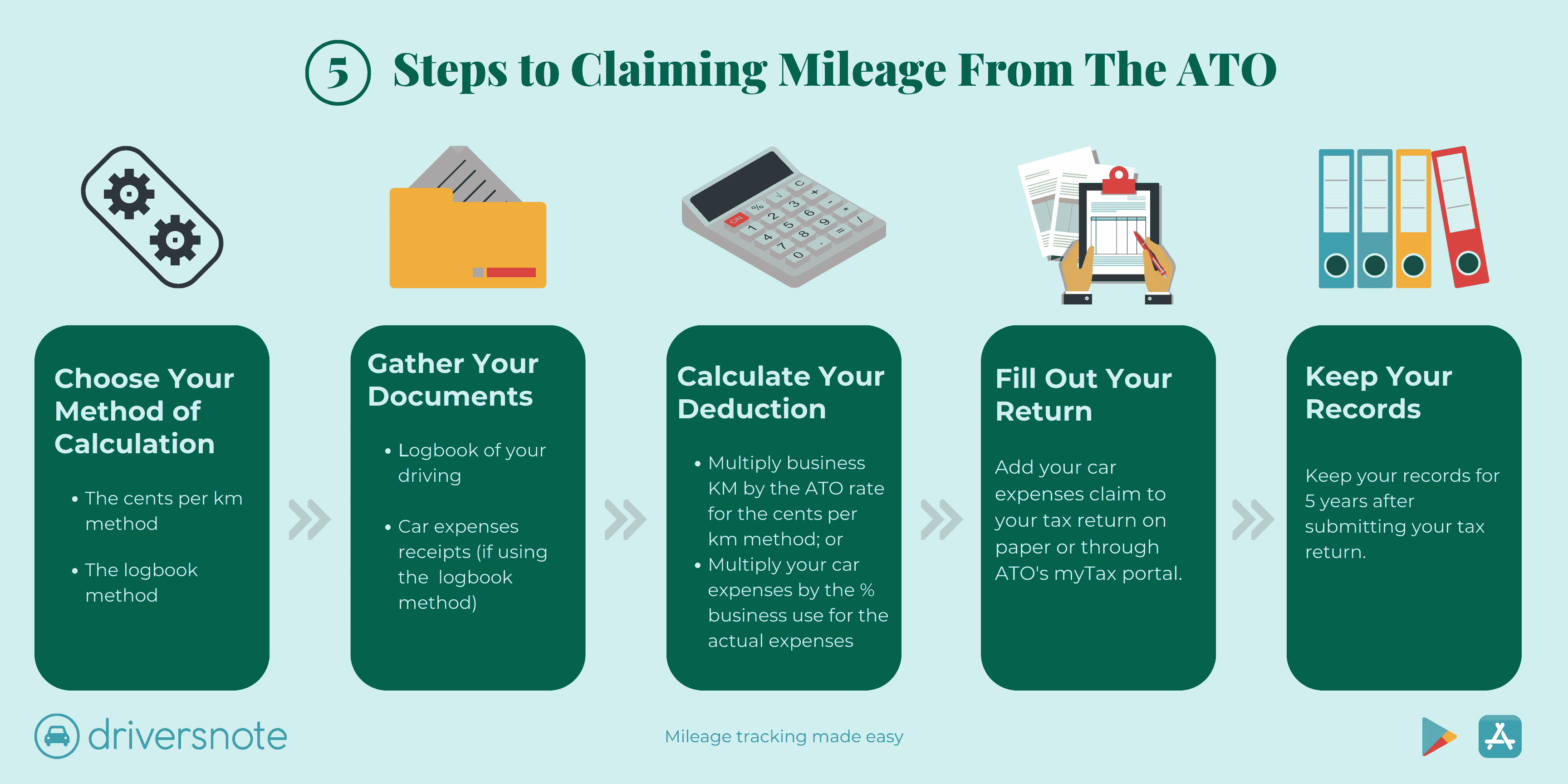

What Mileage Can I Write Off For Doordash Web 1 Mileage or Car Expenses One of the best tax deductions for Doordash drivers or

Web The answer to the question can you write off mileage as a DoorDash driver is yes However you just need to decide which IRS method the standard rate vs the actual car expense method you want to use Web Can one write off both milage and gasoline If I use 100 of that gas for DoorDash

What Mileage Can I Write Off For Doordash

What Mileage Can I Write Off For Doordash

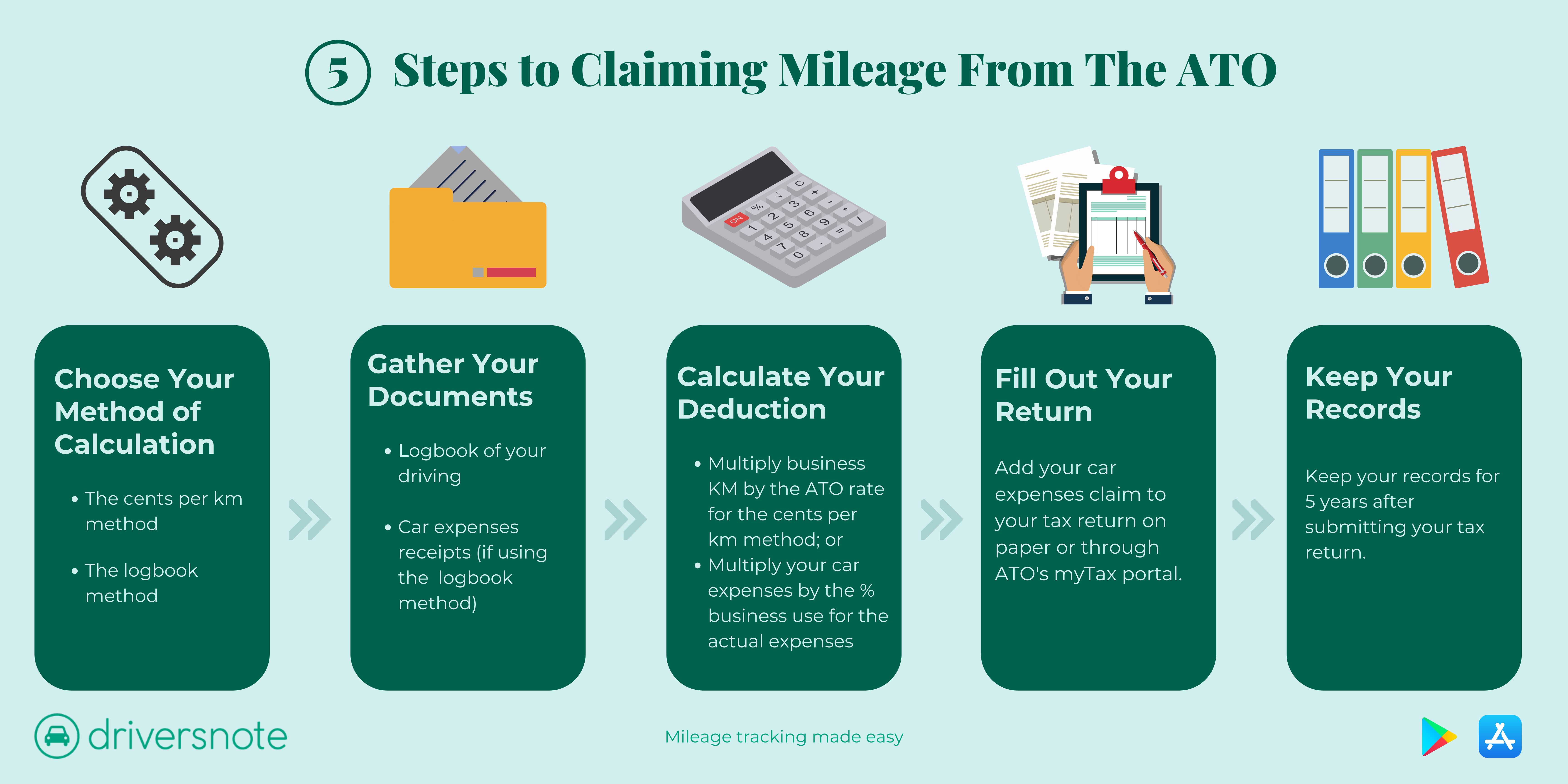

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Door Dash Printable Delivery In Progress Sign For Your Car Dashboard Etsy

https://i.etsystatic.com/12280241/r/il/e3f5e1/3377510549/il_fullxfull.3377510549_lod3.jpg

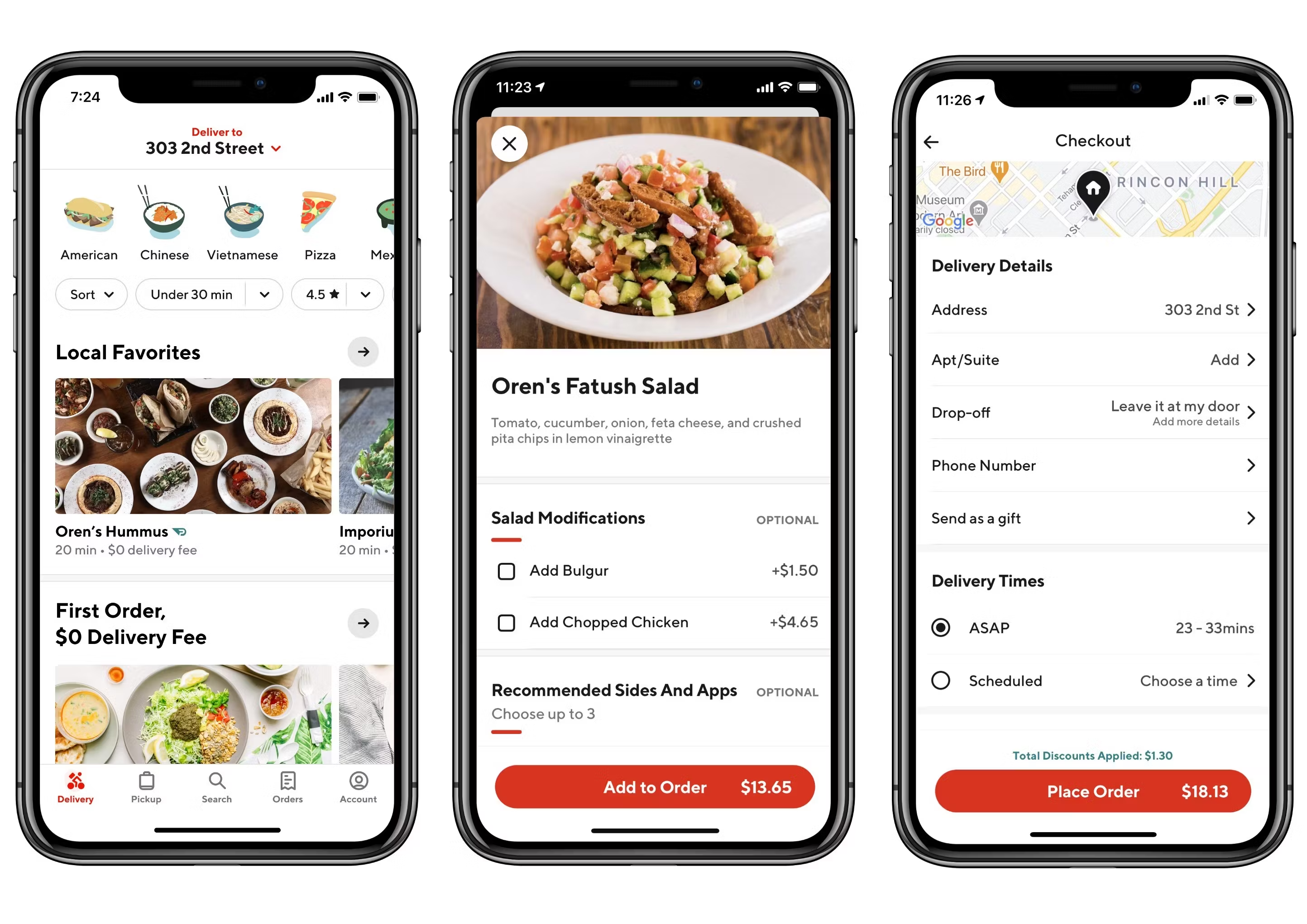

DoorDash Reviews Cost Features GetApp Australia 2023

https://gdm-catalog-fmapi-prod.imgix.net/ProductScreenshot/34502fb4-f9fd-4396-ab56-45dd5cf908d2.jpeg?auto=format&q=50

Web 24 Sept 2022 nbsp 0183 32 Can I claim the standard mileage for Doordash bicycle e bike scooter or motorcycle deliveries No The standard mileage deduction can only be used for cars vans pickup trucks panel trucks Web 19 Jan 2023 nbsp 0183 32 Here are the business expenses you can write off Mileage Because Doordash is considered self employment Dashers can deduct their non commuting business mileage This includes miles that you

Web Vor 4 Tagen nbsp 0183 32 If you are a DoorDash delivery driver you may be wondering how many Web 16 M 228 rz 2023 nbsp 0183 32 Dashers can lower their taxable income by deducting business expenses such as mileage parking tolls cell phone usage insulated courier bags inspections repairs health insurance and

Download What Mileage Can I Write Off For Doordash

More picture related to What Mileage Can I Write Off For Doordash

How To File DoorDash Taxes DoorDash Drivers Write offs

https://andersonadvisors.com/wp-content/uploads/2021/09/Doordash_blog-1.png

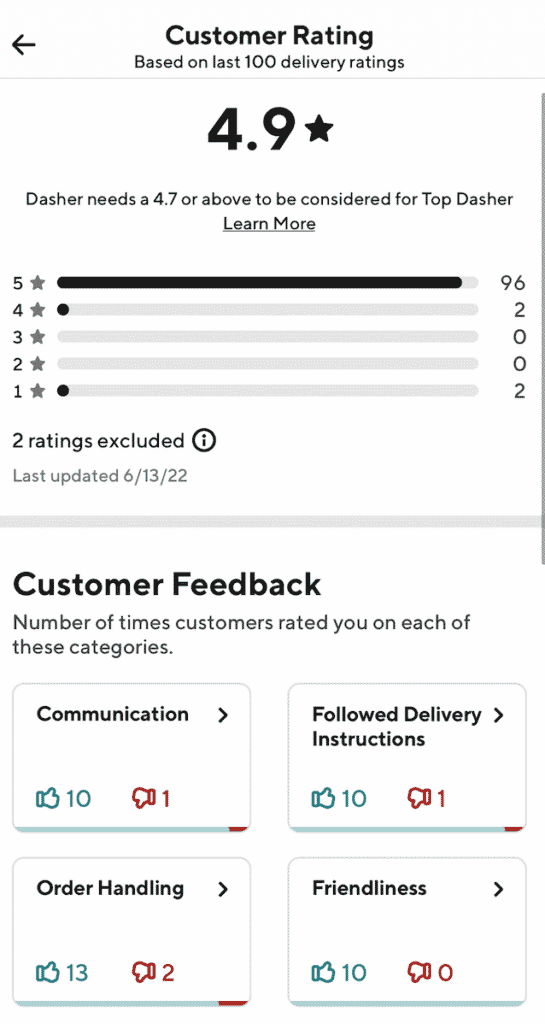

Can You See Your DoorDash Reviews Financial Panther

https://financialpanther.com/wp-content/uploads/Screen-Shot-2022-06-13-at-3.12.48-PM-545x1024.png

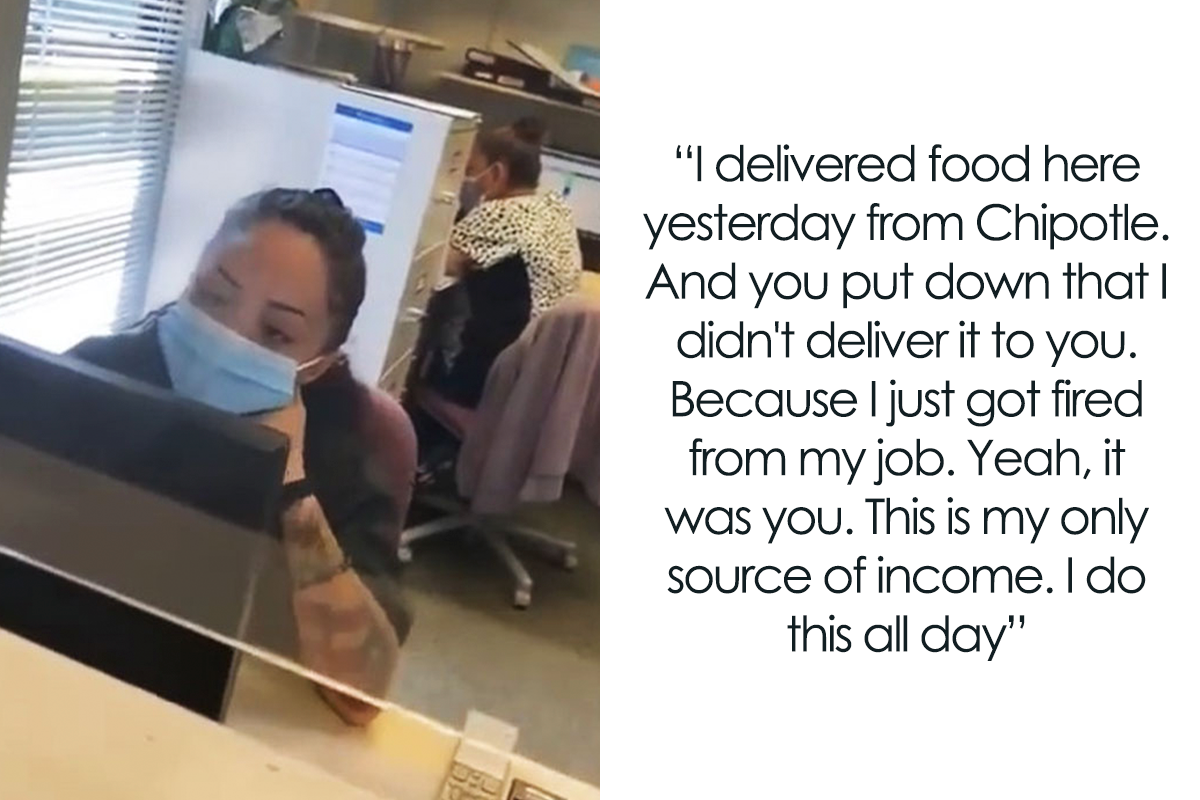

DoorDash Driver Gets Fired Confronts The Client At Her Office For

https://www.boredpanda.com/blog/wp-content/uploads/2022/08/doordash-gets-fired-confronts-customer-cover_800.png

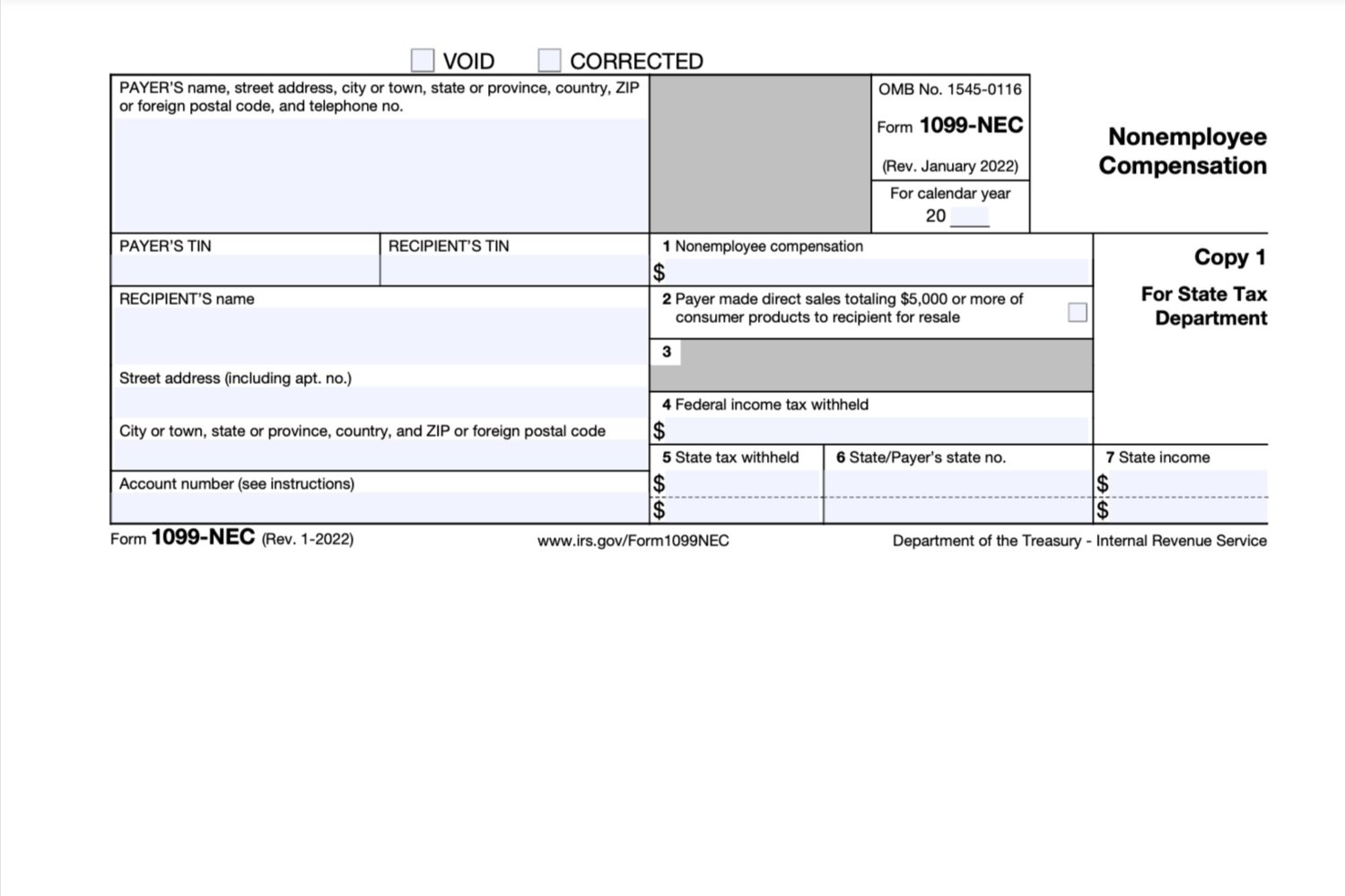

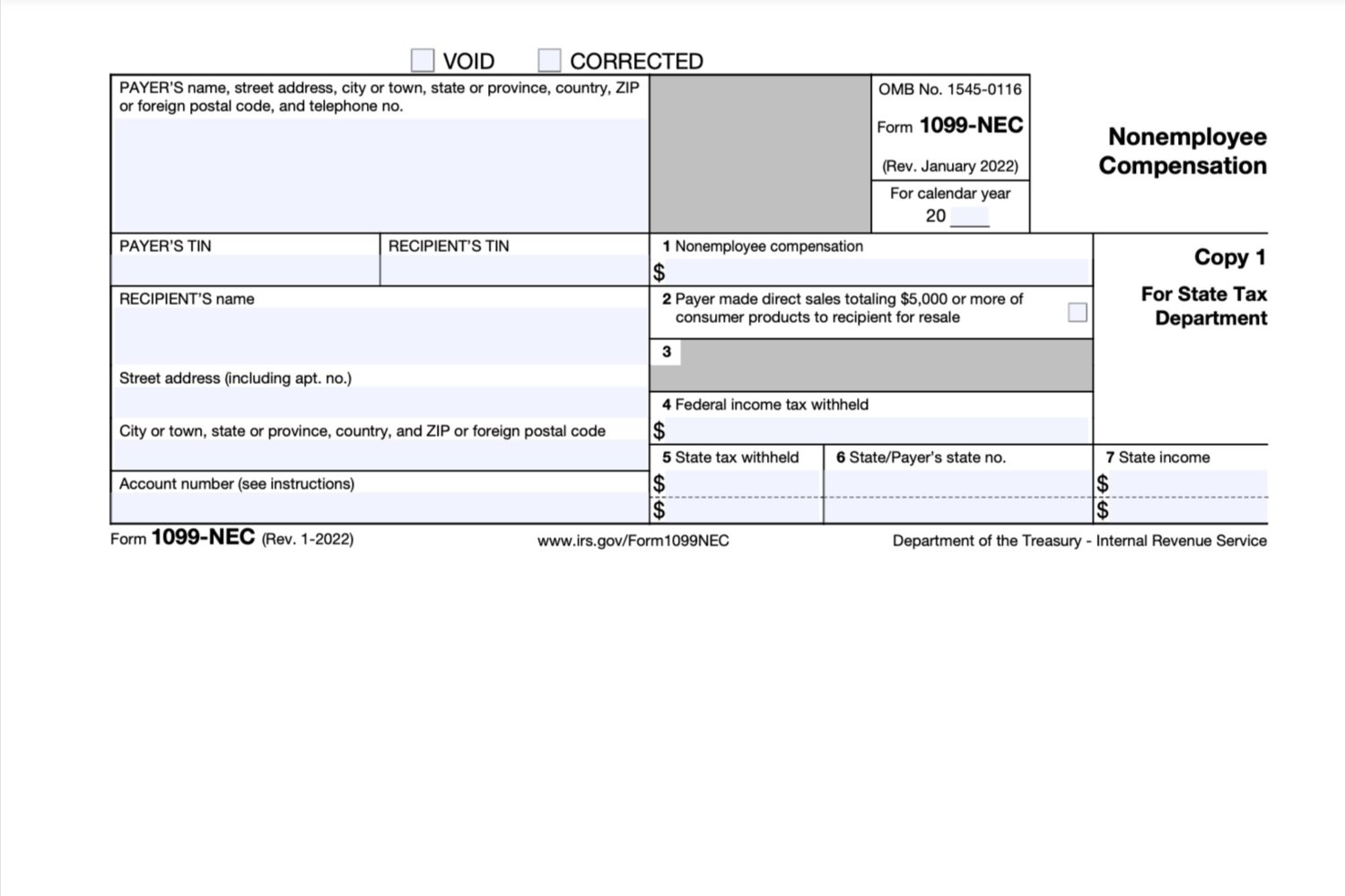

Web 2 Jan 2024 nbsp 0183 32 If you earn 600 or more as a DoorDash driver in a given year you re Web Vor 2 Tagen nbsp 0183 32 Yes as a Doordash driver you may be able to write off your car payment

Web The most common way for delivery drivers to write off mileage is with the Standard Web Dasher Guide to Taxes Disclaimer As an independent contractor you are responsible for

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/bea1cd88-6aec-4981-a2c0-962d82b5638a/screencapture-irs-gov-pub-irs-pdf-f1099nec-pdf-2022-01-10-13_48_46.jpg

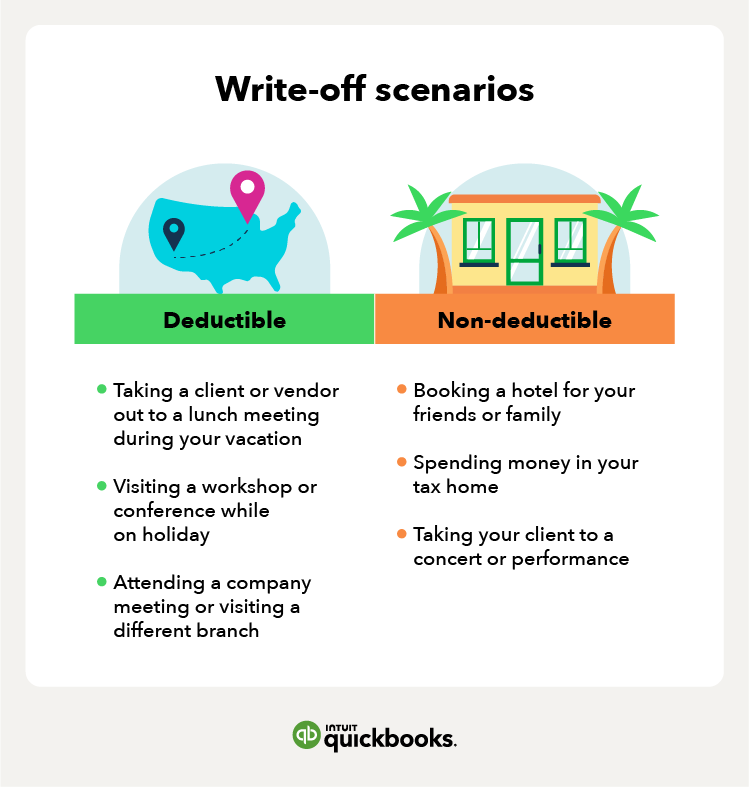

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/write-off-scenarios.png

https://www.everlance.com/blog/top-deductions-for-doordash

Web 1 Mileage or Car Expenses One of the best tax deductions for Doordash drivers or

https://falconexpenses.com/blog/can-yo…

Web The answer to the question can you write off mileage as a DoorDash driver is yes However you just need to decide which IRS method the standard rate vs the actual car expense method you want to use

How To Write Off Business Expenses Knowdemia

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

Tax Write offs For LLCs Maximize Deductions TRUiC

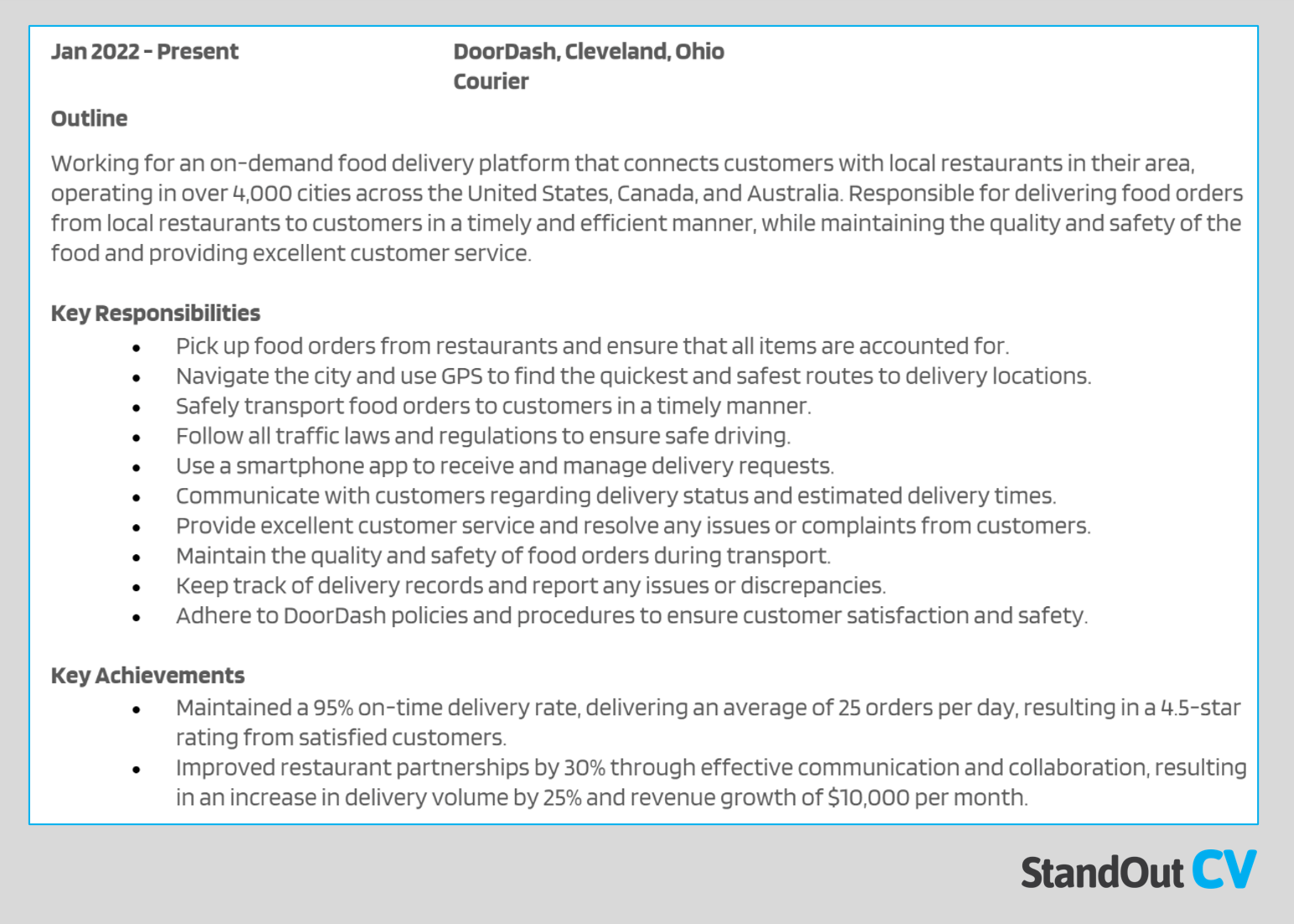

How To Put DoorDash Or Uber Eats On Your Resume

Should I Put DoorDash On My Resume The Facts Examples

Can You Write Off Mileage For DoorDash Falcon Expenses Blog

Can You Write Off Mileage For DoorDash Falcon Expenses Blog

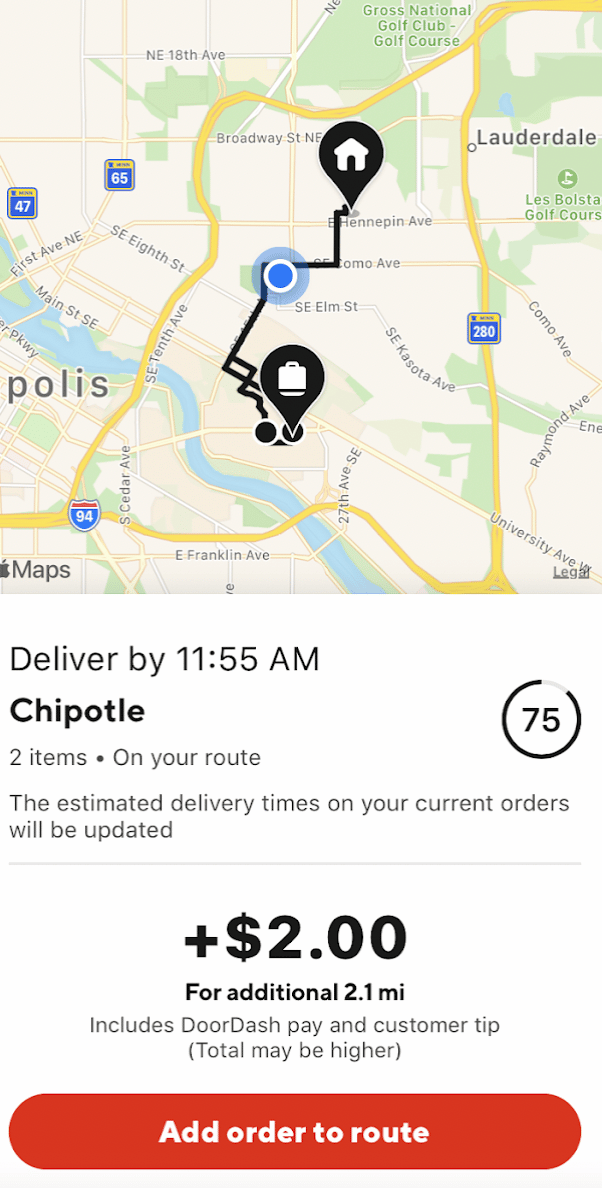

Do DoorDash Drivers Pick Up Multiple Orders Financial Panther

How To See Drop Off Location Of Order Before Accepting On DoorDash For

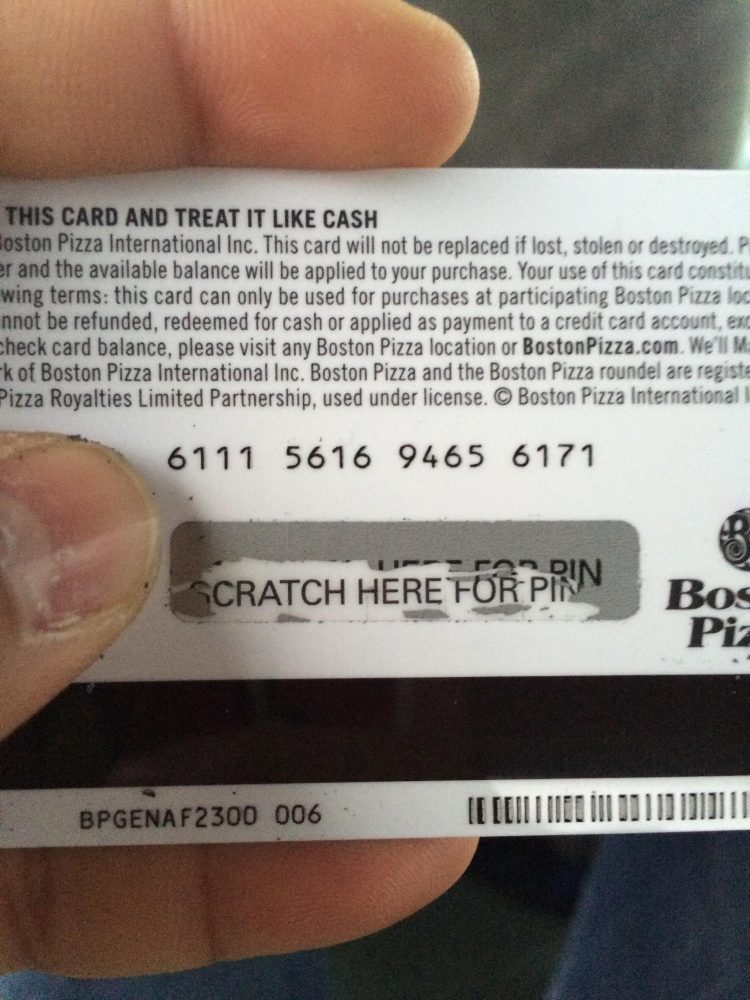

Doordash Gift Card Pin Scratched Off How To Recover Milvestor

What Mileage Can I Write Off For Doordash - Web 16 M 228 rz 2023 nbsp 0183 32 Dashers can lower their taxable income by deducting business expenses such as mileage parking tolls cell phone usage insulated courier bags inspections repairs health insurance and