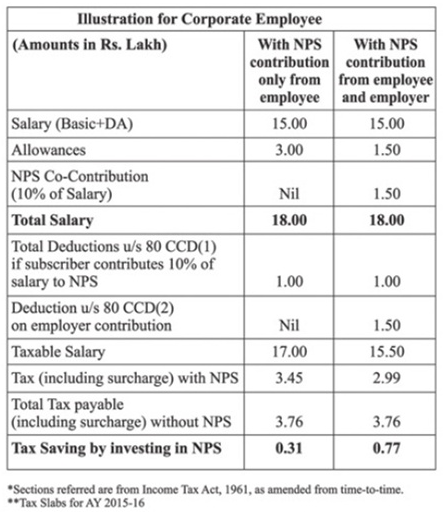

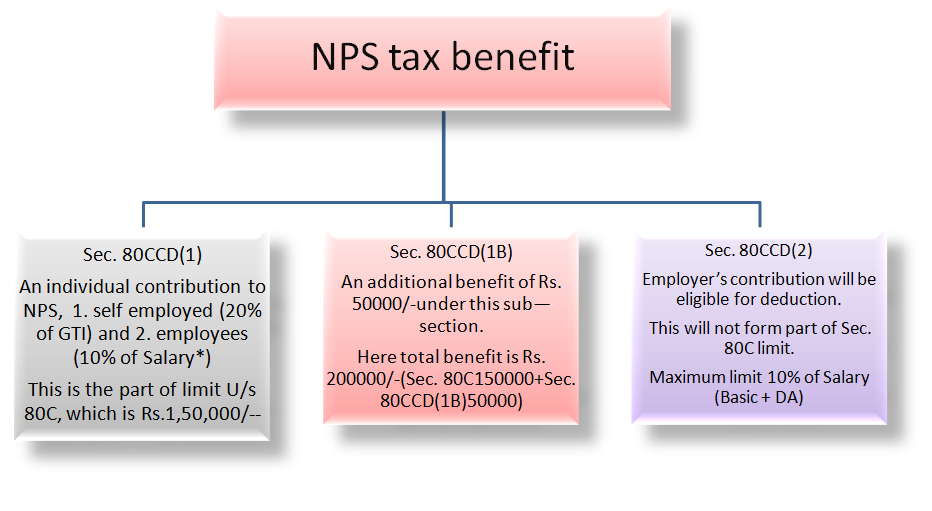

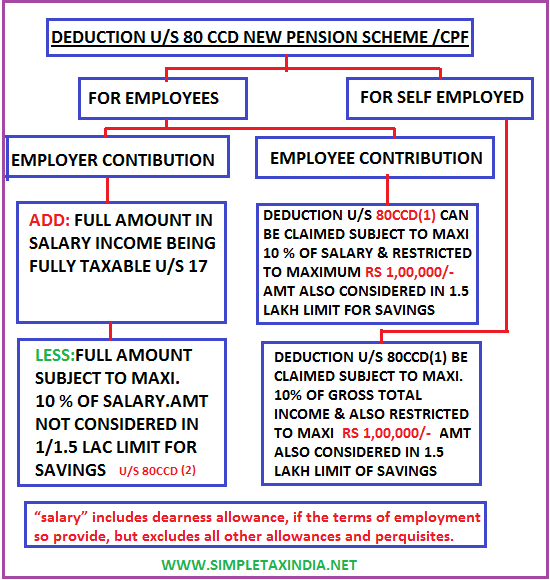

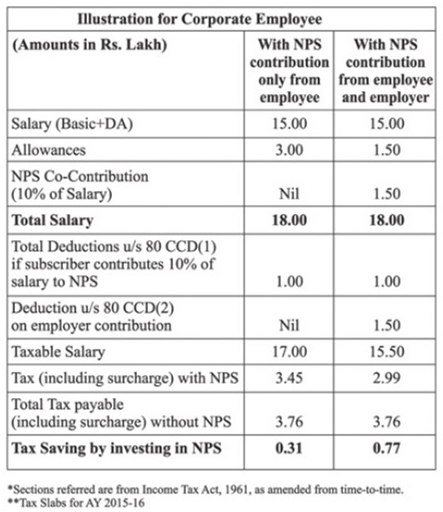

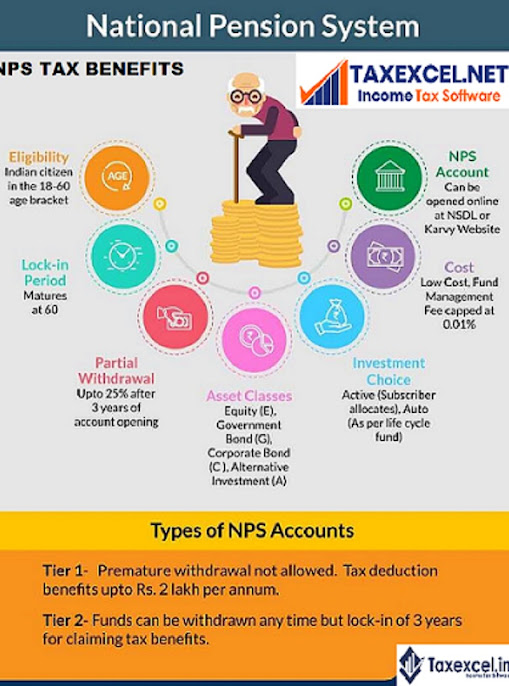

Nps Deduction Income Tax Rebate Web 1 sept 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

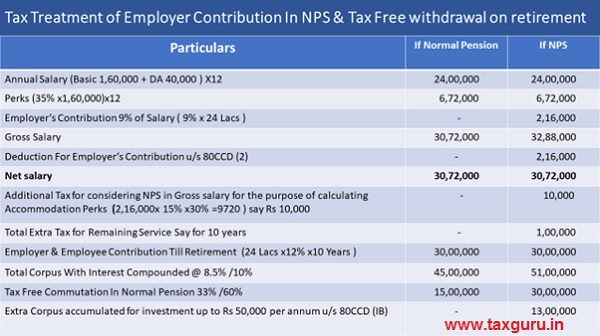

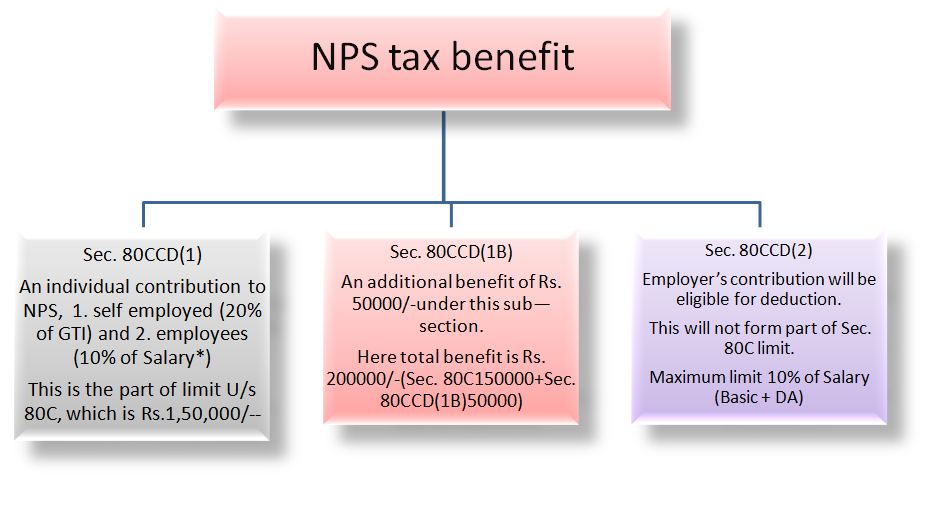

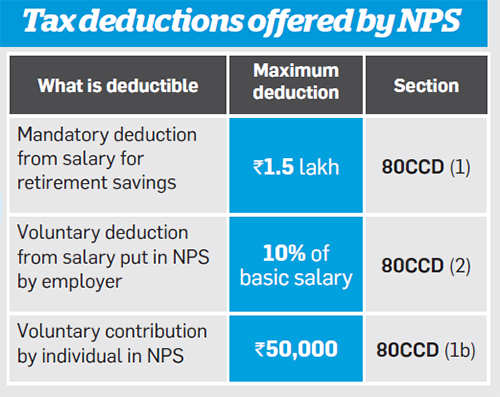

Web 28 sept 2021 nbsp 0183 32 Tax deduction of up to 20 of gross income under Section 80CCD 1 subject to a total limit of Rs 1 5 lakh under Section 80CCE Tax benefits on partial Web 30 janv 2023 nbsp 0183 32 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961 The tax treatment of NPS is the same as any

Nps Deduction Income Tax Rebate

Nps Deduction Income Tax Rebate

https://www.apnaplan.com/wp-content/uploads/2015/12/NPS-illustration-of-Tax-Exemption-on-NPS-by-restructing-of-Salary.png

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

https://2.bp.blogspot.com/-M2x6C7-6FRs/Wv7FH91f_QI/AAAAAAAAAYA/a3qFywzgcPwMcFze1jMvhr6r0hgmni_hQCLcBGAs/s1600/NPS%2Bdeduction.png

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme.png

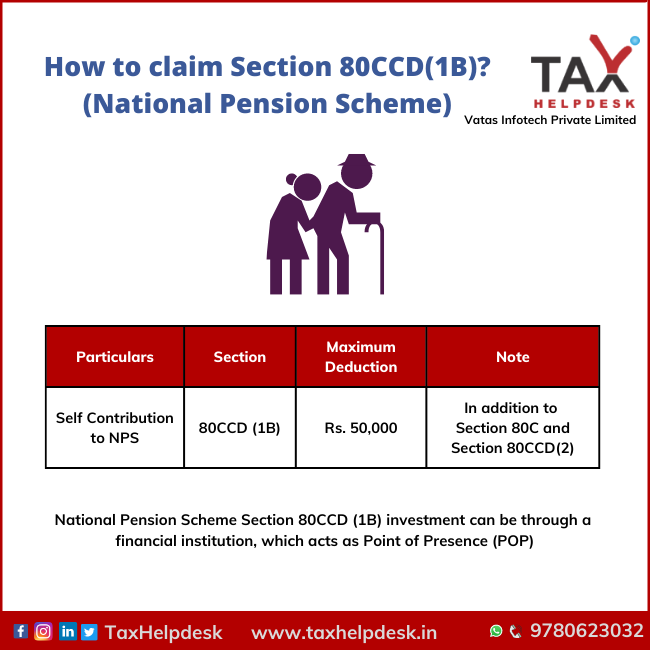

Web 17 juil 2023 nbsp 0183 32 Tax deductions up to Rs 1 5 lakhs are eligible under section 80CCD 1 Like NPS an additional investment of up to Rs 50 000 is eligible for tax deduction under Web Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80

Web 5 f 233 vr 2016 nbsp 0183 32 Rs 1 50 000 as per section 80CCD 1 section 80C The deduction which may be claimed has to be minimum of 10 of gross income in case of a self employed Web 15 juil 2023 nbsp 0183 32 Income tax deductions under Section 80CCD 1B under Income Tax Act which allows deduction upto Rs 50 000 Learn about National Pension Scheme NPS benefits types of NPS accounts amp tax

Download Nps Deduction Income Tax Rebate

More picture related to Nps Deduction Income Tax Rebate

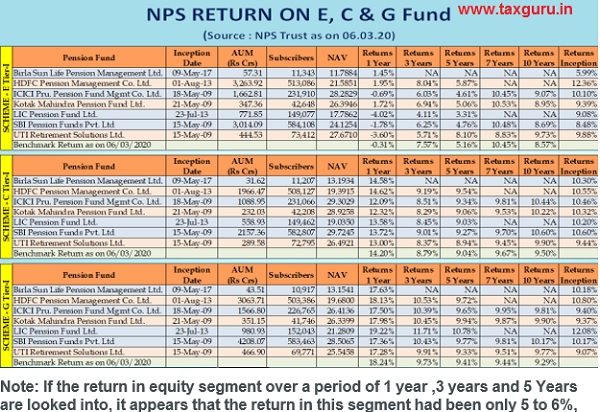

Taxation Of NPS Return From The Scheme

https://taxguru.in/wp-content/uploads/2020/03/NPS-Return-On-EC-And-G-fund.jpg

Taxation Of NPS Return From The Scheme

https://taxguru.in/wp-content/uploads/2020/03/Tax-Treatment-of-Employer-Contribution-In-NPS.jpg

Deduction U s 80CCD For CPF NPS Upper Limit One Lakh Only SIMPLE

http://2.bp.blogspot.com/-bz4lxlD0Klc/VI2Ae4K0awI/AAAAAAAAGa4/p7m0blqybhg/s1600/NPS.png

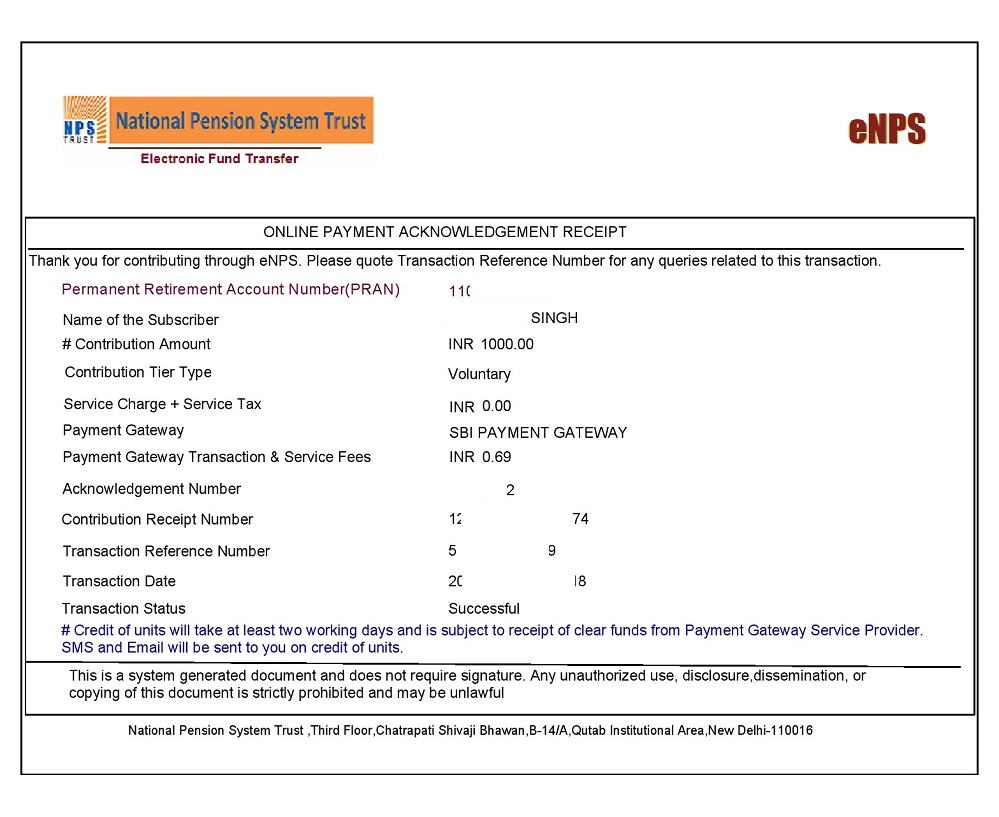

Web 11 nov 2022 nbsp 0183 32 You can claim tax benefits on your contribution and employer contribution to the National Pension Scheme under various sections of the Income Tax Act 1961 Government employees can apply for a tax Web 2 avr 2019 nbsp 0183 32 NPS tax benefits are offered under section 80C Section 80 CCD 1 amp Section 80 CCD 1B and Section CCD 2 National Pension Scheme offers these tax benefits to state amp central government

Web 30 mars 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs Web 5 oct 2022 nbsp 0183 32 Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year

Steps To Voluntary Contribution In NPS News 1

http://4.bp.blogspot.com/-K1H6VkbZwDM/WKMQq7gplWI/AAAAAAABNRg/LrCdwDq5w94WTPrhUUzZ5QnkYmyP5qYJgCLcB/s1600/15.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

https://taxguru.in/income-tax/income-tax-be…

Web 1 sept 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

https://cleartax.in/s/nps-national-pension-scheme

Web 28 sept 2021 nbsp 0183 32 Tax deduction of up to 20 of gross income under Section 80CCD 1 subject to a total limit of Rs 1 5 lakh under Section 80CCE Tax benefits on partial

Tax Benefits Of NPS Scheme Deduction Coming Under Section 80CCD 1B

Steps To Voluntary Contribution In NPS News 1

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

80ccc Pension Plan Investor Guruji

NPS Tax Benefit Experts Differ On How To Claim Additional NPS Tax

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

Creating NPS Deduction Pay Head For Employees Payroll

Section 80 CCD Deduction For NPS Contribution Updated Automated

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

Nps Deduction Income Tax Rebate - Web 17 juil 2023 nbsp 0183 32 Tax deductions up to Rs 1 5 lakhs are eligible under section 80CCD 1 Like NPS an additional investment of up to Rs 50 000 is eligible for tax deduction under