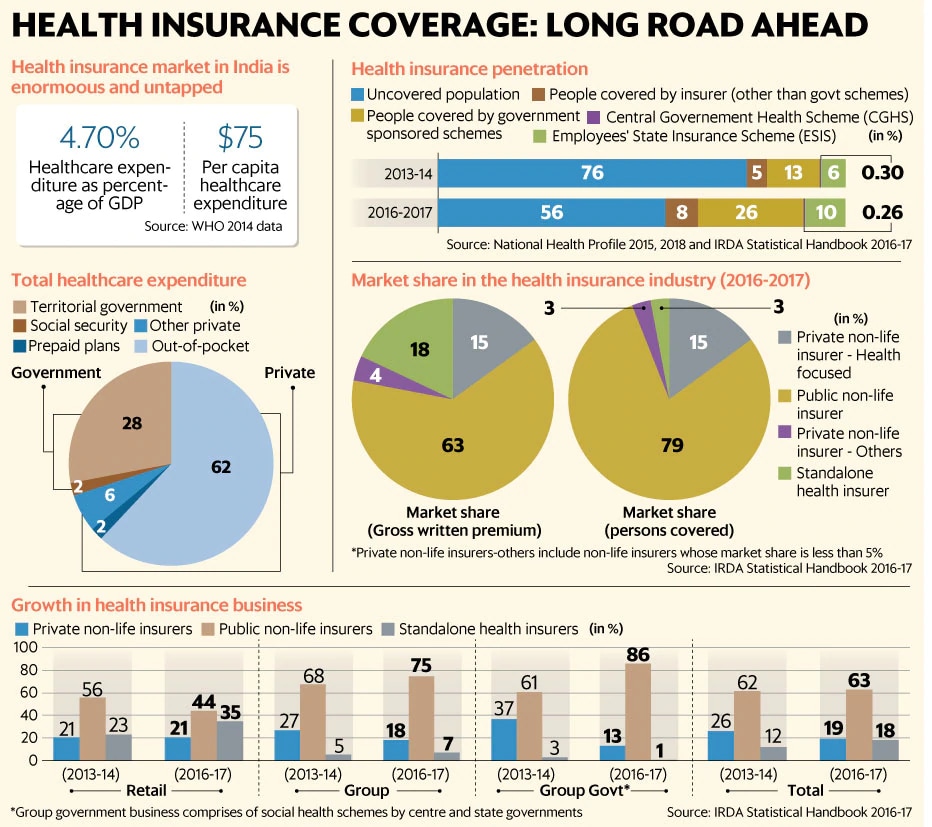

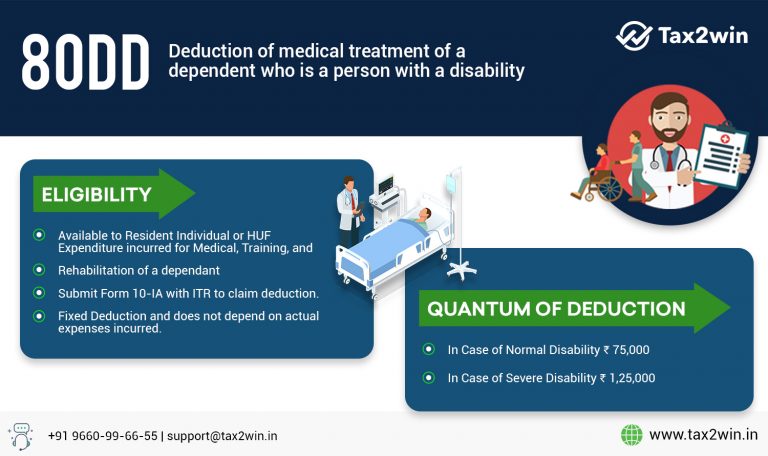

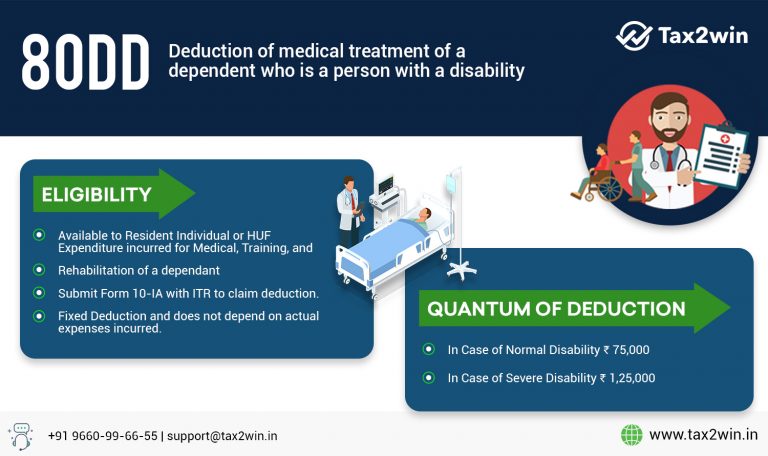

Income Tax Rebate Under Section 80dd Web Deduction Under Section 80DD Assessment Year Whether handicapped dependent is claiming deduction under section 80U Yes No Status Residential Status Please

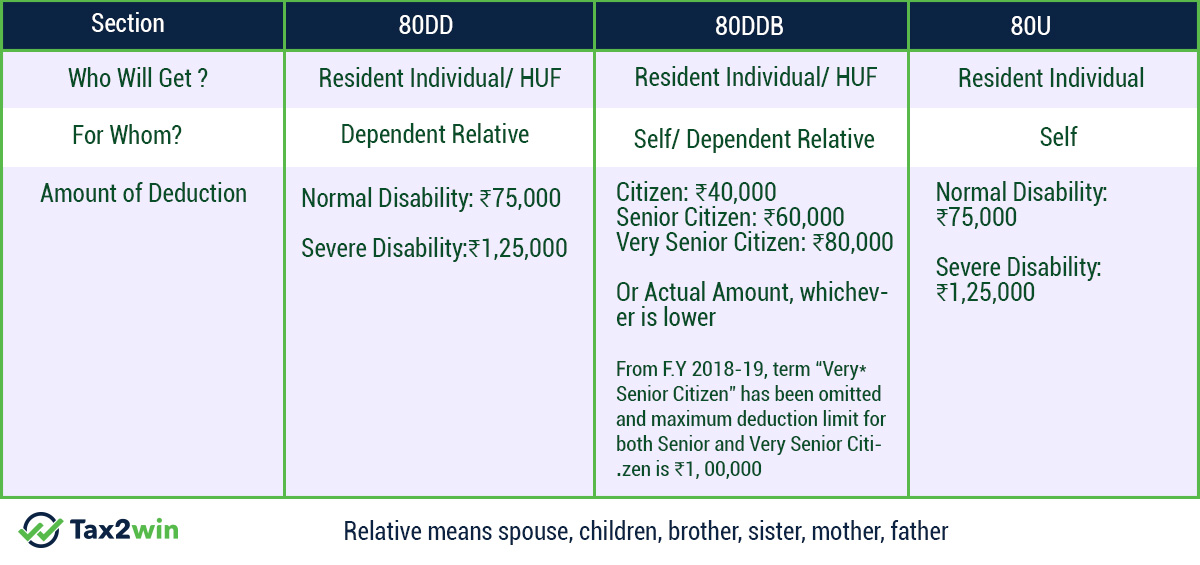

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is Web 22 sept 2019 nbsp 0183 32 As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case

Income Tax Rebate Under Section 80dd

Income Tax Rebate Under Section 80dd

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

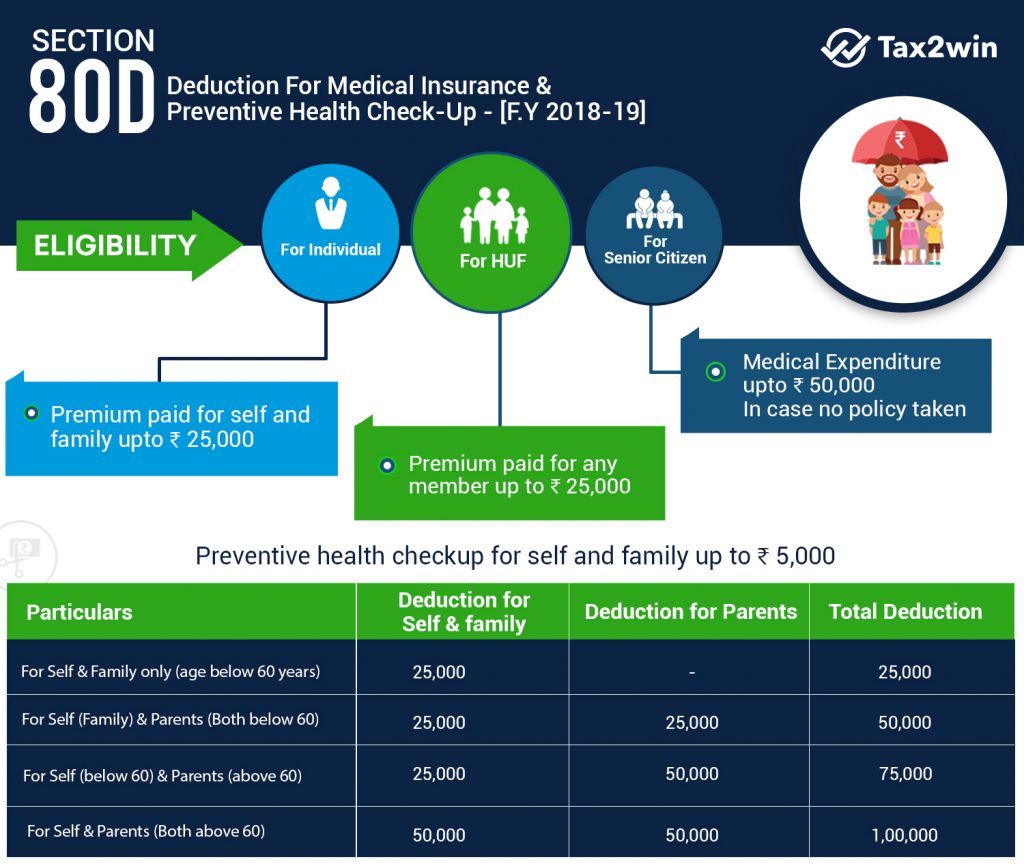

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

Income Tax Deductions FY 2016 17 AY 2017 18 Details

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

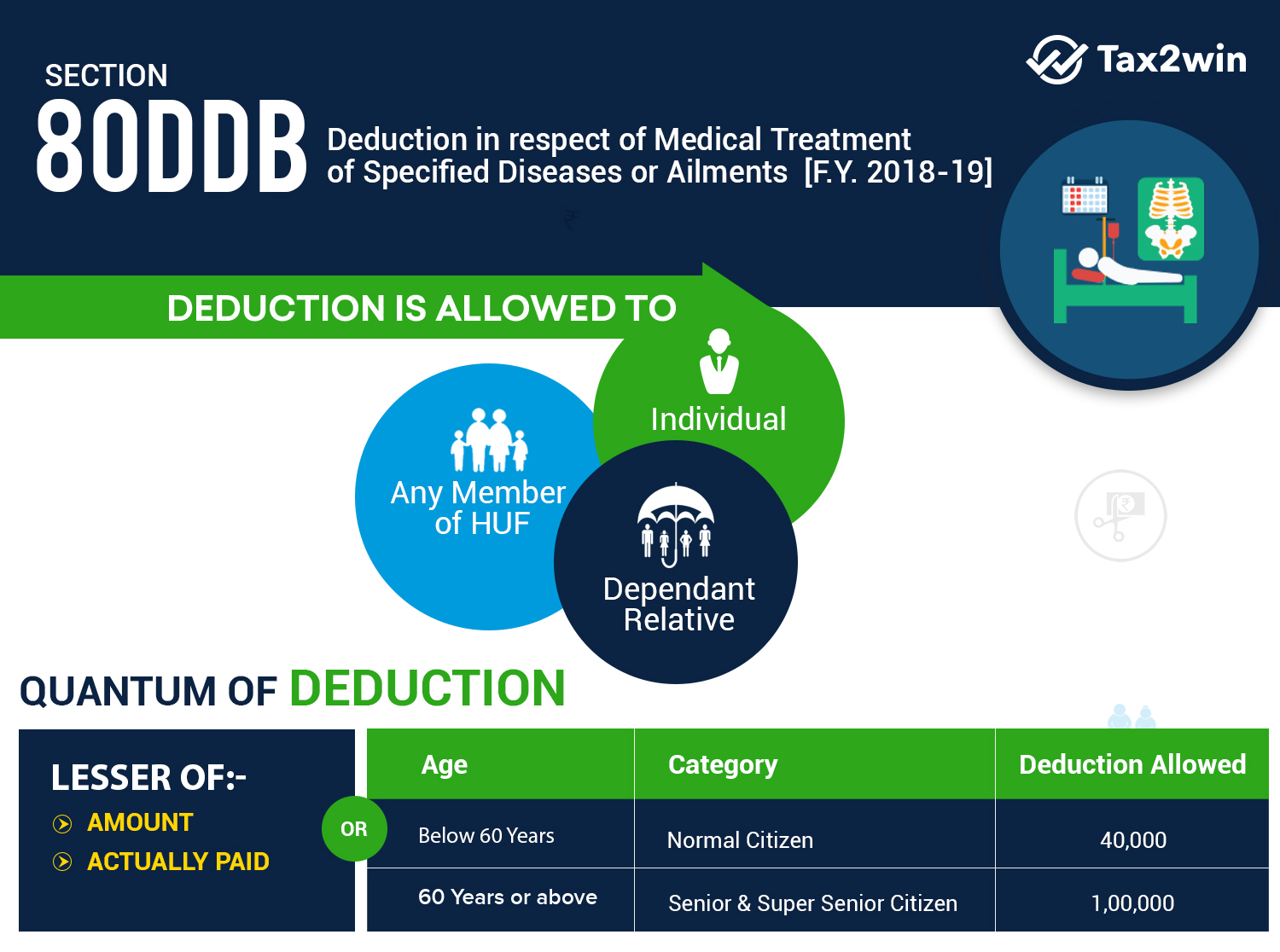

Web 20 juil 2019 nbsp 0183 32 Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The Web 11 sept 2023 nbsp 0183 32 All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family

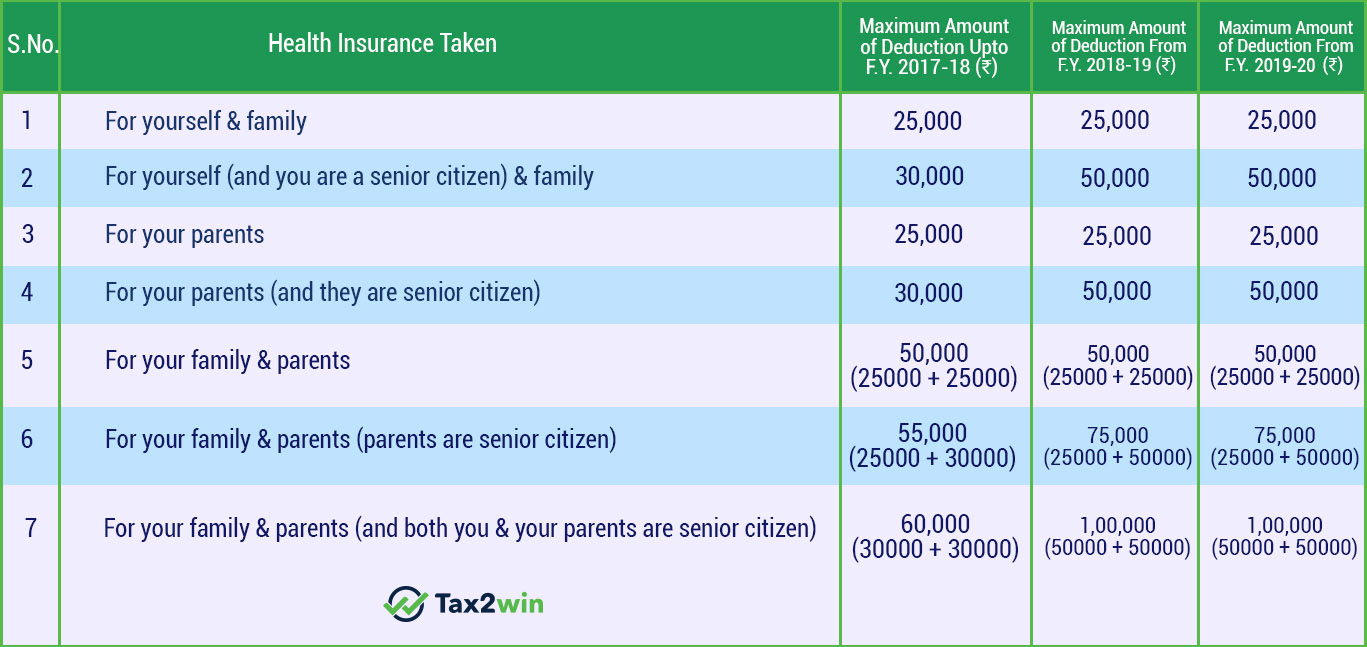

Web Tax deduction under Section 80DD of the Income Tax Act can be claimed by individuals who are residents of India and HUFs for the medical treatment of a dependant with Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax

Download Income Tax Rebate Under Section 80dd

More picture related to Income Tax Rebate Under Section 80dd

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Income Tax Deduction Income Tax Standard Deduction 2019 2020

https://www.policybazaar.com/images/section-80d.jpg

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 Section 80DD of income tax act provides tax deductions to resident individuals or HUFs for any expenses incurred on the medical treatment of differently abled dependents This income tax deduction Web 29 mai 2023 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be

Web 11 juin 2018 nbsp 0183 32 Who is Eligible to Get Deduction under Section 80DD Any individual or HUF Hindu Undivided Family who has a dependent person with disability is eligible to claim this deduction Tax deduction under Web 24 juil 2023 nbsp 0183 32 Terms and Conditions for applicability of 80DD The deduction limit permitted u s 80 DD is up to Rs 75 000 in cases of disability up to 40 The annual limit for

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/80U-Deduction-in-case-of-disability.jpg

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80DDB-Deductions.jpg

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80dd...

Web Deduction Under Section 80DD Assessment Year Whether handicapped dependent is claiming deduction under section 80U Yes No Status Residential Status Please

https://economictimes.indiatimes.com/wealth/tax/budget-2022-introduces...

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

80D Tax Deduction Under Section 80D On Medical Insurance

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Section 80DD Tax Deduction For Care Of Handicapped Disabled Persons

Section 80DD Of The Income Tax Act Who Can Claim This Deduction

Income Tax Rebate Under Section 80dd - Web 18 juil 2023 nbsp 0183 32 You are a resident individual Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY