What Is The Maximum Tax Deduction For A Car Donation If your vehicle sells for more than 500 you may deduct the full selling price If your vehicle sells for 500 or less you can deduct the fair market value of your vehicle up to 500 How do I

If you donate a qualified vehicle with a claimed value of more than 500 you can t claim a deduction unless you attach to Form 8283 a copy of the CWA you received from the donee The amount you may deduct for a vehicle contribution depends upon what the charity does with the vehicle as reported in the written acknowledgment you receive from the charity Charities

What Is The Maximum Tax Deduction For A Car Donation

What Is The Maximum Tax Deduction For A Car Donation

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

https://3.bp.blogspot.com/-I2ZnysVTsCw/V0MFtS_ztYI/AAAAAAAAAAY/Aq_AEm6A9LE47-HnrHKpziRJSvLjgVpYwCLcB/s1600/tax.jpg

The main problem with claiming a deduction for a donated car is overcoming the standard deduction Everyone gets a standard deduction and it s a whopper 25 900 for joint filers 19 400 for heads of household and Generally limits the deduction to the actual sales prices of the vehicle when sold by the donee charity and requires donors to get a timely acknowledgment from the charity to claim the

Your tax deduction depends on the vehicle s worth and how the charity intends to use it If the car is worth less than 500 you can claim its fair market value FMV For contributions of qualified vehicles with a claimed fair market value FMV of more than 500 the charitable deduction amount will be determined by one of the following two situations

Download What Is The Maximum Tax Deduction For A Car Donation

More picture related to What Is The Maximum Tax Deduction For A Car Donation

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

To be eligible for a tax deduction the car must be donated to a tax exempt nonprofit organization most commonly known as a 501 c 3 organization To verify if an organization is tax exempt If it is worth more than 500 you ll need to complete section A of IRS Form 8283 when you file your tax return If the vehicle is worth more than 5 000 you will need to get an

Recordkeeping and filing requirements depend on the amount you claim for the deduction 1 If the deduction you claim for the car is at least 250 but not more than 500 Maximizing Your Deduction To truly benefit from your car donation understanding the nuances of tax laws is essential This means knowing whether to itemize deductions and how the charity s

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

https://www.habitat.org/support/donate-your-car/tax-benefits

If your vehicle sells for more than 500 you may deduct the full selling price If your vehicle sells for 500 or less you can deduct the fair market value of your vehicle up to 500 How do I

https://www.irs.gov/publications/p526

If you donate a qualified vehicle with a claimed value of more than 500 you can t claim a deduction unless you attach to Form 8283 a copy of the CWA you received from the donee

10 Tax Deduction Worksheet Worksheeto

Potentially Bigger Tax Breaks In 2023

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Your Guide To Car Donation Tax Deduction

Your Guide To Car Donation Tax Deduction

Can I Take A Tax Deduction For A Dangerous Funding Bizagility

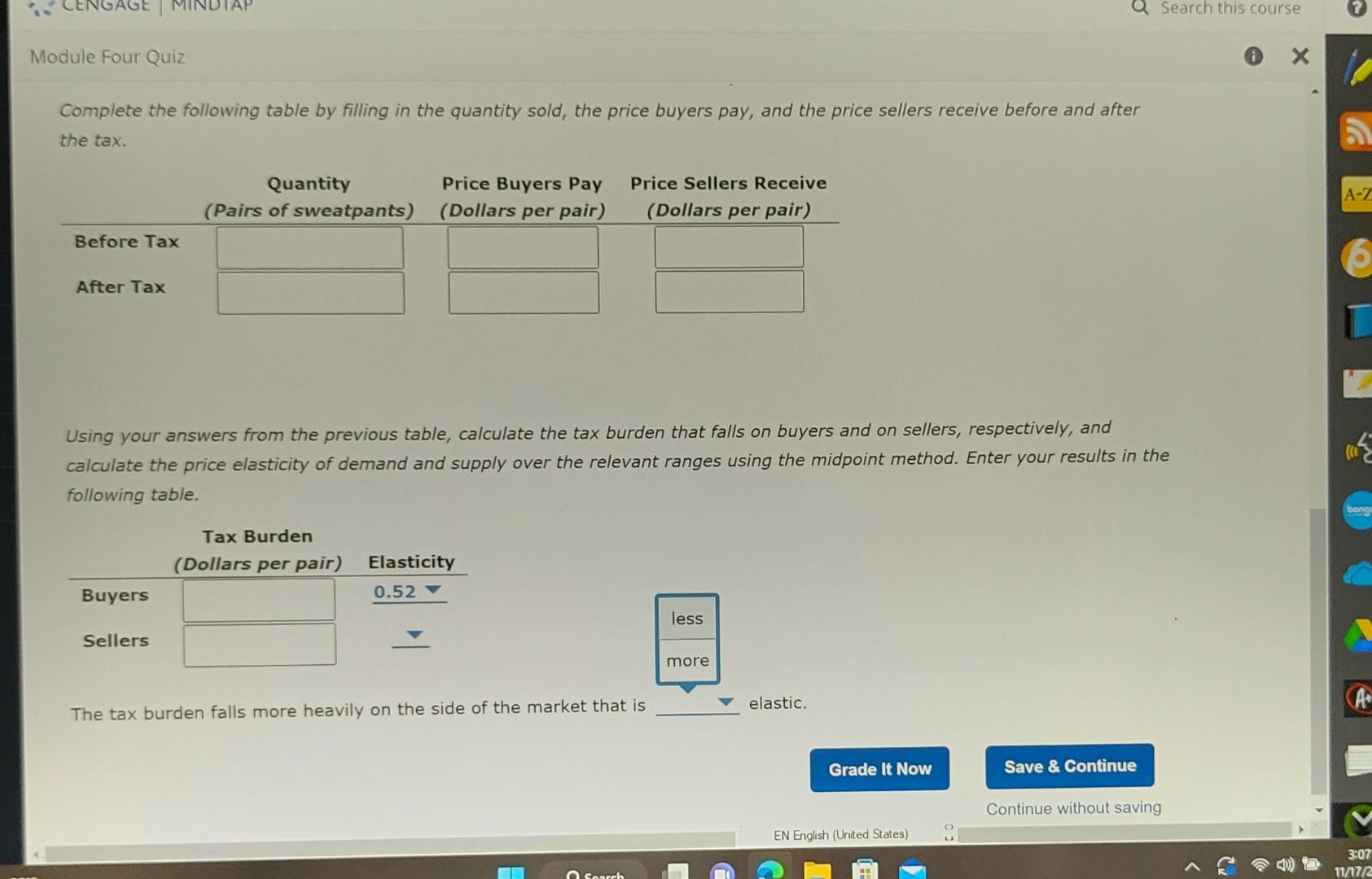

Solved 3 Effect Of A Tax On Buyers And Sellers The Chegg

Small Business Tax Deductions Worksheet

What Is The Maximum Tax Deduction For A Car Donation - Understanding a few fundamentals before donating your car for tax deductions is important You can claim a deduction if you donate to a qualified charity but the amount