What Is Total Income Tax Deducted Total income is the taxpayer s income that remains after taking into account all the permissible deductions under the income tax act It is calculated by subtracting GTI

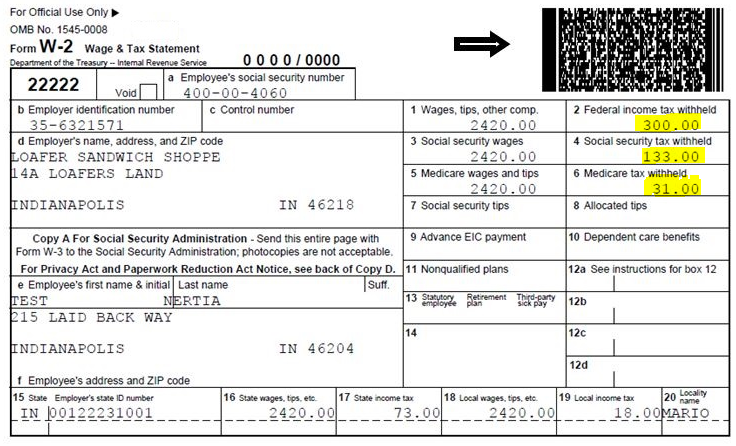

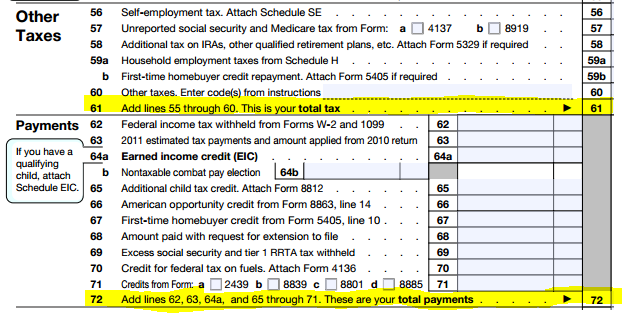

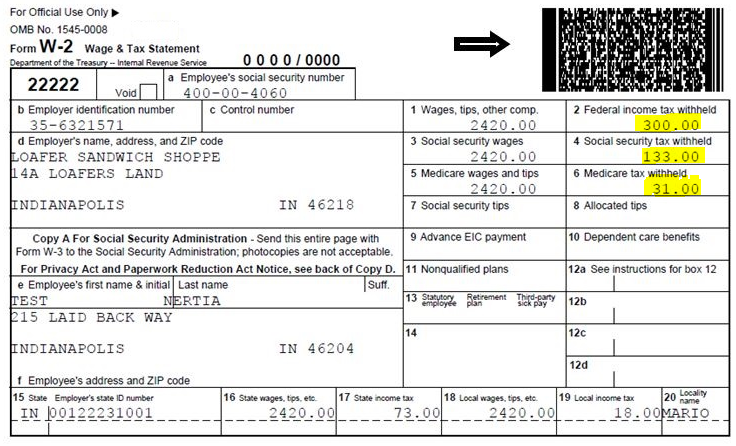

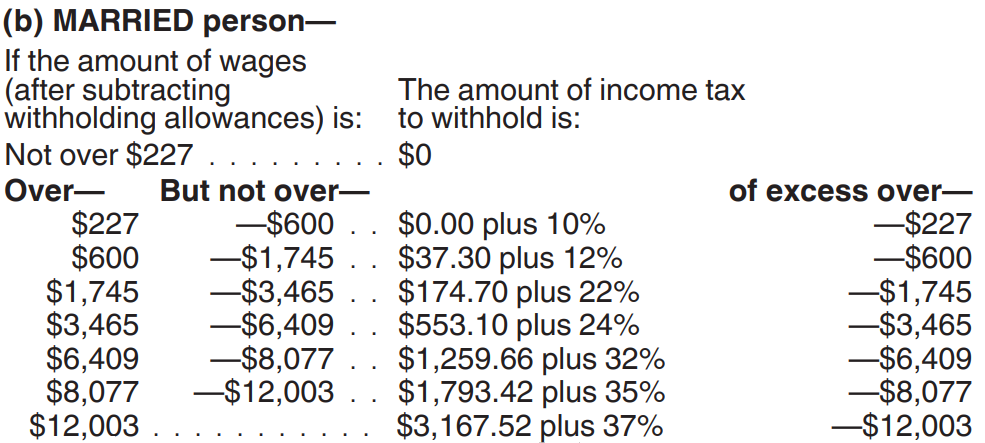

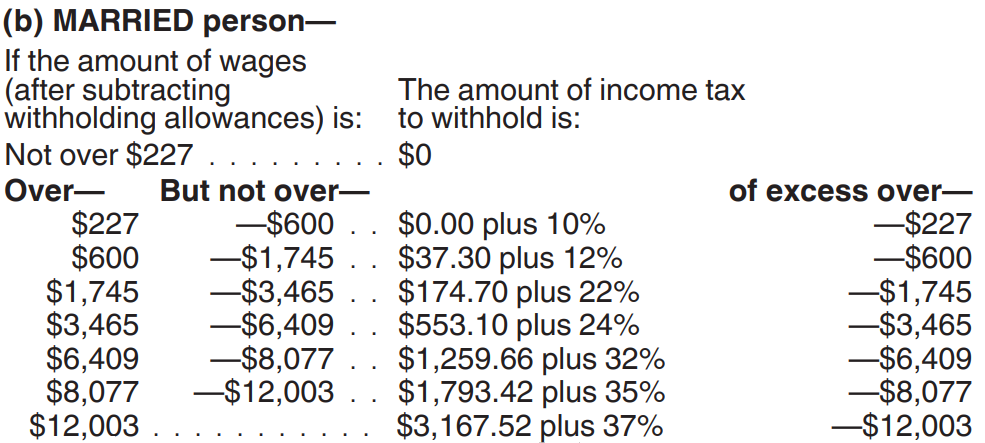

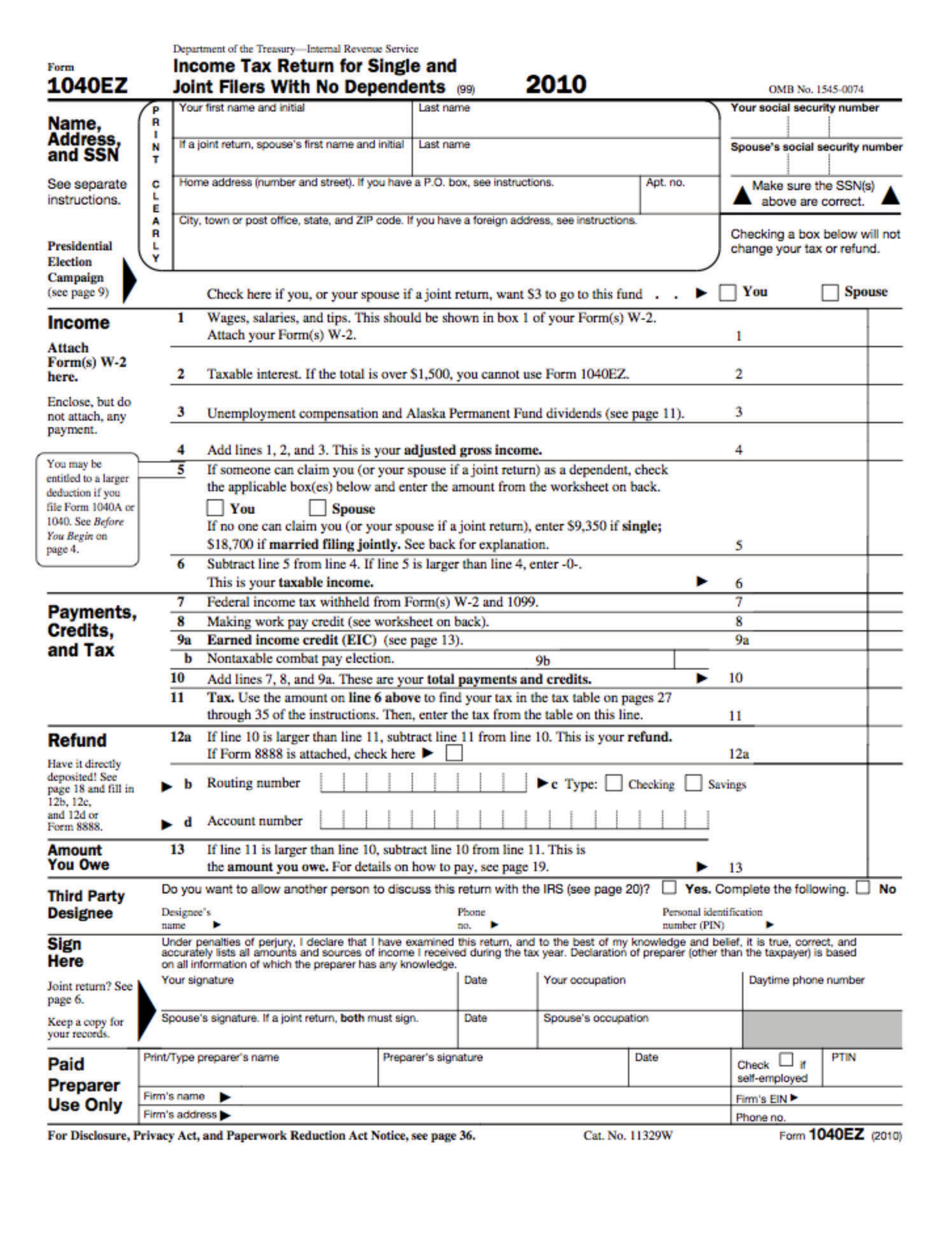

Total tax is all taxes owed by a taxpayer for the year after credits and deductions The IRS determines whether you get a refund or owe money To calculate Net Income Before Adjustments line 23400 on the tax return deduct the following items from Total Income for Tax Purposes registered pension plan deduction from T4 and T4A slips

What Is Total Income Tax Deducted

What Is Total Income Tax Deducted

https://i2.wp.com/physicianfinancebasics.com/wp-content/uploads/2020/08/total-income-1024x380.png

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

http://www.tax-rates.org/wp-content/uploads/2012/04/1040-total.png

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

Income tax bands and rates 2024 25 Income tax band Taxable income Tax rate Personal allowance Up to 12 570 0 Basic rate 12 571 to 50 270 20 Higher rate Total income is the sum of all income sources before deductions or adjustments It represents the full amount of money you earned in a given year Net income on the other

Your PF is deducted at 12 of your basic salary It is usually a large portion of your total salary Salaried individuals who live in a rented house apartment can claim house rent allowance or HRA to lower tax outgo 103 rowsFind out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

Download What Is Total Income Tax Deducted

More picture related to What Is Total Income Tax Deducted

Pin On Income Tax Blogs

https://i.pinimg.com/originals/7f/63/ec/7f63ec88885e63841ab2aa85433df846.jpg

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Visualizing Taxes Deducted From Your Paycheck In Every State

https://cdn.howmuch.net/articles/how-much-money-gets-taken-out-paychecks-1542.jpg

14 rowsEvery employee in Canada who earns 500 or more in employment income within a calendar year January 1 to December 31 must receive a T4 from every Calculate your Taxes by using our Tax Calculator Depending on the applicable tax slab you need to pay the tax on your total income which is determined by subtracting the

The amount of tax deducted from your salary depends on your earnings tax slab and the tax regime old or new you choose After accounting for non operating items such as taxes and interest expense net income also known as the bottom line is calculated Net income is what s left after all

Kentucky Employee State Withholding Form 2022 Employeeform Net

https://www.employeeform.net/wp-content/uploads/2022/06/w2-withholding-calculator-tax-withholding-estimator-2021.png

All About Tax Deducted At Source Under Income Tax YouTube

https://i.ytimg.com/vi/fuqNUU5whRU/maxresdefault.jpg

https://tax2win.in › guide › total-income

Total income is the taxpayer s income that remains after taking into account all the permissible deductions under the income tax act It is calculated by subtracting GTI

https://www.investopedia.com › terms › to…

Total tax is all taxes owed by a taxpayer for the year after credits and deductions The IRS determines whether you get a refund or owe money

Tutorial Download Income Balance Sheet For Free Printable PDF DOC

Kentucky Employee State Withholding Form 2022 Employeeform Net

How To Calculate Income Tax FY 2020 21 EXAMPLES New Income Tax

WHAT IS TDS Tax Deducted At Source Source Of Income Tax

Misconceptions On TDS Tax Deducted At Source Certicom

How To Calculate Payroll And Income Tax Deductions PEO Human

How To Calculate Payroll And Income Tax Deductions PEO Human

TDS Income Tax Tax Deducted At Source Lecture 1 CA I CMA I CS I

Yes The Top 1 Percent Do Pay Their Fair Share In Income Taxes U S

Income Tax E Filing Form Download Osekits

What Is Total Income Tax Deducted - Taxable income is a central concept that forms the basis for calculating income tax It comprises the income of an individual or company after deduction of all allowable expenses allowances