What Is 80dd In Income Tax Verkko 23 marrask 2023 nbsp 0183 32 Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

Verkko 3 helmik 2023 nbsp 0183 32 Last updated on February 3rd 2023 Section 80DD of income tax act provides tax deductions to resident individuals or HUFs for any expenses incurred on the medical treatment of differently abled dependents This income tax deduction can be claimed at the time of filing ITR under Chapter VI A INDEX Verkko 22 syysk 2019 nbsp 0183 32 Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

What Is 80dd In Income Tax

What Is 80dd In Income Tax

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

https://paytmblogcdn.paytm.com/wp-content/uploads/2022/11/paytm-section-80dd-800x500.jpg

Income Tax Deduction U s 80DD TaxSaving Upto 125000 YouTube

https://i.ytimg.com/vi/CnMU8K--CnE/maxresdefault.jpg

Verkko 18 helmik 2023 nbsp 0183 32 What is Section 80DD Section 80DD of the Income Tax Act provides for tax relief to taxpayers who have dependent family members with a disability A dependent family member can be a spouse children parents or siblings The disability can be physical or mental and the extent of disability should be at least 40 Verkko 18 marrask 2022 nbsp 0183 32 Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely reliant on them for support and maintenance Families who provide care for disabled dependents are eligible for tax breaks under Section 80DD

Verkko 8 jouluk 2023 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health insurance a deduction up to Rs 50 000 can be claimed on the medical expenses incurred for them Verkko 24 toukok 2023 nbsp 0183 32 Tax laws often provide incentives and benefits for individuals who have certain disabilities or incur expenses in caring for dependents with disabilities Section 80DD of the Income Tax Act 1961 is

Download What Is 80dd In Income Tax

More picture related to What Is 80dd In Income Tax

INCOME TAX DEDUCTIONS PART 2 U S 80D 80U YouTube

https://i.ytimg.com/vi/4YHT8MJULhA/maxresdefault.jpg

Income Tax Sec 80DD Deduction In Relation To Disable Autism Etc

https://www.autismfinancialplanning.com/wp-content/uploads/2022/06/A-Complete-Overview-of-Section-80-DD.jpg

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

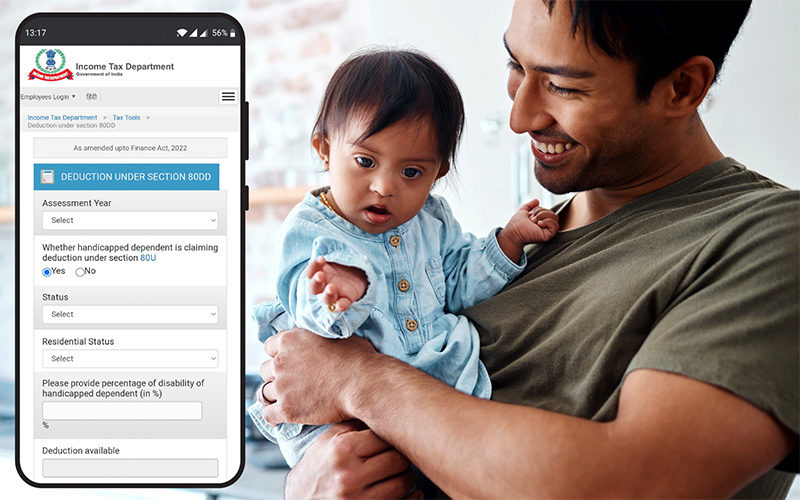

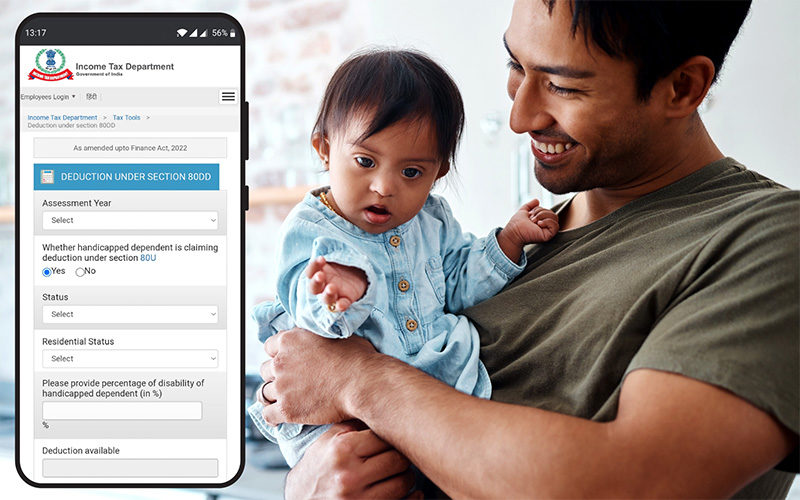

Verkko Financial year Status 80DD Calculator Tax Deduction for Disabled Dependents Before you file taxes check out your potential tax benefits under section 80DD It takes a few minutes to compute the deductions you can avail of under this section What is Section 80DD in Income Tax Verkko 12 jouluk 2023 nbsp 0183 32 Section 80DD in the Income Tax Act of 1961 is like a helping hand for those taking care of family members with disabilities This section of the ITA offers a fixed tax deduction to the caretaker no matter how much they earn The purpose behind this is to ease the financial burden that comes with looking after a disabled family member

Verkko 24 hein 228 k 2023 nbsp 0183 32 Section 80 DD of the Income Tax Act deals specifically with persons with disability The section speaks of Income Tax deductions with respect to maintenance including medical treatment of a dependent Who can be called a person with disability Verkko Section 80DD serves as a crucial provision in the Income Tax Act offering financial support to individuals taking care of dependents with disabilities Understanding the eligibility criteria documentation requirements and the maximum deduction limits is essential for taxpayers looking to avail themselves of this benefit

Disability Deduction In ITR I Sec 80U And 80DD Deduction Of Income Tax

https://i.ytimg.com/vi/A8leHyRvuzY/maxresdefault.jpg

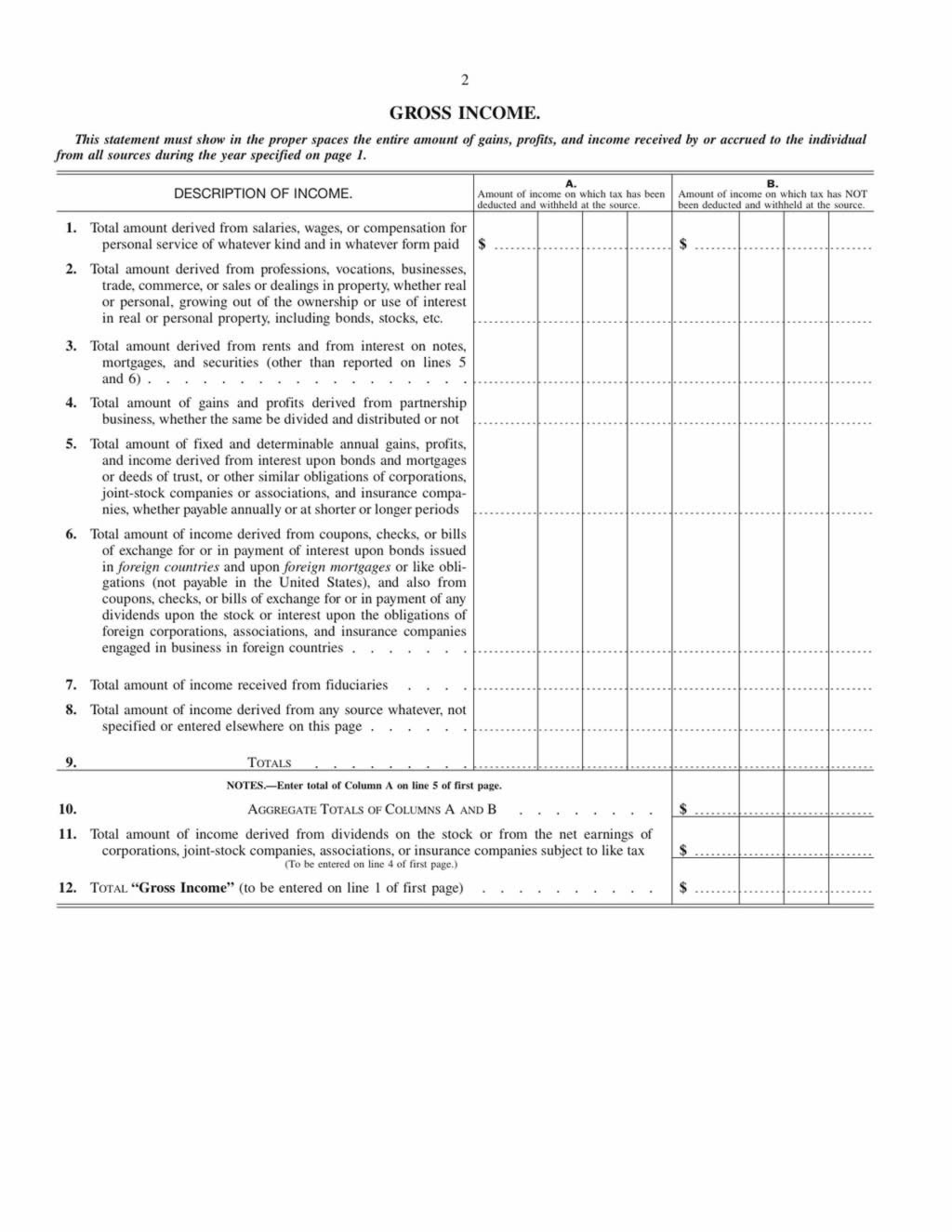

The 1913 Income Tax

http://www.zeugmaweb.net/histdocs/images/1040-1913-p2.jpg

https://tax2win.in/guide/section-80dd

Verkko 23 marrask 2023 nbsp 0183 32 Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

https://learn.quicko.com/section-80dd-deduction-for-differently-abled...

Verkko 3 helmik 2023 nbsp 0183 32 Last updated on February 3rd 2023 Section 80DD of income tax act provides tax deductions to resident individuals or HUFs for any expenses incurred on the medical treatment of differently abled dependents This income tax deduction can be claimed at the time of filing ITR under Chapter VI A INDEX

Income Tax 80DD 75000 125000

Disability Deduction In ITR I Sec 80U And 80DD Deduction Of Income Tax

What Is Section 80DDB Of Income Tax Act Completely Explained

Income Tax Exemption U s 80DD Medical Treatment Of Dependent

Claim Deduction Under Section 80DD Learn By Quicko

735 Income Tax Cut In Return For Capital Gains Tax Would Be hypocrisy

735 Income Tax Cut In Return For Capital Gains Tax Would Be hypocrisy

Income Tax Slab Rates 2022 23 Updated Tax2win

SECTION 80DD SECTION 80DD OF INCOME TAX ACT EXPLAINED IN HINDI

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

What Is 80dd In Income Tax - Verkko 18 helmik 2023 nbsp 0183 32 What is Section 80DD Section 80DD of the Income Tax Act provides for tax relief to taxpayers who have dependent family members with a disability A dependent family member can be a spouse children parents or siblings The disability can be physical or mental and the extent of disability should be at least 40