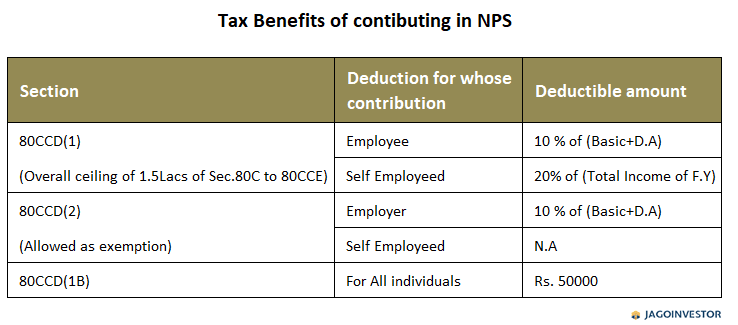

Nps Deduction Tax Benefit Verkko 1 syysk 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals employed by the Government or any other employer and self employed people Below are the tax benefits available under

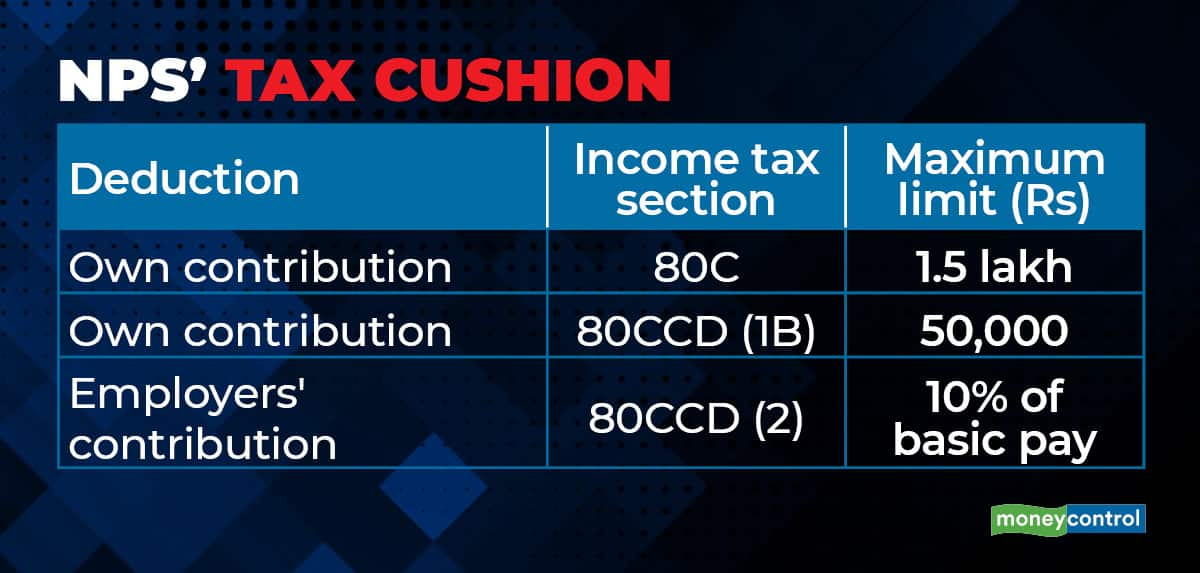

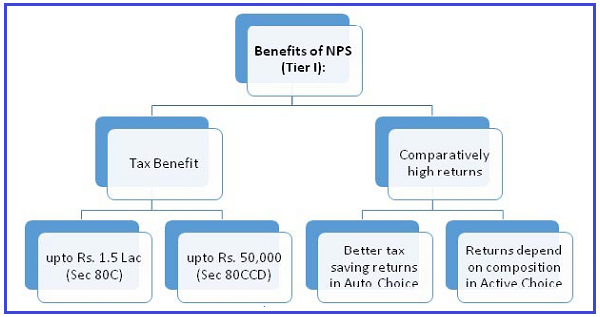

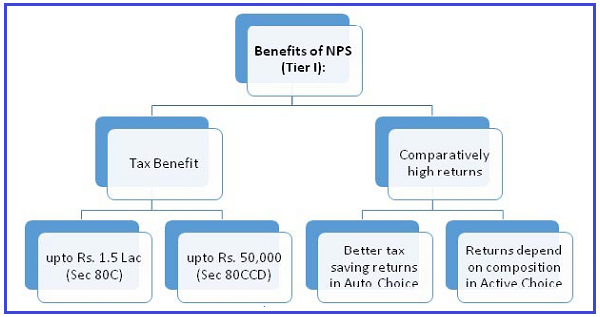

Verkko 20 syysk 2022 nbsp 0183 32 In other words one can claim a tax deduction of up to Rs 2 lakh by simply investing in NPS i e investing Rs 1 5 lakh under Section 80C and another Rs 50 000 under Section 80CCD 1B But a more practical scenario is where someone has Rs 30 000 in employee provident fund Rs 20 000 in insurance premium and Rs Verkko At maximum you can claim a 14 tax deduction under the NPS tax benefit provision How is the equity allocation decided in NPS NPS users have the choice between two investment options Active Choice and Auto Choice

Nps Deduction Tax Benefit

Nps Deduction Tax Benefit

https://cdnblog.etmoney.com/wp-content/uploads/2020/04/NPS-Tax-Benefits.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

https://i.ytimg.com/vi/rYJYpL_AjkM/maxresdefault.jpg

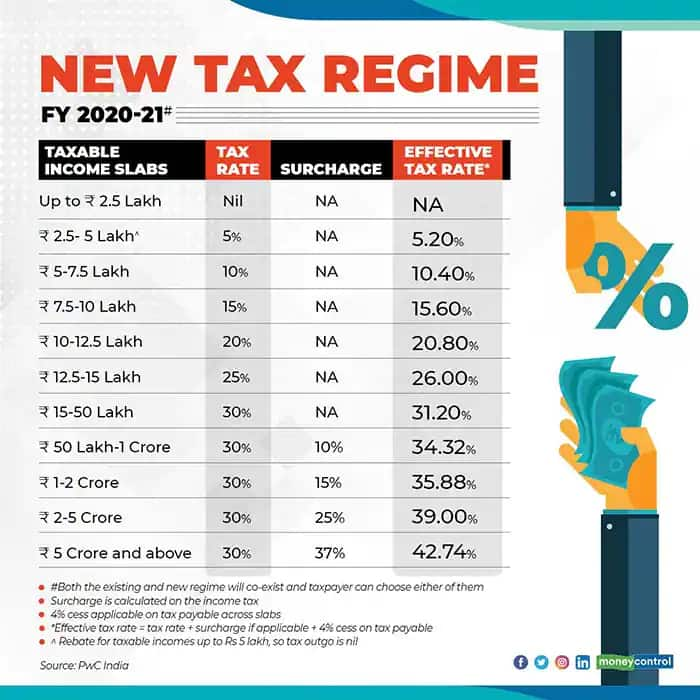

Verkko 26 kes 228 k 2020 nbsp 0183 32 Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to avail the lower tax rates This means an Verkko What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income

Verkko 5 helmik 2016 nbsp 0183 32 Tax savings The Rs 50 000 extra deduction on NPS is useful for those in the highest tax bracket of 30 who can make an additional saving of Rs 16 000 in taxes Employees in the 20 tax bracket can make a saving of over Rs 10 000 while those in the 10 can make a saving of Rs 5 000 Verkko What Are the Income Tax Provisions under NPS Section 80C of the Income Tax Act gathers all the rules about general deductions related to certain payments

Download Nps Deduction Tax Benefit

More picture related to Nps Deduction Tax Benefit

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

https://i.ytimg.com/vi/ksiudwEV8a0/maxresdefault.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Verkko 18 jouluk 2023 nbsp 0183 32 Yes Additional Tax Benefit is available to Subscribers under the Corporate Sector u s 80CCD 2 of the Income Tax Act Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Verkko 16 syysk 2022 nbsp 0183 32 The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits Tax Benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs You can invest the entire amount in NPS and claim the deduction if you wish

Verkko The NPS tax benefits are included in the NPS deduction section 80CCD 1 and 80CCD 1B NPS tax exemption on maturity and withdrawal and taxation of the annuity income at the applied slab rate The NPS tax benefits make the National Pension Scheme a tempting investment option for those who are planning their post retirement and saving Verkko Conditions for NPS tax saving for self employed people are mentioned below Up to Rs 1 5 Lakh is exempted from tax under Section 80CCD 1 Up to 20 of the total income is from tax Additionally up to Rs 50 000 is eligible for a tax deduction apart from the aforementioned Rs 1 5 Lakh NPS Tax Benefits for Employers

Different Types Of National Pension Scheme Accounts And Tax Benefits

https://www.alankit.com/blog/blogimage/different-types-of-nps-accounts-and-tax-benefits.jpg

What Are The Tax Benefits That NPS Offers

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

https://taxguru.in/income-tax/income-tax-benefits-national-pension...

Verkko 1 syysk 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals employed by the Government or any other employer and self employed people Below are the tax benefits available under

https://www.etmoney.com/learn/nps/what-are-the-tax-benefits-of-the...

Verkko 20 syysk 2022 nbsp 0183 32 In other words one can claim a tax deduction of up to Rs 2 lakh by simply investing in NPS i e investing Rs 1 5 lakh under Section 80C and another Rs 50 000 under Section 80CCD 1B But a more practical scenario is where someone has Rs 30 000 in employee provident fund Rs 20 000 in insurance premium and Rs

Nps Contribution By Employee Werohmedia

Different Types Of National Pension Scheme Accounts And Tax Benefits

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Why The New Income Tax Regime Has Few Takers

TAX BENEFIT OF NPS SIMPLE TAX INDIA

TAX BENEFIT OF NPS SIMPLE TAX INDIA

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

Nps Deduction Tax Benefit - Verkko What Are the Income Tax Provisions under NPS Section 80C of the Income Tax Act gathers all the rules about general deductions related to certain payments