Nps Deduction By Employer Tax Benefit A maximum deduction of 14 of their salary basic DA contributed by the Central Government or State Government towards NPS A maximum deduction of 10 of their salary basic DA contributed

Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year In respect of employer s Employees who contribute to NPS can claim the following tax benefits on their contributions Tax deduction of up to 10 of pay Basic DA under Section

Nps Deduction By Employer Tax Benefit

Nps Deduction By Employer Tax Benefit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

NPS Subscribers Can Claim This Income Tax Benefit Even After Opting New

https://images.livemint.com/img/2021/08/02/600x338/nps1-kICI--621x414@LiveMint_1627889704104.jpg

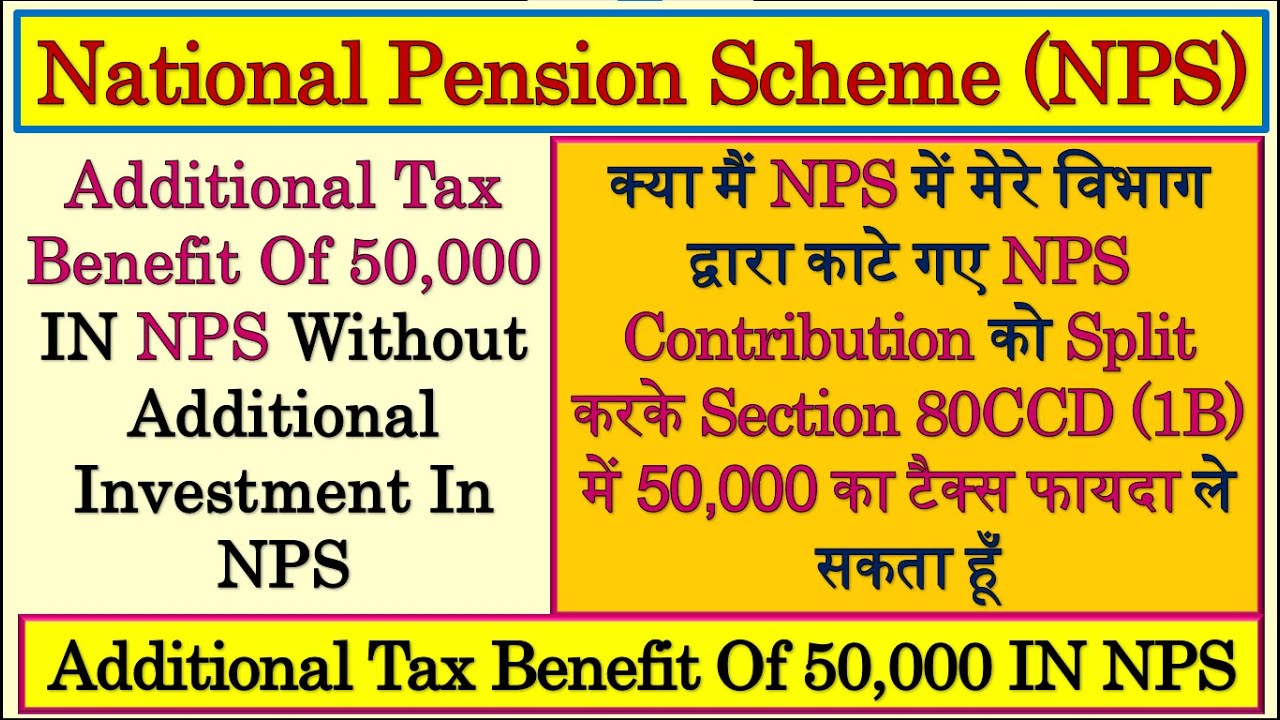

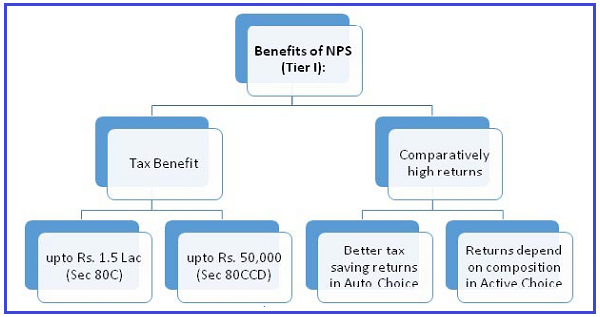

Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS The additional deduction of Rs 50 000 under Section

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic

Download Nps Deduction By Employer Tax Benefit

More picture related to Nps Deduction By Employer Tax Benefit

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

https://i.ytimg.com/vi/ksiudwEV8a0/maxresdefault.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

https://i.ytimg.com/vi/rYJYpL_AjkM/maxresdefault.jpg

Tax Benefits to Corporates Employers Eligible for tax deduction on the amount contributed as employer s contribution towards the NPS account of employees up to Tax Deductible Expense NPS contribution s by employer are considered a deductible business expense reducing the employer s taxable income Enhanced Employee

The deduction under the section is available to both salaried individuals employed by the Government or any other employer and self employed people Below are the tax benefits available under section An employer can also contributes to NPS scheme The contribution amount made by the employer can be claimed as tax deduction u s 80CCD 2 subject to the

Creating NPS Deduction Pay Head For Employees Payroll

https://help.tallysolutions.com/docs/te9rel61/Payroll/Images1/1_NPS_Employee_Deduction1.gif

What Is Dcps Nps Yojana Login Pages Info

https://www.basunivesh.com/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B-1280x720.jpg

https://cleartax.in/s/taxability-on-nps-e…

A maximum deduction of 14 of their salary basic DA contributed by the Central Government or State Government towards NPS A maximum deduction of 10 of their salary basic DA contributed

https://www.livemint.com/money/personal-finance/...

Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year In respect of employer s

Creating Employees NPS Deduction Pay Head

Creating NPS Deduction Pay Head For Employees Payroll

SIBAPRASAD CHAKRABORTY NPS Tax Deduction Instruction MINISTRY OF

How To Get A Tax Deduction Of Up To Rs 9 5 Lakh Just By Investing In NPS

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deduction Under Section 80CCD 2 For Employer s Contribution To

Budget 2022 23 Income Tax Download Finance Bill 2022 No Changes In

NPS Investment Can Lead To An Additional Tax Deduction CA And CS HUB

TAX BENEFIT OF NPS SIMPLE TAX INDIA

Nps Deduction By Employer Tax Benefit - Tax Benefits Under NPS Types of NPS Accounts Investment of Funds under NPS Exit Withdrawal from NPS Investment in NPS Annuity Charges Under NPS Products Retail