Nps Deducted By Employer Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year How is employer s contribution to

Under the existing rules of NPS as outlined by the Pension Fund Regulatory and Development Authority government employees automatically receive NPS contributions from their Your employer contribution to your NPS account gives you the tax benefit for the entire amount your employer won t contribute more than 10 of your basic From the point of view of tax saving it

Nps Deducted By Employer

Nps Deducted By Employer

http://2.bp.blogspot.com/-bz4lxlD0Klc/VI2Ae4K0awI/AAAAAAAAGa4/p7m0blqybhg/s1600/NPS.png

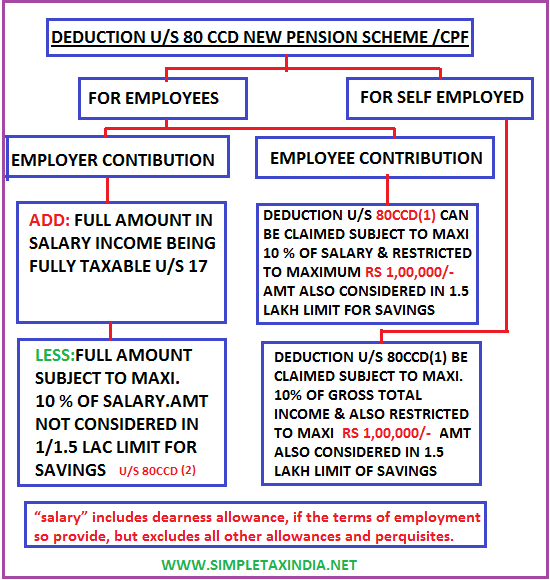

Tax Benefits Of NPS Scheme Deduction Coming Under Section 80CCD 1B

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80-ccd-1b.jpg

How To Calculate Nps Deduction Haiper

https://taxguru.in/wp-content/uploads/2020/03/Tax-Treatment-of-Employer-Contribution-In-NPS.jpg

When your employer contributes to your NPS account you get to claim tax benefits in your income tax return Contributions made by employer are allowed under Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic salary

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 In case of employer s contribution to the NPS account an employee can claim a tax deduction under the income tax laws The maximum deduction that can be

Download Nps Deducted By Employer

More picture related to Nps Deducted By Employer

EPF NPS Your Employer s EPF NPS Contribution Can Be Taxable In Your

https://img.etimg.com/thumb/msid-93582358,width-1070,height-580,imgsize-155278,overlay-etwealth/photo.jpg

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Your Employer s Contribution To NPS Can Make A Huge Difference

https://4.bp.blogspot.com/-ARdbRhlLIVQ/WRwDcrdb2HI/AAAAAAAAQrM/V_MeDWhbAvkaflKs7FCZ8-tNMIR3uupFQCLcB/s1600/nps-tier1-tier2-difference.jpg

Employer s contribution to NPS is allowed as a deduction under section 80CCD 2 while computing the employee s total income However the amount of Tax Benefit for Employer Contribution to the extent of 10 of Salary Basic DA deposited by Employer in NPS account of the Employee is eligible for Business Expense

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section Now if you are a salaried employee and your cost to company structure is such that your employer contributes to your NPS you will qualify for a deduction of up to

Budget Exemption On Employer NPS Contribution For State Govt Staff

https://images.livemint.com/img/2022/02/02/600x338/nps_tax-kaOC--621x414@LiveMint_1643775991520.jpg

Employer s NPS Contribution Of 14 For State And Central Government

https://www.financialexpress.com/wp-content/uploads/2022/02/nps.jpg?resize=300

https://www.livemint.com/money/personal-finance/...

Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year How is employer s contribution to

https://www.etmoney.com/learn/nps/nps-c…

Under the existing rules of NPS as outlined by the Pension Fund Regulatory and Development Authority government employees automatically receive NPS contributions from their

Employer Contribution May Be Tax Free Under National Pension Scheme

Budget Exemption On Employer NPS Contribution For State Govt Staff

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

National Pension System Higher NPS Contribution Enhances Tax

NPS Investment Proof How To Claim Income Tax Deduction Mint

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

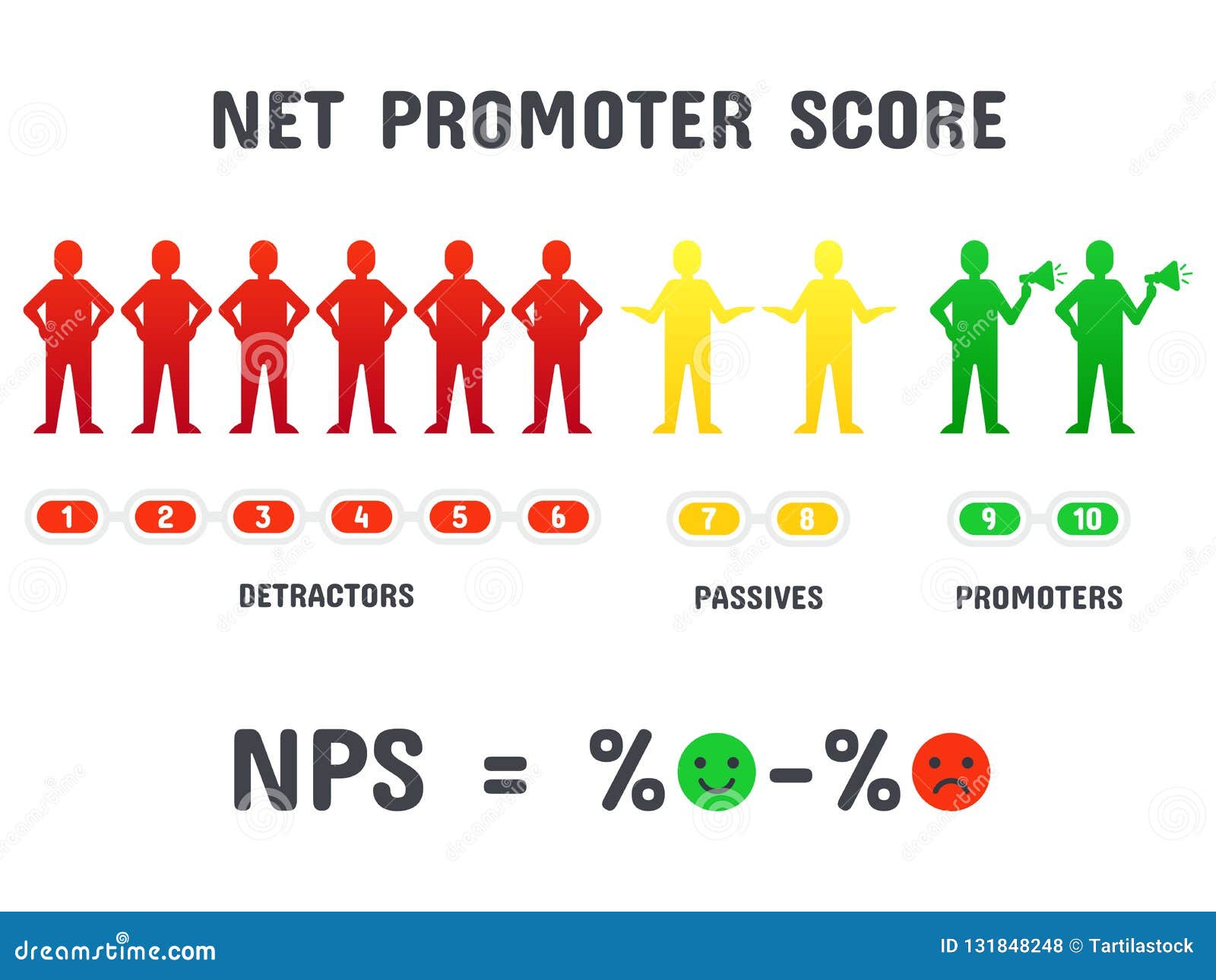

Calculating NPS Formula Net Promoter Score Scoring Net Promotion

Form 16 A Certificate An Employer Issues To Employee When TDS Is

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Nps Deducted By Employer - Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS