Mileage Tax Rebate Web 21 mars 2023 nbsp 0183 32 Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel as a tax

Web 10 000 miles 45p per mile 163 4500 Mileage 163 4500 20 tax relief 163 900 This example was based on a car user driving 10 000 miles during the tax year If they were Web 9 juin 2023 nbsp 0183 32 45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay employees an amount towards the mileage

Mileage Tax Rebate

Mileage Tax Rebate

https://i.pinimg.com/originals/df/61/f1/df61f192a85e1b14ab585b6f451af531.jpg

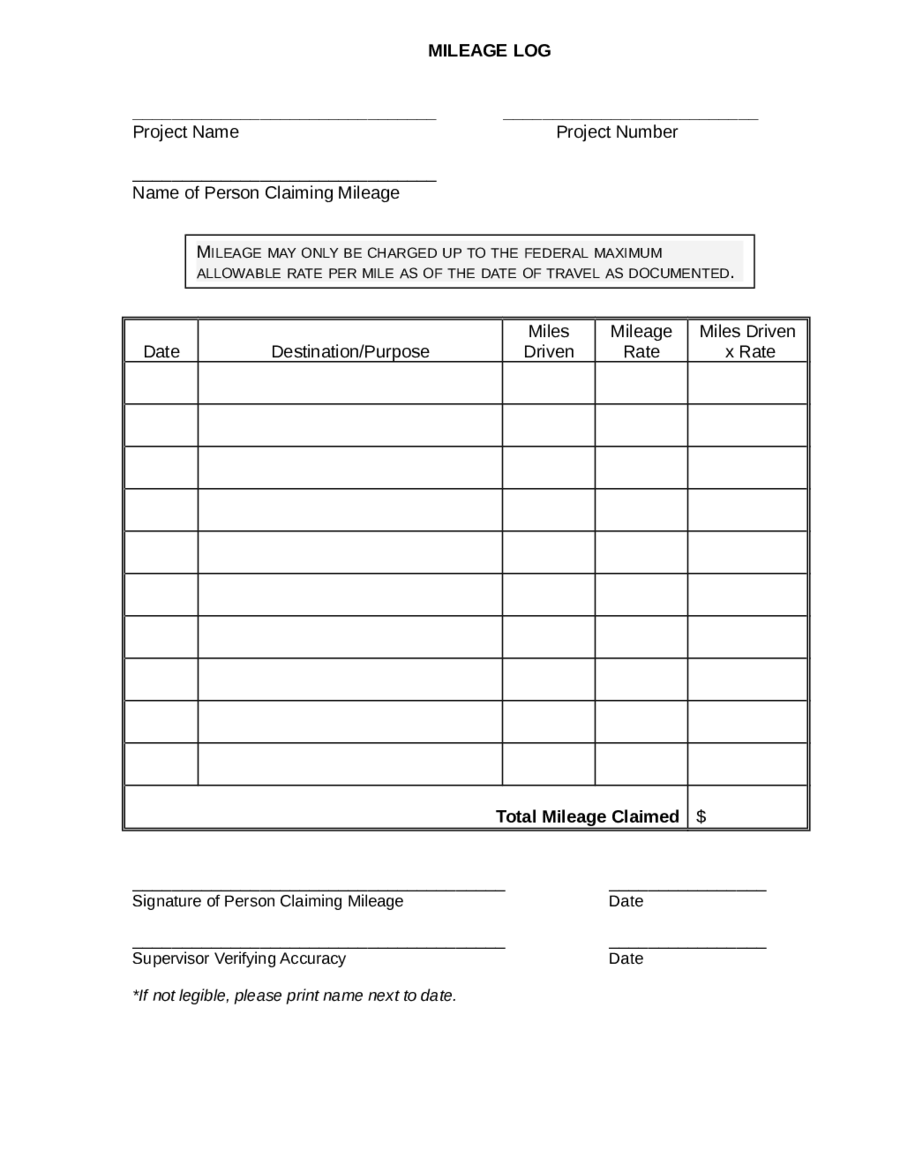

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-2-1024x319.png

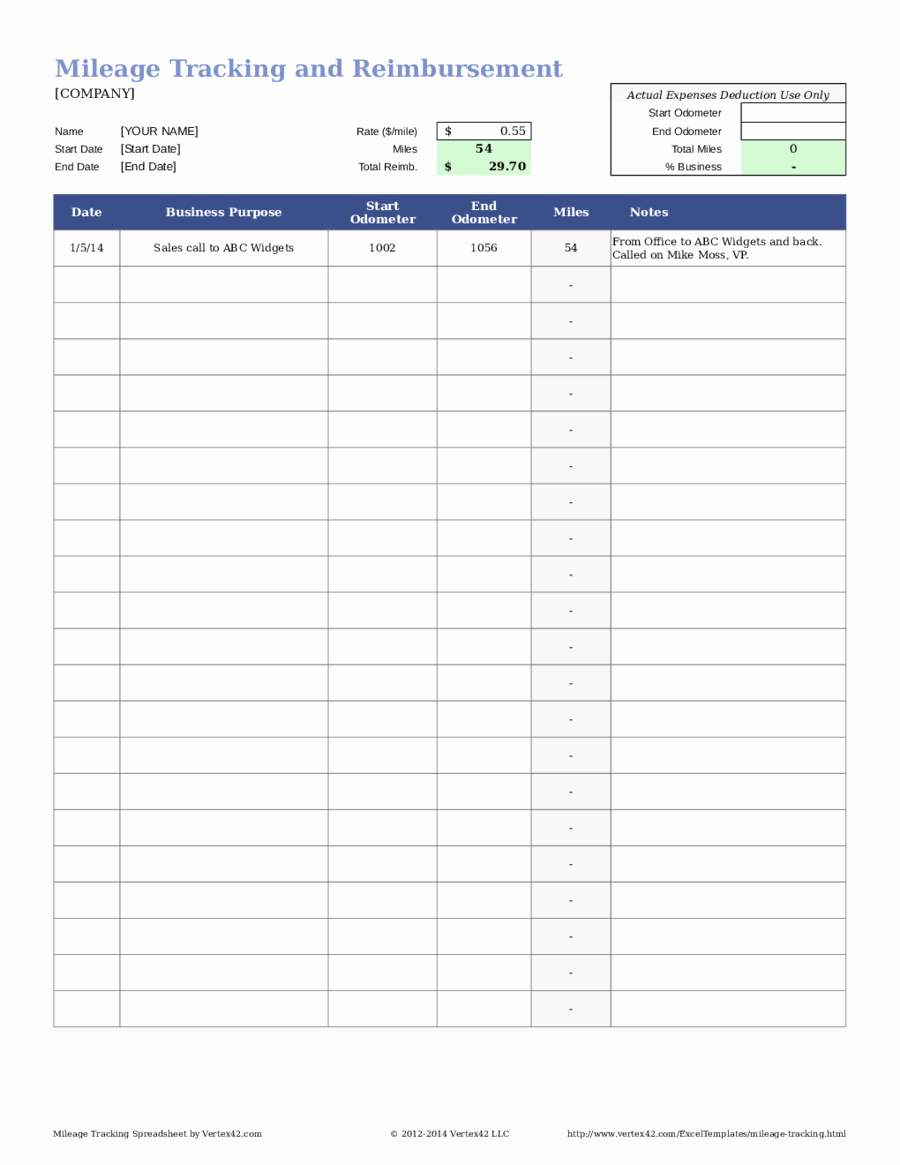

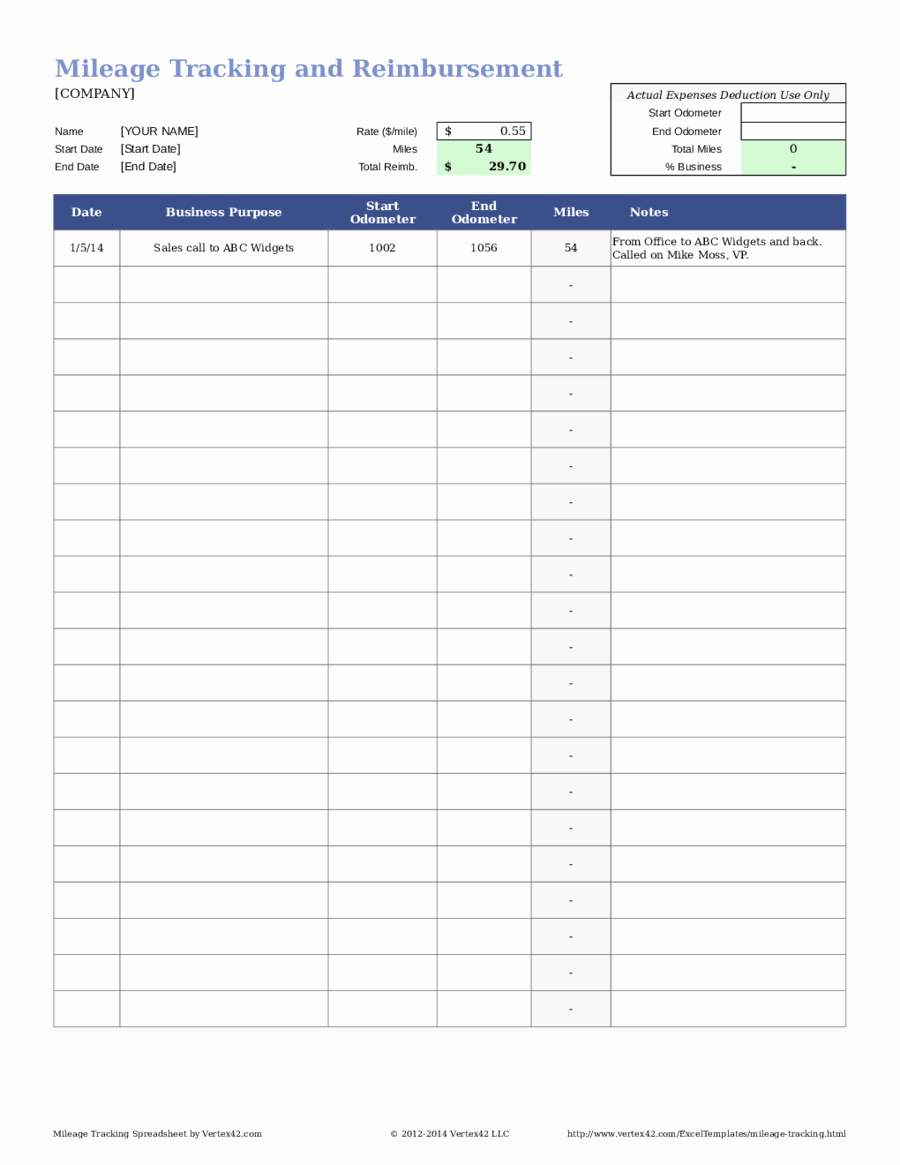

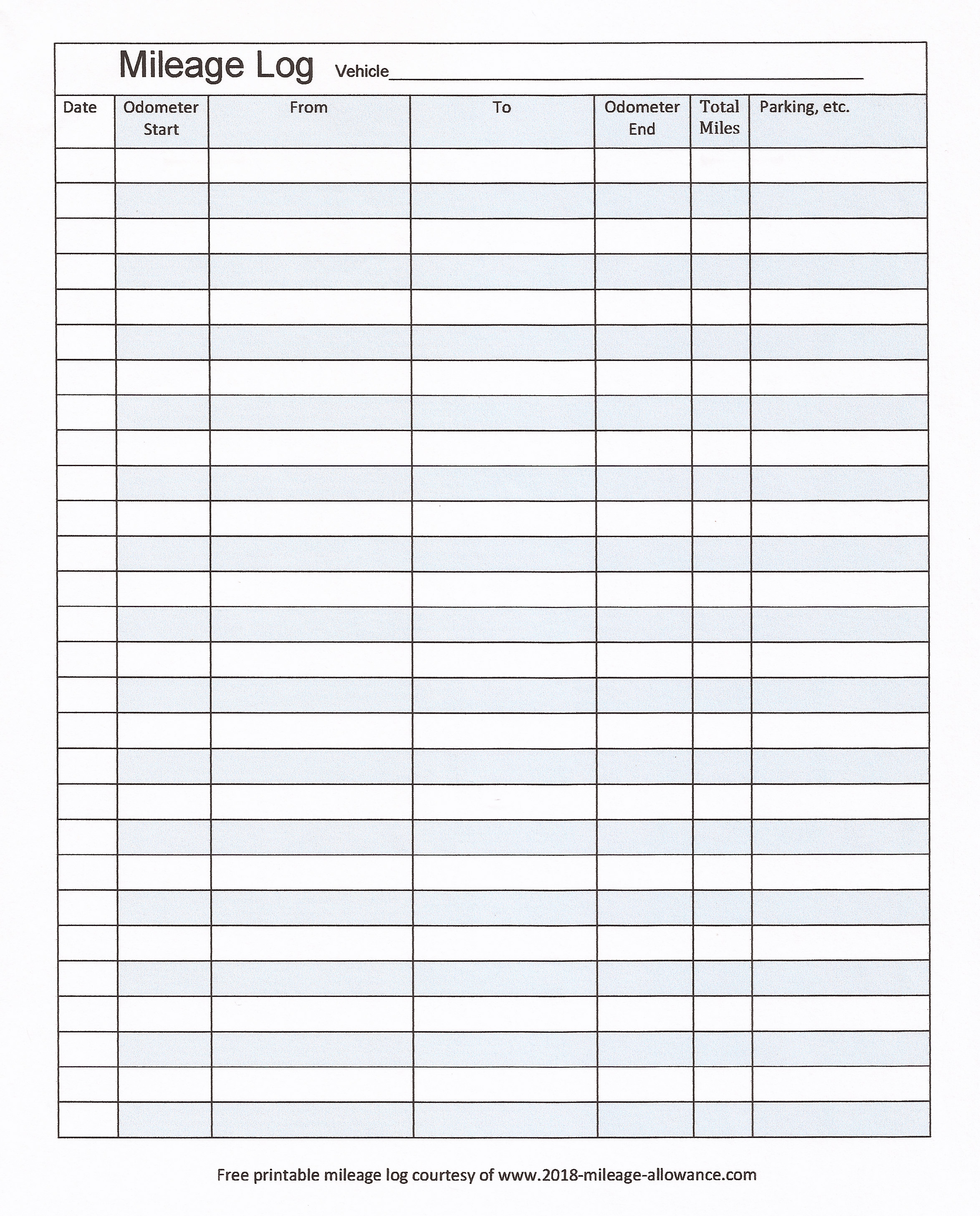

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

https://i.pinimg.com/originals/74/27/72/74277222a9d4830d0a5d5265e743fb9c.jpg

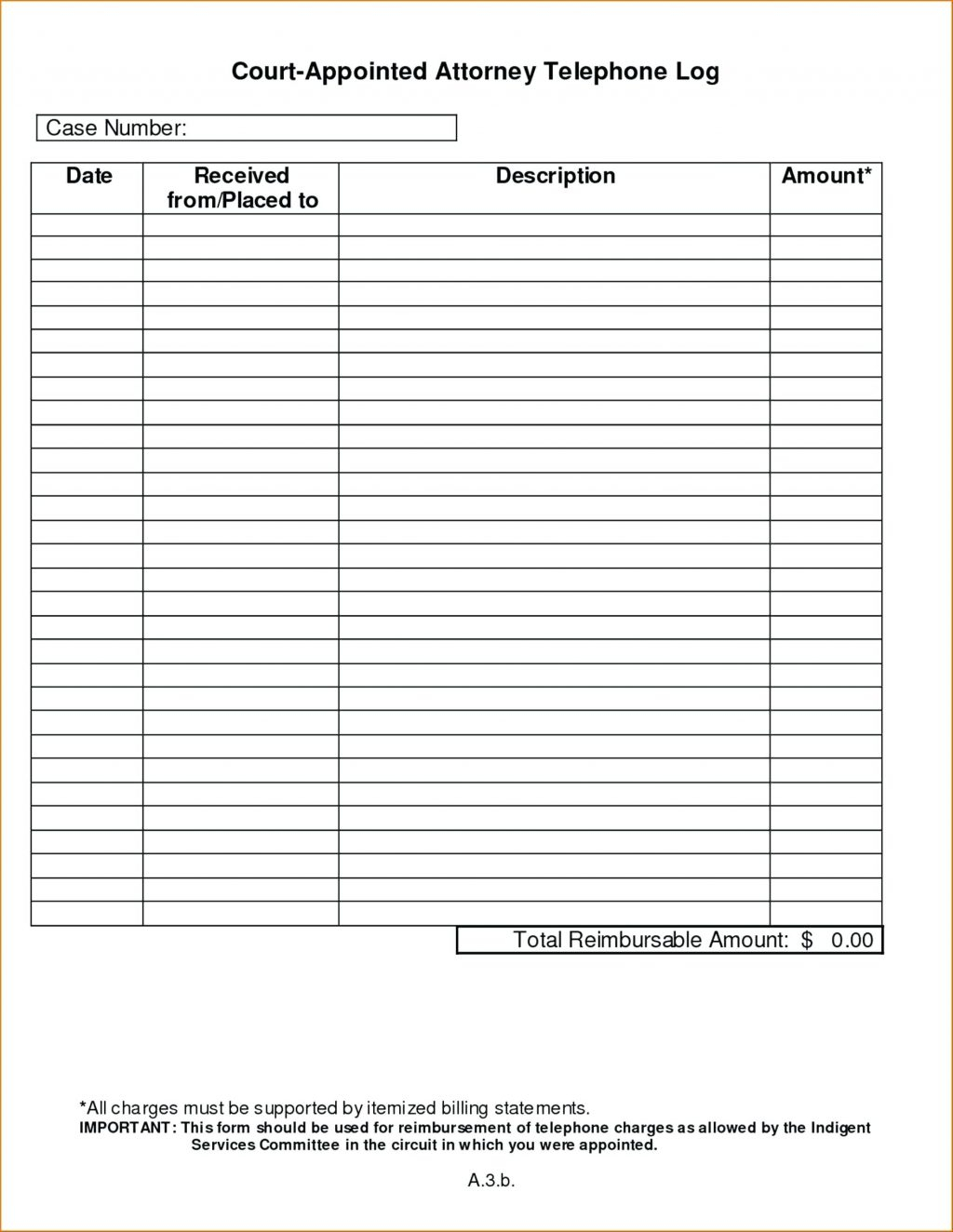

Web View Your Estimated Mileage Tax Rebate What is Mileage Allowance Rebate Mileage Allowance Relief is a tax refund from the HMRC for deducting the costs of business trips Web 1 What is the Work Mileage Tax Rebate 2 How to Calculate the Work Mileage Tax Rebate 3 How to Claim a Tax Rebate on Work Mileage 3 1 Claims Below 163 2 500 3 2 Claims Over 163 2 500 4 How is the Work

Web 27 janv 2023 nbsp 0183 32 Just to make things a tad more confusing the IRS also announced that beginning in January the standard mileage rate for business use is going up again to 65 5 cents per mile driven for business Web 1 juin 2020 nbsp 0183 32 HMRC allows you to claim 45p per mile for the first 10 000 miles and 25p for over 10 000 miles for your fuel and other vehicle expenses Business mileage Traveling

Download Mileage Tax Rebate

More picture related to Mileage Tax Rebate

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

Mileage Log Template For Taxes Awesome Free Mileage Spreadsheet For

https://i.pinimg.com/originals/83/e0/1f/83e01f67e4be5e30783b672af4d0b280.jpg

Mileage Log Form For Taxes Awesome 2019 Mileage Log Fillable Printable

https://i.pinimg.com/originals/6f/6b/27/6f6b275a4b34f6b54f6b92e27be13337.jpg

Web 20 40 How much can I receive in return from HMRC in the form of a rebate HMRC S business mileage rates for 2023 The HMRC business mileage rates remain Web The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the deductible costs of

Web Total tax rebate 163 5 000 x 20 163 800 Are there time limits for claiming You must claim within 4 years after the end of the tax year This means you claim relief on all mileage Web The average mileage expenses rebate made with RIFT Tax Refunds is worth 163 3 000 Many people don t realise that it s not something HMRC will automatically give back to you you

50 Mileage Log Form For Taxes Ufreeonline Template

https://ufreeonline.net/wp-content/uploads/2019/04/mileage-log-form-for-taxes-luxury-2019-mileage-log-fillable-printable-pdf-amp-forms-of-mileage-log-form-for-taxes.png

![]()

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

https://money.usnews.com/money/personal-finance/taxes/articles/...

Web 21 mars 2023 nbsp 0183 32 Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel as a tax

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web 10 000 miles 45p per mile 163 4500 Mileage 163 4500 20 tax relief 163 900 This example was based on a car user driving 10 000 miles during the tax year If they were

2023 Mileage Log Fillable Printable PDF Forms Handypdf

50 Mileage Log Form For Taxes Ufreeonline Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For

50 Example Mileage Log For Taxes Ufreeonline Template

Mileage Log Form For Taxes Example Of Spreadsheet Free Irs Template

Tax Deductions Printable Editable Vehicle Mileage Expense Log

Tax Deductions Printable Editable Vehicle Mileage Expense Log

Mileage Spreadsheet For Taxes With Regard To Irs Mileage Sheet Alex

Mileage Allowance Relief Calculator CALCULATORUK CVG

Mileage Log Template For Taxes Best Of Mileage Form Forms Reimbursement

Mileage Tax Rebate - Web 25 juin 2021 nbsp 0183 32 June 25 2021 You can usually claim mileage tax relief on cars vans motorcycles or bicycles that you use for business purposes It applies to vehicles you