What Percent Is Capital Gains Tax In Texas Texas does not impose a state level capital gains tax but federal capital gains taxes apply This tax is charged on the profit from selling assets including real estate or stocks The rate varies based on the asset type and

Discover the Texas capital gains tax and its rates in 2024 Learn about some tax planning strategies to reduce your capital gains taxes Unlike long term capital gains there is no 0 percent rate or 20 percent ceiling for short term capital gains taxes which means you ll pay a higher rate on profits from selling assets you ve held for less than a year

What Percent Is Capital Gains Tax In Texas

What Percent Is Capital Gains Tax In Texas

https://www.lumina.com.ph/assets/news-and-blogs-photos/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property.webp

Capital Gains Tax How To Reduce It

https://www.aims.co.uk/content/uploads/2022/10/Capital-Gains-Tax.png

Capital Gains Tax Rate Basics For Stock Market Investors DIY Stock Picker

https://diystockpicker.com/wp-content/uploads/2020/08/capital-gains-tax-1583x2048.png

20 Capital Gains Tax If your income exceeds 434 550 individual or 488 850 married filing jointly the capital gains tax rate rises to 20 These rates only apply to long What is the current capital gains tax rate in Texas The current capital gains tax rate in Texas is aligned with federal capital gains tax rates As of 2021 the federal capital

According to the Texas Comptroller s Office Texas has no personal income tax meaning that any capital gains from the sale of your property or other investments are only subject to federal taxes In other states The federal capital gains tax rate for selling a rental property in Texas is the same rate that applies to selling other property types and is based on whether it is a long term or short term capital gain your income tax bracket

Download What Percent Is Capital Gains Tax In Texas

More picture related to What Percent Is Capital Gains Tax In Texas

Understanding Capital Gains Tax What Do You Need To Know Hayward Wright

https://www.haywardwright.co.uk/wp-content/uploads/2023/10/CGT-Graphic.png

How Much Is Capital Gains Tax It Depends On How Long You Held The

https://i.insider.com/5e4317b83ac0c9352d748930?width=700&format=jpeg&auto=webp

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTk3MDQyNTMwNDMxMjgwNDQ3/screenshot-2023-04-05-at-11017-pm.png

The capital gains are registered in the income section of the tax return and inserted in a separate line item This separates them from the yearly earned income of the Once you go over the exclusions and determine that you do owe capital gains taxes in Texas you will need to figure out your tax bracket This will let you know what percent

Texas does not have state or local capital gains taxes The Combined Rate accounts for the Federal capital gains rate the 3 8 percent Surtax on capital gains and the marginal effect of Luckily as a Texas taxpayer you are exempt from state capital gains taxes unlike taxpayers in other states However that doesn t mean you are altogether exempt from taxes

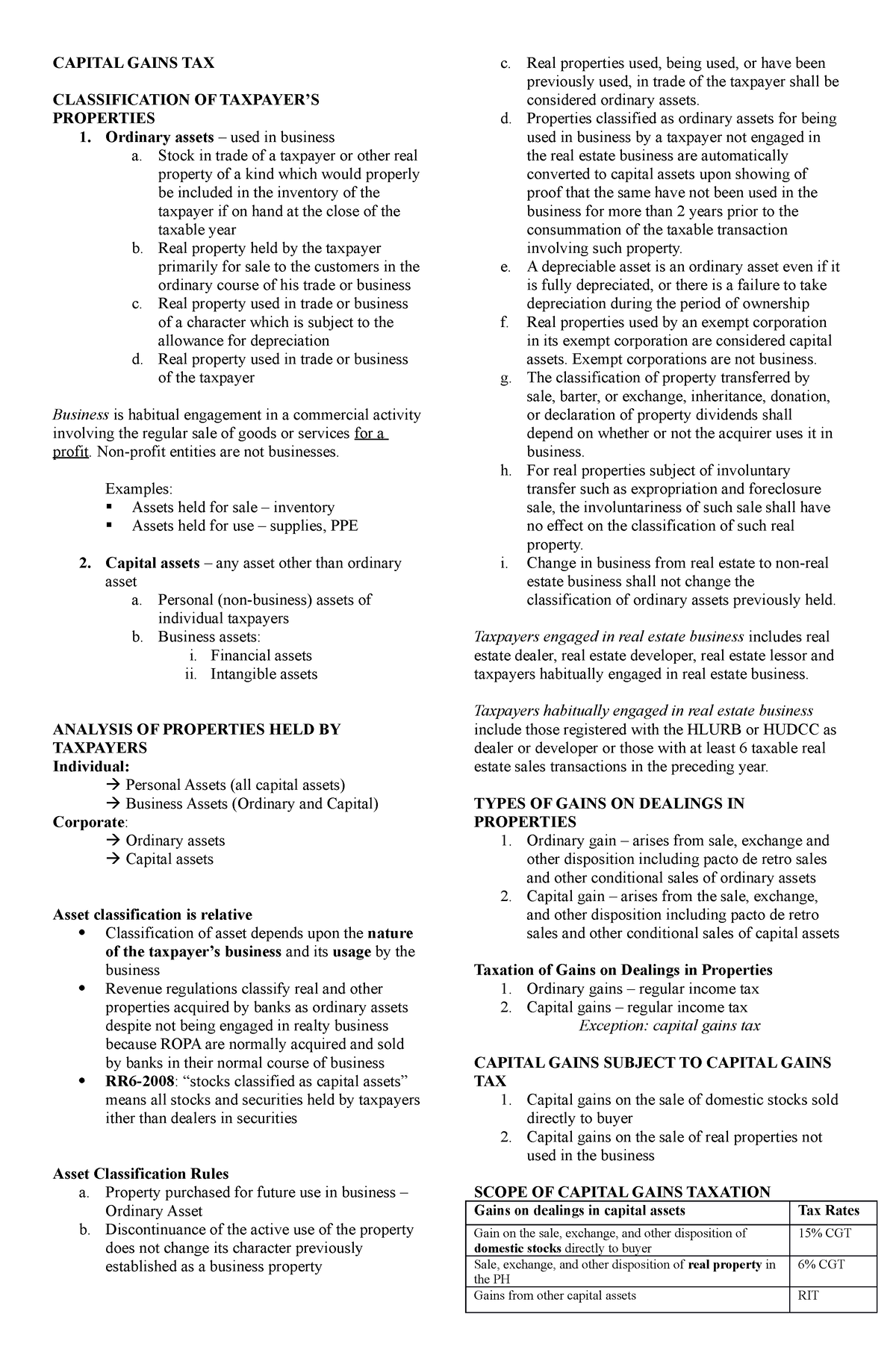

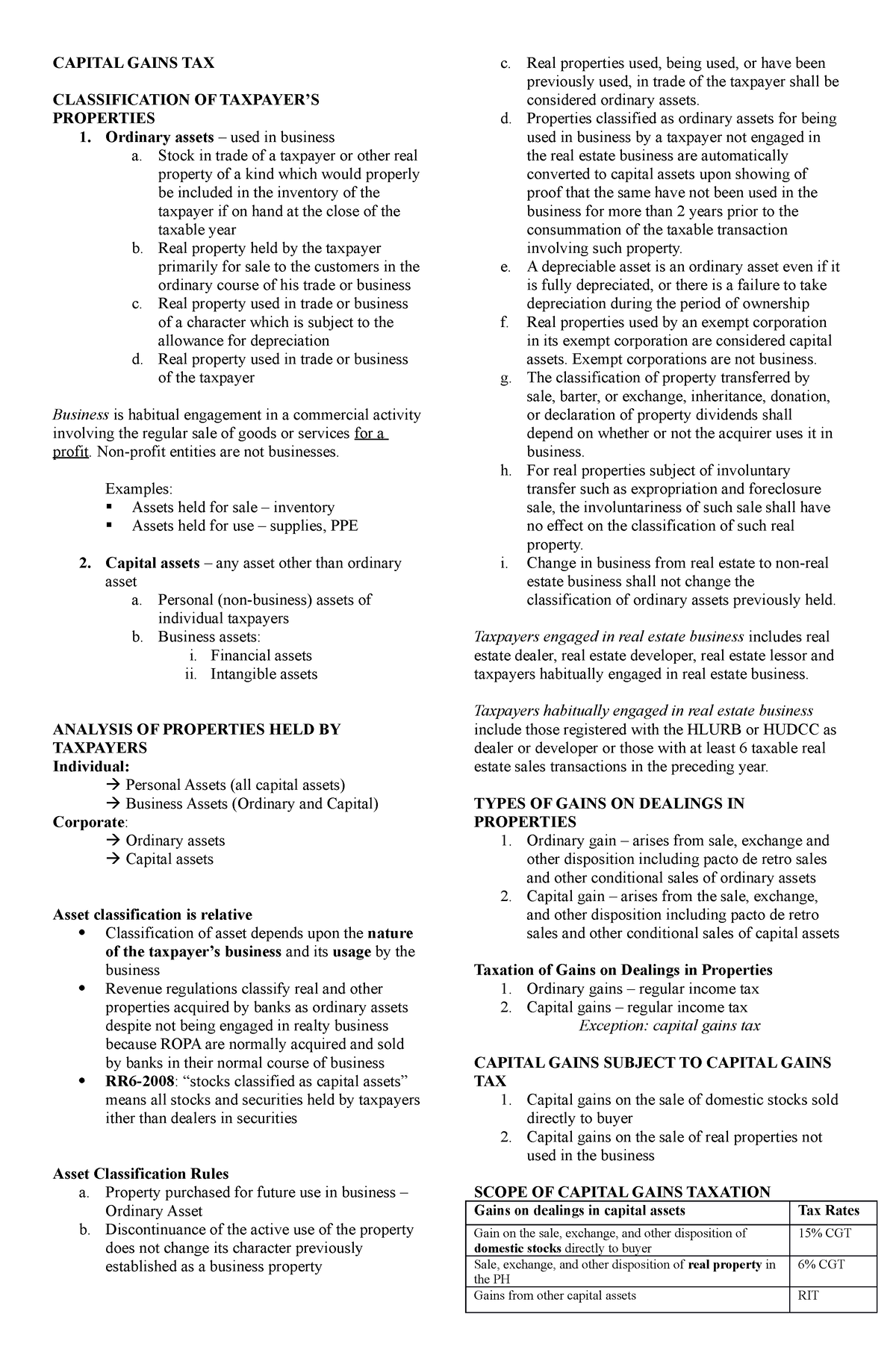

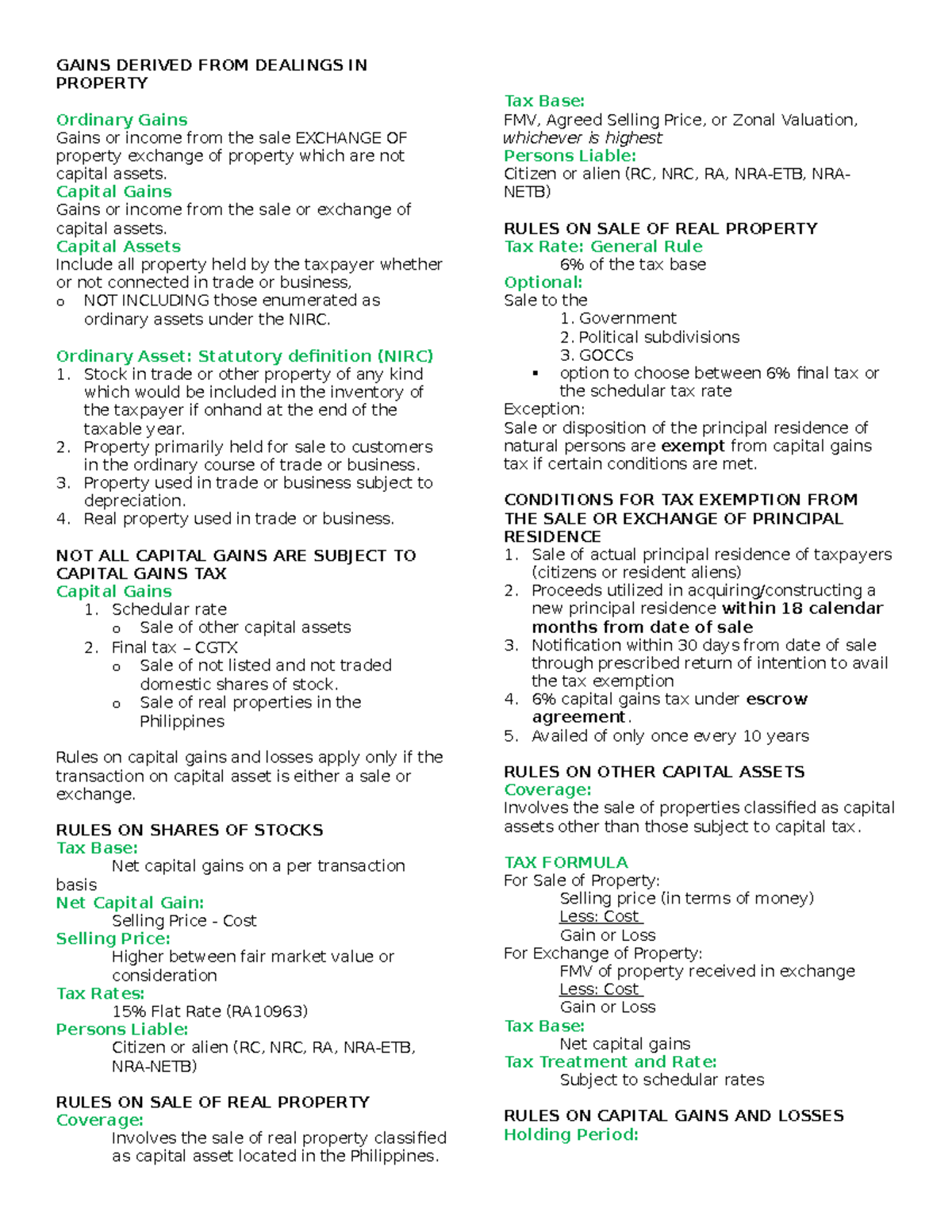

Capital Gains TAX In Reference To Banggawan s Income Taxation

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4a8f504f019d886788b3b27a97106c68/thumb_1200_1835.png

Wk7 Tutorial Questions Short Answers How Is Capital Gains Tax CGT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bc8b319830eeba9a7ae903f64d0e7955/thumb_1200_1697.png

https://www.capitaladvisorstx.com › press

Texas does not impose a state level capital gains tax but federal capital gains taxes apply This tax is charged on the profit from selling assets including real estate or stocks The rate varies based on the asset type and

https://learn.valur.com › texas-capital-gain…

Discover the Texas capital gains tax and its rates in 2024 Learn about some tax planning strategies to reduce your capital gains taxes

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains TAX In Reference To Banggawan s Income Taxation

Futurerent

Capital Gains Tax On Real Estate Exclusions Misconceptions

Why You Won t Regret Buying Treasury Bonds Yielding 5

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Quiz Comp PDF Capital Gains Tax In The United States Financial

How The World Taxes Capital Gains On Equity Mint

Dealings In Property PDF Capital Gains Tax Capital Gains Tax In

What Percent Is Capital Gains Tax In Texas - The federal capital gains tax rate for selling a rental property in Texas is the same rate that applies to selling other property types and is based on whether it is a long term or short term capital gain your income tax bracket