How Much Tax Deduction In Nps Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Self employed individuals who contribute to NPS can claim the following tax benefits on their own contributions Tax deduction of up to 20 of gross income under Section Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS

How Much Tax Deduction In Nps

How Much Tax Deduction In Nps

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

2021 Federal Tax Rates Married Filing Jointly TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/what-is-the-standard-deduction-for-2021-married-filing-jointly-taxirin-1024x1024.jpeg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

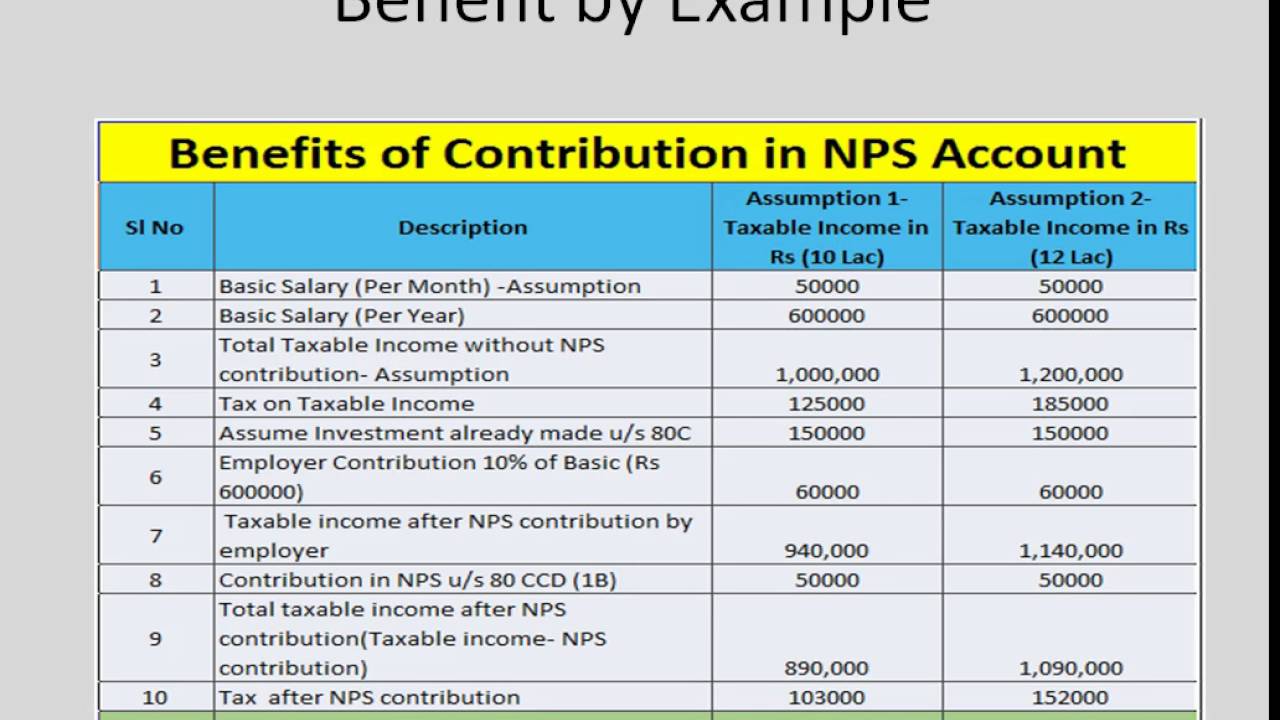

To encourage investment in NPS Section 80CCD 1B of the Income tax Act allows an additional deduction of Rs 50 000 over and above the Rs 1 5 lakh available under Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your

Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and In Budget 2024 held in July the tax deduction allowed under Section 80CCD 2 has been raised from 10 to 14 of the basic pay This means that you can now contribute up to 14 of your basic salary to NPS

Download How Much Tax Deduction In Nps

More picture related to How Much Tax Deduction In Nps

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

ITR Filing How Much Deduction Can You Get For Stamp Duty And Property

https://www.viralbake.com/wp-content/uploads/ITR-Filing-How-Much-Deduction-Can-You-Get-for-Stamp-Duty-and-Property-Registration.jpg

An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over and above the Corporate NPS offers platform to save tax for you and your employer both You can route your contribution through your employer or contribute in your NPS account directly Both

Tax Benefits Under NPS As Per November 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian 6 What are the tax benefits of NPS The various Tax benefit as under A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B

7 Tax Deductions You Shouldn t Miss

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

What Is The Standard Federal Tax Deduction Ericvisser

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-2.jpg

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

https://cleartax.in/s/nps-national-pension-scheme

Self employed individuals who contribute to NPS can claim the following tax benefits on their own contributions Tax deduction of up to 20 of gross income under Section

NPS Investment Proof How To Claim Income Tax Deduction Mint

7 Tax Deductions You Shouldn t Miss

Income Tax Tables In The Philippines 2022 187 Pinoy Money Talk Riset

Your Employer s Contribution To NPS Can Make A Huge Difference

How To Invest In The National Pension Scheme nps 2021 2020 national

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

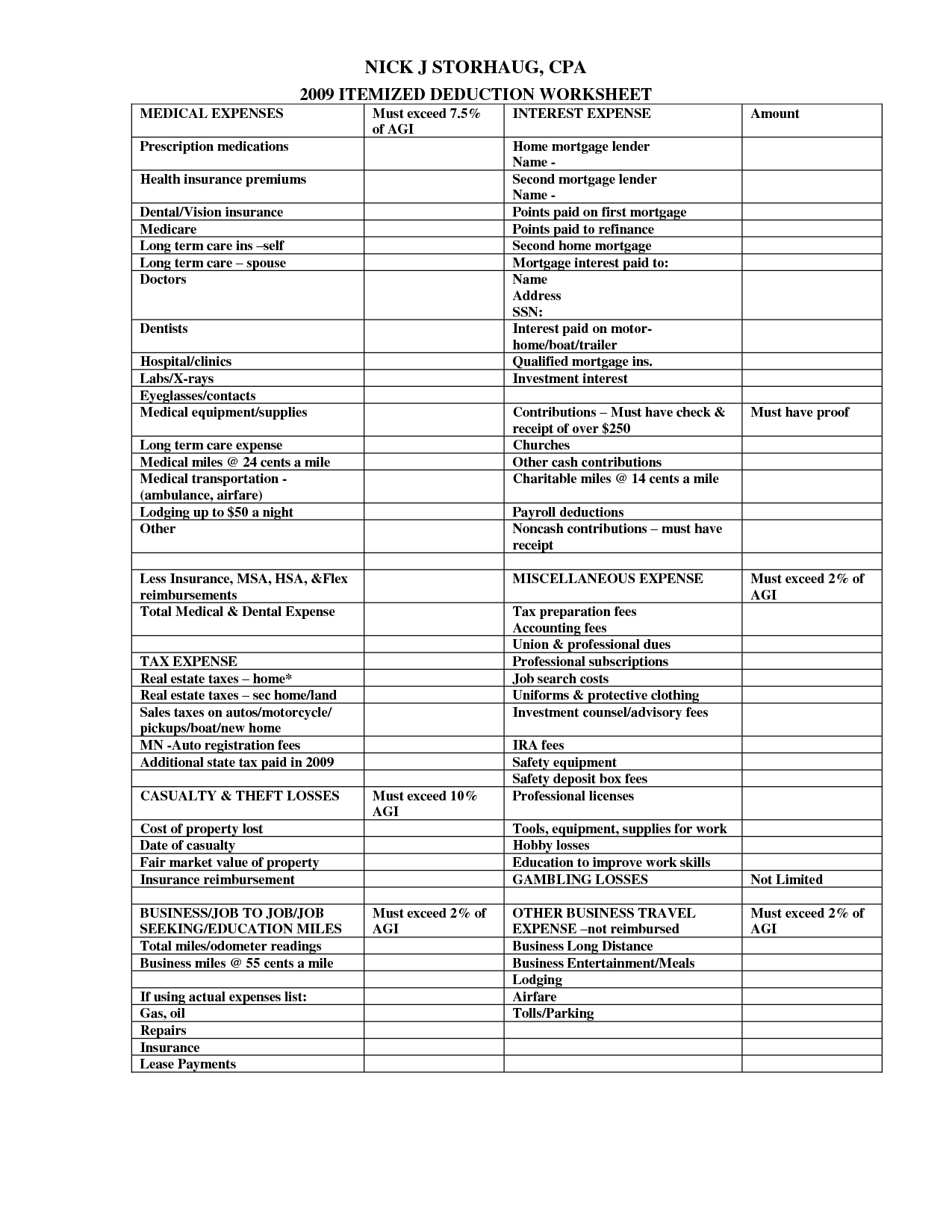

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

2022 Federal Tax Brackets And Standard Deduction Printable Form

How Does Tax Deduction Work In India Tax Walls

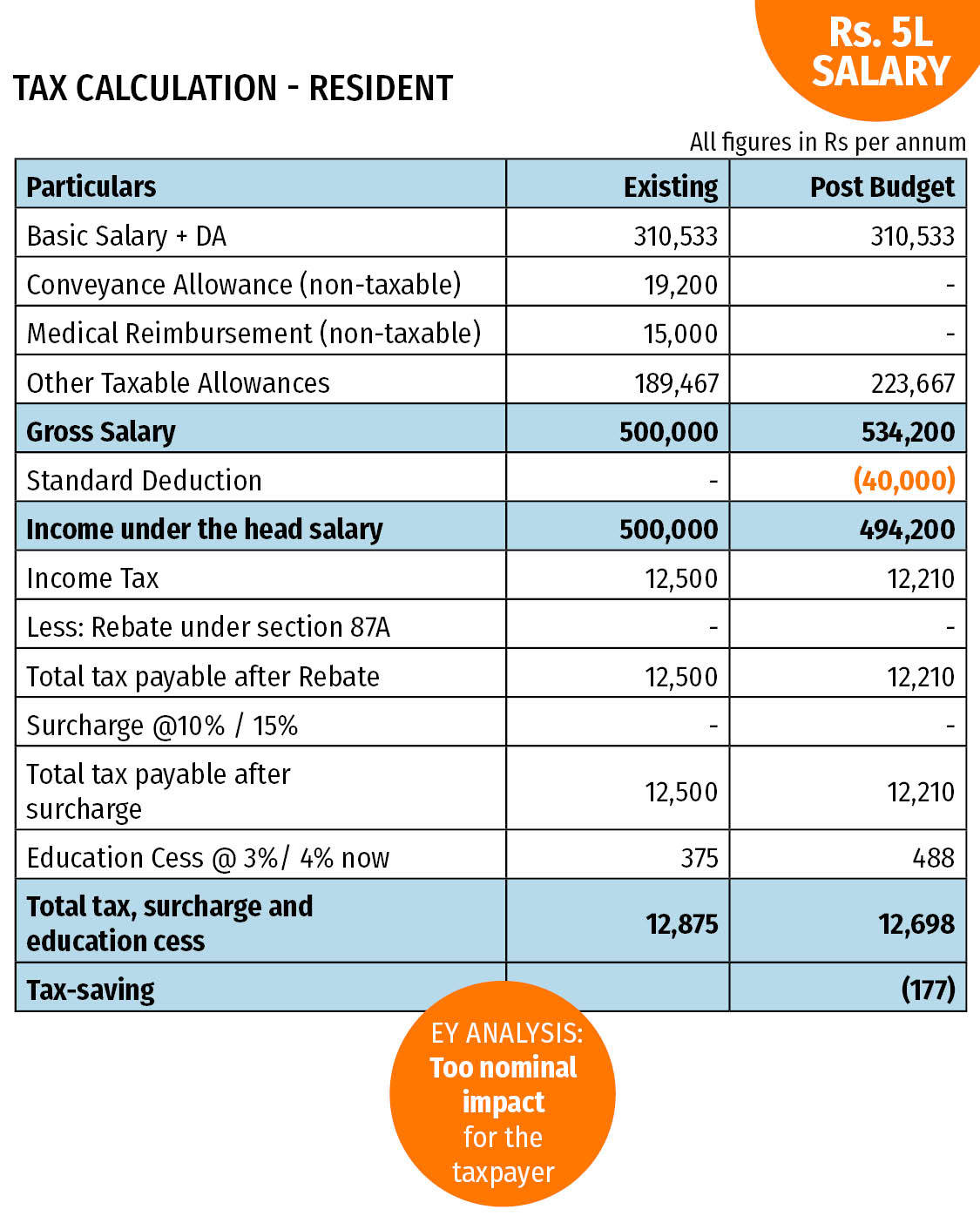

How Much Tax Deduction In Nps - Under the new tax regime a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS can be availed This deduction from gross total income can be