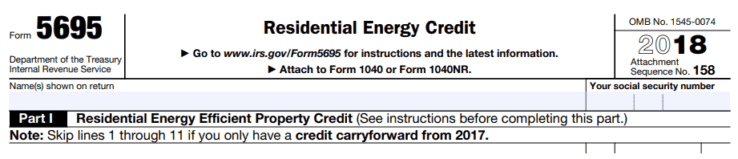

What Is The Residential Energy Credit Form 5695 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your

Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and How to claim the Energy Efficient Home Improvement Credit File Form 5695 Residential Energy Credits Part II with your tax return to claim the credit You must

What Is The Residential Energy Credit Form 5695

What Is The Residential Energy Credit Form 5695

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Heated Up How To Claim The 300 Stove Tax Credit

http://2.bp.blogspot.com/-ne9Y8DBs1Nw/VJnJ2asKmnI/AAAAAAAABSU/ywsCdeqMvxA/w1200-h630-p-k-no-nu/Home_Energy_Tax_Credit_IRS_Form_5695.png

BENNINGTON POOL HEARTH IRS FORM 5695 RESIDENTIAL ENERGY CREDITS

https://www.bpsh.com/wp-content/uploads/2013/03/irs5695-1024x329.jpg

Filling out IRS Form 5695 to claim residential energy credits involves a few key steps Calculate the total cost of any eligible solar electric solar water heating fuel cell small wind energy and The Residential Clean Energy Credit commonly known as the Solar Tax Credit is one of the biggest draws for homeowners turning to solar energy This

The residential energy efficient property credit best known as the residential energy credit and most commonly claimed by homeowners is claimed in Part You can claim tax credits for certain energy efficient home improvements Learn more about how to claim these credits on IRS Form 5695

Download What Is The Residential Energy Credit Form 5695

More picture related to What Is The Residential Energy Credit Form 5695

Form 5695 For 2023 Printable Forms Free Online

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_featured_image.png

IRS Form 5695 Residential Energy Credits Forms Docs 2023

https://blanker.org/files/images/f5695.png

Everything You Need To Know About The Federal Solar Tax Credit

https://ecotality.com/wp-content/uploads/residential-energy-credit-form-e1578427077215.png

You must have completed sections 1 through 18 on your standard 1040 Form to get started For this example we ll assume your tax liability equals 5 000 Now you ll need the instructions for Residential clean energy credit The residential energy efficient property credit has changed to the residential clean energy credit The credit rate for property placed in service in

The IRS offers two residential energy credits to tax payers the non business energy property credit and the residential energy efficient credit which must be claimed The residential energy credits are The energy efficient home improvement credit Also use Form 5695 to take any residential energy efficient property credit carryforward from

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

Form 5695 Residential Energy Credits Stock Photo Image Of 5695

https://thumbs.dreamstime.com/b/form-residential-energy-credits-form-residential-energy-credits-205250156.jpg

https://www.irs.gov › forms-pubs

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your

https://www.irs.gov › pub › irs-pdf

Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and

IRS Form 5695 Download Fillable PDF 2018 Residential Energy Credit

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

2012 Home Energy Tax Credits Are Back And Good For 2013 Red Hot

Residential Solar Energy Credit What You Need To Know For 2021 Taxes

Form 5695 YouTube

Form 5695 Instructions Information On Form 5695 Db excel

Form 5695 Instructions Information On Form 5695 Db excel

Nonbusiness Energy Credit Form

Form 5695 Fill Out Sign Online DocHub

How To Claim The Solar Tax Credit Using IRS Form 5695

What Is The Residential Energy Credit Form 5695 - The Residential Clean Energy Credit commonly known as the Solar Tax Credit is one of the biggest draws for homeowners turning to solar energy This