What Is The Tax On Electric Cars You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return

That s because if you buy a used electric vehicle for 2024 from model year 2022 or earlier there s a tax credit for you too It s worth 30 of the sales price up to 4 000 This tax The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a

What Is The Tax On Electric Cars

What Is The Tax On Electric Cars

https://www.fleetevolution.com/wp-content/uploads/2022/07/Road-tax.jpg

How Much Is Company Car Tax On Electric Cars Octopus EV

https://cdn.sanity.io/images/767s1cf5/production/31a91a691cb94ff62794deea9e9bb5f7b08ca322-2880x1640.png?auto=format

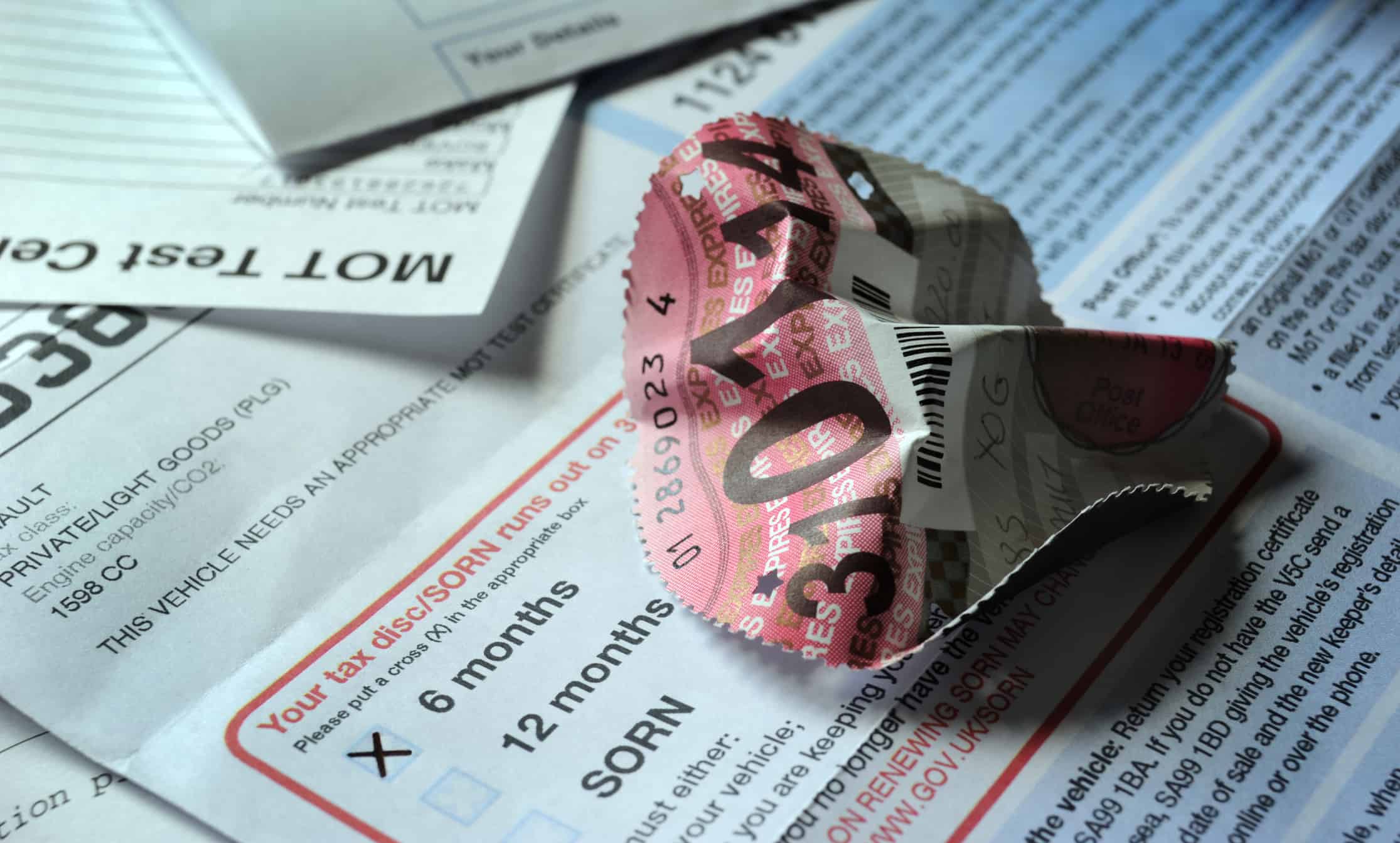

Do Electric Cars Pay Road Tax Tax On Electric Cars Fleet Evolution

https://www.fleetevolution.com/wp-content/uploads/2020/10/IMG_0576-2048x1536.jpg

Qualifying clean energy vehicle buyers are eligible for a tax credit of up to 7 500 Internal Revenue Service Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles For a broader view of what vehicles may now be eligible for this credit the Department of Energy published a list of Model Year 2022 and early Model Year 2023 electric vehicles that likely meet the final assembly requirement The eligibility for a specific vehicle should be confirmed using its VIN number

Updated December 21 2023 Fact checked by David Rubin The Inflation Reduction Act incentivizes people to buy an electric vehicle EV Signed into law in 2022 by President Biden it features The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

Download What Is The Tax On Electric Cars

More picture related to What Is The Tax On Electric Cars

Do Electric Cars Pay Road Tax Tax On Electric Cars Fleet Evolution

https://www.fleetevolution.com/wp-content/uploads/2022/07/Do-Electric-Cars-Pay-Road-Tax_-Fleet-Evolution-Tamworth.jpg

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Road Tax On Electric Cars The Complete Guide EV WIRED

https://evwired.com/app/uploads/2021/10/Road-Tax-Header2-870x350.jpg

A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain electric The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those shopping for a car a revamped 7 500 tax credit if you buy a

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Mar 6 2024 Marc Urbano Car and All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Road Tax On Electric Cars In Malaysia

https://imgcdnblog.carbay.com/wp-content/uploads/2021/12/01182201/image-1193.jpg

Do Electric Cars Pay Road Tax Tax On Electric Cars Fleet Evolution

https://www.fleetevolution.com/wp-content/uploads/2022/07/Tax-768x512.jpg

https://www.forbes.com/advisor/taxes/electric-vehicle-tax-credit-updated

You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return

https://www.npr.org/2023/12/28/1219158071

That s because if you buy a used electric vehicle for 2024 from model year 2022 or earlier there s a tax credit for you too It s worth 30 of the sales price up to 4 000 This tax

The Electric Car Tax Credit What You Need To Know OsVehicle

Road Tax On Electric Cars In Malaysia

Road Tax On Electric Cars In Malaysia

Tax And Electric Cars M A Partners

New Tax On Electric Cars In Mississippi

SA Delays Electric Car Tax Adds Subsidies 7NEWS

SA Delays Electric Car Tax Adds Subsidies 7NEWS

How Much Is Company Car Tax On Electric Cars

Tax On Electric Cars And Low Emission Vehicles TN Accountancy

Tax On Electric Cars Slashed By Up To 75 To Promote Cleaner

What Is The Tax On Electric Cars - A tax credit of up to 7 500 Until the end of 2023 the credit is received when you file your taxes the following year Starting in 2024 the credit is given at the point of sale The Act