What Is The Total Tax Free Allowance An allowance is an amount of otherwise taxable income that you can earn each year without paying tax on it What shall I pay If you earn above the threshold your

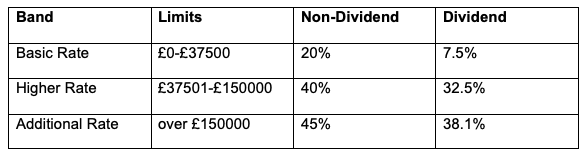

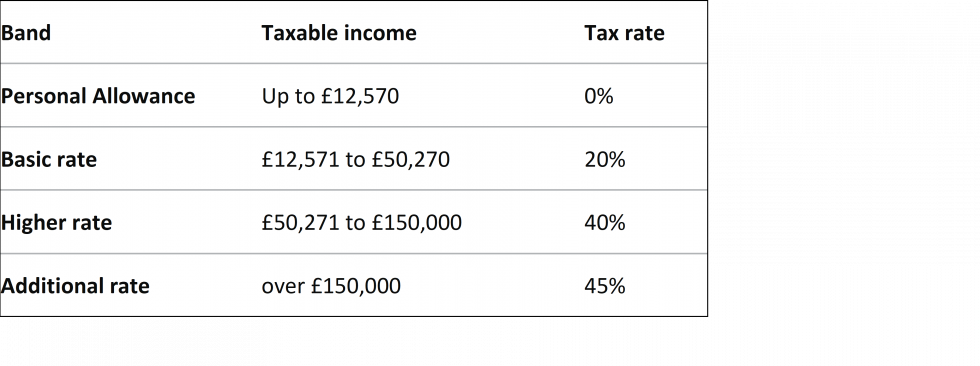

HMRC permits the British public to earn tax free income in the form of certain allowances and tax reliefs An allowance is an amount of money you can Personal Allowance taking into account your age tax code and the 2024 2025 year is 12 570 Your total tax free allowance is 12 570 Below is a chart of how the tax

What Is The Total Tax Free Allowance

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

What Is The Total Tax Free Allowance

https://www.investopedia.com/thmb/VxltrrZ3zSPp5lFRkVV8oSWZmcU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png

Based On The Table What Is The Total Tax Due For A Married Couple Who

https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d76/10471b05e1caa668ca0728ecb604a8f6.png

Chapter 7 Taxes

https://o.quizlet.com/H.WRCWNN82-GUgUdUyP7iQ.jpg

Your tax free Personal Allowance The standard Personal Allowance is 12 570 which is the amount of income you do not have to pay tax on Your Personal Allowance may be For the 2024 25 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your

Tax free income is income that you earn on which you re not liable to pay tax There are lots of allowances that you can claim in the UK in 2024 25 Here s a quick snapshot of some commonly claimed 2023 24 If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance the basic rate 20 the higher

Download What Is The Total Tax Free Allowance

More picture related to What Is The Total Tax Free Allowance

Taxation Graph Hot Sex Picture

https://images.squarespace-cdn.com/content/v1/55b690f2e4b076db679cd340/1481202309202-R4HFI0P9UHTBU0M8BYVY/tax+diagram+-+specific+unit+tax

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/FOlL30LB0IoWAychszapZiHlUVk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg

Effective Income Tax Rates In Ireland Over Time Social Justice Ireland

https://www.socialjustice.ie/sites/default/files/legacy/image/Pictures for website/budget2020analysist6.1.jpg

Any income between the Personal Allowance of 12 571 and 50 270 is taxed at a basic rate of 20 percent Income from 50 271 to 125 140 is taxed at a higher rate of 40 Your personal savings allowance PSA is a tax free allowance that lets you earn interest on your savings without paying tax on that interest The allowance you get depends on what rate of income tax you pay Basic

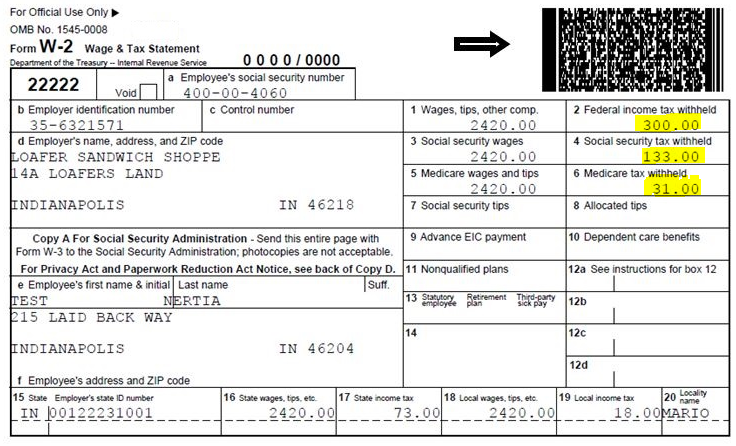

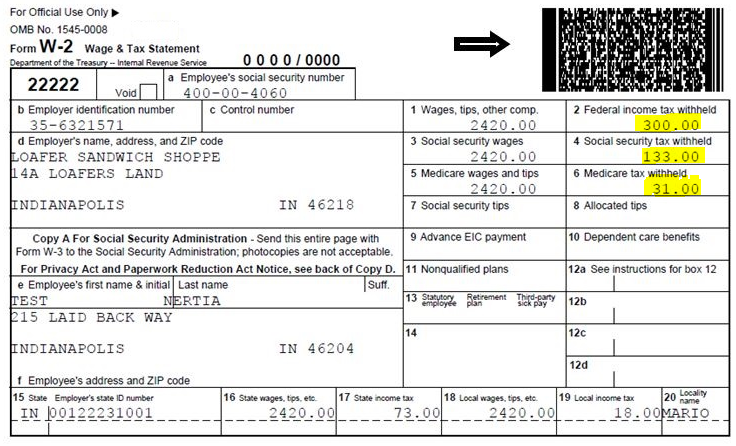

Income Tax is a tax you pay on your earnings find out about what it is how you pay and how to check you re paying the right amount using HMRC s tax calculator Prior to 2020 one of the biggest things you could do to affect the size of your paycheck was to adjust the number of allowances claimed on your W 4 The ideal

Tax free Allowance For Non UK Residents Could Go Wealth And Finance

https://www.wealthandfinance-news.com/wp-content/uploads/2018/06/40ac6aec-41e5-4c73-a20f-a0107a8265ce.jpg

What Is The Tax Free Allowance For 6th April 2020 To 5th April 2021

https://www.forceaccounting.com/images/blog/c5b810da44e097e0d9e1e1c5e32457e9__6de7/zoom587x157z87874cw668.png?etag=74dcdab70bf74a886c7abe211cd1f015

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png?w=186)

https://www.moneyhelper.org.uk/en/work/employment/...

An allowance is an amount of otherwise taxable income that you can earn each year without paying tax on it What shall I pay If you earn above the threshold your

https://www.crunch.co.uk/knowledge/article/what-counts-as-tax-free-income

HMRC permits the British public to earn tax free income in the form of certain allowances and tax reliefs An allowance is an amount of money you can

Petition Raise The Tax Free Allowance On Fuel Mileage For Business

Tax free Allowance For Non UK Residents Could Go Wealth And Finance

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

What Are Tax free Allowances YouTube

Solved Calculate The Total 2017 Tax Liability For A Surviving Spouse

Form Used To Calculate Employee s Income Tax 2024 Employeeform

Form Used To Calculate Employee s Income Tax 2024 Employeeform

Form 1040 U S Individual Income Tax Return 2015 MbcVirtual Income

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

Petition Increase Tax Free Allowance On Gift Cards To 500

What Is The Total Tax Free Allowance - Tax free income is income that you earn on which you re not liable to pay tax There are lots of allowances that you can claim in the UK in 2024 25 Here s a quick snapshot of some commonly claimed 2023 24