What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta Under Section 80TTA of the Income Tax Act 1961 in India individuals and Hindu Undivided Families HUFs are eligible for a

The maximum amount of deduction allowable under Section 80TTA is INR 10 000 for the interest earned from the savings bank account However if the accumulated interest The interest that has been received from a savings account is deductible up to Rs 10 000 in Section 80TTA of Income Tax Act If an individual has multiple accounts with different

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

https://i.ytimg.com/vi/pLTEggSa2pA/maxresdefault.jpg

Don t Claim Fake Income Tax Deduction Under Section 80C 80D 80GG

https://i.ytimg.com/vi/YJoz_Wkntmw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYWyBlKFgwDw==&rs=AOn4CLAemIatRMjP9bXEDUnkuu-TeGE8bw

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

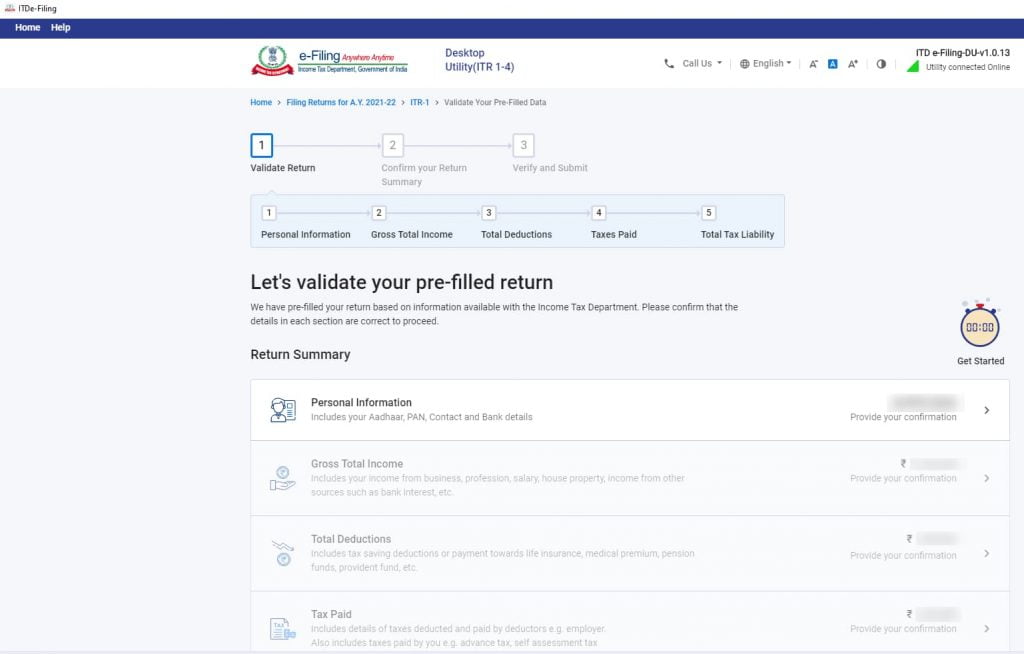

Maximum deductions allowed under Section 80TTA The maximum deduction permitted under Section 80TTA is Rs 10 000 If an individual s interest What is the maximum amount of deduction that can be claimed under section 80TTA An individual can claim maximum deduction of Rs 10 000 for interest earned

The maximum amount of deduction available under section 80TTA is lower of the following The whole of the interest income or INR 10 000 In simple terms if the The maximum deduction allowed under Section 80TTA is Rs 10 000 per financial year If your total interest income from specified sources exceeds Rs 10 000

Download What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

More picture related to What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

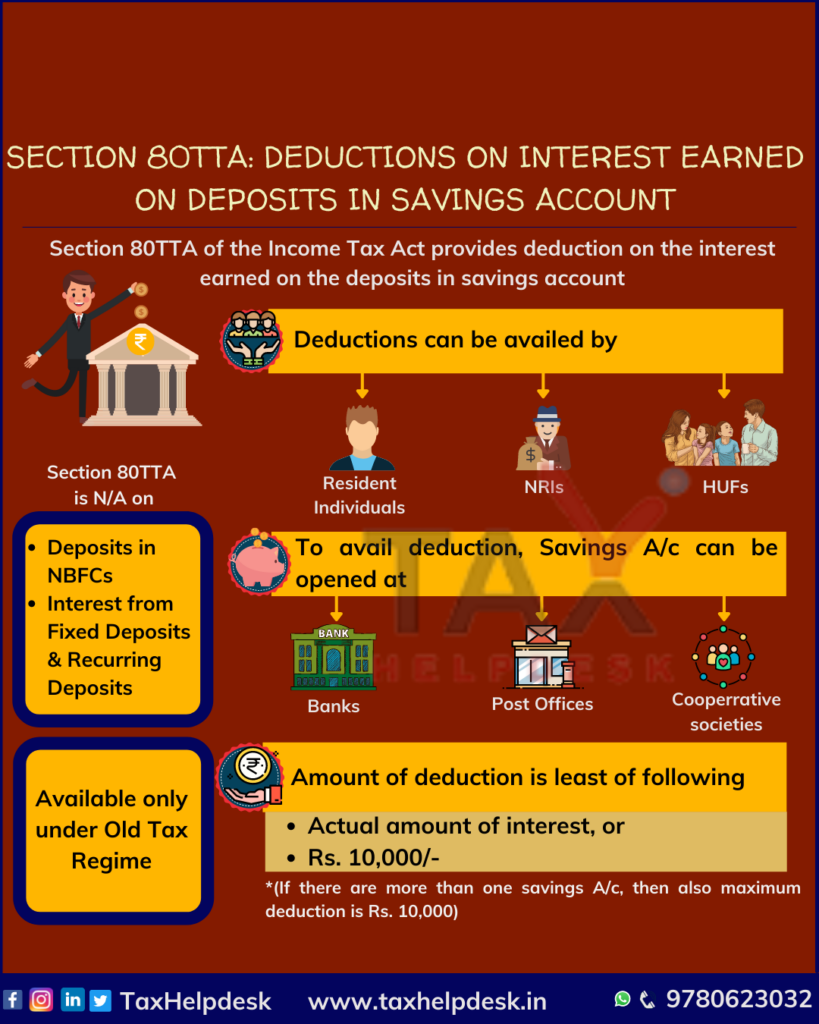

Deductions On Interest On Deposits In Savings Account Section 80TTA

https://www.taxhelpdesk.in/wp-content/uploads/2021/09/Section-80TTA-DEDUCTIONS-ON-INTEREST-EARNED-ON-DEPOSITS-In-SAVINGS-ACCOUNT-1-819x1024.png

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

TAX DEDUCTION UNDER SECTION 80TTA DEDUCTION ON SAVINGS INTEREST

https://1.bp.blogspot.com/--3aJsdyy8TA/XVb06wmCXhI/AAAAAAAAARM/8k81jTpDWDcKNFWboPjtuyMCrGa2_E3BwCLcBGAs/s1600/SocialMediaPostMaker_16082019_235322.png

Deduction limit u s 80TTA The maximum deduction allowed under this section is INR 10 000 for the relevant assessment year If interest income from all the Sec 80TTA income tax exemption is allowed to an individual as well as a HUF This deduction is given for interest earned on saving deposits with bank co

Exceptions under Section 80TTA Considering that deduction under this section is not allowed for interest on fixed deposits and recurring deposits it will be taxable according Maximum Deduction The maximum amount of deduction available under this section stands at Rs 10 000 per annum In the interest income is less than Rs 10 000 per

Section 80TTA Claim Tax Deduction On Savings Account Interest Income

https://life.futuregenerali.in/media/2qsf3zkl/taxation-on-savings-interest.jpg

Section 80TTA Income Tax Act Claim Deduction On Interest Income

https://mybillbook.in/blog/wp-content/uploads/2021/08/section-80tta-of-income-tax-act-1024x576.jpg

https://tax2win.in/guide/section-80tta

Under Section 80TTA of the Income Tax Act 1961 in India individuals and Hindu Undivided Families HUFs are eligible for a

https://www.taxbuddy.com/section-80tta

The maximum amount of deduction allowable under Section 80TTA is INR 10 000 for the interest earned from the savings bank account However if the accumulated interest

All You Need To Know On Exempted Income In Income Tax Ebizfiling

Section 80TTA Claim Tax Deduction On Savings Account Interest Income

Section 80TTA How You Can Claim Tax Deduction

Section 80TTA Deduction Interest Deposits Savings Account GST Guntur

Section 80TTA Of Income Tax Act 2023 Guide InstaFiling

Section 80TTA Of The Income Tax Act A Guide To Saving Tax On Interest

Section 80TTA Of The Income Tax Act A Guide To Saving Tax On Interest

Interest On Savings Account Income Tax Deduction Section 80TTA

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And

Deductions Allowed Under The New Income Tax Regime Paisabazaar

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta - The maximum deduction allowed under Section 80TTA is Rs 10 000 per financial year If your total interest income from specified sources exceeds Rs 10 000