What Is The Unified Tax Credit For The Elderly The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older TCE volunteers specialize in answering

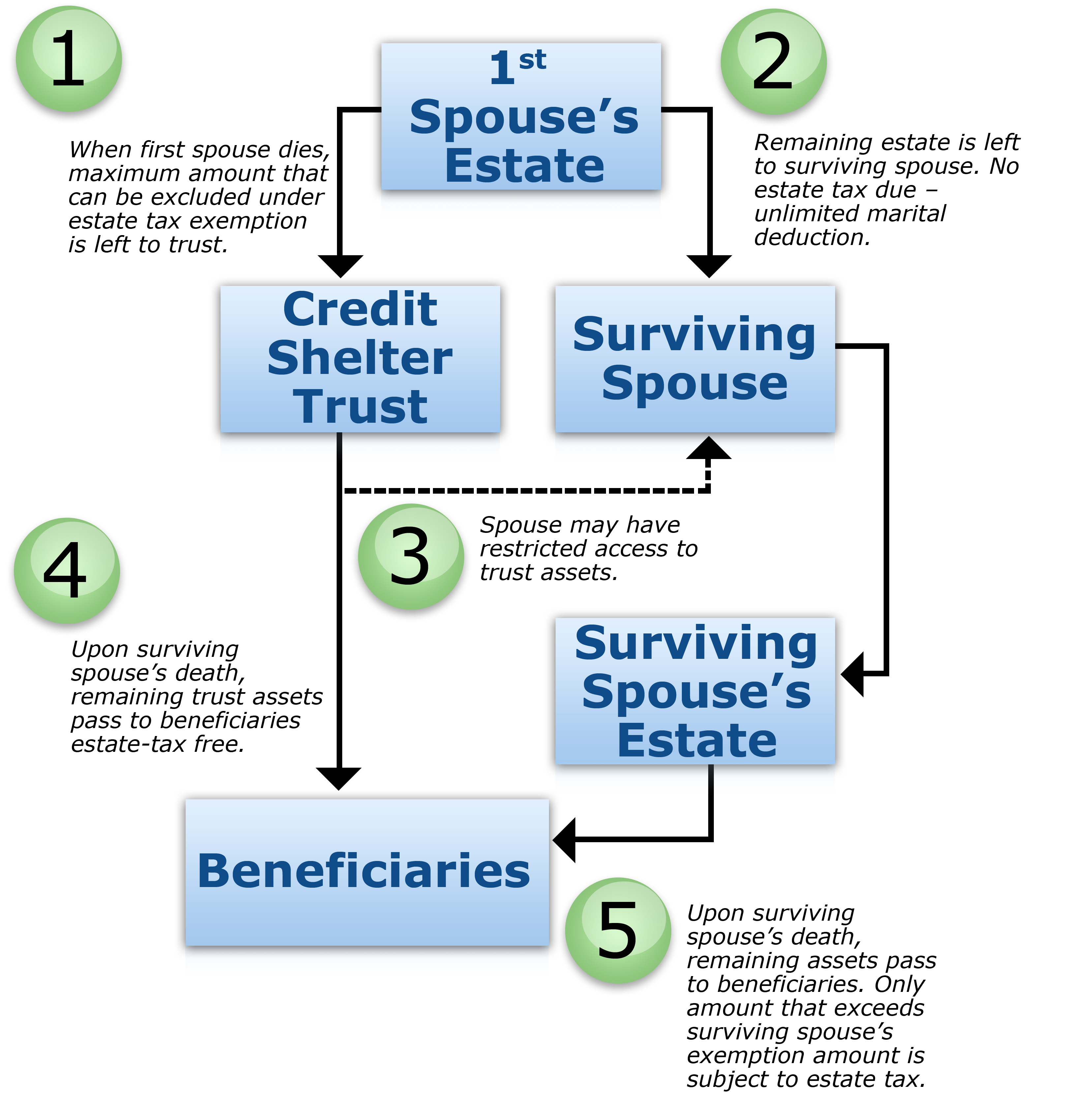

The unified tax credit is the combined amount of your estate and lifetime gifts that will not be subject to taxes Learn how to make the most of this tax credit A unified tax credit establishes a money limit for lifetime gifts above which the IRS requires you to pay estate or gift taxes Here s how it works

What Is The Unified Tax Credit For The Elderly

What Is The Unified Tax Credit For The Elderly

https://www.ws-law.com/wp-content/uploads/2021/01/counting-3125587_1920.jpg

Unified Number In UAE 2023 All You Need To Know

https://eormiddleast.com/wp-content/uploads/2022/11/What-Is-the-Unified-Number-in-UAE_.jpg

2022 Guide To The Unified Tax Credit

https://www.oakstreetfunding.com/hs-fs/hubfs/Imported_Blog_Media/Flowchart-4-1-1024x422-1.jpg?width=1244&height=512&name=Flowchart-4-1-1024x422-1.jpg

The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled This tax break allows individuals and couples to reduce the amount of The unified tax credit provides a predetermined financial amount that a person may gift during their lifetime and leave to heirs without incurring gift or estate taxes The tax credit

IRS Publication 524 Credit for the Elderly or the Disabled is an Internal Revenue Service IRS document that details the eligibility requirements for a tax credit that is available People age 65 or older and those who have retired early due to disability can be eligible for a federal tax credit ranging from 3 750 to 7 500 The credit for the elderly or the

Download What Is The Unified Tax Credit For The Elderly

More picture related to What Is The Unified Tax Credit For The Elderly

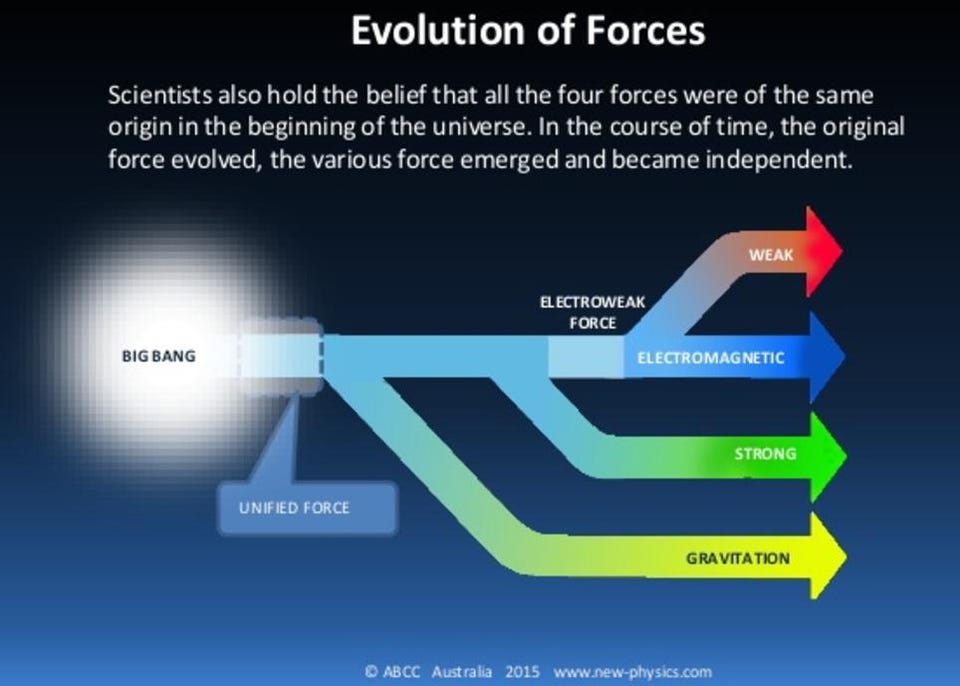

Ask Ethan What Does Grand Unified Theory Mean Big Think

https://bigthink.com/wp-content/uploads/2022/01/abcc.jpg

FinancialFridays Seniors Tax Credits Part 1 United Way Of Bruce Grey

https://unitedwayofbrucegrey.com/wp-content/uploads/2022/03/275750249_10159719719897970_6754699348310005992_n-1024x1024.jpg

Unified Number UAE How To Find It On Visa Guide 2022

https://connectme.ae/wp-content/uploads/2022/10/unified-number.jpg

In short the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes kick in The unified aspect of this tax credit The Credit for the Elderly and Disabled ranges from 3 750 to 7 500 depending on your income and filing status If you owe 4 000 in taxes before the credit and you get a

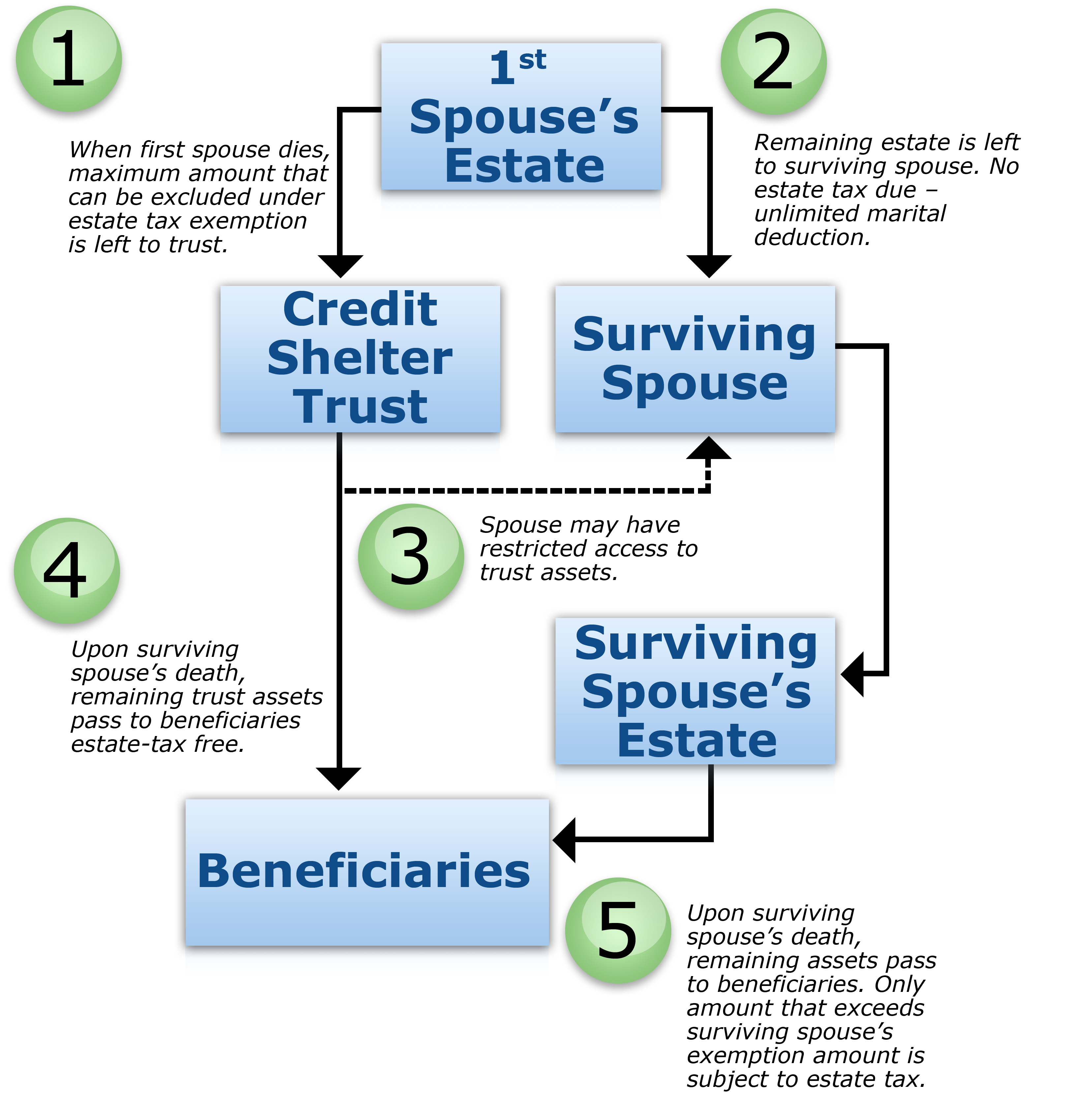

Simplified Form for Low Income Seniors Eligible seniors can file Form SC 40 to claim a refund of the Unified Tax Credit for the Elderly Most taxpayers claim this credit by filing their taxes on What exactly is the unified tax credit The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer

2023 Guide To The Unified Tax Credit

https://www.oakstreetfunding.com/hs-fs/hubfs/unified tax credit 2023.png?width=526&height=315&name=unified tax credit 2023.png

An Up To 7 500 Tax Credit For The Elderly And Disabled Grady H

https://www.floridaelder.com/wp-content/uploads/2019/04/Tax-credit-1-930x620.jpg

https://www.irs.gov/publications/p524

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older TCE volunteers specialize in answering

https://www.thebalancemoney.com/what-is-a-unified...

The unified tax credit is the combined amount of your estate and lifetime gifts that will not be subject to taxes Learn how to make the most of this tax credit

Everything You Need To Know About Unified Number UAE

2023 Guide To The Unified Tax Credit

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)

Unified Tax Credit Smartinvestplan

The Future Of The Unified Tax Credit And Potential Strategies CBA s

What Is UID Number In UAE How To Check The UID Number Online

What Is The Unified Credit Amount Leia Aqui What Is The Unified

What Is The Unified Credit Amount Leia Aqui What Is The Unified

When Can You Claim The Federal Tax Credit For Electric Cars OsVehicle

Form Sc 40 Unified Tax Credit For The Elderly 2000 Printable Pdf

What Does Unified Credit Mean Leia Aqui What Is An Example Of A

What Is The Unified Tax Credit For The Elderly - People age 65 or older and those who have retired early due to disability can be eligible for a federal tax credit ranging from 3 750 to 7 500 The credit for the elderly or the