What Over The Counter Medical Items Are Tax Deductible But over the counter medications like pain relievers or laxatives are not Vitamins and supplements are not deductible unless recommended by a doctor to treat a health condition such as iron pills for anemia Here is a closer look at what is and what is not tax deductible Tax Deductible Bandages Breast pumps and supplies

Some of the lesser known deductible medical expenses include acupuncture addiction treatment braille publications chiropractic services for medical care contact lenses diet food exercise programs and Some health related expenses cannot be claimed per IRS rules like nonprescription supplements vitamins over the counter medications toothpaste health club memberships and medical marijuana even if it s legal in your state See this IRS list of common but nondeductible medical expenses

What Over The Counter Medical Items Are Tax Deductible

What Over The Counter Medical Items Are Tax Deductible

http://media4.s-nbcnews.com/i/newscms/2017_24/1221158/over-the-counter-products-today-170612-tease_78d1dbf109af23b9fde91d4d2bd95491.jpg

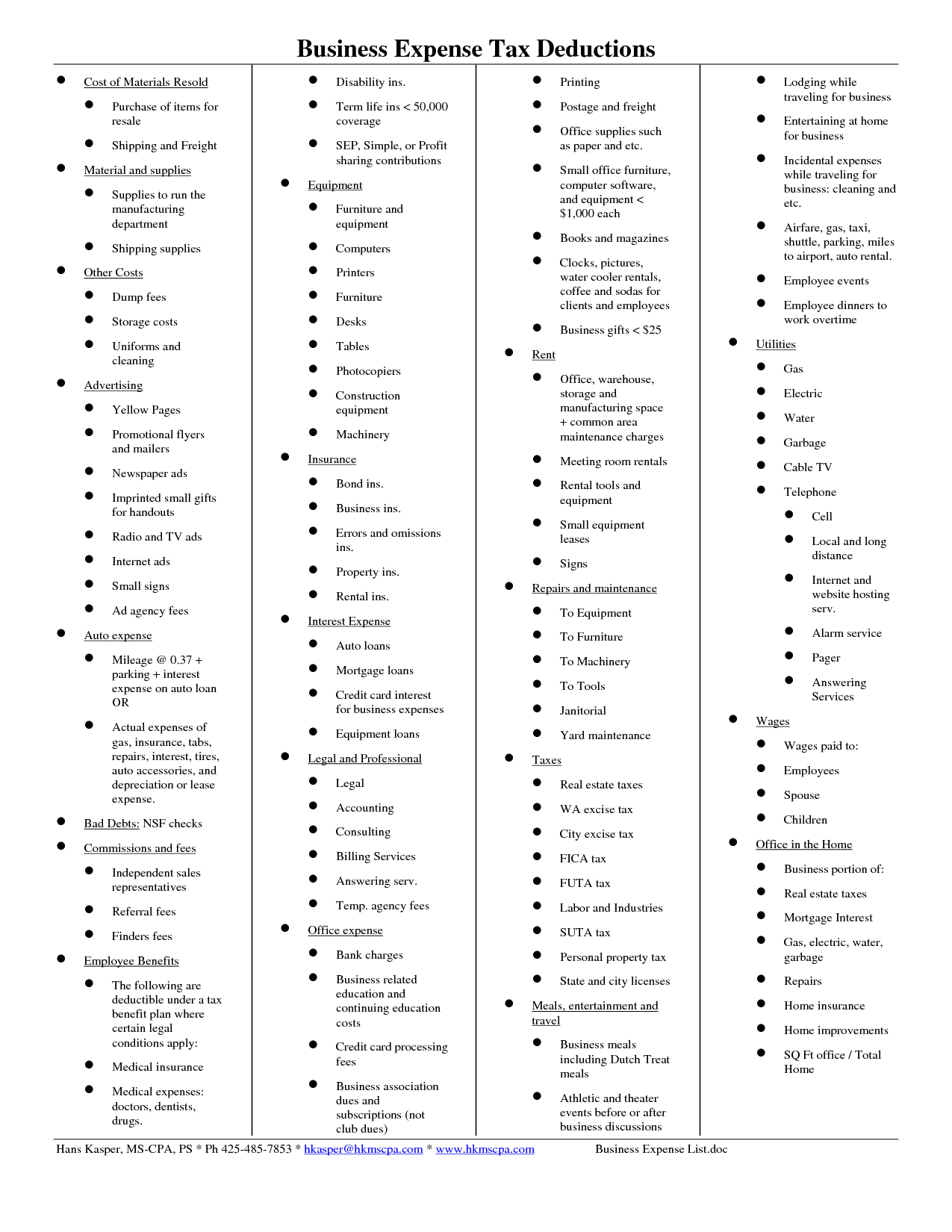

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/small-business-expenses-tax-deductions-list_449336.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Deductible medical expenses may include but aren t limited to the following Amounts paid of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners You can deduct unreimbursed qualified medical and dental expenses that exceed 7 5 of your AGI Say you have an AGI of 50 000 and your family has 10 000 in medical bills for the tax year

Are Over the Counter Medications Tax Deductible The IRS website states that only medications that your physician prescribes are tax deductible So buying antacid tablets over the counter is likely not tax deductible Also things like vitamins and health supplements are explicitly stated as non deductible For some taxpayers medical and healthcare related expenses might be tax deductible There are a few calculations you and ideally your accountant will need to make to see if you qualify but it could be worth your time in order to keep more dollars in your pocket and fork over fewer to Uncle Sam

Download What Over The Counter Medical Items Are Tax Deductible

More picture related to What Over The Counter Medical Items Are Tax Deductible

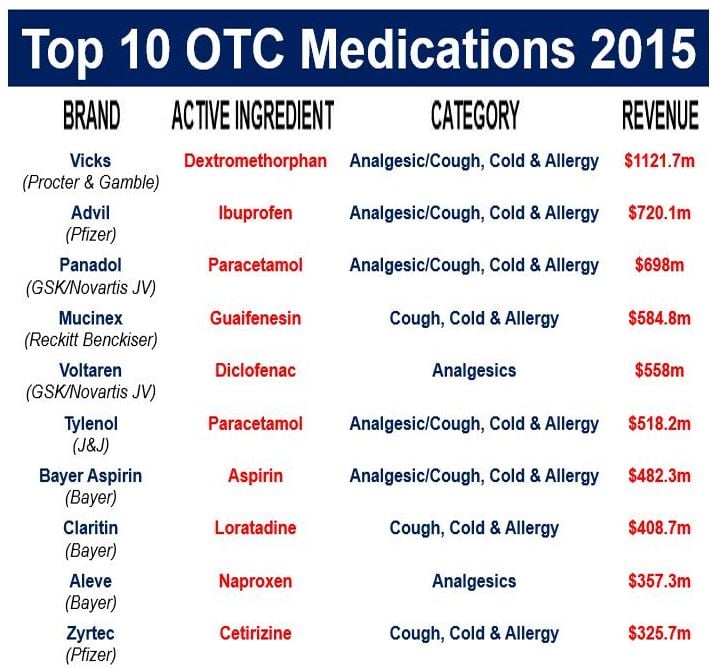

What Is Over The Counter OTC Definition And Meaning Market

https://marketbusinessnews.com/wp-content/uploads/2017/02/Top-10-over-the-counter-medications-globally.jpg

Which Over the Counter Pain Medication Should You Take EINSURANCE

https://dmyr67ch4ceo0.cloudfront.net/images/journal/articles/which-over-the-counter-pain-medication-should-you-take.jpg

Explainer Why Are Donations To Some Charities Tax deductible

https://images.theconversation.com/files/160105/original/image-20170309-21047-1tidnuj.jpg?ixlib=rb-1.1.0&rect=0%2C366%2C4018%2C1948&q=45&auto=format&w=1356&h=668&fit=crop

Insulin products Public Law 117 169 August 16 2022 amended section 223 to provide that an HDHP may have a 0 deductible for selected insulin products The amendment applies to plan years beginning after 2022 Health FSA contribution and carryover for 2022 These products are defined as tampons pads liners cups sponges or other similar products In addition over the counter products and medications are now reimbursable without a prescription The new rules apply to

So if your adjusted gross income is 40 000 anything beyond the first 3 000 of medical bills or 7 5 of your AGI could be deductible Simple tax filing with a 50 flat fee for every scenario In general deductions allowed for medical expenses on your federal income tax according to Internal Revenue Code Section 213 d may be reimbursed through your spending account You cannot deduct medical expenses on your federal income tax that have been reimbursed through your spending account

Common Over the Counter Medicines Linked To Dementia In New Study ABC

https://s.abcnews.com/images/Health/GTY_over_the_counter_drugs_jef_150128_16x9_992.jpg

A Guide To Tax Deductible Donations Best Charities To Donate To

https://www.sbg.org.au/wp-content/uploads/2014/08/Tax-deductible-donations.jpg

https://www.verywellhealth.com/deduct...

But over the counter medications like pain relievers or laxatives are not Vitamins and supplements are not deductible unless recommended by a doctor to treat a health condition such as iron pills for anemia Here is a closer look at what is and what is not tax deductible Tax Deductible Bandages Breast pumps and supplies

https://turbotax.intuit.com/tax-tips/health-care/...

Some of the lesser known deductible medical expenses include acupuncture addiction treatment braille publications chiropractic services for medical care contact lenses diet food exercise programs and

Use Your FSA Or HSA Funds For Over the counter Medications

Common Over the Counter Medicines Linked To Dementia In New Study ABC

Over the Counter Medications Divers Alert Network

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductible Donations Bold

Sars 2022 Weekly Tax Tables Brokeasshome

Sars 2022 Weekly Tax Tables Brokeasshome

Investment Expenses What s Tax Deductible Charles Schwab

School Supplies Are Tax Deductible Wfmynews2

Marguerita Elementary PTA Donations Are Tax Deductible

What Over The Counter Medical Items Are Tax Deductible - Are Over the Counter Medications Tax Deductible The IRS website states that only medications that your physician prescribes are tax deductible So buying antacid tablets over the counter is likely not tax deductible Also things like vitamins and health supplements are explicitly stated as non deductible