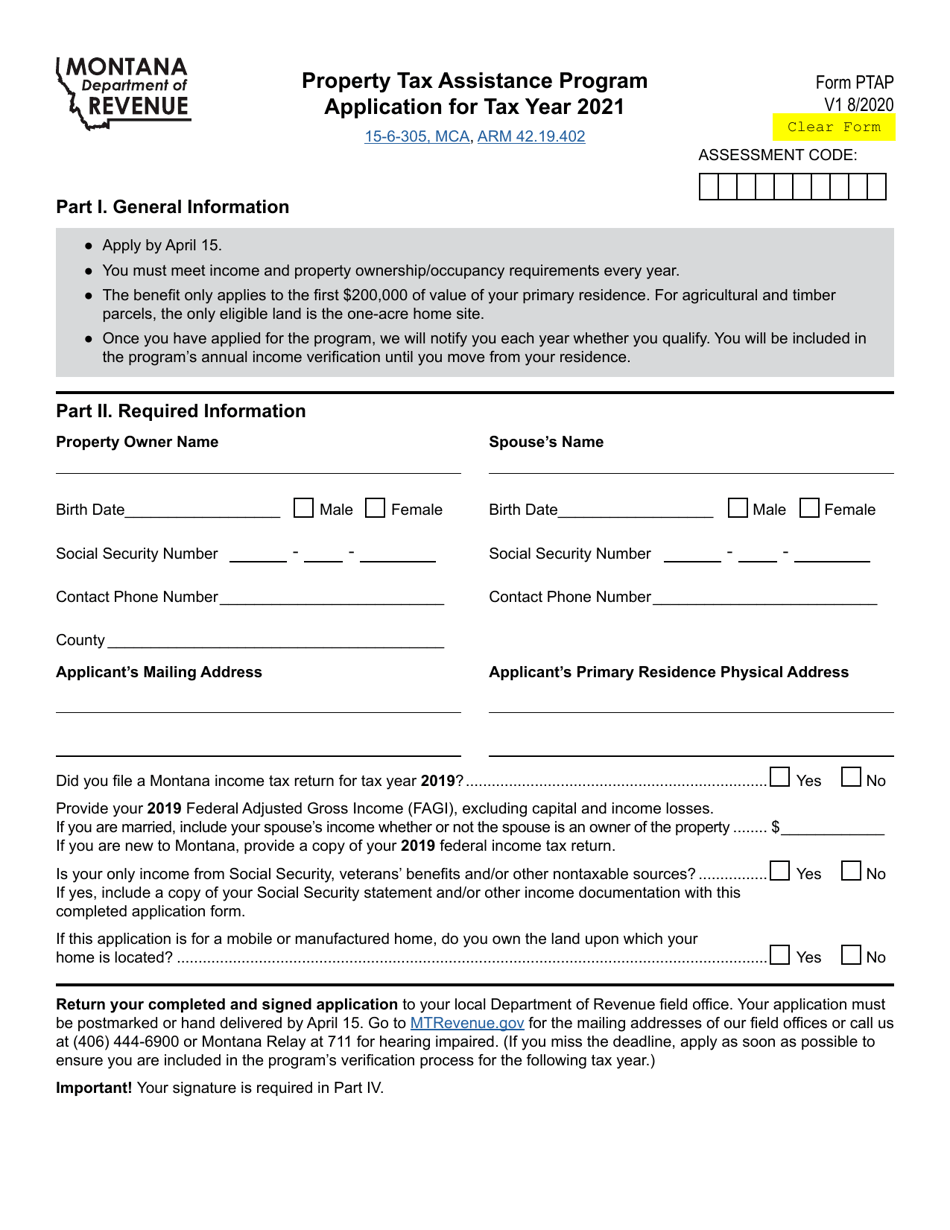

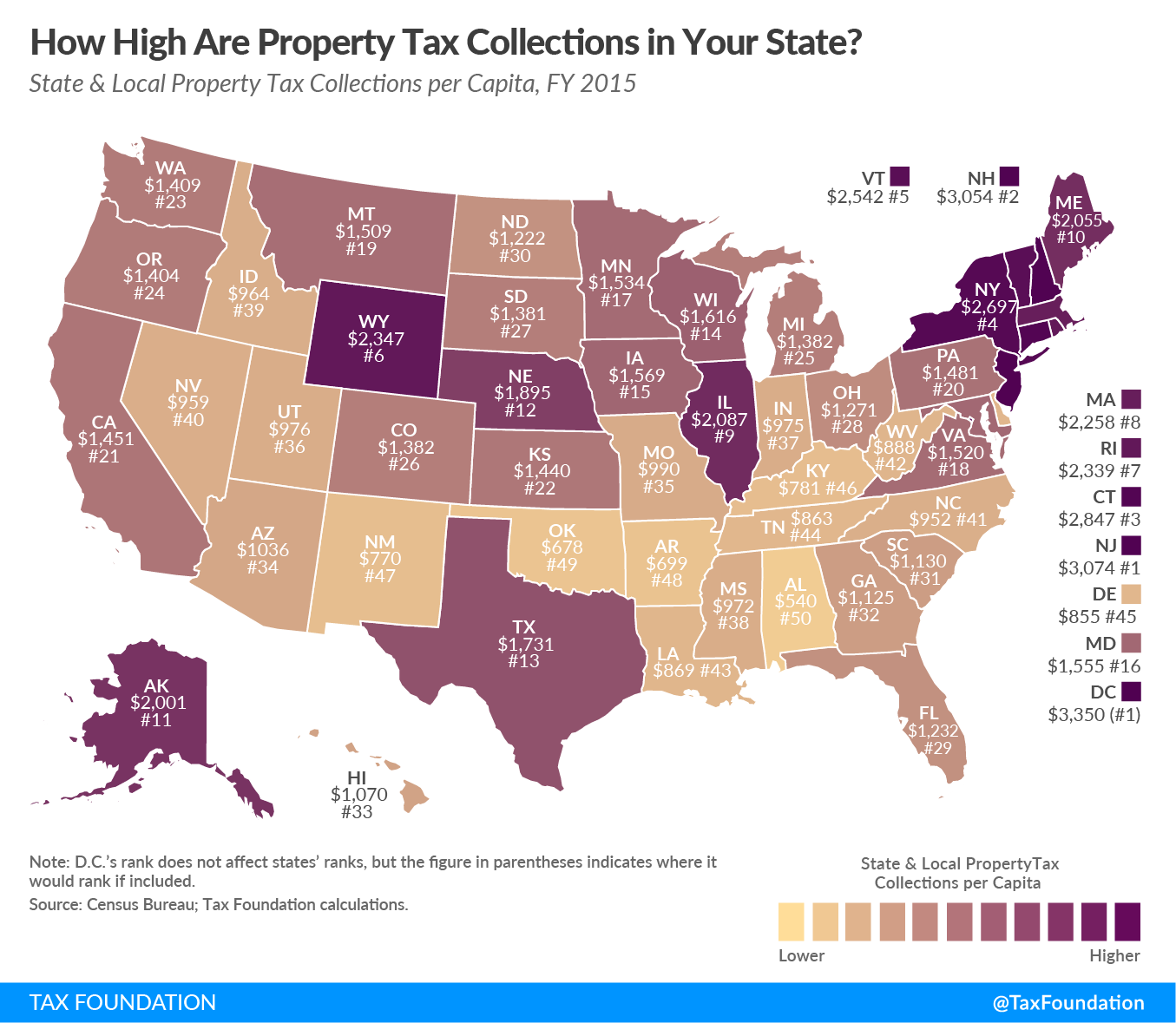

What Is The Property Tax Assistance Program In Montana Homeowners may qualify for the Property Tax Assistance Program PTAP Eligibility for this program is based on home ownership occupancy requirements and income qualifications

Low income Montanans seeking help paying their property tax bills now have until June 1 to apply for aid through two state relief programs intended to keep property tax bills from forcing low income homeowners out of their homes The Property Tax Assistance Program PTAP is a program designed to provide relief for Montana residents who are on a fixed income by reducing their property tax rate on their principal residence Refer to our website here for more information regarding the PTAP program

What Is The Property Tax Assistance Program In Montana

What Is The Property Tax Assistance Program In Montana

https://data.templateroller.com/pdf_docs_html/2091/20919/2091992/form-ptap-property-tax-assistance-program-application-montana_print_big.png

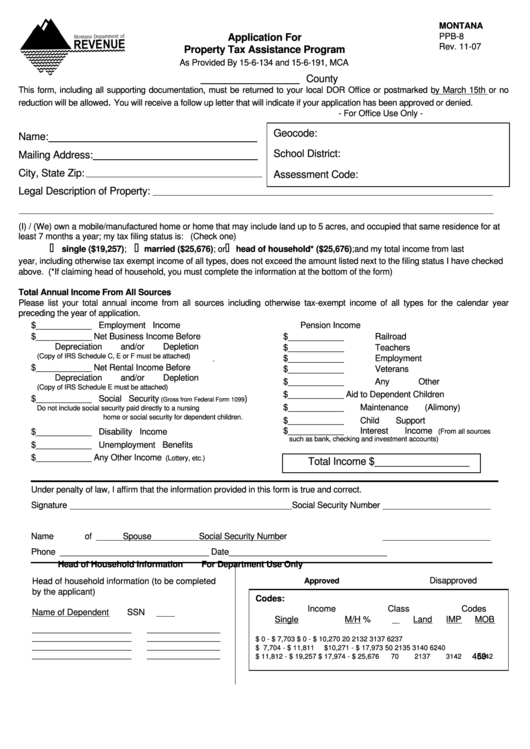

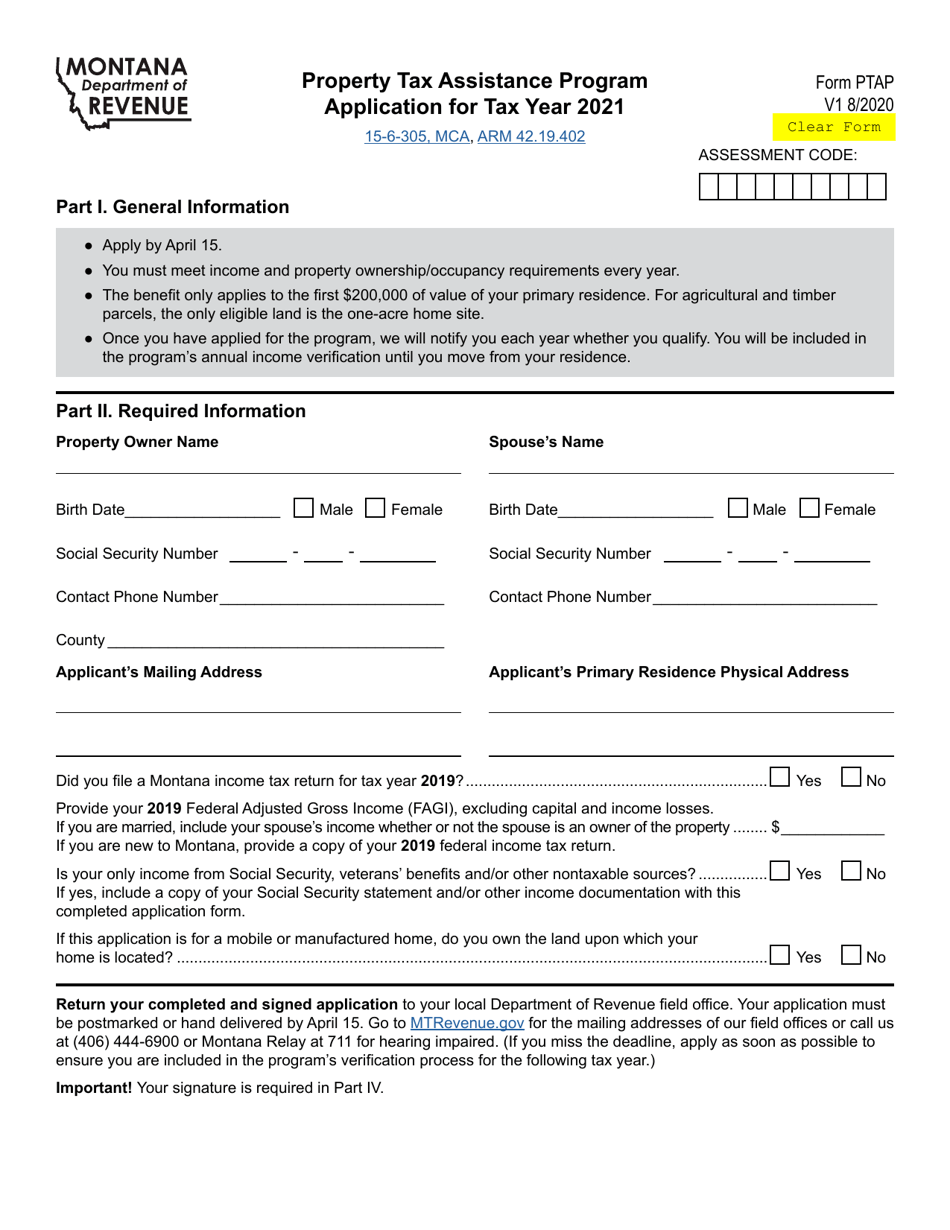

Ppb 8 Application For Property Tax Assistance Program Form Montana

https://data.formsbank.com/pdf_docs_html/176/1762/176258/page_1_thumb_big.png

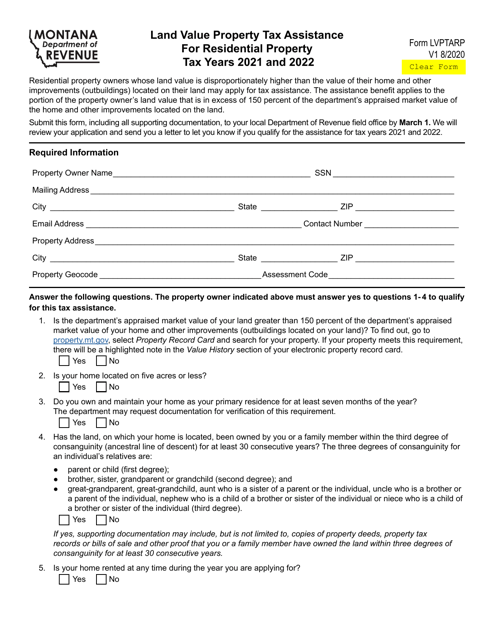

Form LVPTARP Download Fillable PDF Or Fill Online Land Value Property

https://data.templateroller.com/pdf_docs_html/2091/20919/2091990/form-lvptarp-land-value-property-tax-assistance-for-residential-property-montana_big.png

Property Tax Assistance Programs Low income Montanans Learn more about the Property Tax Assistance Program PTAP Disabled veterans or their surviving spouse Learn more about the Montana Disabled Veteran Assistance Program MDV The Property Tax Assistance Program helps citizens on a fixed or limited income by reducing the property tax rate on their home The PTAP benefit only applies to the first 350 000 of your primary residence s market value Your income and marriage status determine the reduction

Low income Montanans seeking help paying their property tax bills now have until June 1 to apply for aid through two state relief programs administered by the Montana Department of Revenue The state also provides two property tax programs that directly reduce property taxes for certain households The first the Property Tax Assistance Program PTAP reduces residential property taxes for households with low incomes

Download What Is The Property Tax Assistance Program In Montana

More picture related to What Is The Property Tax Assistance Program In Montana

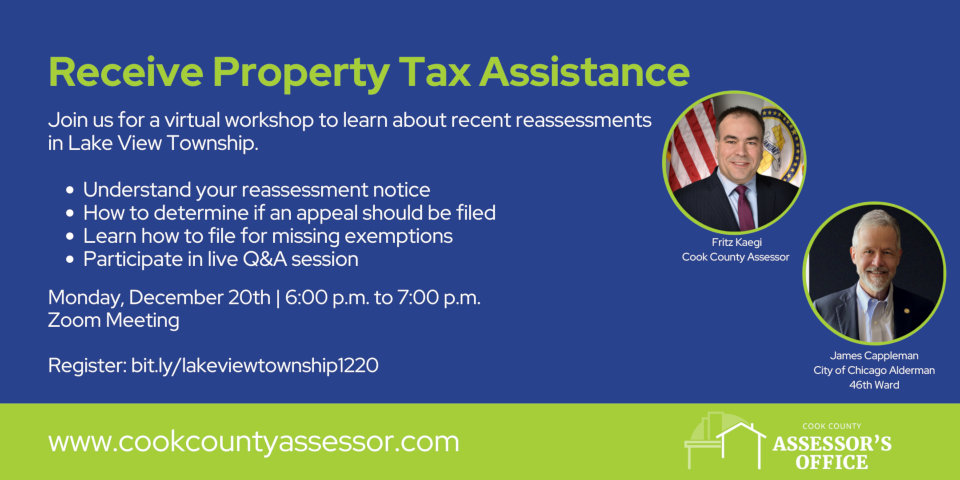

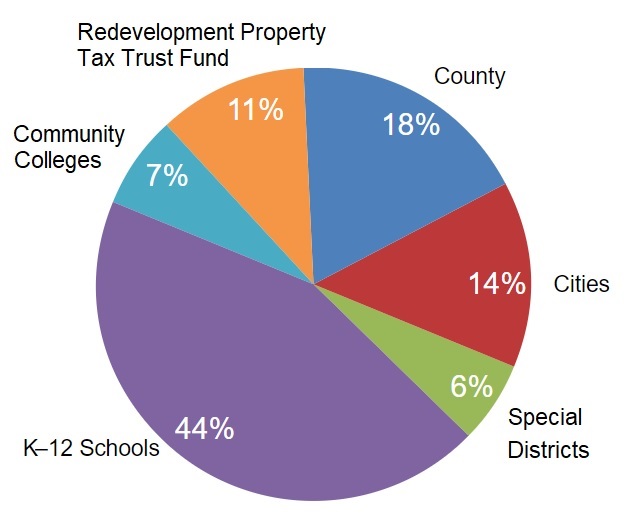

Receive Property Tax Assistance Lake View Citizens Council

https://www.lakeviewcitizens.org/wp-content/uploads/2021/12/image.png

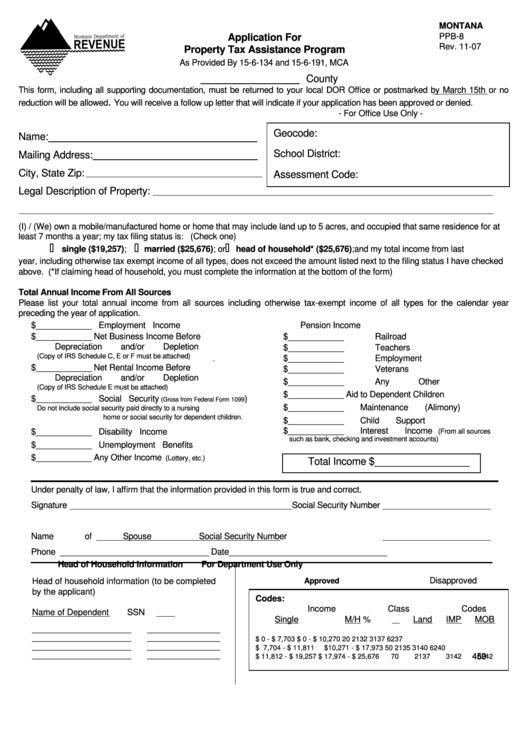

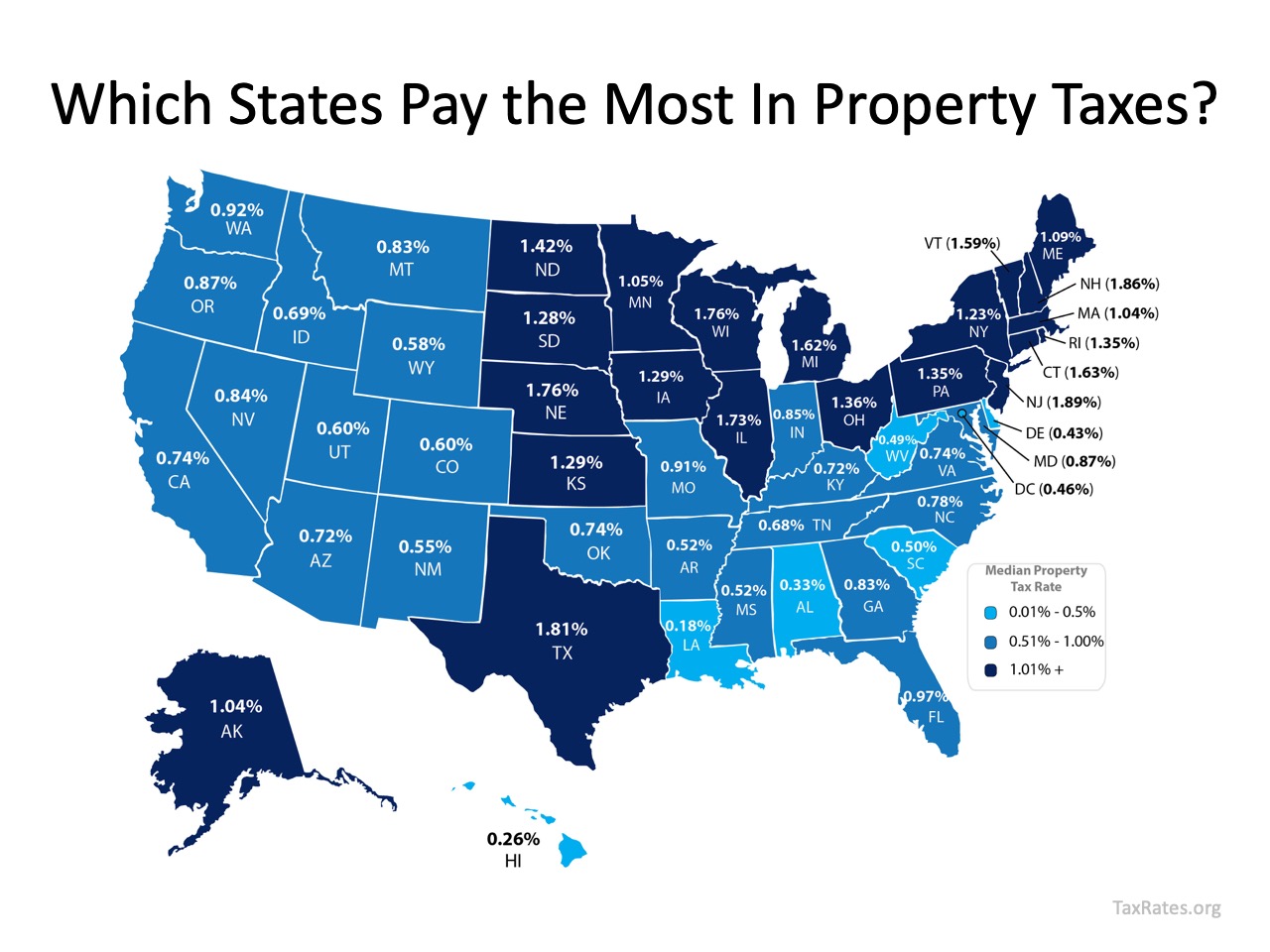

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

How High Are Property Tax Collections In Your State Tax Foundation

https://files.taxfoundation.org/20180511093121/PropTaxesPerCap-01.png

Property Tax Assistance Program PTAP You are eligible for PTAP if you meet the following criteria Own or currently be under a contract to purchase a home or mobile manufactured home Property tax assistance programs in Montana include three programs administered through the property tax system and one income tax credit All are targeted at people who reside in Montana for more than half of the year

The state also provides two property tax programs that directly reduce property taxes for certain households The first the Property Tax Assistance Program PTAP reduces residential property taxes for households with lower incomes The taxpayer must live in their home for at least seven months out of the You may use this form to apply for the Property Tax Assistance Program PTAP If you are already approved for the Property Tax Assistance Program you will not need to apply again For more information and to see if you qualify

Property Tax Assistance Programs Nevada County CA

https://nevadacountyca.gov/ImageRepository/Document?documentId=44275

Homeowners Property Tax Assistance Program HPTAP City Of Detroit

https://detroitmi.gov/sites/detroitmi.localhost/files/2021-05/P-GeneralFlier-HPTAP-Counselling-Network-V8_5-11-2021-1.jpg

https://mtrevenue.gov/property-tax-relief-programs...

Homeowners may qualify for the Property Tax Assistance Program PTAP Eligibility for this program is based on home ownership occupancy requirements and income qualifications

https://montanafreepress.org/2024/04/16/...

Low income Montanans seeking help paying their property tax bills now have until June 1 to apply for aid through two state relief programs intended to keep property tax bills from forcing low income homeowners out of their homes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Assistance Programs Nevada County CA

How Property Taxes Can Impact Your Mortgage Payment

What Is Property Tax Property Tax What Is Property Tax

Resources For Property Tax Assistance CLEARCorps Detroit

Miscellaneous Tax Forms Archives Montana Department Of Revenue

Miscellaneous Tax Forms Archives Montana Department Of Revenue

About Your Property Tax Statement Anoka County MN Official Website

Property Tax Assistance Program Florida Linh Schumacher

What The City Is Doing To Manage Property Tax Levels News City Of

What Is The Property Tax Assistance Program In Montana - Property Tax Assistance Programs Low income Montanans Learn more about the Property Tax Assistance Program PTAP Disabled veterans or their surviving spouse Learn more about the Montana Disabled Veteran Assistance Program MDV