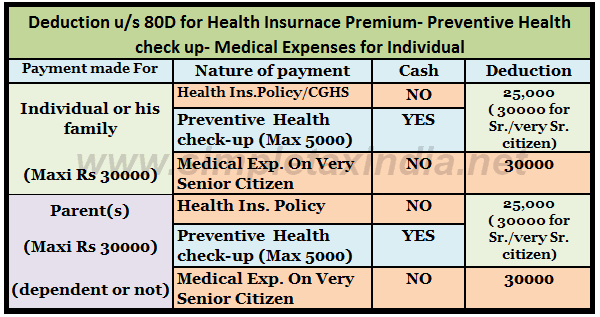

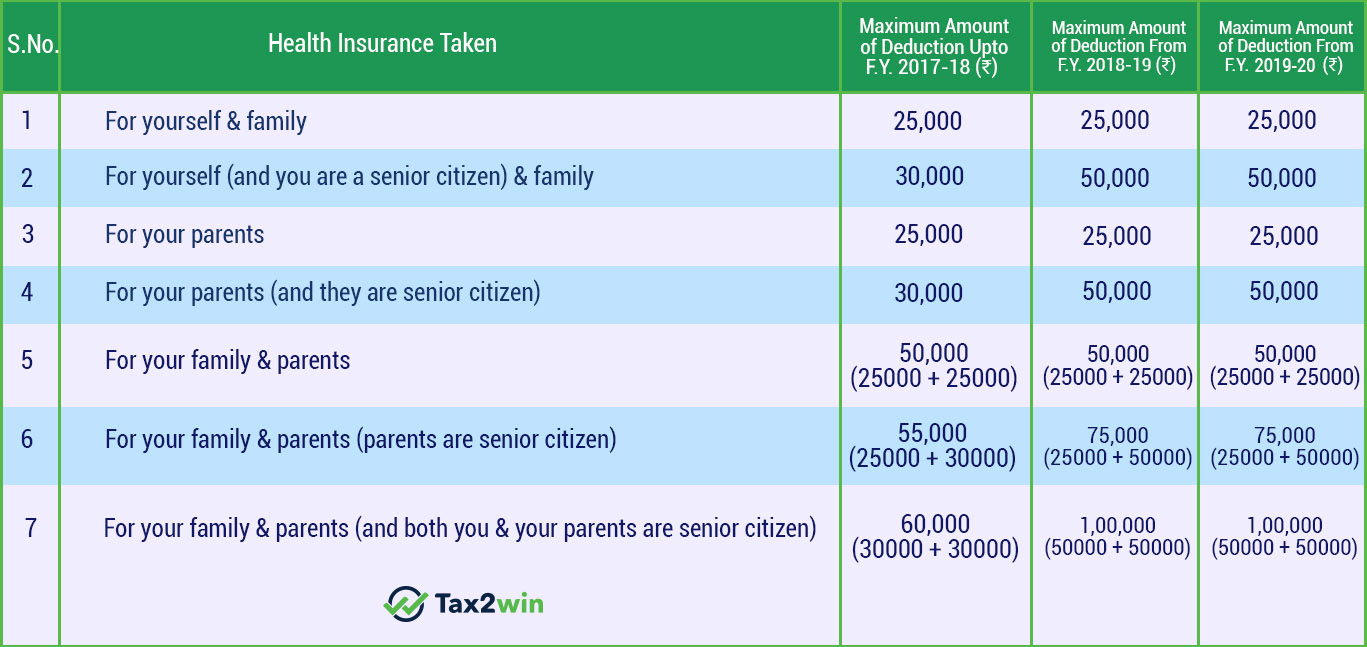

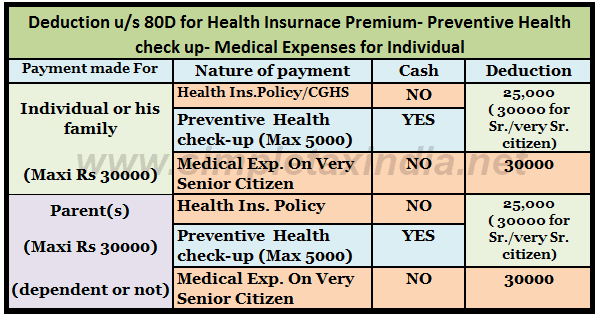

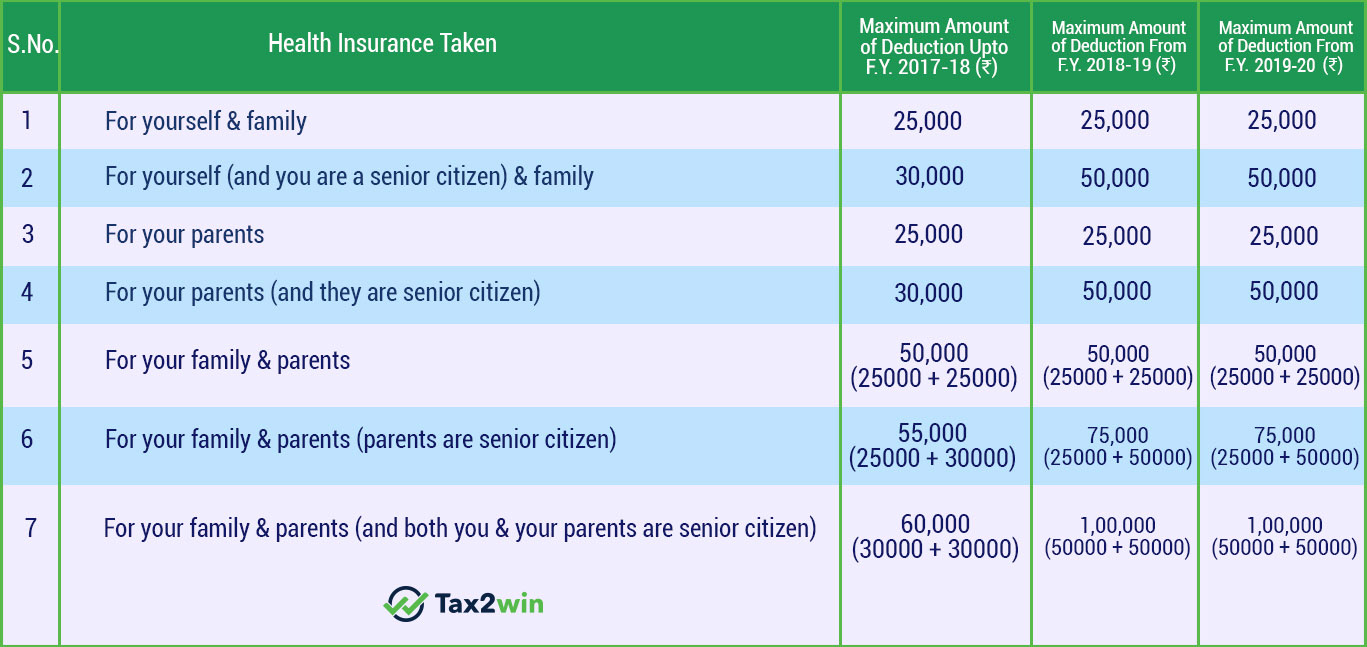

Preventive Health Check Up Income Tax Rebate Web 21 mars 2015 nbsp 0183 32 Read S 80D Deduction for expenditure on preventive health check up not exceeding Rs Five Thousand 2 Controversy Subsection 2A of section 80D lays an additional bar to restrict the

Web 13 juin 2019 nbsp 0183 32 C Preventive Health Check Up D Deduction of Medical Expenditure on Senior Citizens aged 60 amp above E Contribution to CGHS notified scheme Deduction Web 1 mars 2022 nbsp 0183 32 Yes of course Preventive health check up does have a role to play in your income tax returns and tax deductions and it was implemented by law in the year 2013

Preventive Health Check Up Income Tax Rebate

Preventive Health Check Up Income Tax Rebate

https://4.bp.blogspot.com/-2BihF6FG36E/WIbyy4F5x1I/AAAAAAAAPlM/kPJoPX-nK148RZ2z3EoRedH3Vrs1_6p5ACLcB/s1600/DEDUCTION%2BSECTION%2B%2B80D%2BHEALTH%2BINSURANCE%2BPREVENTIVE%2BHEALTH%2BCHECK%2BUP%2BMEDICAL%2BEXP..png

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

Preventive Health Check Up Tax Benefits Under Sec 80D

https://www.basunivesh.com/wp-content/uploads/2016/02/Sec.80D-and-Preventive-Health-Check-Up-Tax-Benefits.jpg

Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses Web 9 d 233 c 2021 nbsp 0183 32 Senior citizens can avail health insurance tax benefit 80d of up to INR 50000 every financial year Besides this individuals or policyholders can enjoy tax deductions

Web 10 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income Tax Act 1961 allows an individual to claim a deduction of up to Rs 25 000 Rs 50 000 for senior citizens in respect of any Web 3 f 233 vr 2022 nbsp 0183 32 You can claim a total of 5000 as preventive health check up 80D deduction This goes up to 7000 for senior citizens However it is important to remember that this

Download Preventive Health Check Up Income Tax Rebate

More picture related to Preventive Health Check Up Income Tax Rebate

What s The Distinction Between PMI And Home Loan Defense Insurance

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up.jpg

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Web 28 f 233 vr 2015 nbsp 0183 32 1 There are 2 different things As per IT Act one can get quot Medical Reimbursement quot upto Rs 15 000 which is tax free The way it is supposed to work is an Web 2 janv 2023 nbsp 0183 32 Preventive Health Check Up Income Tax Rebate Rebate cheques are a cost saving tool that you can use to reduce the cost of your purchases However many

Web 19 mars 2021 nbsp 0183 32 Hence you can claim the maximum deduction of Rs 50 000 from the health insurance premium Central Government Health Scheme CGHS preventive health Web 21 f 233 vr 2022 nbsp 0183 32 Further the deduction of up to Rs 5 000 is available for expenses incurred for the preventive health check up under the overall eligible deduction limit under

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

https://lh5.googleusercontent.com/proxy/pcox4XzMYcSmZKejb-7-pN4ZTifTUzhtCOAiCztWUoVTL0E3tIgH4cSPme7saY9qgDjy31-ZXB0a1_eJWc_xXYxTM0s9S0ZwDxV_BYsUnRnuSZqJf71Fr0UL_7mQm2V9=w1200-h630-p-k-no-nu

https://taxguru.in/income-tax/section-80d-thr…

Web 21 mars 2015 nbsp 0183 32 Read S 80D Deduction for expenditure on preventive health check up not exceeding Rs Five Thousand 2 Controversy Subsection 2A of section 80D lays an additional bar to restrict the

https://tax2win.in/guide/section-80d-deduction-medical-insurance...

Web 13 juin 2019 nbsp 0183 32 C Preventive Health Check Up D Deduction of Medical Expenditure on Senior Citizens aged 60 amp above E Contribution to CGHS notified scheme Deduction

Preventive Health Checkup Packages

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

Did You Know That You Can Claim Tax Deduction If You Get A Preventive

Anything To Everything Income Tax Guide For Individuals Including

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Preventive Health Checkups In Vadodara Preventive Health Checkup Package

Preventive Health Checkups In Vadodara Preventive Health Checkup Package

Preventive Health Checkups Important For Corporate Wellness

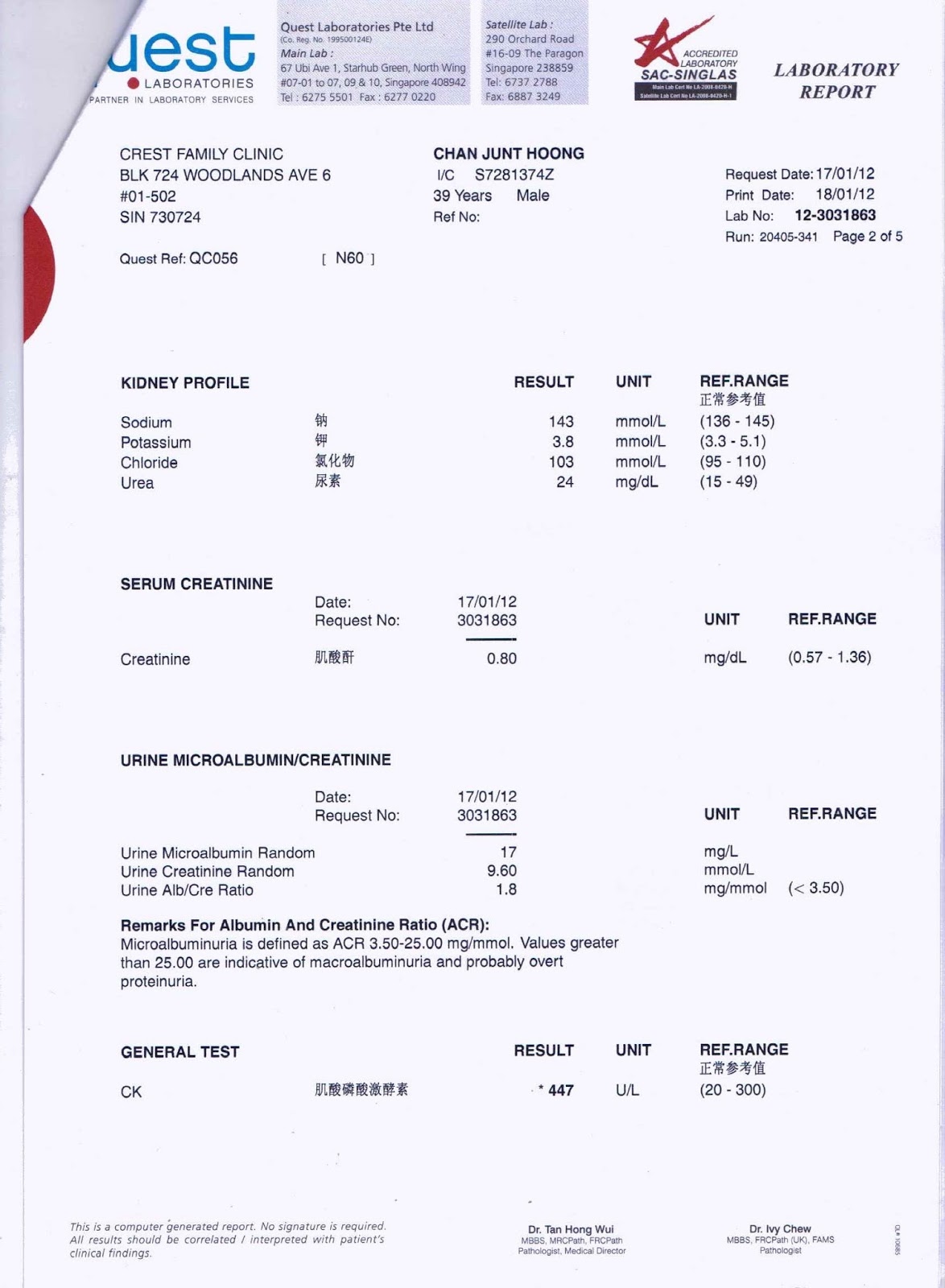

Chan Junt Hoong s Blog Continuation From Chan Junt Hoong s Mobile Blog

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Preventive Health Check Up Income Tax Rebate - Web 3 f 233 vr 2022 nbsp 0183 32 You can claim a total of 5000 as preventive health check up 80D deduction This goes up to 7000 for senior citizens However it is important to remember that this