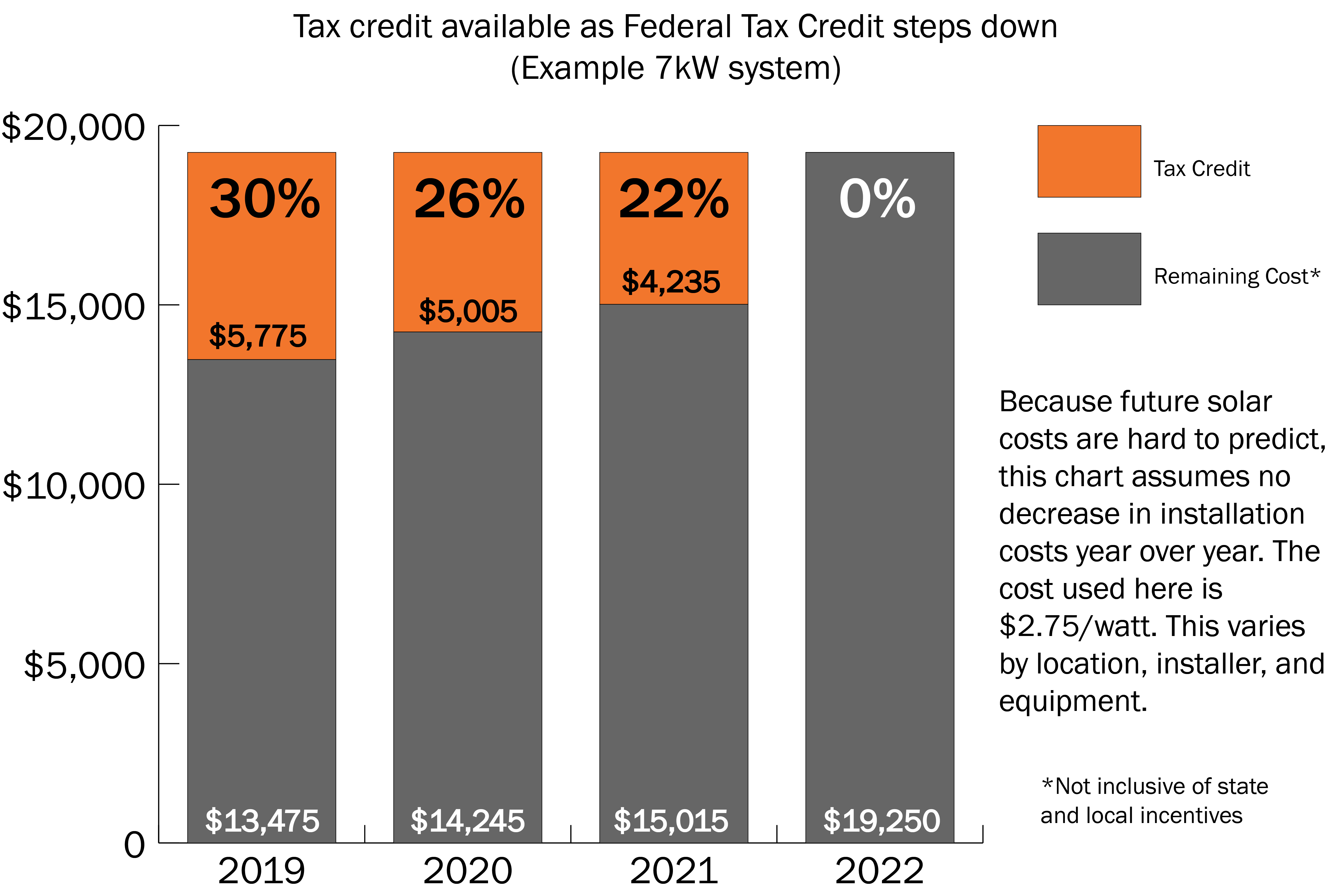

What Is The Income Limit For Solar Tax Credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year Is there a solar tax credit income limit No there is no income limit You can claim the solar tax credit regardless of your income level so long as the project expenses and residence are all qualified

What Is The Income Limit For Solar Tax Credit

What Is The Income Limit For Solar Tax Credit

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2021/10/What-is-a-Solar-Tax-Credit-R01-1089x1536.jpg

Per the Inflation Reduction Act the ITC is 30 of the solar system cost until 2033 and will gradually reduce until it expires in 2035 Property tax exemptions SREC markets and utility rebates Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When this is the case

There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full credit The federal residential solar tax credit is the most valuable incentive you can claim this year because it saves you thousands of dollars in the form of a 30 tax credit There s no

Download What Is The Income Limit For Solar Tax Credit

More picture related to What Is The Income Limit For Solar Tax Credit

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

https://i.pinimg.com/originals/58/28/2c/58282c905274c1827d1d8b95646b152a.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

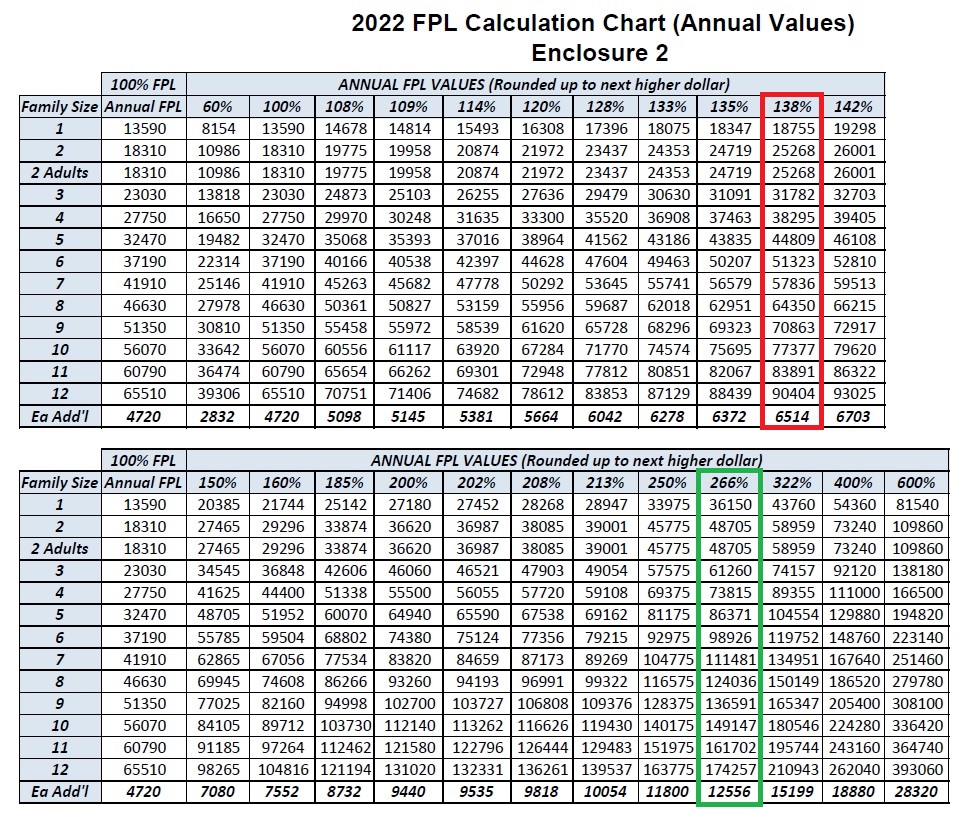

Big Increase For The 2022 Medi Cal Income Amounts

https://insuremekevin.com/wp-content/uploads/2022/02/Annual-FPL-2022-Income-Chart-Medi_Cal.jpg

In 2024 the federal solar tax credit is equal to 30 of solar installation costs and it directly reduces your federal income tax liability Here s an example of how the solar tax credit works If you installed a home solar power system for 20 000 There are no income limits on the solar tax credit so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United States

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed So if your all in solar cost is 25 000 your federal solar tax credit would be worth 7 500 If you spend 75 000 on solar and battery your tax credit would be worth 22 500

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

https://www.buildnative.com/wp-content/uploads/2017/03/solar-tax-credit-seia.jpg

https://www.energy.gov/eere/solar/hom…

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

https://www.nerdwallet.com/.../taxes/s…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

All You Need To Know On How To Save Income Tax Ebizfiling

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

Solar Tax Credit Graph without Header Solar United Neighbors

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

FAQ WA Tax Credit

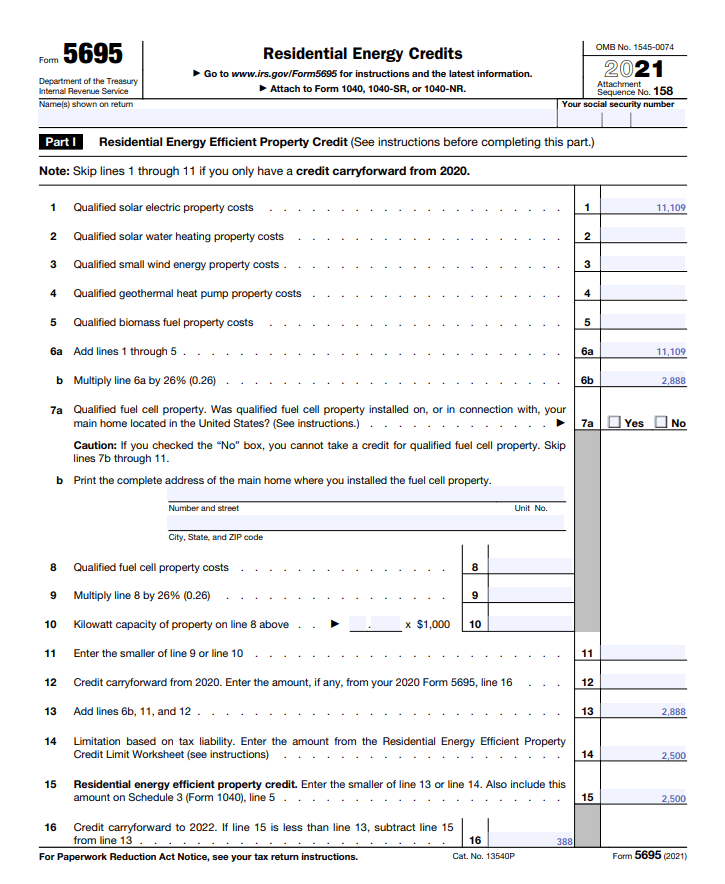

How To File The Federal Solar Tax Credit A Step By Step Guide

How To File The Federal Solar Tax Credit A Step By Step Guide

Maximize Your Paycheck Understanding FICA Tax In 2023

Union Budget 2023

2022 Tax Brackets

What Is The Income Limit For Solar Tax Credit - The federal solar tax credit residential energy credits Form 5965 is a tax credit not an itemized deduction So it won t be affected if you stop itemizing your deductions You