What Is The Total Tax In Canada 2024 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available to you to reduce your total tax payable

Canadian income tax rates vary according to the total amount of income you earn and how much of that is considered taxable income For prior year tax rates review this link from the Canadian government and for Qu bec residents review this link from Revenu Qu bec What are income tax brackets That means you will pay 15 in federal tax on your 50 000 of income that s 7 500 not including deductions and claims of course To give an another example in November 2023 the average

What Is The Total Tax In Canada

What Is The Total Tax In Canada

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

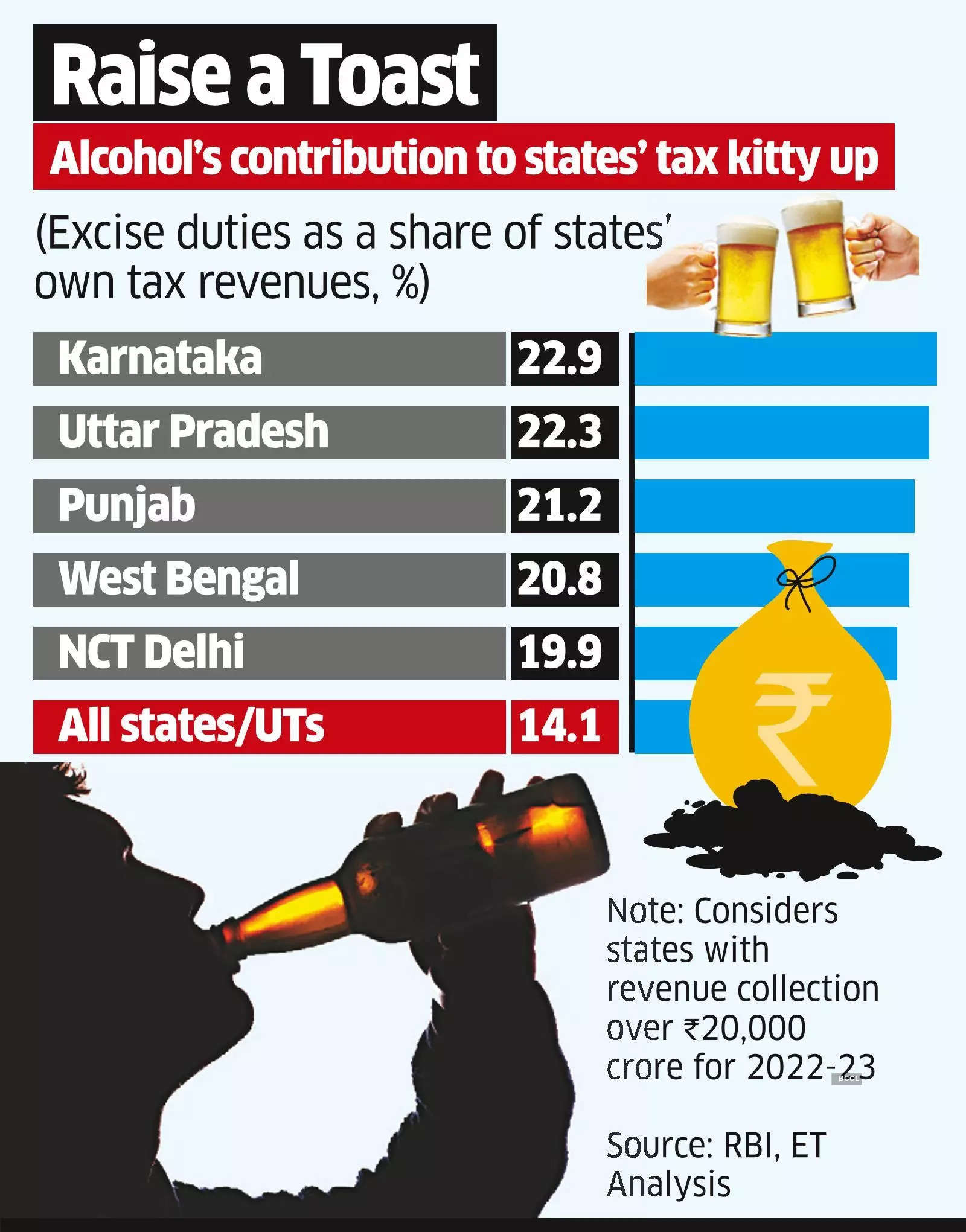

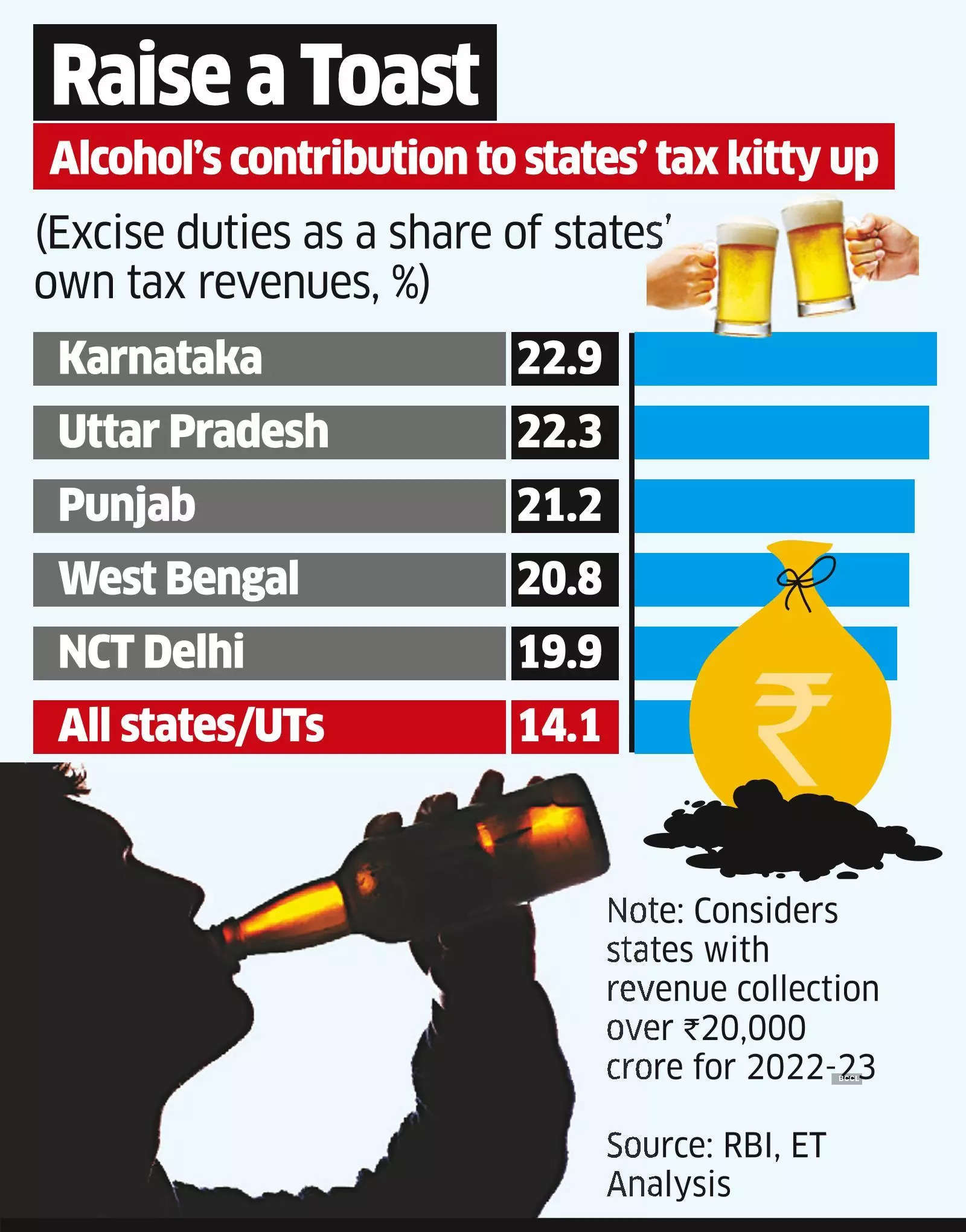

Share Of Alcohol On Rise In States Tax Revenue Kitty The Economic Times

https://img.etimg.com/photo/msid-97846599/share-of-alcohol-on-rise-in-states-tax-revenue-kitty-.jpg

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

https://www.crowe.com/ca/crowesoberman/-/media/Crowe/Firms/Americas/ca/Crowe-Soberman/Images/Insights/Map-of-Canada---Tax-Rates.png?h=2460&la=en-US&w=4276&modified=20200727145752&hash=EAC1D464A20FD6F48830EB22D7C826BC0DD935B2

The Canadian income tax system is a self assessment regime Taxpayers assess their tax liability by filing a return with the CRA by the required filing deadline CRA will then assess the return based on the return filed and on information it has obtained from employers and financial companies correcting it for obvious errors The top federal tax rate is 33 and when we add in provincial tax rates the total marginal tax rate now reaches 54 8 But we pay it without much complaint because it s the price of living in a prosperous nation As Oliver Wendell Holmes the 19th century U S Supreme Court Justice said I hate paying taxes

Notes Quebec has its own personal tax system which requires a separate calculation of taxable income Recognising that Quebec collects its own tax federal income tax is reduced by 16 5 of basic federal tax for Quebec residents Generally those with higher incomes fall into a higher tax bracket so they pay a higher tax rate than those with lower incomes who fall into lower tax brackets Current tax brackets in Canada

Download What Is The Total Tax In Canada

More picture related to What Is The Total Tax In Canada

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

State Income Tax Reliance Individual Income Taxes Tax Foundation

https://files.taxfoundation.org/20210210123118/State-tax-reliance-State-income-tax-reliance.-How-much-do-states-rely-on-income-taxes-To-what-extent-does-your-state-rely-on-individual-income-taxes-2021-01.png

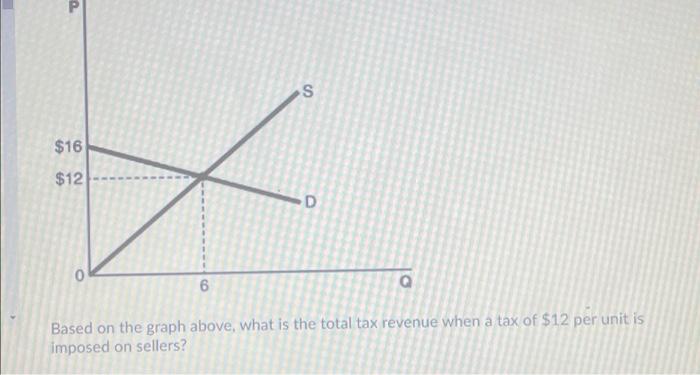

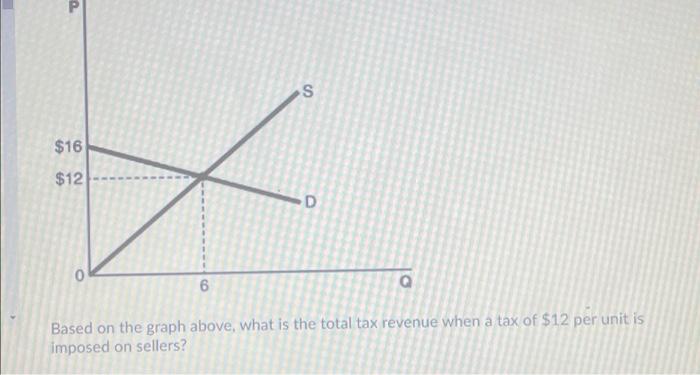

Solved Based On The Graph Above What Is The Total Tax Chegg

https://media.cheggcdn.com/study/896/8969ab4b-6ac4-421b-ab2e-0a9787964d2f/image

Tax Rates Current Marginal Tax Rates Canada Personal Income Tax Brackets and Tax Rates Canada 2024 and 2023 Tax Rates Tax Brackets Income Tax Act s 117 117 1 121 The Federal tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1 047 a 4 7 increase To find your effective tax rate you ll need to divide the total amount of your taxes by your taxable income For example let s say your 2023 taxable income is 150 000

[desc-10] [desc-11]

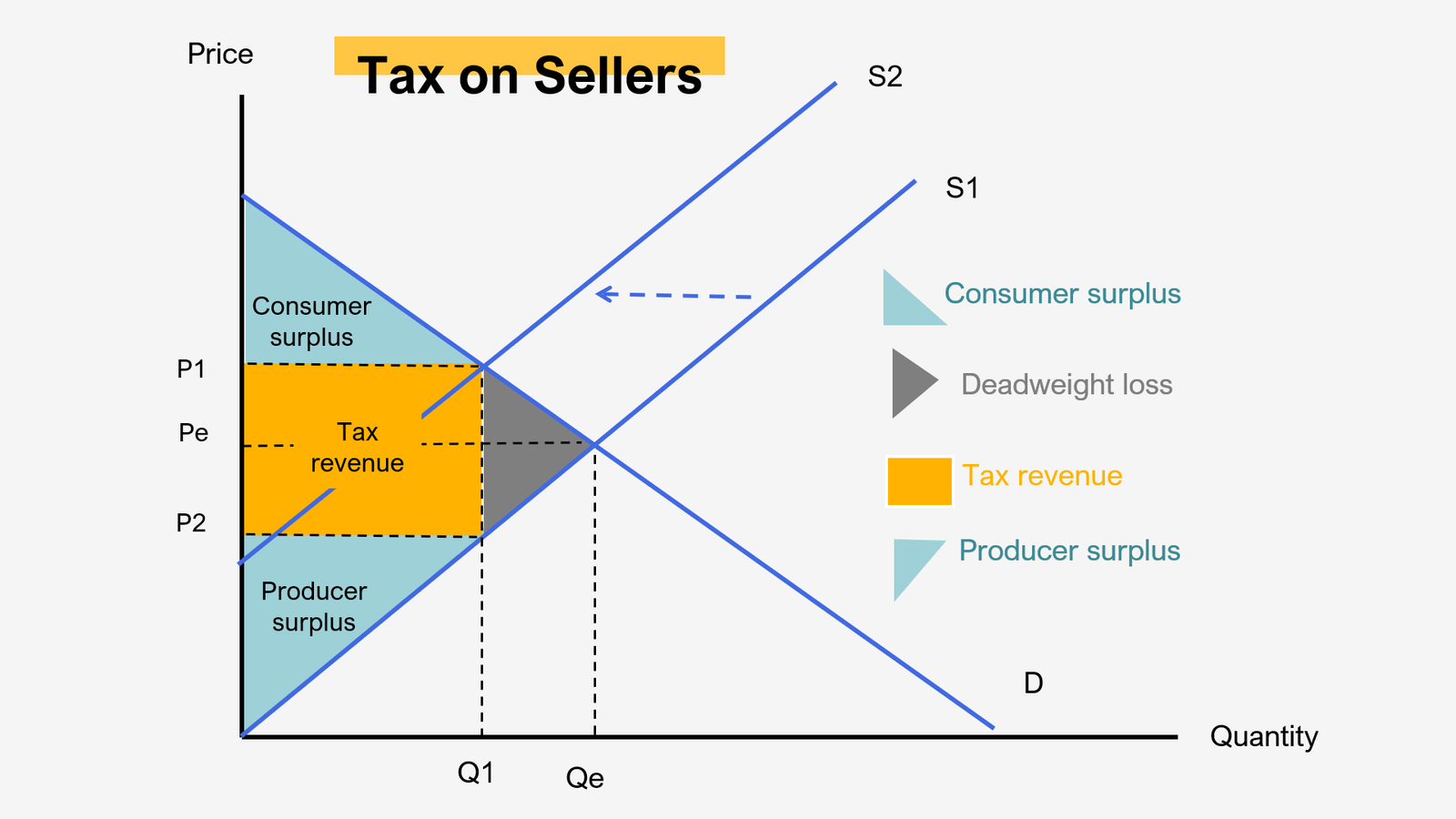

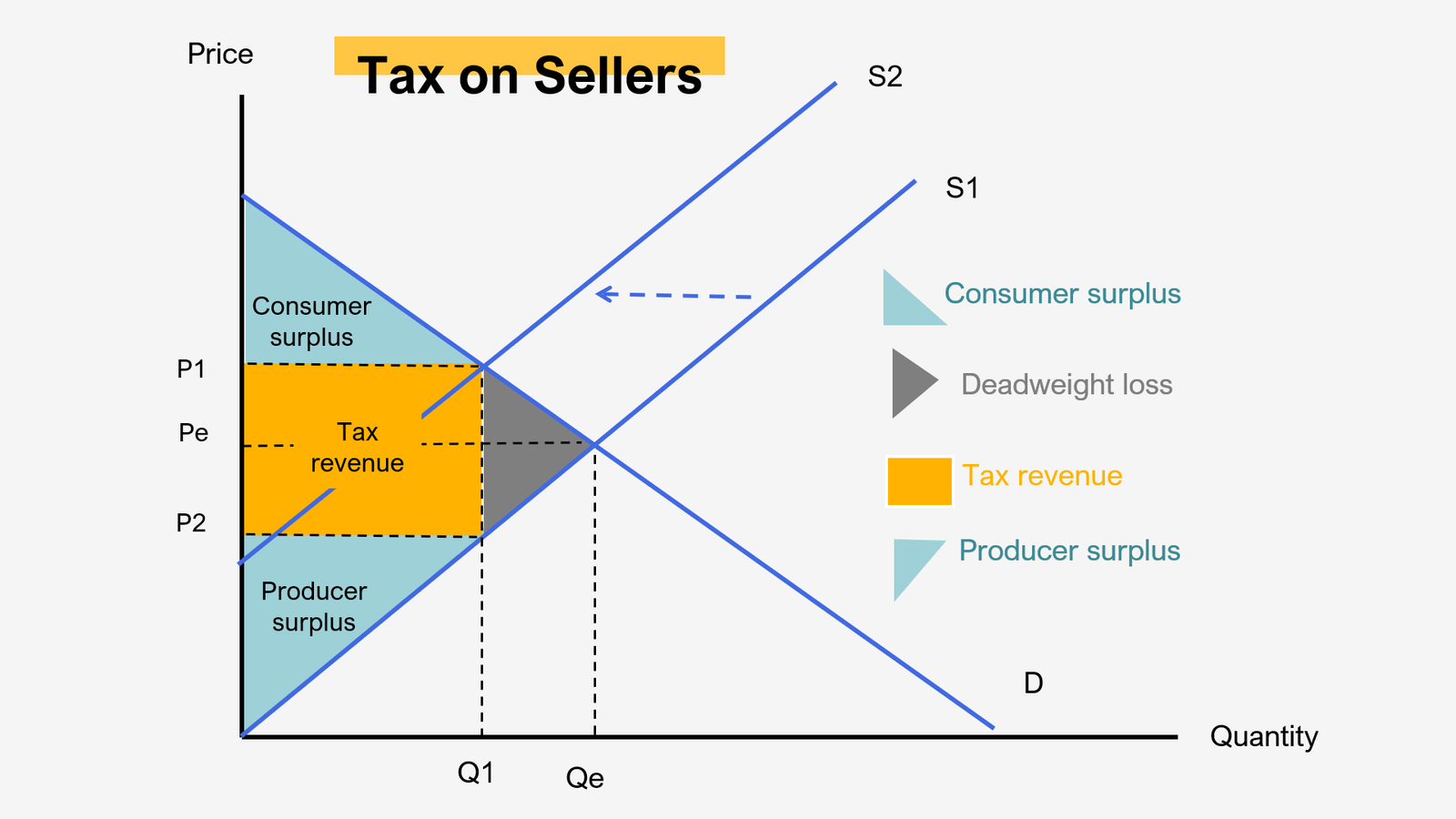

How To Calculate Deadweight Loss With A Price Ceiling

https://penpoin.com/wp-content/uploads/2020/11/Deadweight-Loss-caused-by-tax-on-seller.png

How Much Is Ohios Sales Tax Tax Walls

https://ohiomemory.org/digital/api/singleitem/image/pdf/p267401ccp2/15523/default.png

https://www.canada.ca/en/revenue-agency/services...

2024 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available to you to reduce your total tax payable

https://turbotax.intuit.ca/tips/an-overview-of-federal-tax-rates-286

Canadian income tax rates vary according to the total amount of income you earn and how much of that is considered taxable income For prior year tax rates review this link from the Canadian government and for Qu bec residents review this link from Revenu Qu bec What are income tax brackets

How High Are Taxes In The US Compared To Canada Quora

How To Calculate Deadweight Loss With A Price Ceiling

The Basics Of Tax In Canada WorkingHolidayinCanada

Is Medical Cannabis Tax deductible In Canada We Have The Answer MJ

Top 1 Pay Nearly Half Of Federal Income Taxes

Solved Based On The Graph Above What Is The Total Tax Chegg

Solved Based On The Graph Above What Is The Total Tax Chegg

Tax Deadline Canada More Tax Filers Opting To Do It Themselves BMO

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

llami G zad kulcsok llami G zad Rangsor 2021 J lius Ad alap

What Is The Total Tax In Canada - Generally those with higher incomes fall into a higher tax bracket so they pay a higher tax rate than those with lower incomes who fall into lower tax brackets Current tax brackets in Canada