What Is The Property Tax Rate In Harris County Texas 2023 Calculate how much you can expect to pay in property taxes on your home in Harris County Texas Compare your rate to the state and national average

What s new in 2025 legislative changes effecting Harris County resident The county is providing this table of property tax rate information as a service to the residents of the county Officials with the Harris County Office of Management and Budget have proposed a total property tax rate of 0 52664 per 100 valuation a 0 74 decrease from the previous year s rate of

What Is The Property Tax Rate In Harris County Texas 2023

What Is The Property Tax Rate In Harris County Texas 2023

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

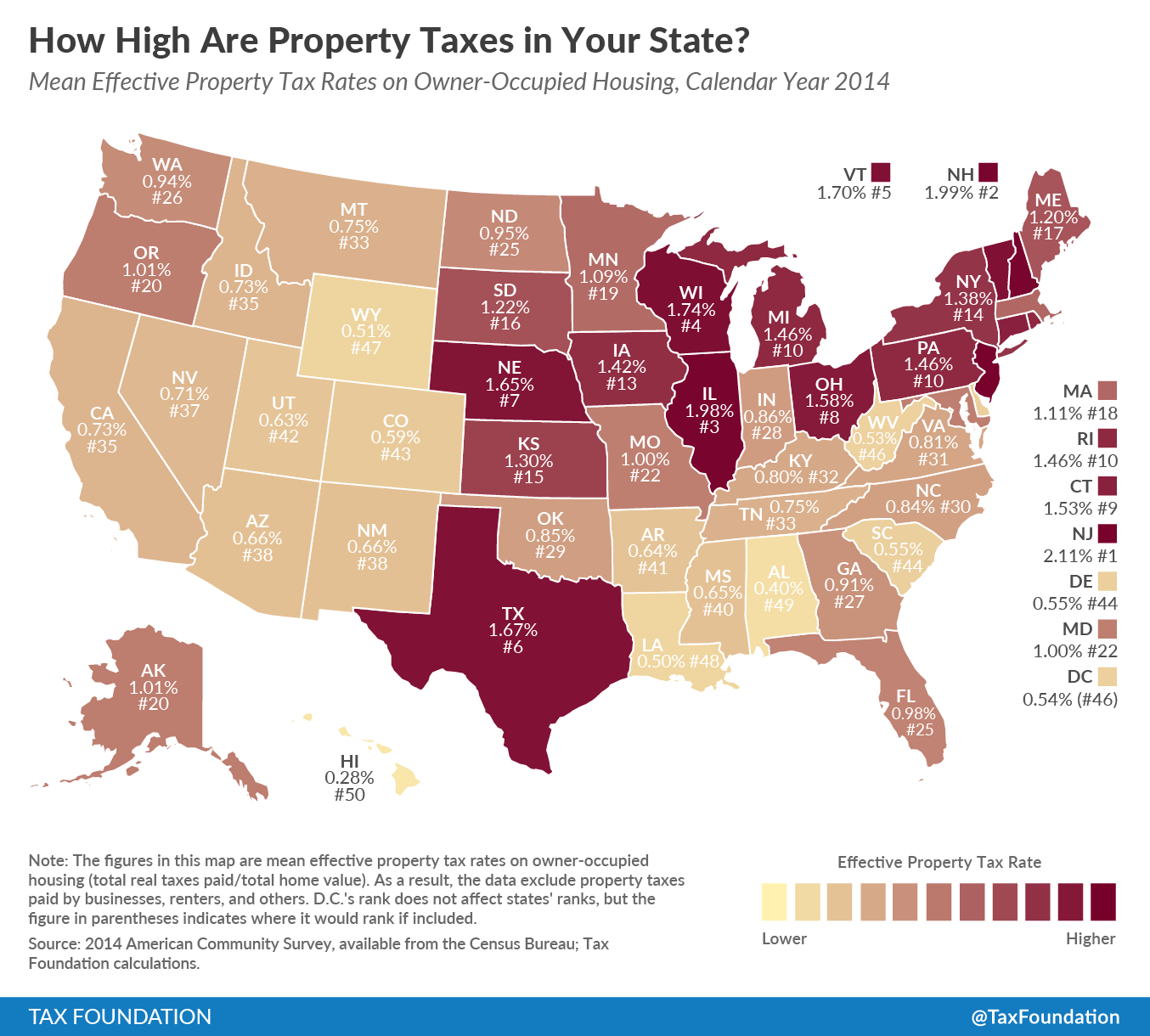

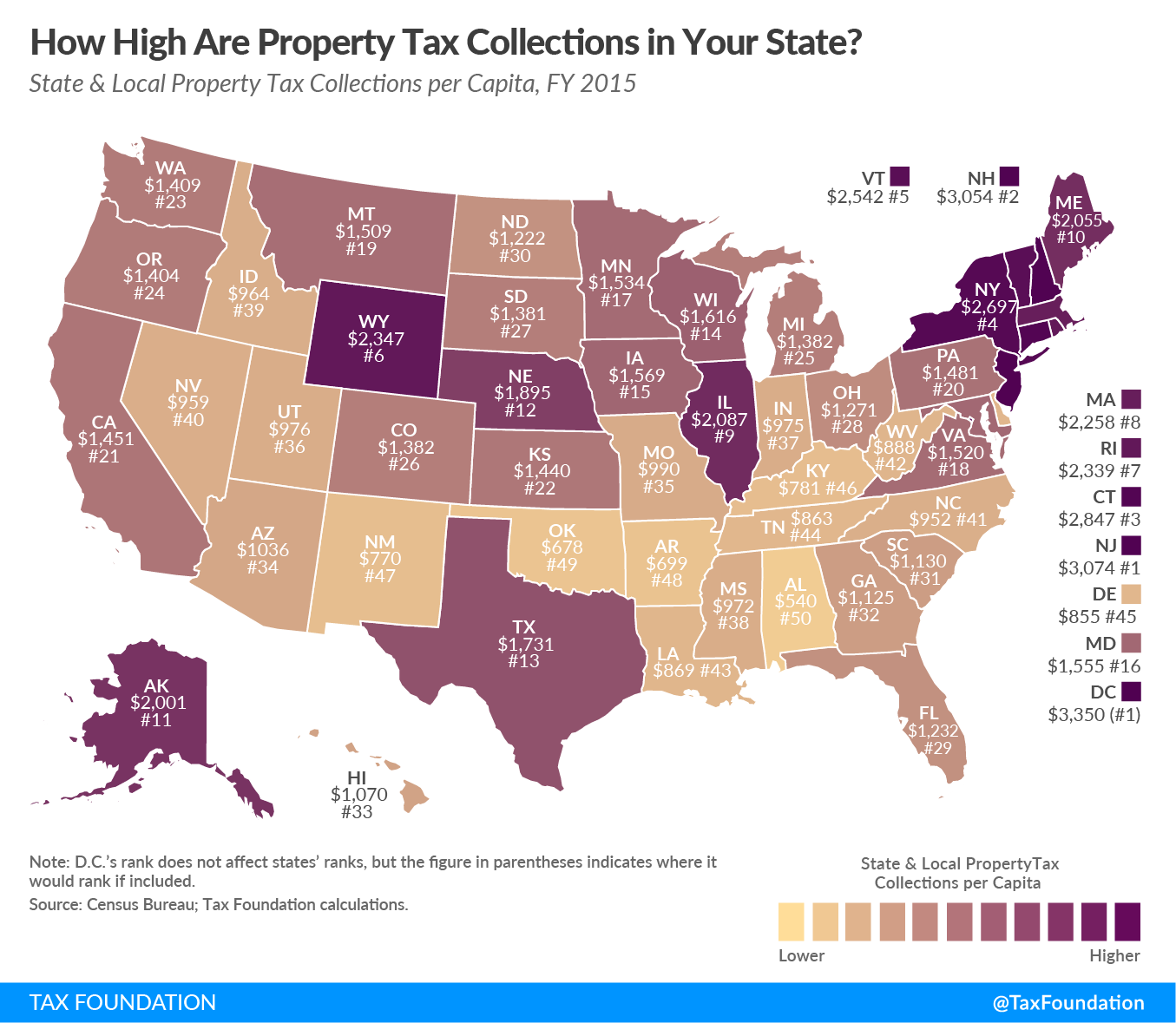

How High Are Property Taxes In Your State 2016 Tax Foundation

https://files.taxfoundation.org/20170113143210/Property-01.png

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

Harris County s overall property tax rate is composed of four rates the county the Harris County Flood Control District the Port of Houston and the Harris Health hospital district Together the four jurisdictions levies totaled The report provides tax rate and value information for tax years 2022 and 2023 We are committed to assisting taxpayers appraisal districts appraisal review boards tax assessor

The average effective property tax rate in Harris County is 1 77 significantly higher than the national average That average rate incorporates all types of taxes including school district taxes city taxes and special district levies Visit Texas gov PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes including information about proposed

Download What Is The Property Tax Rate In Harris County Texas 2023

More picture related to What Is The Property Tax Rate In Harris County Texas 2023

How Much Does Your State Collect In Property Taxes Per Capita

https://files.taxfoundation.org/20200311095830/Property-per-capita-2020-dv1-01-e1583935117243.png

Property Taxes By State County Median Property Tax Bills

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

Property Taxes Department Of Tax And Collections County Of Santa Clara

https://dtac.sccgov.org/sites/g/files/exjcpb271/files/2023-01/FY22-23.jpg

The median property tax also known as real estate tax in Harris County is 3 040 00 per year based on a median home value of 131 700 00 and a median effective property tax rate of 2 31 of property value The no new revenue tax rate is the tax rate for the 2023 tax year that will raise the same amount of property tax revenue for Harris County from the same properties in both the

The current tax rate for fiscal year FY 2024 which began on Oct 1 2023 and ends Sept 30 2024 is 0 35 35007 per 100 of a property s appraisal value Harris County 1 77 has a 8 6 higher Property Tax Rate than the average of Texas 1 63 Harris County is rank 16th out of 254 counties This means the Property Tax Rate are higher

Cahnman s Musings TXLEGE On Property Taxes Several Good Proposals

https://i.pinimg.com/originals/c0/57/21/c05721beb40e3356cb39c9940146a9e8.png

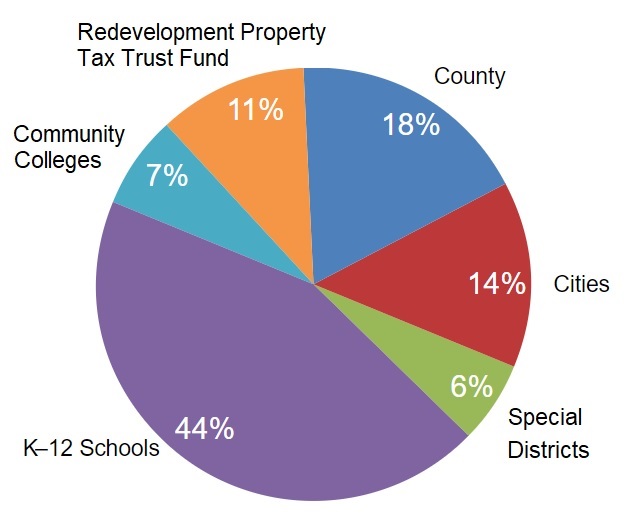

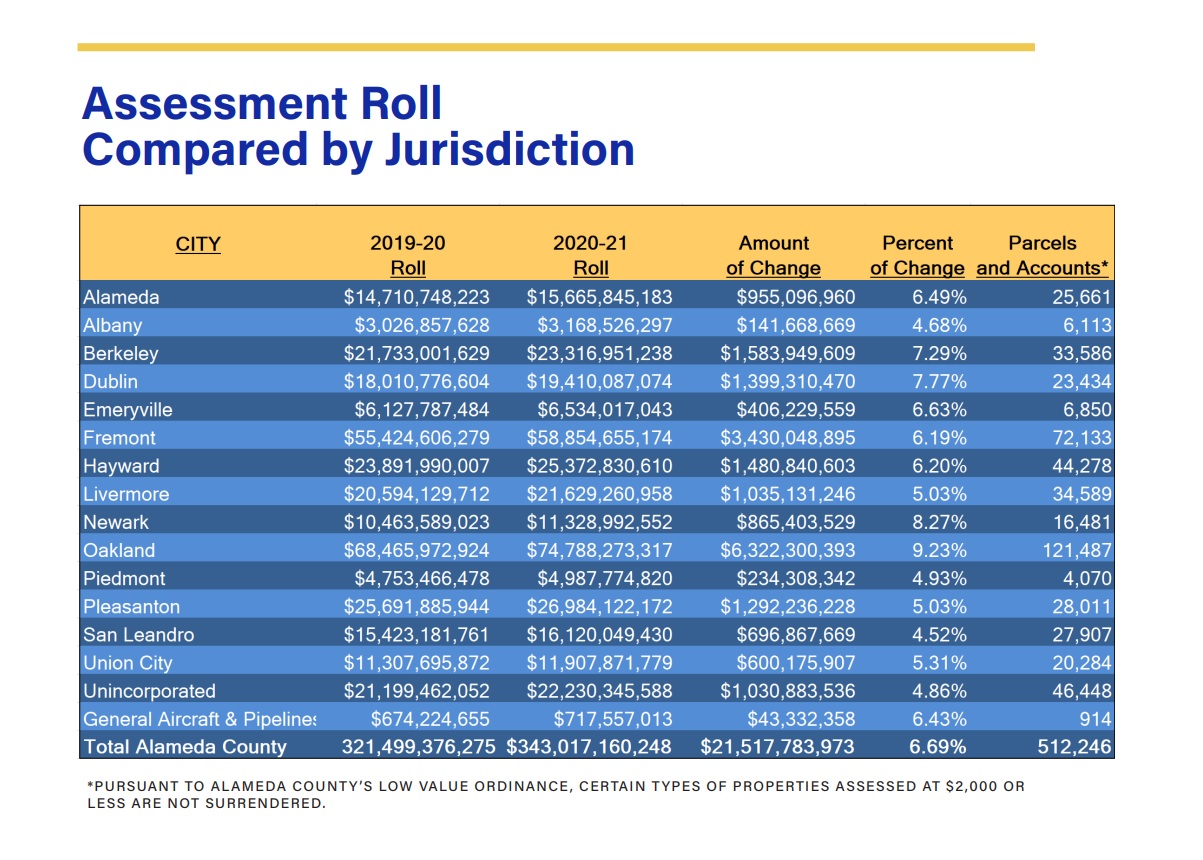

Alameda County Property Tax 2023 Ultimate Guide To Alameda County

https://bekinsmovingservices.com/wp-content/uploads/2022/05/Alameda-County-Tax-Assessment-Roll.jpg

https://smartasset.com › taxes › harris-cou…

Calculate how much you can expect to pay in property taxes on your home in Harris County Texas Compare your rate to the state and national average

https://www.hctax.net › property › TaxRates.cshtml

What s new in 2025 legislative changes effecting Harris County resident The county is providing this table of property tax rate information as a service to the residents of the county

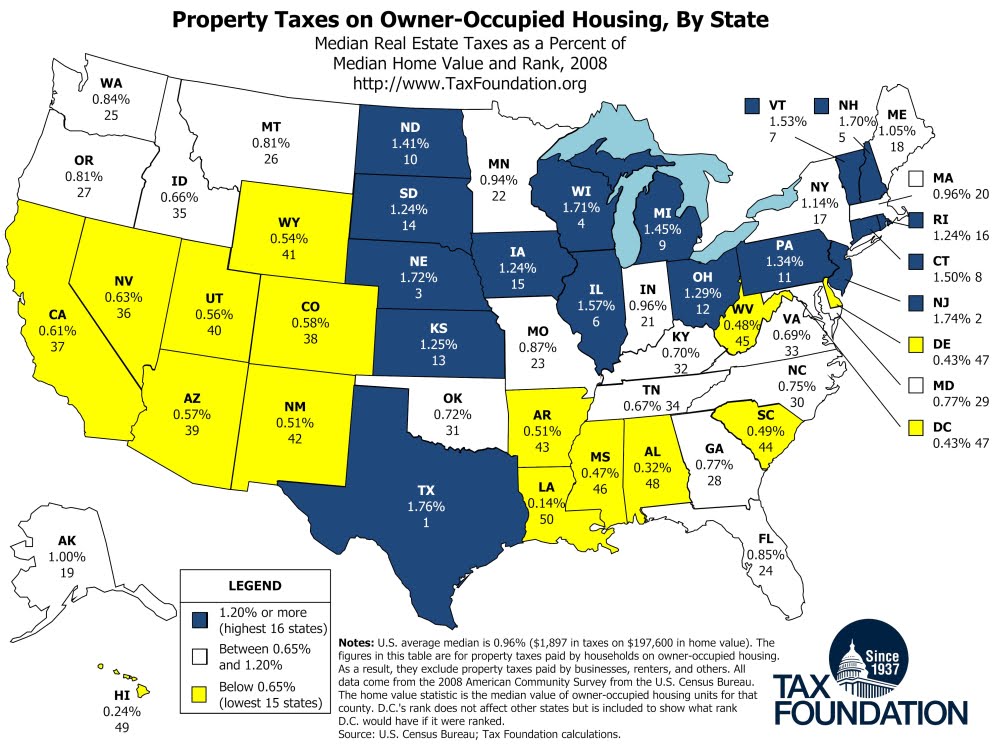

State Property Taxes Reliance On Property Taxes By State

Cahnman s Musings TXLEGE On Property Taxes Several Good Proposals

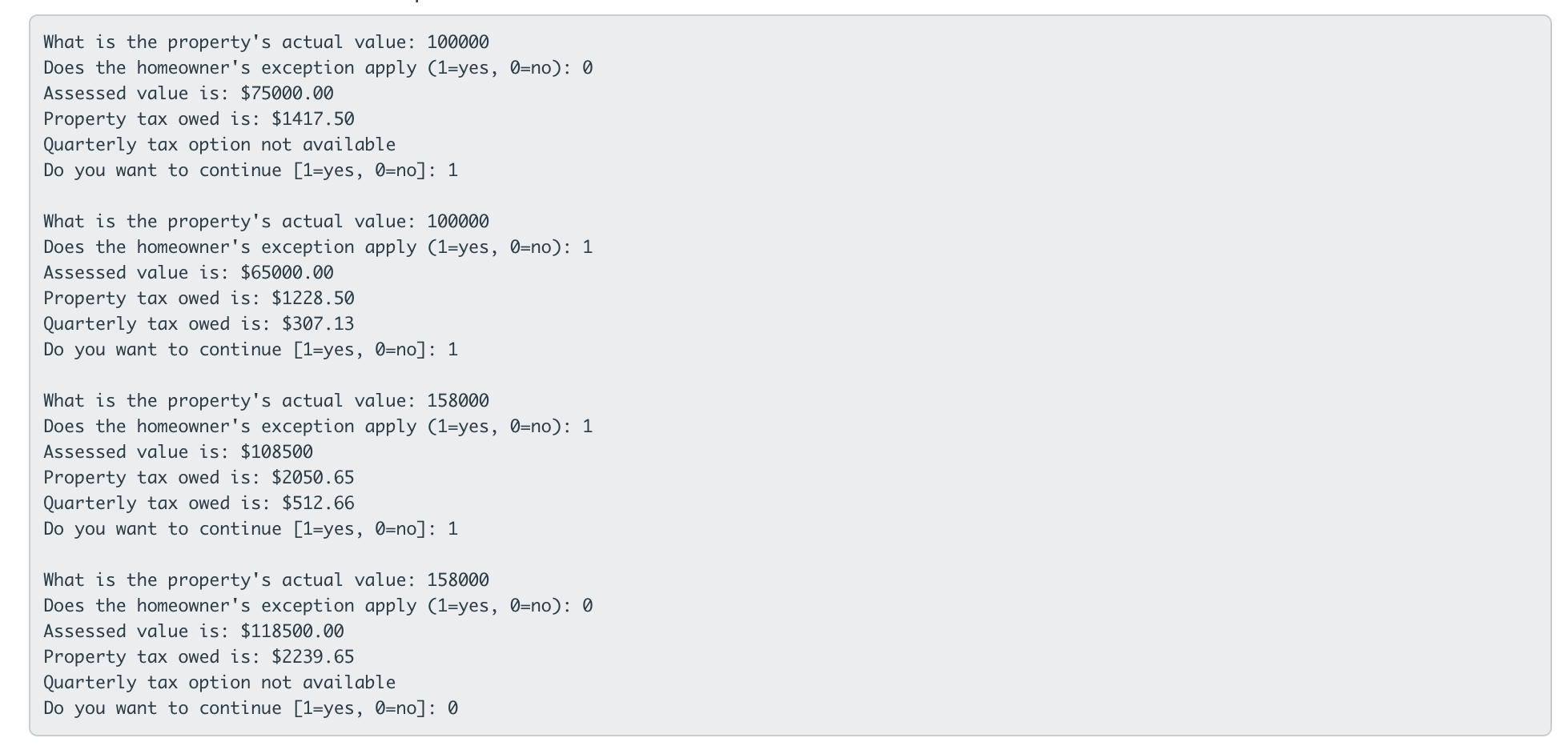

Solved Project 1 Property Tax Calculator Suppose A County Chegg

How Much Are You Paying In Property Taxes Real Estate Investing Today

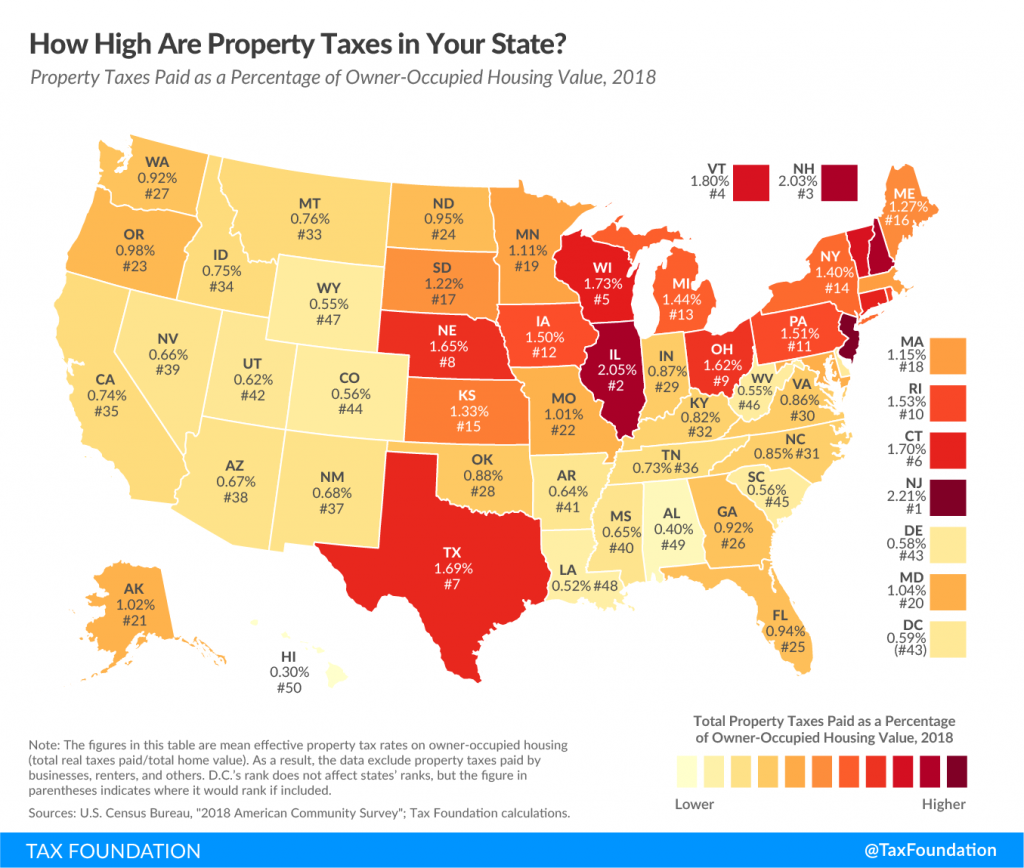

How High Are Property Tax Collections In Your State Tax Foundation

How Much Is Ohios Sales Tax Tax Walls

How Much Is Ohios Sales Tax Tax Walls

Decatur Tax Blog Georgia s Median Property Tax Rate

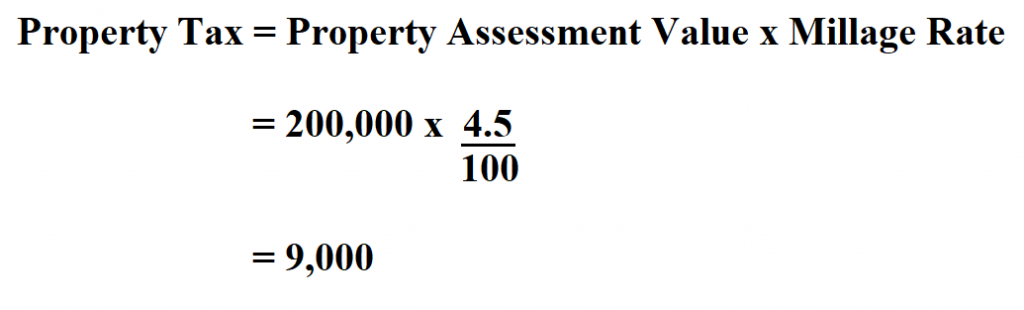

How To Calculate Property Tax

Property Tax Installment Payment Plan TIPP Walden Legacy Homes

What Is The Property Tax Rate In Harris County Texas 2023 - Harris County s overall property tax rate is composed of four rates the county the Harris County Flood Control District the Port of Houston and the Harris Health hospital district Together the four jurisdictions levies totaled