000

Any sale proceeds up to 393 702 are exempt from creditor claims for up to 1 years 18 months Check with your state about monetary coverage but in Montana a Homestead Declaration protects up to 393 702 in BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MONTANA NEW SECTION Section 1 Homestead exemption eligibility recapture definitions 1 Except as provided in subsection 10 there is a homestead exemption of 50 000 of appraised value for class four residential property owned and used as a primary residence

What Is The Homestead Exemption In Montana 2023

What Is The Homestead Exemption In Montana 2023

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

California Homestead Exemption 2024 Cornie Kerrie

https://www.exemptform.com/wp-content/uploads/2022/08/example-of-homestead-declaration-certify-letter-3.jpg

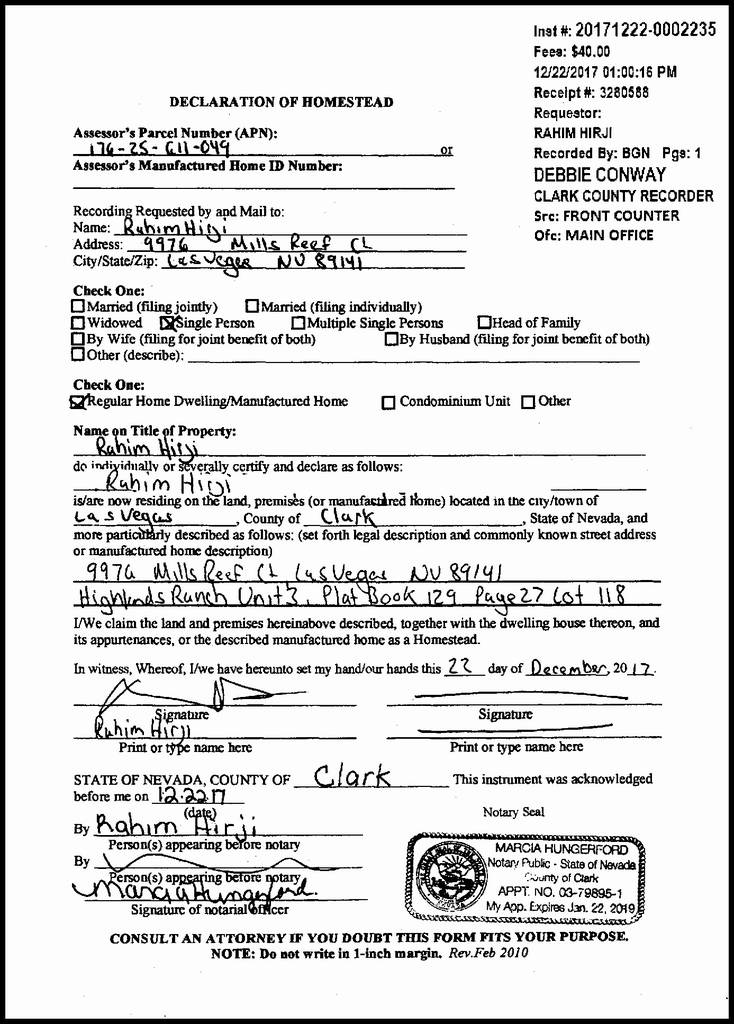

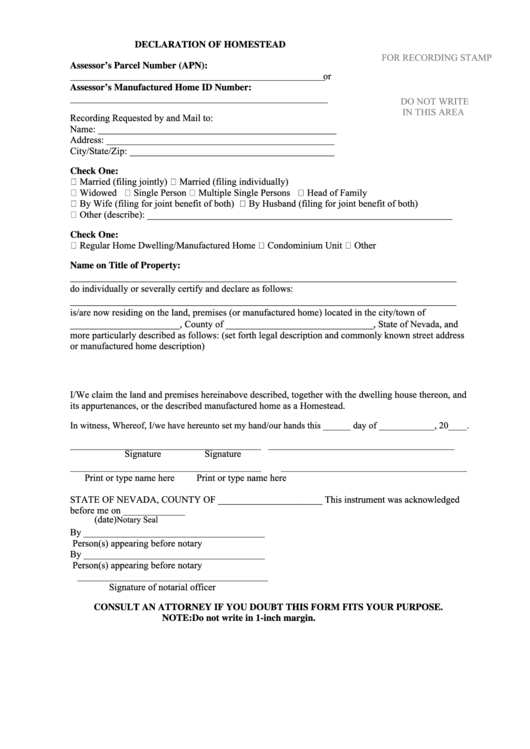

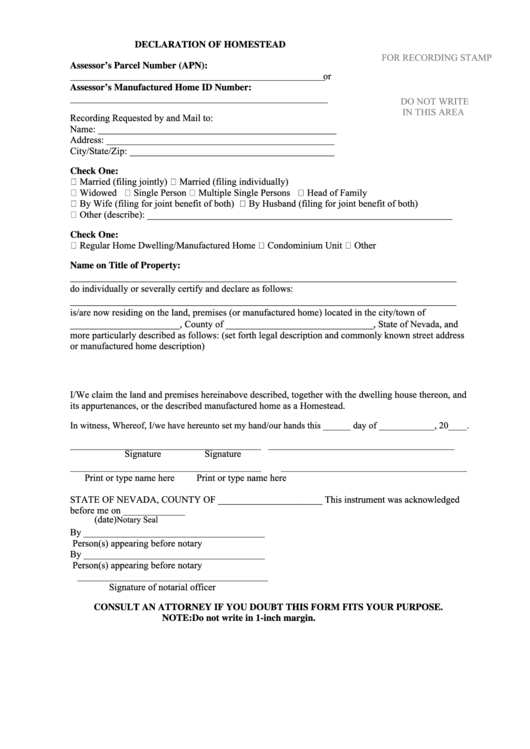

In 2023 Montanans will be eligible for tax refunds and rebates on income and property taxes Generally one time or short term tax relief options are not efficient or effective and can exacerbate the negative effects of inflation In Montana up to 250 000 in assessed value of a home or mobile home can be protected against most creditors claims if the owner files a homestead declaration After the homestead declaration form is completed signed and notarized it should be filed in the office of the clerk and recorder in the county in which the home or mobile home is

Updated Jul 30 2023 The state of Montana has something called a Homestead Exemption which protects the investment you have made in your primary home So what is it A homestead declaration is a legal document designed to protect up to 350 000 of value in your home against most creditor s claims in times of Updated on December 19 2023 Written by Amelia Josephson The homestead tax exemption applies to property taxes It s generally a dollar amount or percentage of the property value that is excluded when calculating property taxes The amount or percentage depends on the state as does who is eligible for the exemption

Download What Is The Homestead Exemption In Montana 2023

More picture related to What Is The Homestead Exemption In Montana 2023

What Is Classstrata In Homestead Exemption Form Fill Out Sign Online

https://www.pdffiller.com/preview/100/430/100430540/large.png

Millions Of Acres Iowa And Nebraska Land For Sale On 10 Years Credit

http://tile.loc.gov/storage-services/service/rbc/rbpe/rbpe13/rbpe134/13401300/001dr.jpg

2022 Texas Homestead Exemption Law Update HAR

https://byjoandco.com/wp-content/uploads/2021/12/Screen-Shot-2021-12-16-at-9.41.14-PM.jpg

In bankruptcy a homestead exemption protects equity in your home Here you ll find specific information about the homestead exemption in Montana For general information about how the homestead exemption works in both Chapter 7 and Chapter 13 bankruptcy read The Homestead Exemption in Bankruptcy Not Sure What Property Tax Exemption Application February 13 2024 Any person firm corporation partnership association or other group who wants Real or Personal Property qualified as tax exempt must submit an application to the Department of Revenue Download the Montana Property Tax Exemption Application

Montana Code Annotated 2023 TITLE 70 PROPERTY CHAPTER 32 HOMESTEADS Part 2 Homestead Exemption Execution 70 32 201 Homestead exempt from execution generally 70 32 202 Execution allowed under certain judgments 70 32 203 Execution under judgments not enumerated application required Line 2 Line 3 Line 4 DECLARATION OF HOMESTEAD KNOW ALL MEN BY THESE PRESENTS Make sure the correct county is entered That Owner of Property and Owner of Property of Street Address City Town Montana ZIP Code select claim and declare a homestead on the dwelling house and all appurtenances which are situated and located

Free Printable Homestead Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/199/1994/199487/page_1_thumb_big.png

The Fund 2019 Florida Homestead Exemption

https://www.thefund.com/getattachment/28076945-8349-4223-b3f4-2589c112b6b5/2019-Florida-Homestead-Exemption

https:// worldpopulationreview.com /state-rankings/...

Montana Homestead Exception amount 250 000 Status and notes Mont Code Ann 70 32 104 Real property or mobile home you occupy to 250 000 sale condemnation or insurance proceeds exempt for 18 months Must record homestead declaration before filing for bankruptcy Nebraska Homestead Exception amount 60 000

https://www. taunyafagan.com /montana-homestead-declaration

Any sale proceeds up to 393 702 are exempt from creditor claims for up to 1 years 18 months Check with your state about monetary coverage but in Montana a Homestead Declaration protects up to 393 702 in

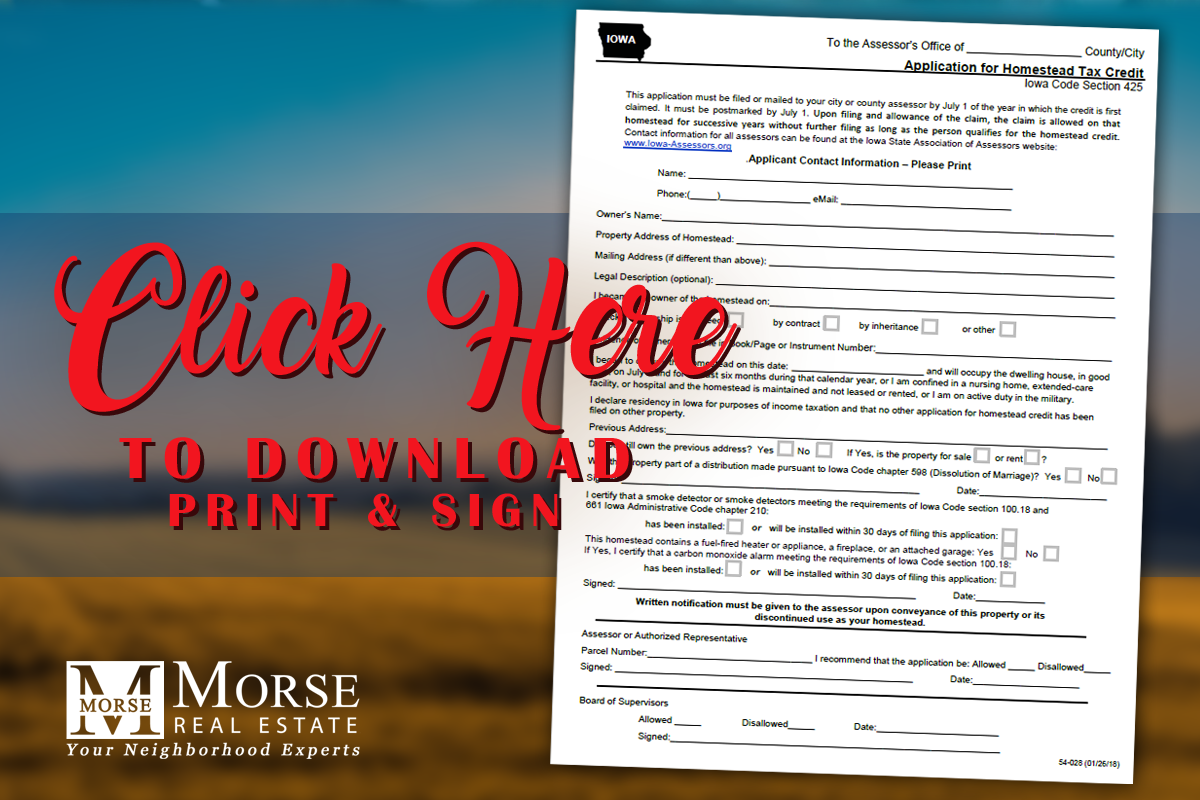

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Free Printable Homestead Forms Printable Forms Free Online

Property Tax Exemption For Individuals For South Carolina Pt 401 1

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

How Do I Register For Florida Homestead Tax Exemption W Video

How Do I Register For Florida Homestead Tax Exemption W Video

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Montgomery County Homestead Exemption Online 2019 2024 Form Fill Out

Homestead Exemption Attorney Miami Martindale

What Is The Homestead Exemption In Montana 2023 - Texas residents are eligible for a standard 100 000 homestead exemption from public school districts as of November 2023 which can be applied for via an Application for Residential Homestead Exemption and once granted remains in place without needing annual renewal