What Is The Senior Tax Credit In Colorado The PTC Rebate is available to Colorado residents base on income including people with disabilities and older adults to help with their property tax rent and or heat expenses

Income qualified seniors may claim a refundable housing tax credit on their 2022 and 2024 Colorado income tax returns Anyone who claims the Senior Property Tax Exemption does not Coloradoans over 65 can receive up to a 1000 Senior Income Tax Credit if they have less than 25 000 annual income Individuals earning up to 75 000 are also eligible for the Senior

What Is The Senior Tax Credit In Colorado

What Is The Senior Tax Credit In Colorado

http://driveelectricnoco.org/wp-content/uploads/2013/03/Vehicle-Model.png

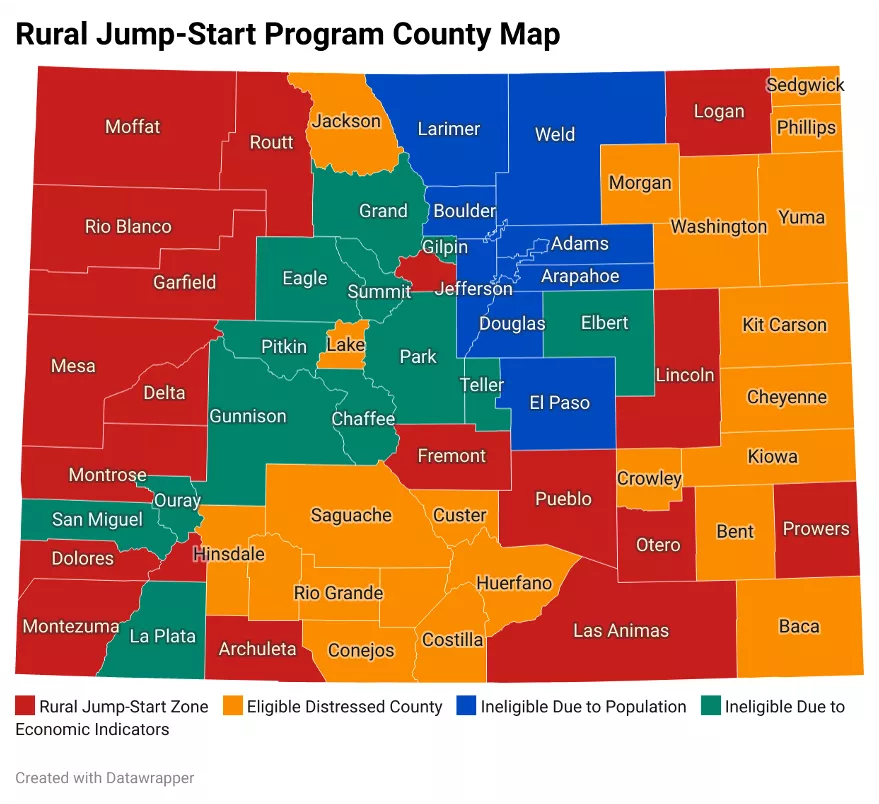

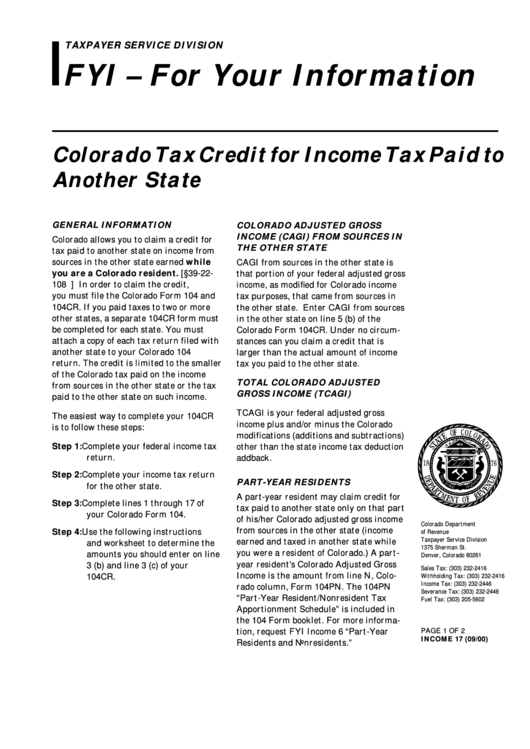

Colorado Tax Credit For Income Tax Paid To Another State Form 2000

https://data.formsbank.com/pdf_docs_html/218/2187/218742/page_1_thumb_big.png

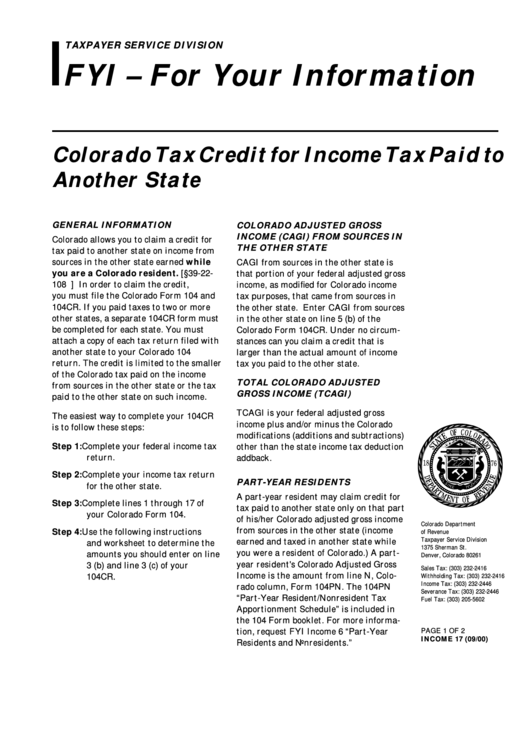

Rural Jump Start Grant And Tax Credit Colorado Office Of Economic

https://oedit.colorado.gov/sites/coedit/files/styles/basic_card_crop_is/public/08-2021/rural_jump-start_and_just_transition_counties_map.png

The act creates a refundable income tax credit credit that is available for the income tax year commencing on January 1 2022 for a qualifying senior which means a resident individual The credit is for a qualifying senior which means a resident individual who Is 65 years of age or older at the end of 2024 Has federal adjusted gross income AGI that is less than or equal to

If you re an older adult 65 or older and not participating in the Senior Property Tax Exemption Program you may qualify for the Income Qualified Senior Housing Income Tax Credit This A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income that is less than or equal to 65 000 adjusted for

Download What Is The Senior Tax Credit In Colorado

More picture related to What Is The Senior Tax Credit In Colorado

What Is The Senior Tax Credit Senior Finance Advisor

https://d2hbfxhchh2fc6.cloudfront.net/comfy/cms/files/files/000/000/522/original/what-is-the-senior-tax-credit

Property Tax Exemption For Senior Citizens In Colorado 2018 pdf

https://lh5.googleusercontent.com/W5C6Ewd_6p_ReUZir5GXOraa7CEN2r9sAywhWq9-9bHLOkMG2zyIRUrwYckLUjmFR20=w1200-h630-p

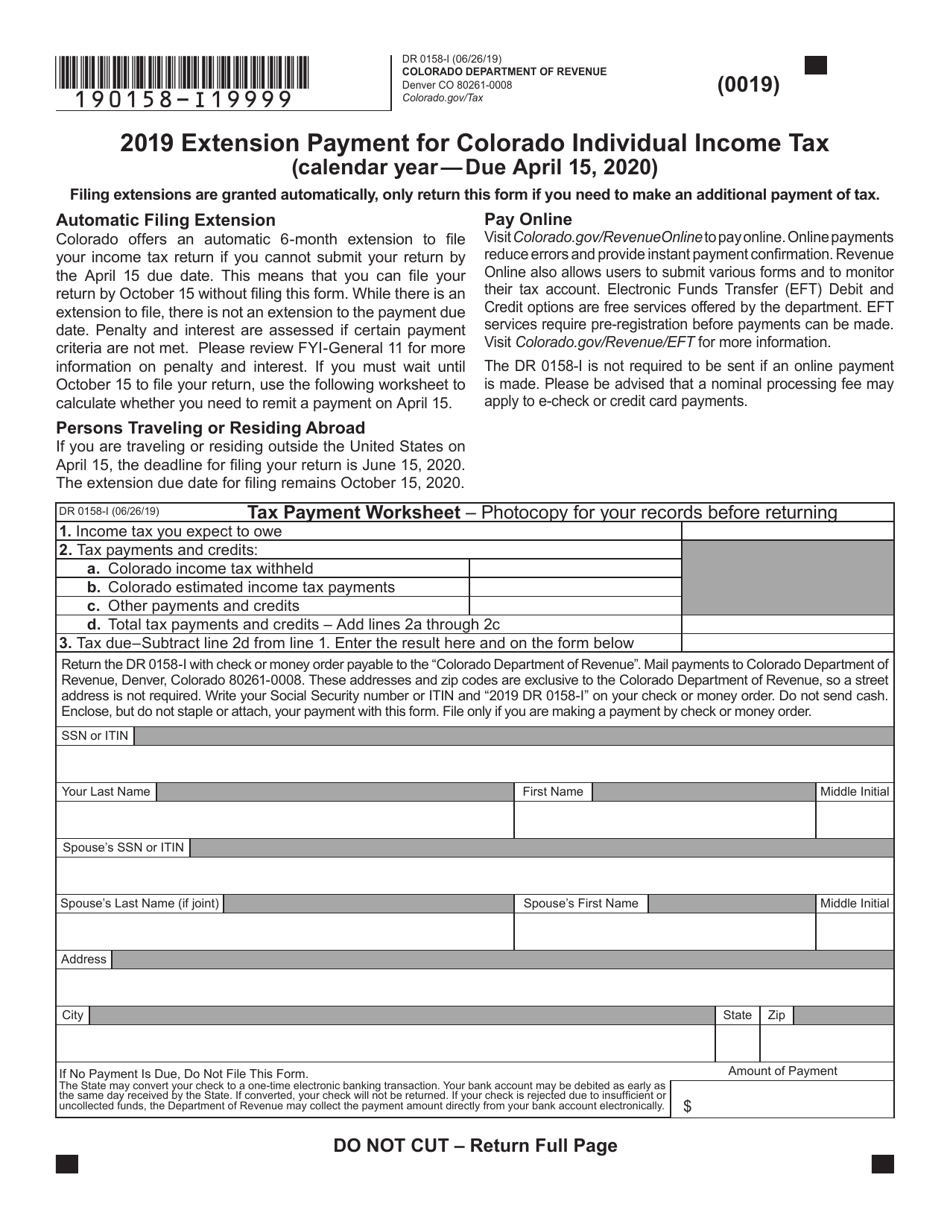

Form DR0158 I Download Fillable PDF Or Fill Online Extension Payment

https://data.templateroller.com/pdf_docs_html/2060/20608/2060852/form-dr0158-i-extension-payment-for-colorado-individual-income-tax-colorado_print_big.png

Coloradoans over 65 can receive up to a 1 000 Senior Income Tax Credit if they have less than 25 000 annual income Individuals earning up to 75 000 are also eligible for The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in revenue When the

What is the Senior Income Tax Credit in Colorado Colorado seniors over 65 can receive up to a 1000 Senior Income Tax Credit if they have less than 25 000 annual income Another bill that passed House Bill 1052 reinstates a senior housing income tax credit for tax year 2024 to help renters and homeowners who don t qualify for the homestead

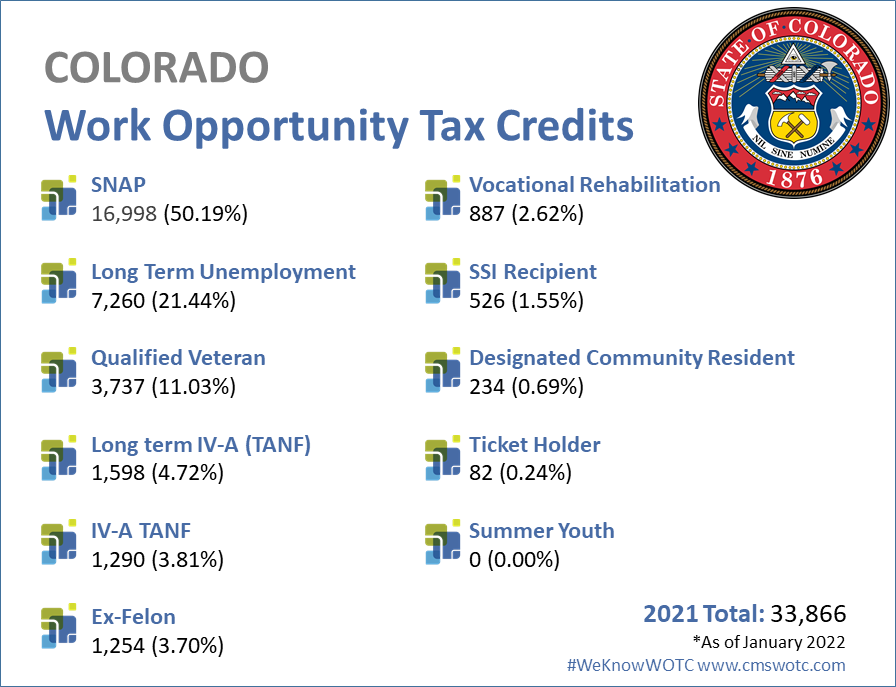

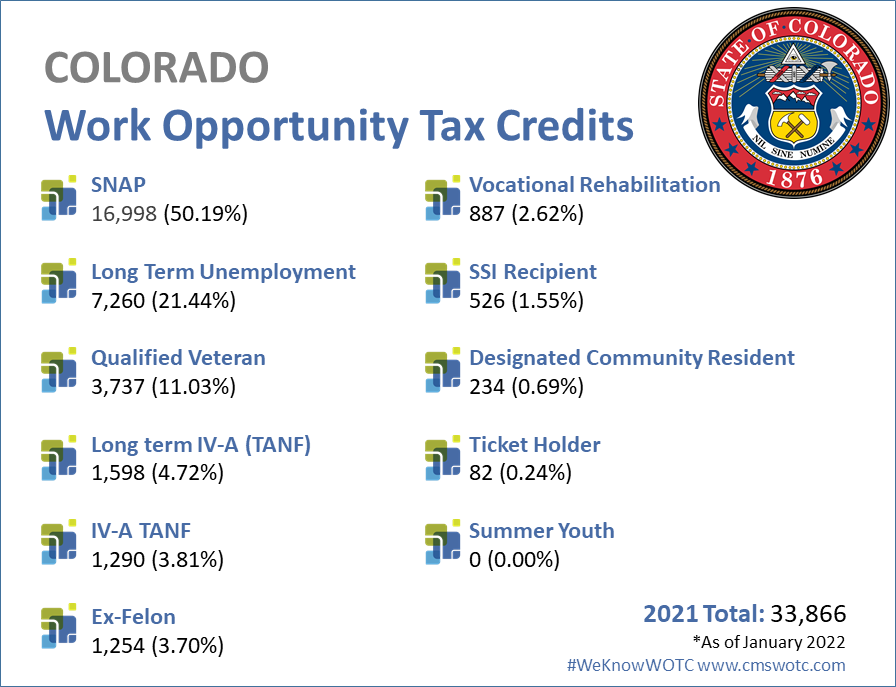

Work Opportunity Tax Credit Statistics For Colorado 2021 Cost

http://www.cmswotc.com/wp-content/uploads/2022/02/Work-Opportunity-Tax-Credit-Statistics-WOTC-Colodado-2021.png

The Senior Tax Credit Do I Qualify FindLaw

https://www.findlaw.com/elder/elder-care-law/the-senior-tax-credit-do-i-qualify/_jcr_content/main/responsivegrid/imageinline_copy.coreimg.jpeg/1675367983615.jpeg

https://tax.colorado.gov › information-on-senior-tax-credits

The PTC Rebate is available to Colorado residents base on income including people with disabilities and older adults to help with their property tax rent and or heat expenses

https://tax.colorado.gov › income-tax-topics-income...

Income qualified seniors may claim a refundable housing tax credit on their 2022 and 2024 Colorado income tax returns Anyone who claims the Senior Property Tax Exemption does not

FinancialFridays Seniors Tax Credits Part 1 United Way Of Bruce Grey

Work Opportunity Tax Credit Statistics For Colorado 2021 Cost

Boost Tax Credits For Colorado s Working Families Colorado Newsline

Colorado Historic Tax Credits Heritage Consulting Group Historic Tax

The Senior Tax Credit Do You Qualify Ksdk

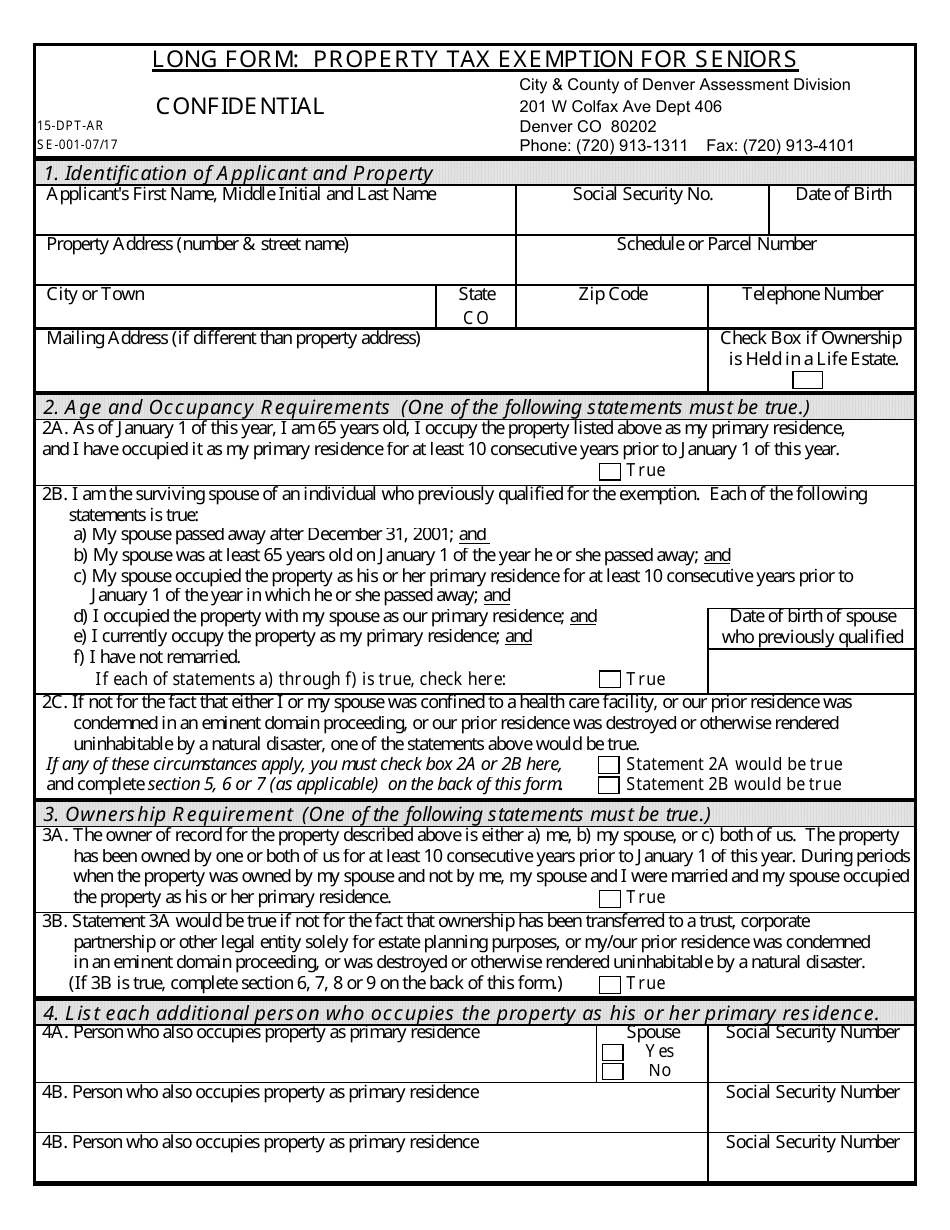

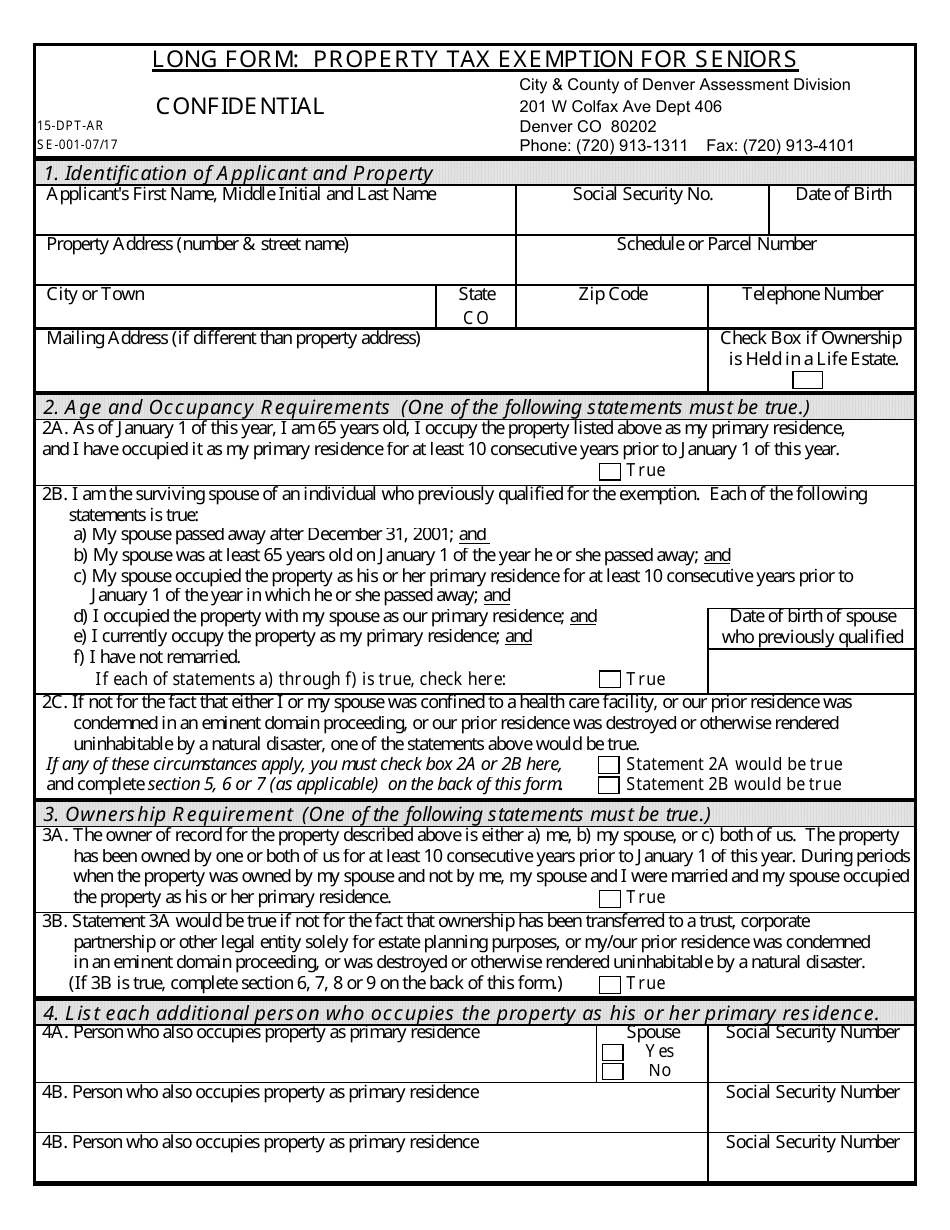

Form 15 DPT AR Fill Out Sign Online And Download Printable PDF

Form 15 DPT AR Fill Out Sign Online And Download Printable PDF

Can I Claim The Senior Tax Credit For The Elderly And Disabled

IRS Tax Credits And What To Be Aware Of E file

What Is The Difference Between A Tax Credit And Tax Deduction

What Is The Senior Tax Credit In Colorado - Colorado tax credits Retirement Taxes Costa Rica may be a good place for retirement if you like the low cost of living and savings for your heirs By Kate Schubel