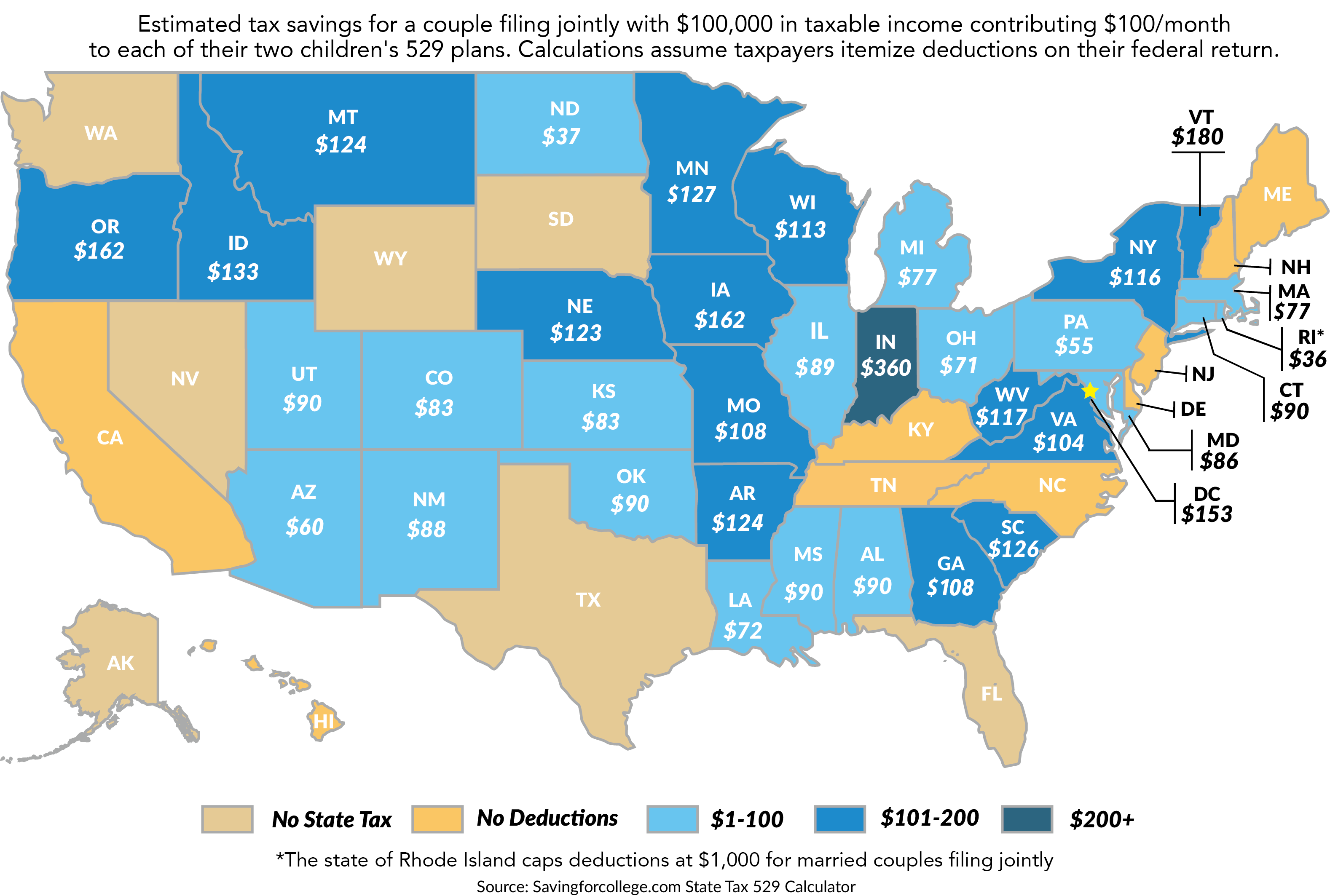

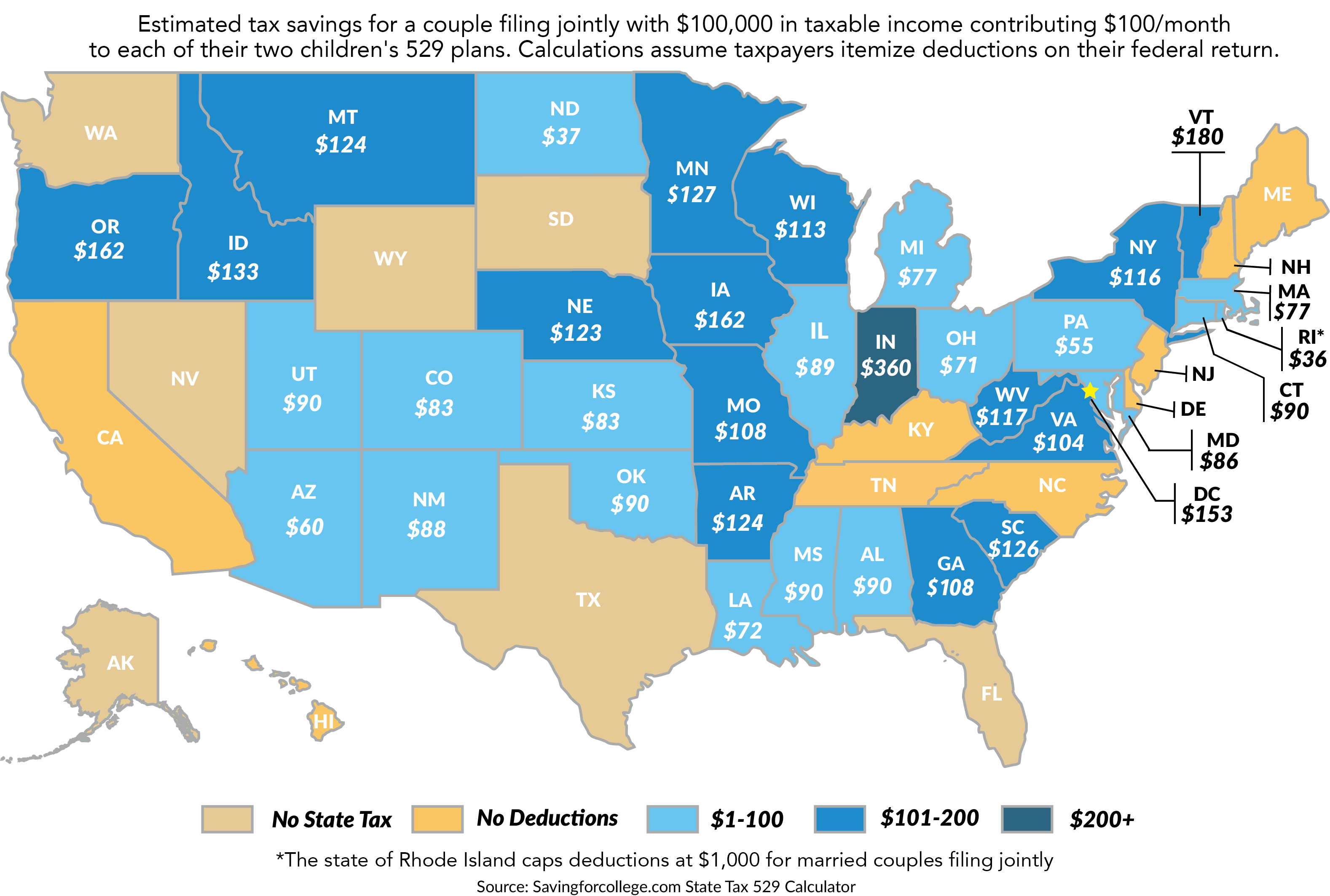

What States Allow Tax Deductions For 529 Contributions Verkko 21 helmik 2019 nbsp 0183 32 Taxpayers in over 30 states may claim a state income tax deduction or tax credit for contributions to a 529 plan However each state has its own rules regarding the type of tax benefit and the amount of 529 plan contributions that are eligible for a state tax deduction or credit each year

Verkko 4 kes 228 k 2020 nbsp 0183 32 Virginia taxpayers can deduct 529 contributions up to 4 000 per account per year virginia529 Washington Washington has no personal income tax so there are no deductions wastate529 wa gov West Virginia West Virginia allows families to deduct 100 of their 529 contributions on their state taxes Verkko 17 kes 228 k 2023 nbsp 0183 32 If your state has no income tax the 529 plan tax deduction doesn t apply These states include Florida Nevada Texas South Dakota Washington Wyoming Some states do have income taxes but no 529 plan tax deduction They include California Hawaii Kentucky Maine New Hampshire North Carolina

What States Allow Tax Deductions For 529 Contributions

What States Allow Tax Deductions For 529 Contributions

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

/Tax-form-56a0d5af3df78cafdaa57849.jpg)

Business Travel Tax Deductions

https://www.tripsavvy.com/thmb/IteNxEW8QfH_iYKm5GSnBrx6j18=/4230x2914/filters:fill(auto,1)/Tax-form-56a0d5af3df78cafdaa57849.jpg

7 Things To Know About Tax Deductions When Moving Tamara Like Camera

https://i0.wp.com/tamaracamerablog.com/wp-content/uploads/2022/01/Screen-Shot-2022-01-12-at-12.09.10-PM.png?ssl=1

Verkko 7 huhtik 2023 nbsp 0183 32 The 9 states with no income tax and thus no 529 deductions are Alaska Florida New Hampshire no tax on earned wages Nevada South Dakota Tennessee Texas Washington and Wyoming Verkko 13 tammik 2021 nbsp 0183 32 529 plan contributions are made with after tax dollars That means they don t qualify for a tax deduction on your federal income taxes But 34 states do offer some form of tax

Verkko 29 kes 228 k 2023 nbsp 0183 32 Nine states do not have income tax which means they don t offer a 529 plan deduction Those states are Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming California Hawaii and Kentucky do not offer any type of 529 tax deduction but do assess income tax Verkko 529 plan tax deductions are offered by 36 states and DC here s the list for 2022 along with states that give breaks for each other s plans Written by Lee Huffman 529 plan tax

Download What States Allow Tax Deductions For 529 Contributions

More picture related to What States Allow Tax Deductions For 529 Contributions

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Understanding Tax Deductions For Seniors Sugar Grove Senior Living

https://sugargroveseniorliving.com/wp-content/uploads/2022/01/AdobeStock_50623544-2048x1367.jpeg

Top 5 Business Tax Deductions For Employers Accountabilities

https://acctable.com/wp-content/uploads/2022/03/Blog-11-Top-5-business-tax-deductions-for-employers-1200-×-800-px_png.png

Verkko These states offer a tax deduction for contributing to any 529 plan including out of state plans that may be more attractive than the in state option Arizona Arkansas3 Kansas Maine Minnesota3 Missouri Montana Ohio Pennsylvania Tax neutral states These states offer no state tax deduction for 529 plan Verkko 4 lokak 2022 nbsp 0183 32 A 529 tax deduction or credit is available in more than 30 states as well as the District of Columbia allowing you to write off 529 payments and reduce your state income tax burden That will enable you to save more money for your child s education

Verkko 29 marrask 2022 nbsp 0183 32 Over 30 states offer a tax deduction that allows taxpayers to receive a state tax break on contributions to 529 plans Three states offer tax credits Seven states offer tax parity on contributions to plans in other states States with tax deductions tax parity and tax credits make them obvious front runners for the best Verkko 23 lokak 2020 nbsp 0183 32 All but seven of them Arizona Arkansas Kansas Minnesota Missouri Montana and Pennsylvania require that contributions be made to the state s own 529 plan to be eligible for the deduction Here s a short guide on how to take best advantage of this particular benefit on your state tax return

Tax Deductions For Remote Workers and How WFH Affects Your Tax Bill

https://i.pinimg.com/originals/7c/15/e0/7c15e099fa3f11edc0fbbf3debc878c9.jpg

Home Ownership Taxes The Most Common Tax Deductions For Homeowners

https://res.cloudinary.com/luxuryp/images/f_auto,q_auto/giatudwbswapurtfppae/tax-tips-website-2-common-tax-write-offs

https://www.savingforcollege.com/article/how-does-your-states-529-…

Verkko 21 helmik 2019 nbsp 0183 32 Taxpayers in over 30 states may claim a state income tax deduction or tax credit for contributions to a 529 plan However each state has its own rules regarding the type of tax benefit and the amount of 529 plan contributions that are eligible for a state tax deduction or credit each year

/Tax-form-56a0d5af3df78cafdaa57849.jpg?w=186)

https://collegefinance.com/saving-for-college/tax-deduction-rules-for...

Verkko 4 kes 228 k 2020 nbsp 0183 32 Virginia taxpayers can deduct 529 contributions up to 4 000 per account per year virginia529 Washington Washington has no personal income tax so there are no deductions wastate529 wa gov West Virginia West Virginia allows families to deduct 100 of their 529 contributions on their state taxes

Tax Deductions For Home Daycare Businesses

Tax Deductions For Remote Workers and How WFH Affects Your Tax Bill

5498 Esa 2018 2024 Form Fill Out And Sign Printable PDF Template

Corporation Prepaid Insurance Tax Deduction Financial Report

Connecticut Tax Deductions For 529 Savings Financial Advisor In

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

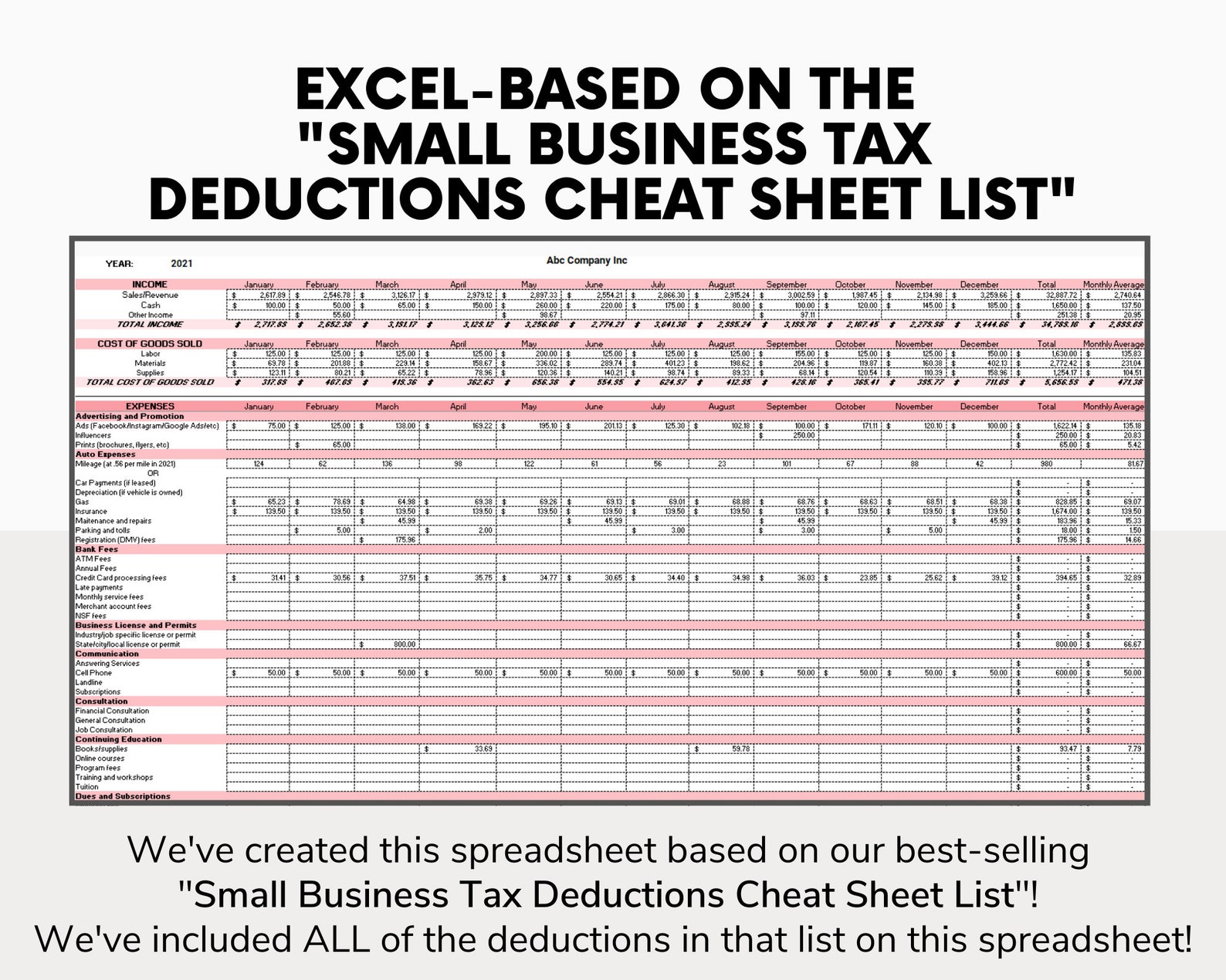

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deductions For Bloggers Money Blogging Blog Tips Tax Deductions

Nj 529 Plan Tax Benefits Tiffaney Bernal

What States Allow Tax Deductions For 529 Contributions - Verkko 529 plan tax deductions are offered by 36 states and DC here s the list for 2022 along with states that give breaks for each other s plans Written by Lee Huffman 529 plan tax