What Nursing Expenses Are Tax Deductible Common tax deductible nurse expenses Here are common tax deductions for travel nurses home health nurses and other 1099 nurses Vehicle use and mileage Vehicle

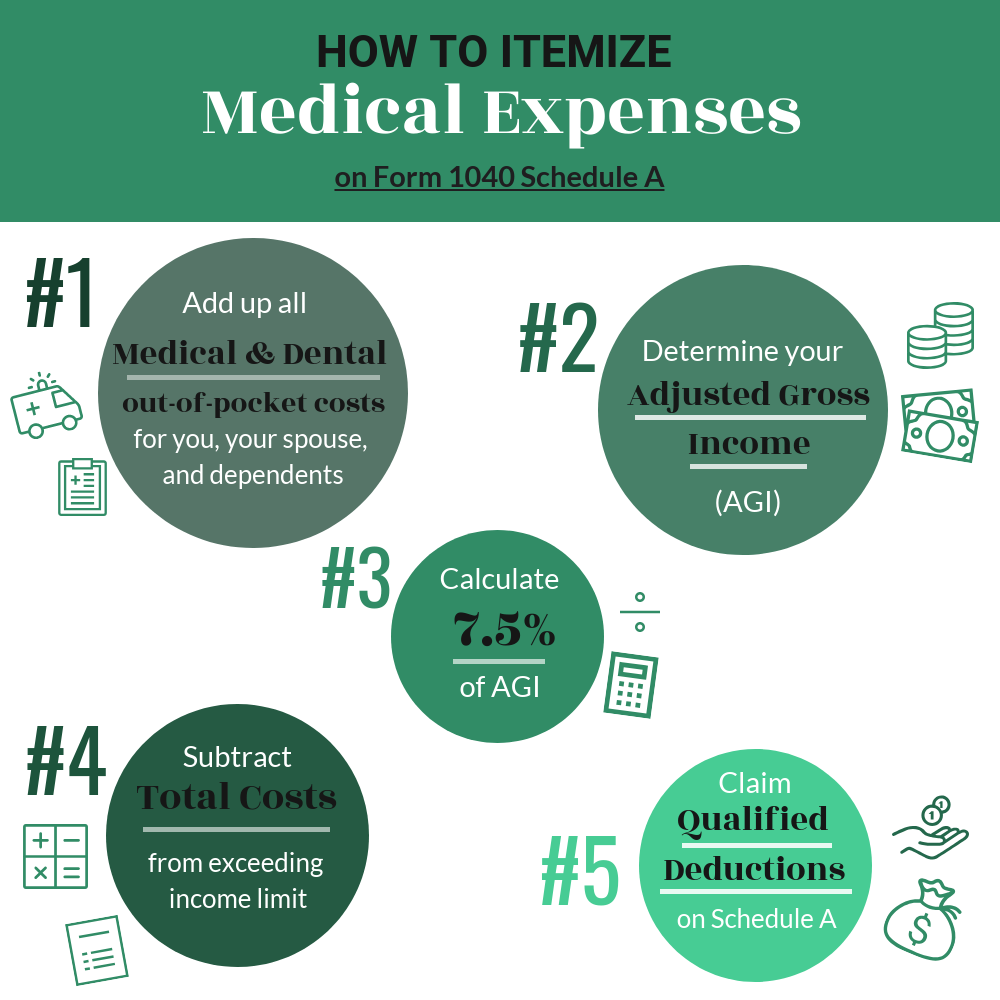

As of 2024 the IRS allows certain medical expenses including those for nursing home care to be deducted if they exceed 7 5 of the taxpayer s adjusted gross income AGI Like other medical expenses nursing home and assisted living costs are only deductible if you itemize your deductions instead of taking the Standard Deduction You can

What Nursing Expenses Are Tax Deductible

What Nursing Expenses Are Tax Deductible

https://www.lihpao.com/wp-content/uploads/2023/01/are-nursing-home-care-expenses-deductible.jpg

Are Nursing Home Expenses Tax Deductible

https://s.yimg.com/ny/api/res/1.2/pelwqbcnBpw2PNkTTlqnWg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTQyNw--/https://dr5dymrsxhdzh.cloudfront.net/blog/images/a8f966a32/2022/10/iStock-1242630220.jpg

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

Nurses have many expenses related to their profession and if you are paying for things required by your job then you can probably deduct those costs Anything that reduces your federal taxable income means more money According to the IRS qualifying medical expenses for long term care can include preventive therapeutic treating mitigating curing or rehabilitative services Expenses for in home

Read on for a list of the top tax deductions for nurses and healthcare professionals so you can file taxes in a snap and save some money Before you file your taxes and start thinking about deductions it s important to consider Yes some nursing home costs are tax deductible The costs that can be deducted generally fall under medical expenses However it s important to understand that strict rules and restrictions apply Nursing homes are not the

Download What Nursing Expenses Are Tax Deductible

More picture related to What Nursing Expenses Are Tax Deductible

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Printable Itemized Deductions Worksheet

https://www.anchor-tax-service.com/s/cc_images/cache_2322205.jpg?t=1395581512

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

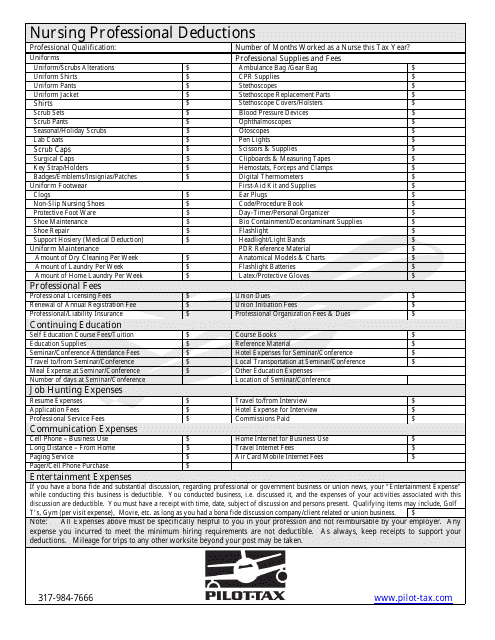

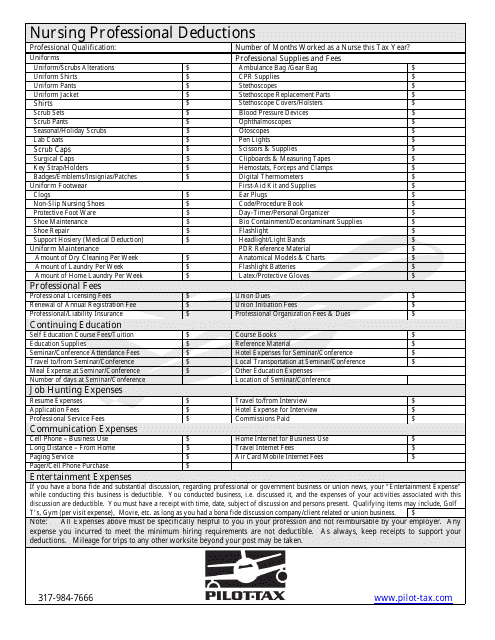

Educator expenses Eligible educators can deduct up to 250 for unreimbursed classroom supplies and professional development expenses Employer equivalent portion of self employment taxes If you re self While tax rules may vary several common tax deductions for nurses include work uniforms continuing education professional fees and travel expenses If you re required to wear a specific uniform for your role and you

Nurses often spend money on work related items and activities and tax deductions allow them to offset these costs By understanding which expenses are deductible The entire costs paid including meals and lodging to a nursing home home for the aged or similar institution are fully deductible as a medical expense if the person is staying at the

Nursing Professional Deductions Form Pilot Tax Fill Out Sign

https://data.templateroller.com/pdf_docs_html/295/2953/295322/nursing-professional-deductions-form-pilot-tax_big.png

10 Tax Deductions You Didn t Know You Should Be Taking

https://1.bp.blogspot.com/-Urch4572cqw/XswrsGMMSCI/AAAAAAAB5Qw/DXAiOOOysSYA4bCVBnd_OSQ4LemxLwi_ACK4BGAsYHg/d/image3%2B%25282%2529.png

https://www.driversnote.com › blog › nurse-tax-write-offs

Common tax deductible nurse expenses Here are common tax deductions for travel nurses home health nurses and other 1099 nurses Vehicle use and mileage Vehicle

https://accountinginsights.org › are-nursing-home...

As of 2024 the IRS allows certain medical expenses including those for nursing home care to be deducted if they exceed 7 5 of the taxpayer s adjusted gross income AGI

Property Expenses What s Tax Deductible In The Year Of Occurrence

Nursing Professional Deductions Form Pilot Tax Fill Out Sign

Medical Expense Tax Deduction Who Can Use It And How It Works Cedar

What Kind Of Medical Finance Expenses Are Tax Deductible Medical

Real Estate Agent Tax Deductions Worksheet 2022

IRS Code Section 213 d FSA Eligible Medical Expenses Deductible

IRS Code Section 213 d FSA Eligible Medical Expenses Deductible

Are You Unsure What Expenses Are Deductible For You Business This

Business Expenses To Claim On Your Federal Tax Forms

Itemized Deductions Examples Editable Template AirSlate SignNow

What Nursing Expenses Are Tax Deductible - What nursing home costs are tax deductible Generally medical costs associated with nursing home care are tax deductible However room board and meal expenses do not