What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022 You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Last updated 3 May 2024 A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for

What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022

What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

How To Qualify For 7 500 EV Tax Credit Smart Money Cookie

https://i0.wp.com/smartmoneycookie.com/wp-content/uploads/2023/03/How-to-Qualify-for-7500-EV-Tax-Credit-Cover.jpg?fit=2049%2C1055&ssl=1

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

https://cdn.motor1.com/images/custom/toyota-us-federal-tax-credit-q2-2022-b.png

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit It also amends the Qualified Plug in Electric Drive Motor Vehicle Credit also known as IRC 30D which gave consumers up to 7 500 in tax credits for buying a battery electric vehicle and

Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 for buyers of new all electric Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible

Download What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022

More picture related to What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

New Bill Could Save Tesla s 7 500 Tax Credit Electric Car Tax Credit

https://hips.hearstapps.com/hmg-prod/images/tesla-model-x-2017-1280-12-1539697058.jpg?crop=1.00xw:0.708xh;0,0.172xh&resize=1200:*

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The tax credit is limited to cars under 55K MSRP and under 80K MSRP for trucks and SUVs The IRS updated their guidelines on February 3 qualifying more EVs as SUVs increasing the credit

According to the IRS 2023 Tax Table to owe 7 500 you d need a taxable income IRS Form 1040 line 15 of at least 55 400 as a single filer 62 700 for a head of household and 66 150 for All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Tesla Cybertruck Officially Approved For 7 500 EV Tax Credit

https://electriccarproject.com/wp-content/uploads/2023/12/1702276234_tesla-cybertruck-1024x576.jpg

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

https://www. irs.gov /credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www. irs.gov /credits-deductions/credits-for...

The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

Tesla Cybertruck Officially Approved For 7 500 EV Tax Credit

Income Limit For 7500 Electric Vehicle Credit Todrivein

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

New U S Federal Tax Credit For Buying An Electric Car In 2024 7 500

Electric Car Buyers In 2023 May Have To Pay Back Their US 7 500 Tax

Electric Car Buyers In 2023 May Have To Pay Back Their US 7 500 Tax

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

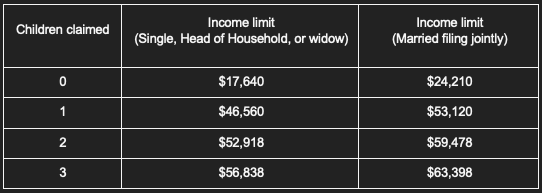

Earned Income Tax Credit EITC In 2023 PriorTax Blog

These 11 Cars Now Qualify For The 7 500 Federal EV Tax Credit Flipboard

What Is The Income Limit For 7500 Federal Tax Credit Electric Car 2022 - Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 for buyers of new all electric