What Is The Maximum Tax Deduction For Charitable Donations Web 26 M 228 rz 2021 nbsp 0183 32 The maximum amount that can be deducted is 1 650 euros for single people or 3 300 for married couples that are assessed together For example if you donate 1 650 euros to a political party you can pay 825 euros less in tax burdens

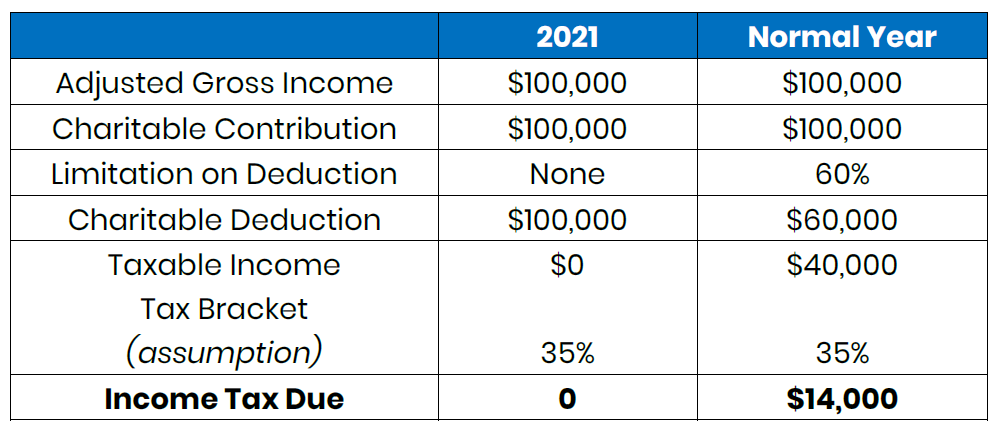

Web Vor 3 Tagen nbsp 0183 32 Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60 of a taxpayer s adjusted gross income AGI Key Takeaways For a Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t itemize Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people file

What Is The Maximum Tax Deduction For Charitable Donations

What Is The Maximum Tax Deduction For Charitable Donations

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Tax Deductions For Charitable Donations

https://www.thebalanceai.com/thmb/Iv3JmDfVlOYV3g14ZuockNA4g9o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif

Tips To Get The Best Tax Deduction On Donated Items Tax Deductions

https://i.pinimg.com/originals/9c/81/07/9c810783419aeff645459e4e51010ce8.jpg

Web 27 Nov 2023 nbsp 0183 32 Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for appreciated assets in 2023 and 2024 including stock is 30 of your AGI Contributions must be made to a qualified organization Web 21 Nov 2023 nbsp 0183 32 Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are limited to 60 of the taxpayer

Web 2 Jan 2024 nbsp 0183 32 In practical terms at a minimum you will be able to deduct 20 of your AGI At a maximum you will be able to deduct 60 If your donation totals less than 20 of your AGI the case for the overwhelming majority of people then don t worry about all of the details Deduct and move on Web 15 Dez 2022 nbsp 0183 32 For the 2022 tax year the standard deduction is 12 950 for single filers and 25 900 for married couples filing jointly and in 2023 that will increase to 13 850 for individuals and 27 700

Download What Is The Maximum Tax Deduction For Charitable Donations

More picture related to What Is The Maximum Tax Deduction For Charitable Donations

2021 Giving Tax Incentives Judi s House

https://judishouse.org/wp-content/uploads/2021/11/Charitable-Giving-Incentives-2021-Table.png

The IRS Encourages Taxpayers To Consider Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

How To Maximize Your Tax Deduction For Charitable Donations

https://image.cnbcfm.com/api/v1/image/106804360-1606840553278-gettyimages-1229889905-SALVATION_ARMY_KETTLE.jpeg?v=1671804002&w=1920&h=1080

Web 15 Nov 2023 nbsp 0183 32 Typically you can deduct up to 60 of your Adjusted Gross Income AGI for cash donations to public charities and certain private foundations Other limits may apply depending on the type of organization and the nature of Web 17 Sept 2021 nbsp 0183 32 The maximum deduction is increased to 600 for married individuals filing joint returns Cash contributions to most charitable organizations qualify However cash contributions made either to supporting organizations or to establish or maintain a donor advised fund do not qualify

Web 14 Dez 2020 nbsp 0183 32 Following tax law changes cash donations of up to 300 made this year by December 31 2020 are now deductible without having to itemize when people file their taxes in 2021 The Coronavirus Aid Relief and Economic Security Act includes several temporary tax law changes to help charities Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

12 Tax Smart Charitable Giving Tips For 2023 Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/IE_0523_Tax-Smart Charitable Giving Tips_chart_deductions_bunching.jpg

https://germantaxes.de/tax-tips/deduct-donations-from-taxes

Web 26 M 228 rz 2021 nbsp 0183 32 The maximum amount that can be deducted is 1 650 euros for single people or 3 300 for married couples that are assessed together For example if you donate 1 650 euros to a political party you can pay 825 euros less in tax burdens

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif?w=186)

https://www.investopedia.com/articles/personal-finance/041315/tips...

Web Vor 3 Tagen nbsp 0183 32 Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60 of a taxpayer s adjusted gross income AGI Key Takeaways For a

How Anyone Can Get A 2021 Tax Deduction Charitable Donations

Mortgage Interest Tax Relief Calculator DermotHilary

Get 300 Tax Deduction For Cash Donations In 2020 2021

Recognize The Tax Deduction Strategy For Charitable Donations Can The

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

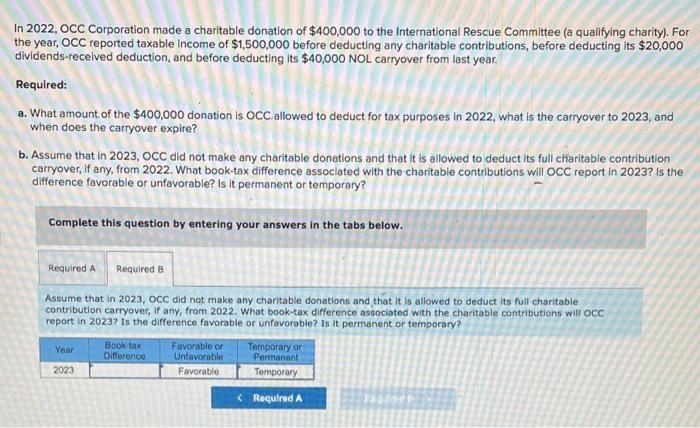

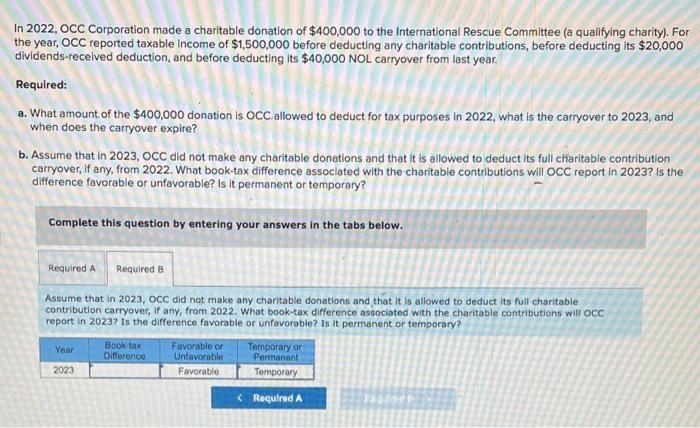

Solved In 2022 OCC Corporation Made A Charitable Donation Chegg

Solved In 2022 OCC Corporation Made A Charitable Donation Chegg

Charitable Donations Tax Deduction Limit 2021

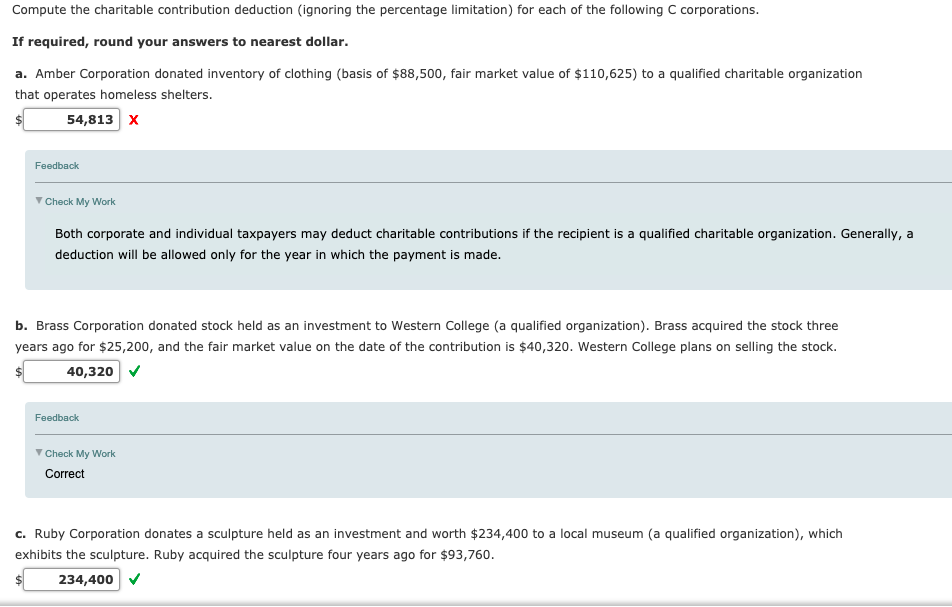

Solved Compute The Charitable Contribution Deduction Chegg

Guide To Tax Deduction For Charitable Donations Backpacks USA

What Is The Maximum Tax Deduction For Charitable Donations - Web 22 Sept 2021 nbsp 0183 32 Standard deduction amounts In a normal tax year the 60 percent donations cap would apply to most cash contributions regardless of the donor s AGI but lower limits would apply to other types