What Is The Tax Deduction For Seniors Over 65 As retirees tend to face rising medical and other expenses the extra standard deduction for individuals 65 and older can help alleviate tax burdens by reducing taxable income

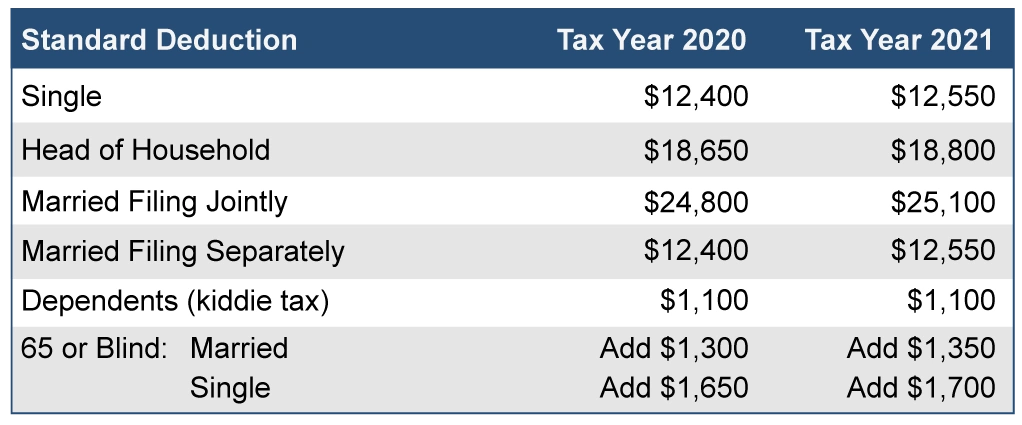

If you are 65 or older and blind the extra standard deduction is 3 700 if you are single or filing as head of household 3 000 per qualifying individual if you are married filing jointly Standard Deduction for Seniors If you do not itemize your deductions you can get a higher standard deduction amount if you and or your spouse are 65 years old or older You can get an even higher standard deduction amount if either you or your spouse is blind

What Is The Tax Deduction For Seniors Over 65

What Is The Tax Deduction For Seniors Over 65

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

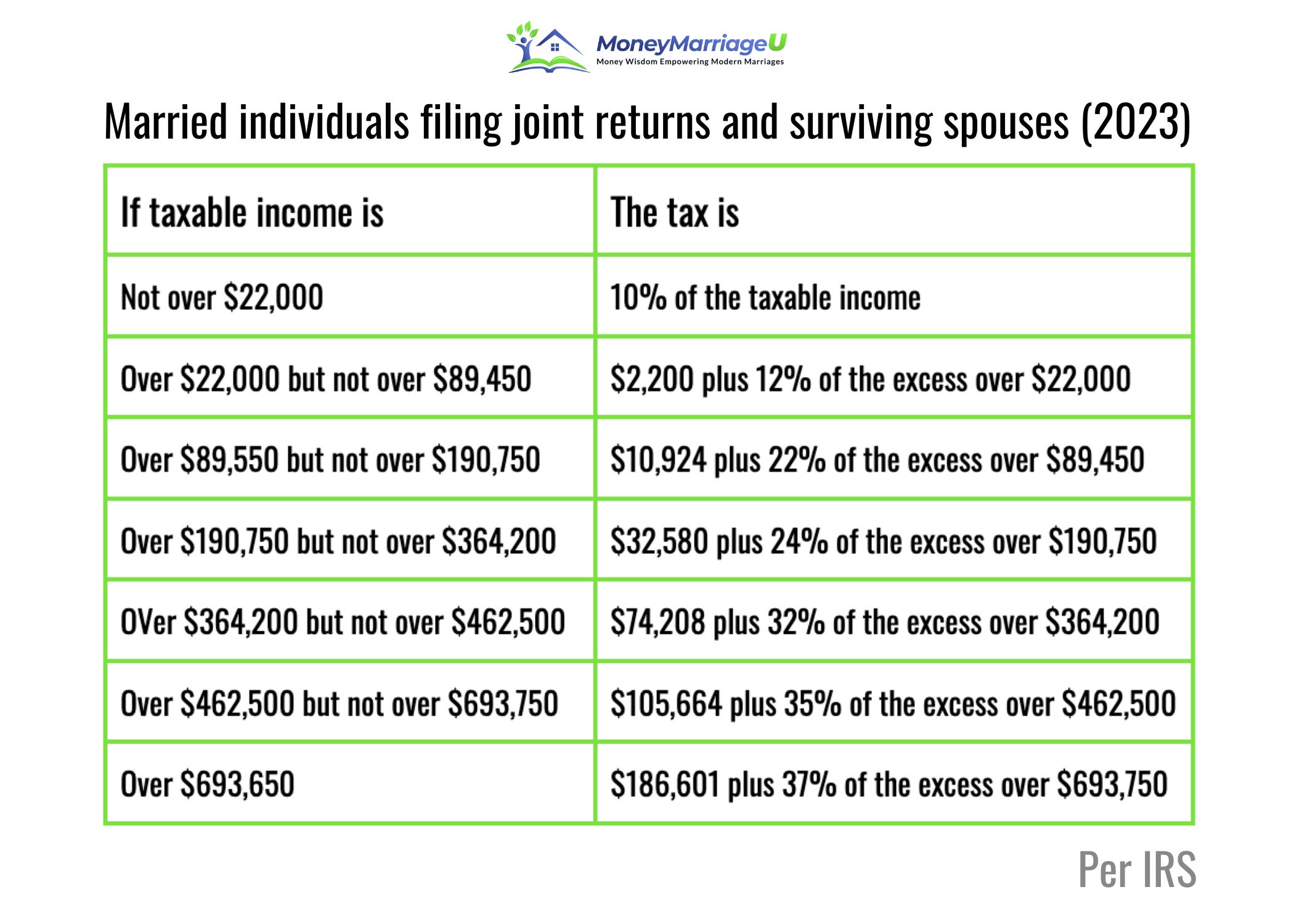

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

Taxpayers who blind and or are age 65 or older can claim an additional standard deduction an amount that s added to the regular standard deduction for their filing status Filing Status What is the extra standard deduction for seniors over 65 in 2024 Taxpayers who are age 65 or older can claim an additional standard deduction which is added to the regular standard deduction

The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are Older adults and people who are retired can take advantage of additional tax breaks and savings when it comes time to file their taxes For starters there is a larger standard deduction for people over the age of 65 You may also receive a tax credit

Download What Is The Tax Deduction For Seniors Over 65

More picture related to What Is The Tax Deduction For Seniors Over 65

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

2022 Us Tax Brackets Irs

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are and 22 650 for head of household Form 1040 SR is a larger type tax return that taxpayers over 65 can use to file their taxes available since 2018 It highlights tax benefits for those who are age 65 or older

Tax Counseling for the Elderly offers free tax return preparation to qualified individuals Publication 554 Tax Guide for Seniors People 65 and older may choose to use Form 1040 SR U S Tax Return for Seniors When you turn 65 the IRS offers you a tax benefit in the form of an extra standard deduction for people age 65 and older For example a single 64 year old taxpayer can claim a standard deduction

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

https://www.kiplinger.com/taxes/extra-standard...

As retirees tend to face rising medical and other expenses the extra standard deduction for individuals 65 and older can help alleviate tax burdens by reducing taxable income

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.usatoday.com/story/money/taxes/2024/01/...

If you are 65 or older and blind the extra standard deduction is 3 700 if you are single or filing as head of household 3 000 per qualifying individual if you are married filing jointly

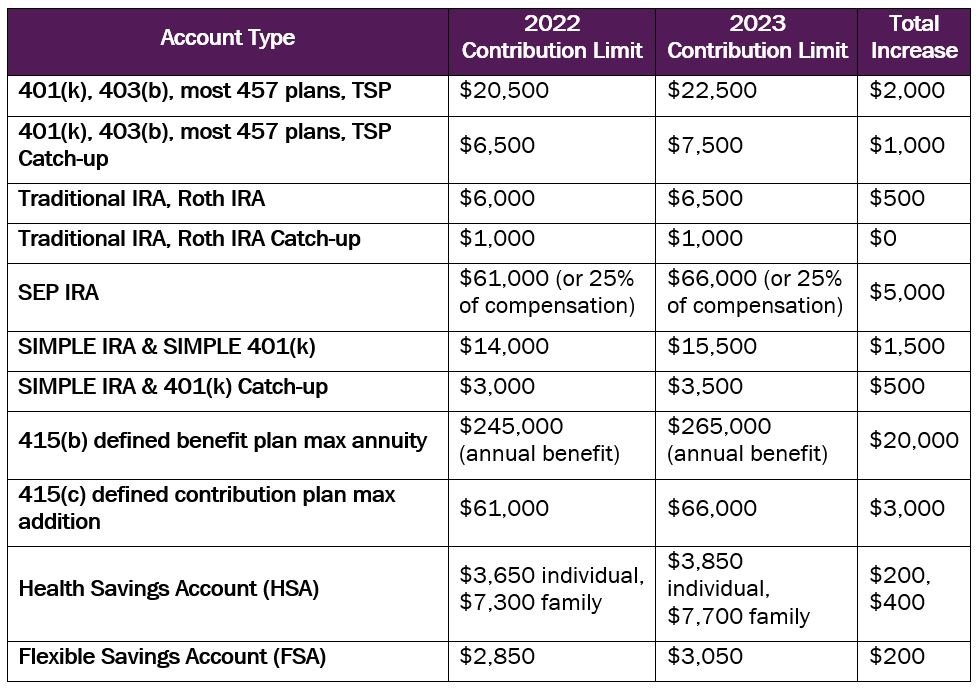

2023 Contribution Limits And Standard Deduction Announced Day Hagan

2021 Taxes For Retirees Explained Cardinal Guide

2022 Federal Tax Brackets And Standard Deduction Printable Form

What Is The Standard Deduction For 2021

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

What Is The Standard Federal Tax Deduction Ericvisser

Standard Deduction 2020 Self Employed Standard Deduction 2021

What Is The Tax Deduction For Seniors Over 65 - What is the extra standard deduction for seniors over 65 in 2024 Taxpayers who are age 65 or older can claim an additional standard deduction which is added to the regular standard deduction