What Is The Maximum Income For Family Tax Benefit Nz Answer the questions below to work out if you may be eligible to get a Working for Families payment We will work out your payments based on your family income and circumstances

Get help with the costs of raising children with Working for Families tax credit payments Your payments are worked out based on the information you give Inland Revenue Childcare assistance includes Childcare Subsidy and OSCAR Subsidy The rate depends on how many children you have and how much your income is This is income and

What Is The Maximum Income For Family Tax Benefit Nz

What Is The Maximum Income For Family Tax Benefit Nz

https://media.apnarm.net.au/media/images/2015/09/28/IQT_29-09-2015_OPINION_02_ThinkstockPhotos-200405397-001.1_fct1024x768_ct1880x930.jpg

My Texas Benefits Medicaid Application MedicAidTalk

https://www.medicaidtalk.net/wp-content/uploads/2021/12/texas-medicaid-eligibility-and-using-your-texas-benefits.jpeg

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

From April 2024 a family needs a minimum after tax weekly income of at least 677 which goes up to 679 from July 2024 Family Tax Credit FTC This is the central part The amount you qualify for depends on your household income From 1 April this rate will increase from a maximum 136 to a maximum 144 a week for the oldest

Working for Families Tax Credits Income Limits 2021 22 Number of Annual Income before tax Best Start tax credit Up to 3 120 a year based on a family with one child No income limit in The minimum family tax credit is a payment that boosts the income of working parents to ensure they re earning a basic income If your annual family income is 30 576 or less after tax then you may qualify for this payment and

Download What Is The Maximum Income For Family Tax Benefit Nz

More picture related to What Is The Maximum Income For Family Tax Benefit Nz

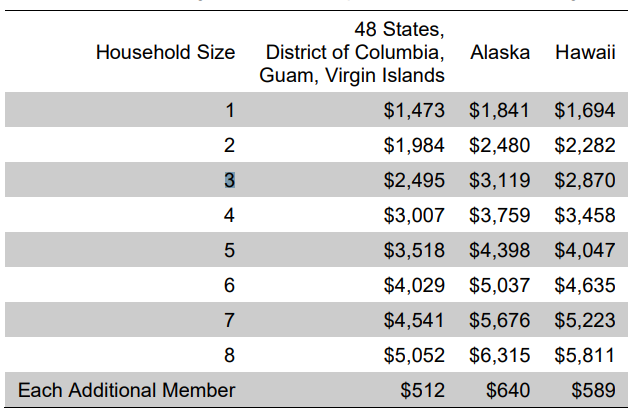

Low Income Guidelines 2022 Yabtio

https://i2.wp.com/amwater.com/paaw/Resources/Images/Customer-Service-and-Billing/MonthlyIncomeGuidelines2021.jpg

Medicaid Eligibility Income Chart Florida MedicAidTalk

https://www.medicaidtalk.net/wp-content/uploads/2021/12/medicaid-income-eligibility-limits-for-parents-in-non.png

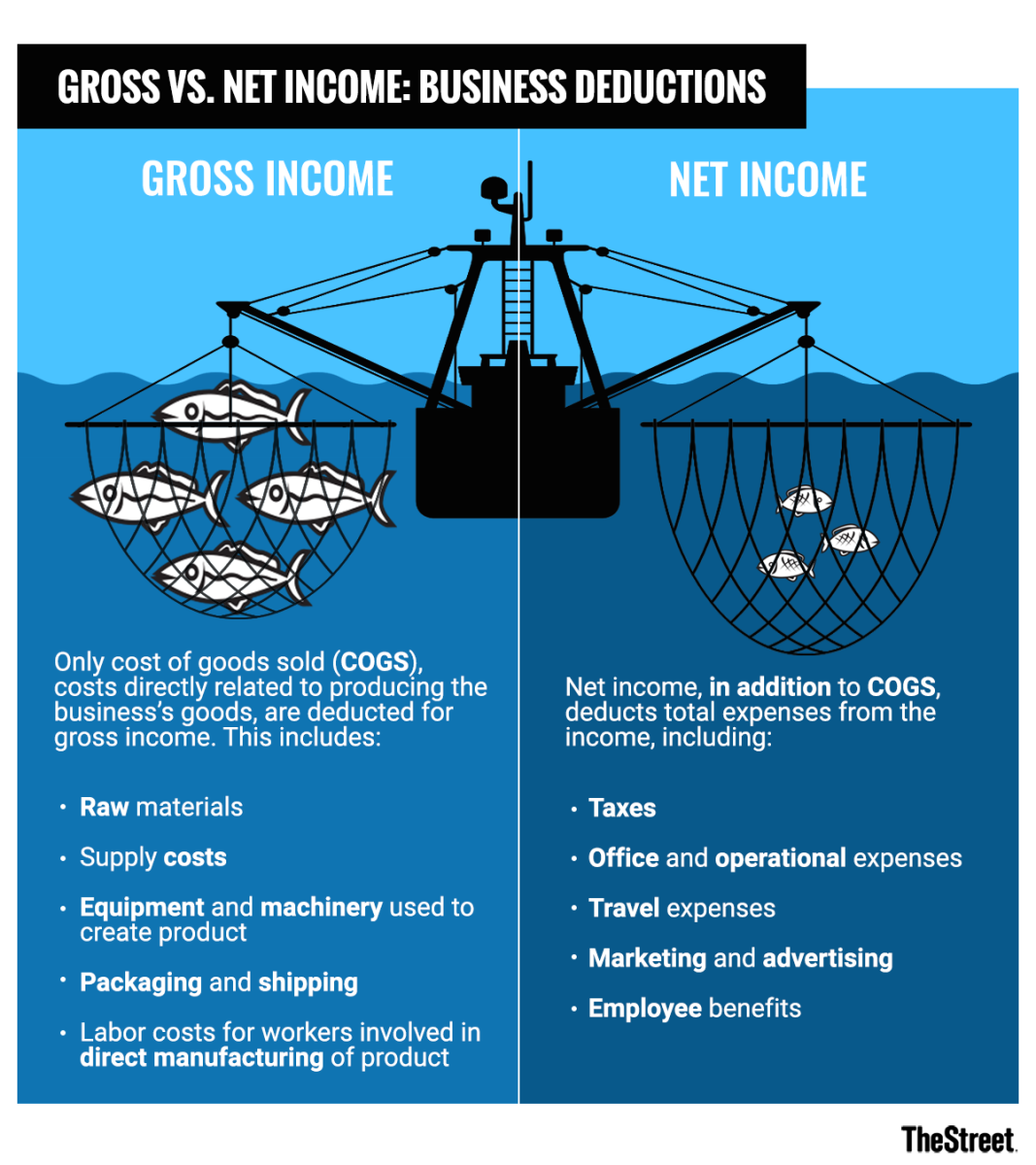

What s The Difference Between Gross Vs Net Income TheStreet

https://www.thestreet.com/.image/t_share/MTY3NTQxMjkzMTYwNDc0NTEw/image-placeholder-title.png

Some people can get Best Start payments until their child turns 3 years of age it depends on family income Payments for young people aged 16 or 17 who cannot live with Increases the maximum credit for the first child under 16 by 9 a week and for each subsequent child under 16 by between 18 and 27 a week Also increases the abatement rate to 25 per

There are 4 types of Working for Families tax credit payments Family tax credit Paid regardless of your income source You can be on salary and wages or receiving an income tested benefit About 12 000 families are expected to get the maximum amount of 250 a fortnight from the combined package those are families who will get the full Family Boost rebate

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

https://i0.wp.com/www.investopedia.com/thmb/3SNbuiCjlAyxtuWGNwzFvL96lOM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.ird.govt.nz › working-for-families › eligibility

Answer the questions below to work out if you may be eligible to get a Working for Families payment We will work out your payments based on your family income and circumstances

https://www.govt.nz › browse › family-and-whanau › ...

Get help with the costs of raising children with Working for Families tax credit payments Your payments are worked out based on the information you give Inland Revenue

How Much Monthly Income To Qualify For Medicaid Astar Tutorial

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

Maximum Income Tax You Can Save For FY 2015 16

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

2023 SNAP Food Stamps Benefit Cuts And Maximum Monthly EBT Benefit

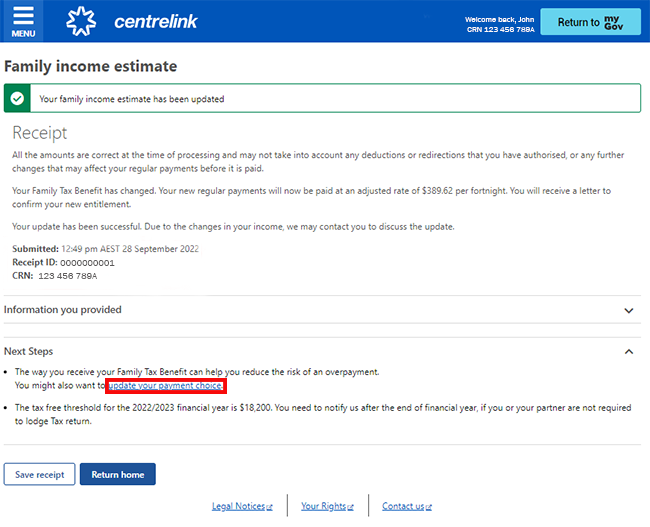

Centrelink Online Account Help Update Your Family Income Estimate And

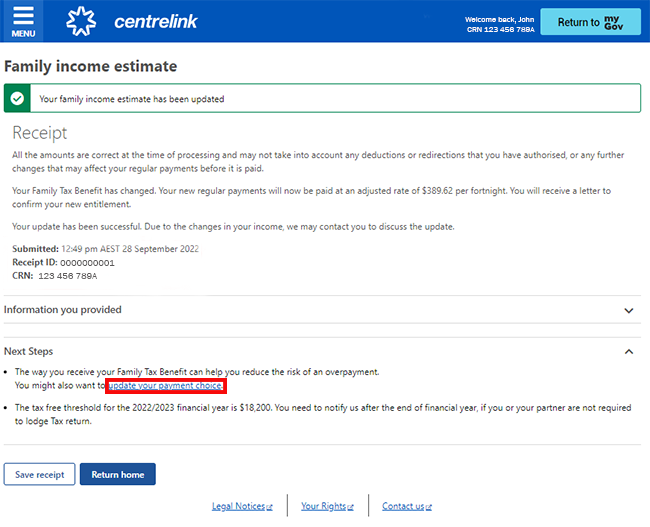

Centrelink Online Account Help Update Your Family Income Estimate And

How Does Family Tax Benefit Really Work Grandma s Jars

Income Verification Letter

How Does Family Tax Benefit Really Work Grandma s Jars

What Is The Maximum Income For Family Tax Benefit Nz - From 1 April 2018 the Minimum Family Tax Credit threshold amount will also increase from 23 816 to 26 156 This is to ensure families with children remain better off working full time