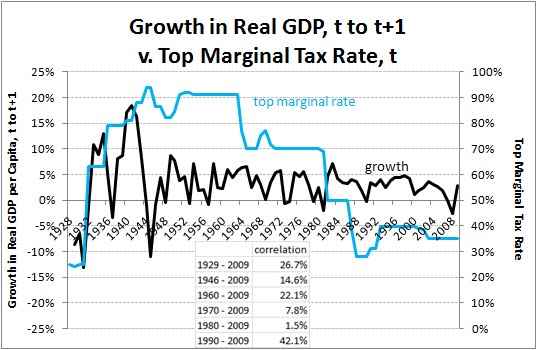

What Is The Relationship Between Tax And Revenue In economics the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government s tax revenue The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0 and 100 meaning that there is a tax rate between 0 and 100 that maximizes government tax revenue

The Laffer Curve is a theoretical explanation of the relationship between tax rates set by a government and the tax revenue collected at that tax rate It was introduced by American supply side economist Arthur Laffer The Laffer Curve illustrates the relationship between tax rates and tax revenue It posits that there is an optimal tax rate that maximizes revenue without discouraging productivity and economic activity

What Is The Relationship Between Tax And Revenue

What Is The Relationship Between Tax And Revenue

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

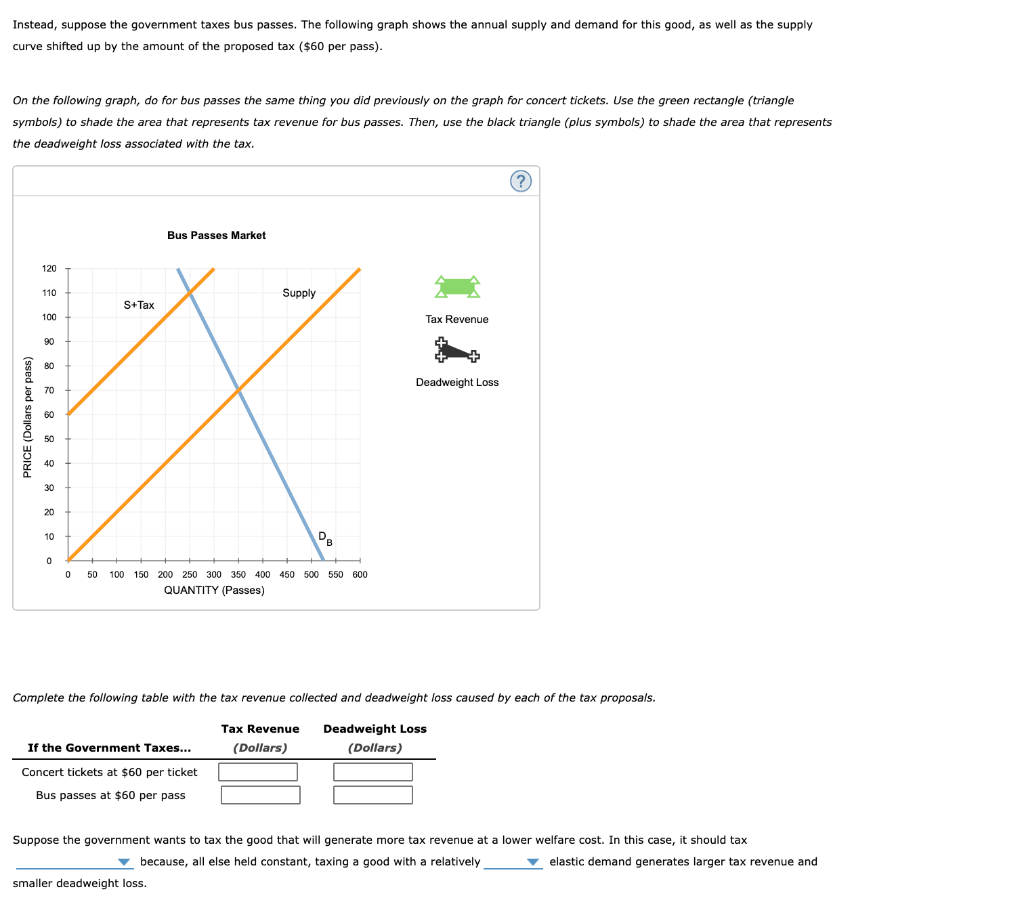

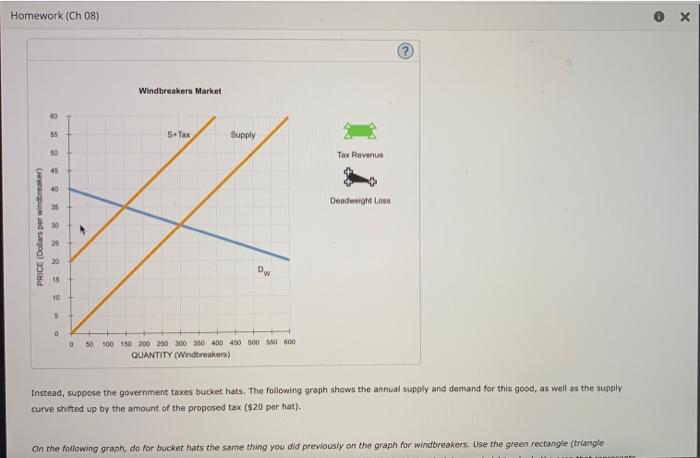

Solved Relationship Between Tax Revenues Deadweight Loss And

https://www.coursehero.com/qa/attachment/17129554/

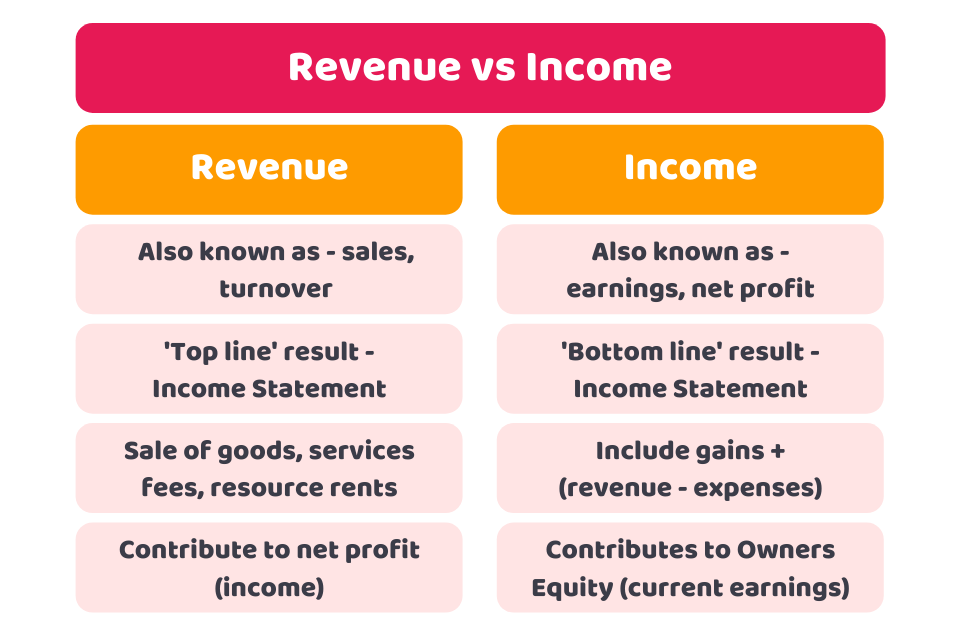

Difference Between Revenue And Income Cruseburke

https://cruseburke.co.uk/wp-content/uploads/2022/01/Revenue-vs-Income.png

The Laffer Curve is a tax theory suggesting an inverted U shaped relationship between tax rates and the amount of tax revenue collected by governments The ideal or optimal rate of taxation In this study we investigated the relationship between tax revenue trade openness and economic growth in developing countries by using the data of 29 developing countries during the period 2000 2020

This series of charts by Antony Davies illustrates the relationship between tax rates and tax revenues As Congress and the administration debate the need for tax increases in the debt deal The results can be summarized as follows a There was a bidirectional causality between economic growth and government expenditure b there was a unidirectional causality from tax revenue to

Download What Is The Relationship Between Tax And Revenue

More picture related to What Is The Relationship Between Tax And Revenue

Solved 3 Relationship Between Tax Revenues Deadweight Chegg

https://media.cheggcdn.com/media/a4b/a4b7cbfd-a8fd-45a5-ba32-823fb84f238b/phpXaUEsS

Solved Relationship Between Tax Revenues Deadweight Loss And

https://www.coursehero.com/qa/attachment/17137936/

How To Increase Tax Revenue Without Increasing Tax Rates B O S S

https://bossretirement.com/wp-content/uploads/2021/05/Tax.jpeg

Tax revenue is money collected by a government body from its constituents for public spending Taxes may be based on income property value or sales of goods and services In the U S federal The findings indicate that tax revenues as a share of GDP above the threshold level adversely affect economic growth whereas a tax revenue rate below the threshold positively affects growth

Placing a tax on a good shifts the supply curve to the left It leads to a fall in demand and higher price However the impact of a tax depends on the elasticity of demand If demand is inelastic a higher tax In this study the relationship between tax revenue government expenditure and economic growth has been examined for Canada France Germany Italy Japan UK and the USA the G7

The Relationship Between Taxes And Economic Growth Research Proposals

https://nerdyseal.com/wp-content/uploads/screenshots/129/129234/the-relationship-between-taxes-and-economic-growth-research-proposals-example-1.jpg

What Is Non Tax Revenue EXPLAINED All You Need To Know Budget

https://i.ytimg.com/vi/Xk3Tdq8u3V8/maxresdefault.jpg

https://en.wikipedia.org/wiki/Laffer_curve

In economics the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government s tax revenue The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0 and 100 meaning that there is a tax rate between 0 and 100 that maximizes government tax revenue

https://corporatefinanceinstitute.com/res…

The Laffer Curve is a theoretical explanation of the relationship between tax rates set by a government and the tax revenue collected at that tax rate It was introduced by American supply side economist Arthur Laffer

Solved 3 Relationship Between Tax Revenues Deadweight Chegg

The Relationship Between Taxes And Economic Growth Research Proposals

Red State Blue City Tax Rates And Tax Revenue As A Percent Of GDP

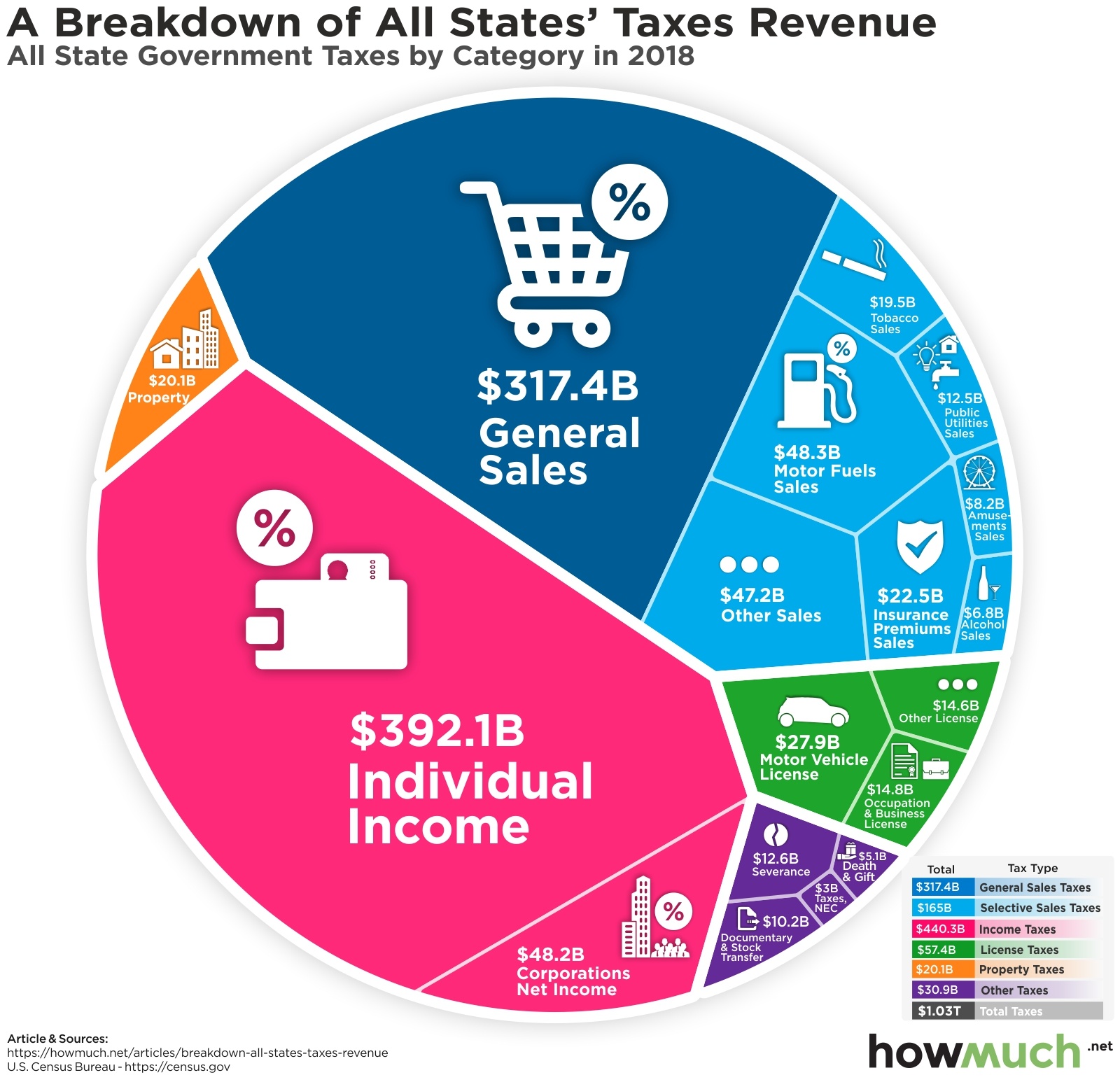

In One Chart State Tax Revenue By Source

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

2022 Tax Brackets PersiaKiylah

2022 Tax Brackets PersiaKiylah

6 FACT ABOUT TAX

Write Summary Of Different Revenue And Capital Receipts Expenditure

Hich Best Describes A Negative Income Tax

What Is The Relationship Between Tax And Revenue - Abstract Purpose Effective tax rates can have dual effect in the economic policy of a country by maintaining the state revenues in sustainable levels providing a safe net for the economic