What Is The Standard Deduction For A Married Couple With One Child For couples filing jointly your AGI must be less than 42 130 if you have one child 47 162 if you have two children or 50 270 if you have three or more to get the credit The amount of your credit is based on a sliding scale which goes up as your AGI rises plateaus at the middle and goes back down as it reaches the AGI limit

The child is married and you can claim the child as a dependent a qualifying person the child is married and you can t claim the child as a dependent not a qualifying person 3 qualifying relative 4 who is your father or mother you can claim your parent as a dependent 5 a qualifying person 6 you can t claim your parent as a dependent In the tax year 2017 standard deduction amounts were Single 6 350 Married Filing Separately 6 350 Head of Household 9 350 Married Filing Jointly 12 700 Surviving Spouse 12 700 For tax year 2023 the standard deduction amounts are Single 13 850 Married Filing Separately 13 850 Head of Household 20 800

What Is The Standard Deduction For A Married Couple With One Child

What Is The Standard Deduction For A Married Couple With One Child

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

What Is The Standard Deduction 2023 Vs 2022

https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg

IRS Announces Inflation Adjustments To 2022 Tax Brackets The Economic

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

For 2024 these amounts are increased to 14 600 for those filing as Single or Married Filing Separately 21 900 for those filing as Head of Household and 29 200 for those filing as Surviving Spouse or Married Filing Jointly Is the Standard Deduction different if someone claims you as a dependent The 2023 standard deduction is 13 850 for single filers and those married filing separately 27 700 for those married filing jointly and 20 800 for heads of household

What is the Standard Deduction for Married Filing Jointly The standard deduction is 25 900 That s up 1 900 from last year If you and your spouse are both 65 or older or if you re blind you get an additional 1 300 deduction So your total deduction would be 27 200 If you are a single filer the standard deduction is 12 550 How they work You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund

Download What Is The Standard Deduction For A Married Couple With One Child

More picture related to What Is The Standard Deduction For A Married Couple With One Child

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Standard Deduction Amounts For 2021 Tax Returns Don t Mess With Taxes

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e202942f950e5d200c-800wi

In the new tax reform world of 2023 and 2024 the child tax credit is now 2 000 per child under the age of 17 with an income limit of 400 000 for married couples 200 000 for individuals 1 Here s how the tax credit works Let s say you have a family of four Mom and Dad and their two kids Kenny and Jenny Topic no 551 Standard deduction The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness

For 2023 the federal standard deduction for single filers was 13 850 for married filing jointly it was 27 700 and for the head of household filers it increased to 20 800 Individuals who are at least partially blind or at least 65 years old get a larger standard deduction The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

https://pocketsense.com/full-list-tax-deductions...

For couples filing jointly your AGI must be less than 42 130 if you have one child 47 162 if you have two children or 50 270 if you have three or more to get the credit The amount of your credit is based on a sliding scale which goes up as your AGI rises plateaus at the middle and goes back down as it reaches the AGI limit

https://www.irs.gov/publications/p501

The child is married and you can claim the child as a dependent a qualifying person the child is married and you can t claim the child as a dependent not a qualifying person 3 qualifying relative 4 who is your father or mother you can claim your parent as a dependent 5 a qualifying person 6 you can t claim your parent as a dependent

Tax Deductions 2022 Hot Sex Picture

How To Calculate Taxes With Standard Deduction Dollar Keg

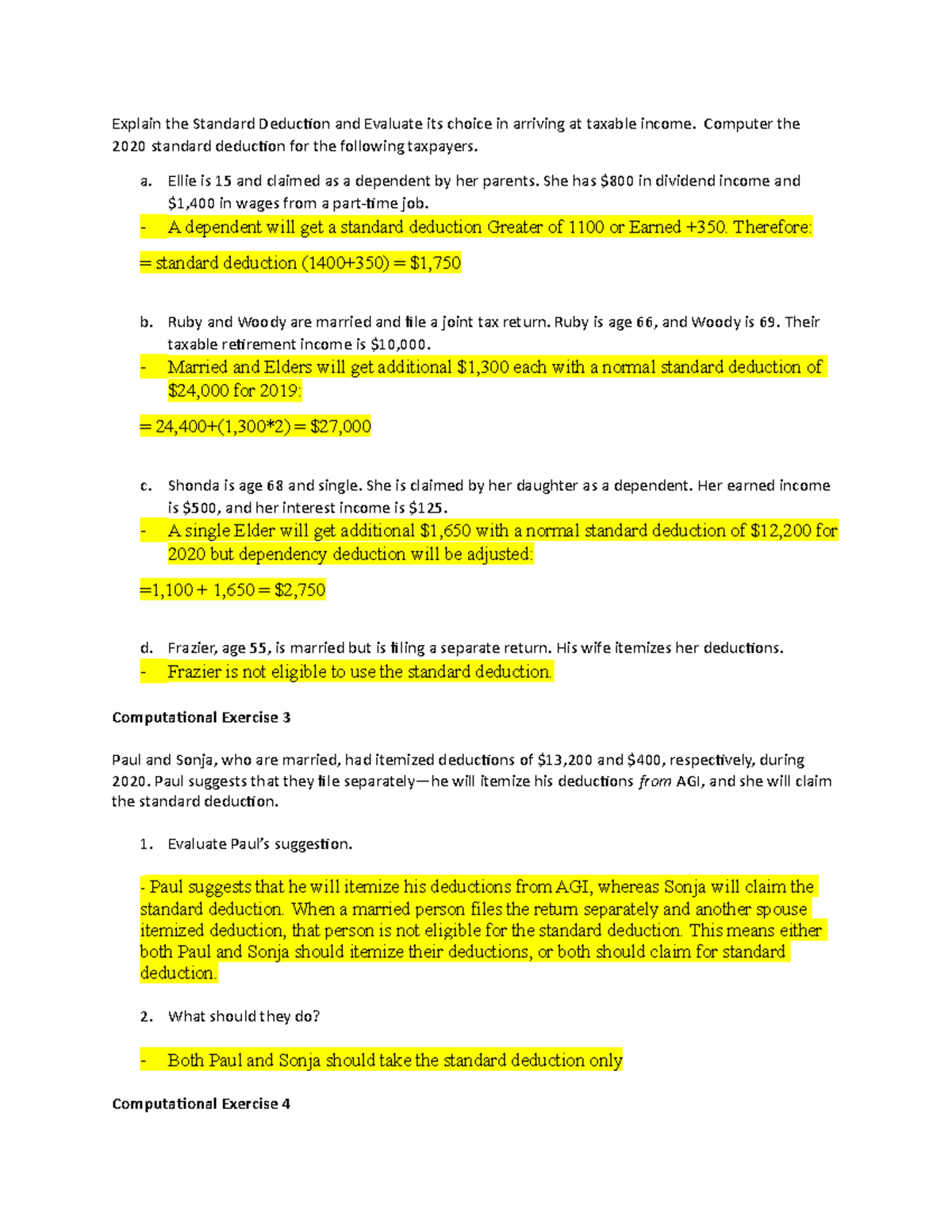

AC 407 Ch 9 Assignments For ACC Taxation Explain The Standard

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

2022 Federal Tax Brackets And Standard Deduction Printable Form

2023 IRS Standard Deduction

2023 IRS Standard Deduction

Pin On Business Template

Should You Take The Standard Deduction On Your 2021 2022 Taxes

2021 Taxes For Retirees Explained Cardinal Guide

What Is The Standard Deduction For A Married Couple With One Child - How they work You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund